Tag Archive: newsletter

Swiss bike couriers take out protection against Uber Eats

Swiss bicycle couriers have signed a 'Europe-first' collective bargaining agreement deal aimed at protecting them from cheaper rivals, such as the food delivery service Uber Eats. The courier employer’s association Swissmessengerlogistics (SML) negotiated the contract with the trade union Syndicom on Tuesday.

Read More »

Read More »

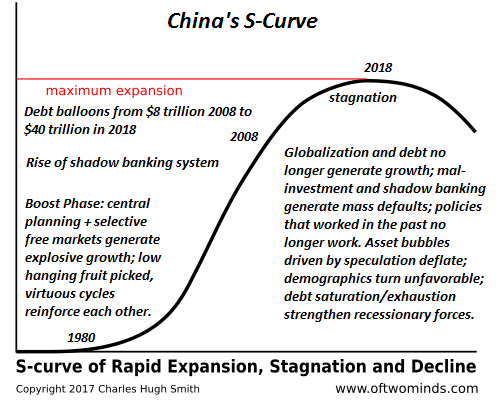

China’s S-Curve of Expansion, Stagnation and Decline

All the policies that worked in the Boost Phase no longer work. Natural and human systems tend to go through stages of expansion, stagnation and decline that follow what's known as the S-Curve. The dynamic isn't difficult to understand: an unfilled ecological niche is suddenly open due to a new adaptation; a bacteria evolves to exploit a new host, etc.

Read More »

Read More »

FX Daily, February 06: Dollar Gains by Default

Overview: The rally in equities is threatening to pause today, even though the few markets open in Asia edged higher. Europe's Dow Jones Stoxx 600, which has advanced in eight of the past ten sessions and six in a row, is seeing some profit-taking pressures. US shares are also trading heavier in Europe. The S&P 500 has a five-day rally in tow but looks poised for some backing and filling action.

Read More »

Read More »

Switzerland’s gender pay gap closes further

A recent survey by the Federal Statistical Office shows the overall median pay gap in Switzerland’s private sector shrunk to 12% in 2016, down from 12.5% in 2014 and 15.6% in 2010. In 2016, median pay for women was CHF 6,011 francs a month and median pay for men was CHF 6,830. The gap rose to 18.54% for the highest management positions.

Read More »

Read More »

Congressman Demands CFTC Explain Its Failure to Find Silver Market Manipulation Where DOJ Did

Washington, DC (February 5, 2018) – A member of the U.S. House Financial Services Committee today pressed the Commodities Futures Trading Commission (CFTC) on its conspicuous failure to uncover the very silver market manipulation now being prosecuted by the U.S. Department of Justice.

Read More »

Read More »

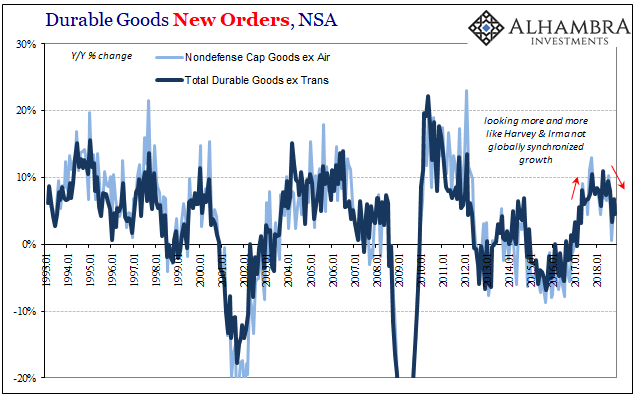

US Manufacturing Questions

The US economic data begins to trickle in slowly. Today, the reopened Census Bureau reports on orders and shipments to and from US factories dating back to last November. New orders for durable goods rose just 4.5% year-over-year in that month, while shipments gained 4.7%. The 6-month average for new orders was in November pulled down to just 6.6%, the lowest since September 2017 (hurricanes).

Read More »

Read More »

FX Daily, February 05: Greenback Remains Firm

Overview: The US dollar is little firmer against most of the major currencies. Despite some disappointing data (retail sales, trade, PMI), the Australian dollar has recovered from initial losses below $0.7200 on the back of the central bank's reluctance to adopt an easing bias. A small upward revision in the eurozone's flash service and composite PMIs help steady the euro after it neared $1.14.

Read More »

Read More »

Swiss firms increase EU lobbying

Swiss companies have sharply increased their lobbying in Brussels in the face of uncertain relations with the European Union. Switzerland has more companies lobbying in Brussels than many other European countries, writes the SonntagsBlick newspaper, citing the EU’s latest transparency register.

Read More »

Read More »

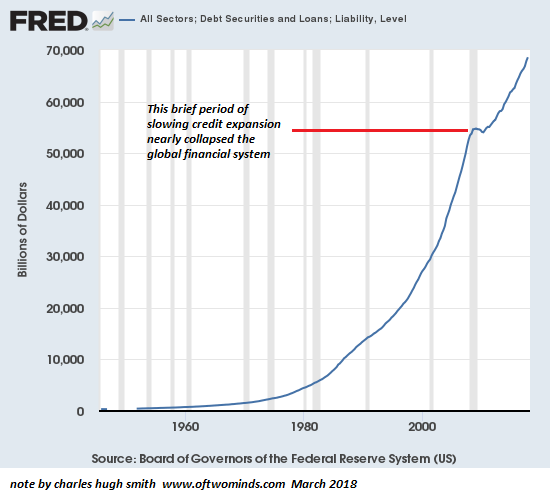

The Coming Global Financial Crisis: Debt Exhaustion

The global economy is way past the point of maximum debt saturation, and so the next stop is debt exhaustion. Just as generals fight the last war, central banks always fight the last financial crisis. The Global Financial Crisis (GFC) of 2008-09 was primarily one of liquidity as markets froze up as a result of the collapse of the highly leveraged subprime mortgage sector that had commoditized fraud (hat tip to Manoj S.) via liar loans and...

Read More »

Read More »

Tennessee Considers Removing Tax on Gold and Silver

Several bills introduced in the Tennessee legislature would eliminate sales and use tax against gold, silver, platinum, and palladium. Introduced by Representative Ron Gant (R-Rossville), House Bill 212 removes sales and use tax against platinum, gold and silver bullion, some numismatic coins, and numismatic coins sold at trade show.

Read More »

Read More »

FX Daily, February 04: Subdued Start to Quiet Week

Overview: The Lunar New Year celebration made for a quiet Asian session while a light diary in Europe saw subdued turnover. Equity markets are narrowly mixed. Among the three large markets open in Asia Pacific, Australia and Japanese equities rose while India slipped. European bourses are little changed, putting the Dow Jones Stoxx 600 four-day advance at risk.

Read More »

Read More »

Chaos-Politik der SNB mobilisiert SVP und SP: Milliarden für Vorsorge

Mit „links und rechts“ hat unsere Schweizerischen Nationalbank (SNB) ihre grosse Mühe. Da ist zunächst ihre Bilanz, bei der sie unfähig ist, „links und rechts“ voneinander zu unterscheiden. Unverstanden gerät sie nun folgerichtig auch politisch immer mehr unter Druck: konsequenterweisee von „links und rechts“.

Read More »

Read More »

No Swiss exemption from EU steel import cap

The European Union is imposing limits on steel coming into the bloc from Saturday in response to US President Donald Trump’s metals tariffs. The measures will also affect Swiss steel exports to the EU. The EU said on Friday that it is introducing new measures to prevent steel produced for the US market from flooding into Europe instead because of tariffs introduced by Trump.

Read More »

Read More »

FX Weekly Preview: The Week Ahead is Mostly About Digestion

The information set investors have is unlikely to substantively change in the coming days. The important macro points are known. The first part of February may be about digesting and making sense of that information rather than an incremental increase.

Read More »

Read More »

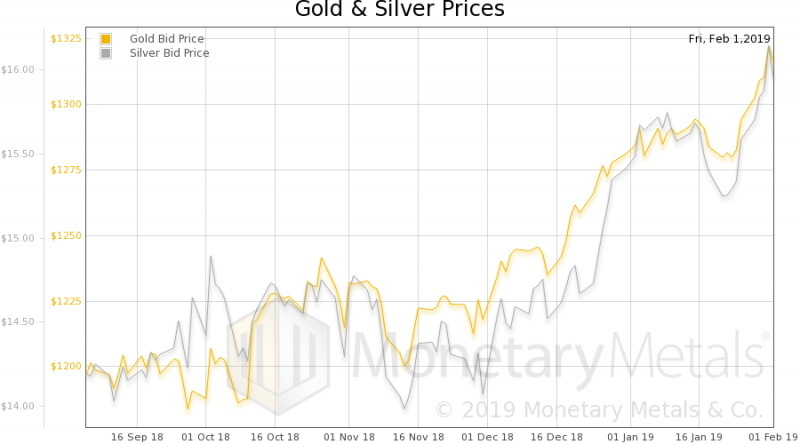

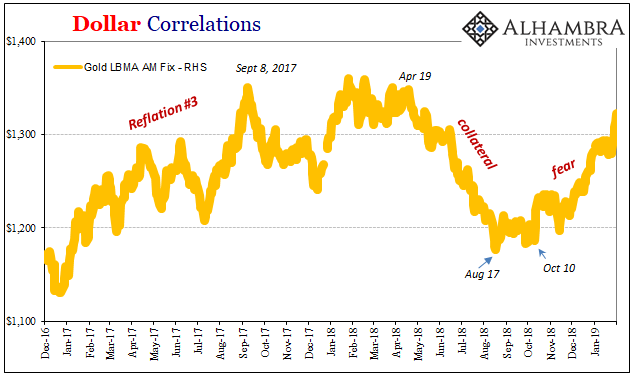

Fear Or Reflation Gold?

Gold is on fire, but why is it on fire? When the precious metals’ price falls, Stage 2, we have a pretty good idea what that means (collateral). But when it goes the other way, reflation or fear of deflation? Stage 1 or Stage 3? If it is Stage 1 reflation based on something like the Fed’s turnaround, then we would expect to find US$ markets trading in exactly the same way.

Read More »

Read More »

Short Note on Jobs Report

The January employment report was mixed. It is unlikely to have a material impact on expectations for Fed policy. However, it does suggest the downside risks may not materialize. The US economy grew 304k jobs, well above expectation. It is marred by a 70k net downward revision of the past two months, and notably a 90k cut in December's estimate, which brings it to 222k (from 312k).

Read More »

Read More »

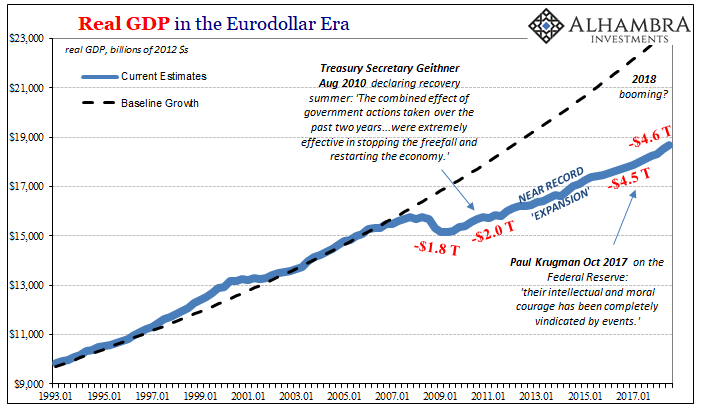

Bond Curves Right All Along, But It Won’t Matter (Yet)

Men have long dreamed of optimal outcomes. There has to be a better way, a person will say every generation. Freedom is far too messy and unpredictable. Everybody hates the fat tails, unless and until they realize it is outlier outcomes that actually mark progress. The idea was born in the eighties that Economics had become sufficiently advanced that the business cycle was no longer a valid assumption.

Read More »

Read More »

Swiss wage gap between genders remains bafflingly wide

The pay gap between men and women in Switzerland has increased slightly, amounting to hundreds of francs per month on average. Men earned 19.6% more pay than female colleagues in 2016, compared to a 19.5% difference in 2012. While some of this gap can be explained by length of service, additional qualifications and the like, in more than four out of ten cases researchers could see no reason why women are paid less.

Read More »

Read More »