Tag Archive: newsletter

Coronavirus: Switzerland extends lockdown until 26 April

On 8 April 2020, Switzerland’s government decided to extend the country’s lockdown measures for a further week. In a press release the Federal Council said the measures would be extended for another week and then possibly progressively loosened before the end of April.

Read More »

Read More »

Cradle of agriculture in the Amazon region much older

People began growing manioc and squash much earlier than previously thought, a team of researchers led by the Swiss university of Bern has found. A study shows that the earliest human inhabitants of Moxos plains began transforming the tropical savanna eco-region in Bolivia 10,000 years ago, that is 8,000 earlier than previously thought.

Read More »

Read More »

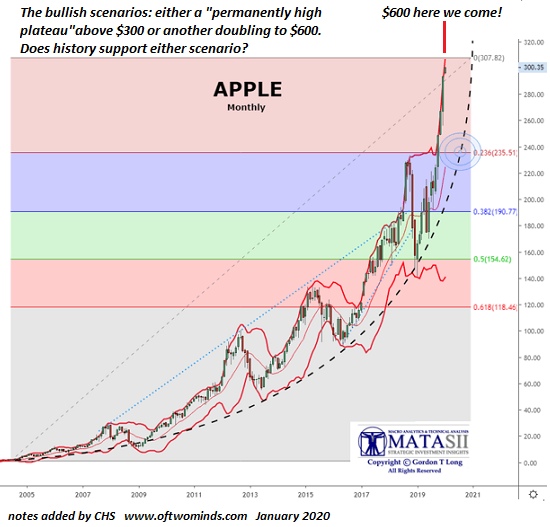

Buy The Tumor, Sell the News

The fictitious valuation of the stock market will eventually re-connect with reality in a violent decline. No, buy the tumor, sell the news (tm) is not a typo: the stock market is a lethal tumor in our economy and society.

Read More »

Read More »

Keynes Called Himself a Socialist. He Was Right.

In 1997 Ralph Raico published an article titled “Keynes and the Reds.” Raico’s article highlighted John Maynard Keynes’s review of a 1936 book by the British socialists Sidney and Beatrice Webb called Soviet Communism. In his review, Keynes discusses Joseph Stalin’s USSR and concludes: “The result is impressive.”

Read More »

Read More »

Government Overreach in the Age of COVID-19

In times of crisis, governments have a tendency to overcompensate for risk. This tendency may be in the public’s best interest, but it could also serve broader governmental interests. The public and government’s interest are not always one and the same.

Read More »

Read More »

Wie ich 5000€ in Dividenden Aktien investiere inkl. Musterportfolio

Meine Dividenden Aktien Strategie inkl. 5 Aktien

📲 Trade Republic Depot kostenlos eröffnen ► https://talerbox.com/go/trade-republic/ *

🔎 Dividenden Aktien finden ► https://talerbox.com/go/aktienfinder/ *

20€ Bitcoin Startprämie Bison (Börse Stuttgart) ► https://www.talerbox.com/out/bison *🚀

Bis zu 280€ Gratisaktie sichern (Scalable Capital) ► https://www.talerbox.com/go/scalable-capital *

Unser App Monetaz: Finanzplaner für die Hosentasche ►...

Read More »

Read More »

Central banks to the rescue

While expecting long-term yields to be capped, we remain neutral on US Treasuries. We think peripheral euro area bonds to avoid the levels of stress seen during the sovereign debt crisis.

Read More »

Read More »

Insanity: As The US Enters A Depression, Stocks Are Now The Most Overvalued Ever

Two days ago, when a platoon of clueless CNBC hacks said that stocks were extremely undervalued, and must be bought (on their fundamentals, not because the Fed was about to nationalize the entire bond market and is set to start buying equity ETFs in the next crash), we showed just how "undervalued" the market was.

Read More »

Read More »

New debt relief measures on the horizon for struggling firms

The Swiss government is examining plans to stave off bankruptcies of companies struggling with the fallout of the coronavirus crisis. But regular debt collection procedures will resume on April 20. Justice Minster Karin Keller-Sutter said the aim was to stabilise the economy and to secure jobs.

Read More »

Read More »

Swiss consortium launches bitcoin on Tezos blockchain

A consortium of Swiss cryptocurrency companies has incorporated bitcoin onto the Tezos blockchain. The move brings Tezos, which has based its foundation in Switzerland, a step closer to rival blockchain Ethereum. Launched in 2018, the Tezos blockchain was designed to play host to a new generation of decentralised finance, business and social projects.

Read More »

Read More »

Why Mexico Is Reluctant to Shut Down Its Economy to Combat COVID-19

Mexico's president Andrés Manuel López Obrador has been reluctant to impose mandatory "social distancing" orders on the Mexican population. According to USNews, López Obrador "has maintained a relaxed public attitude" toward COVID-19, and the Mexican government did not impose a ban on "non-essential" work until March 30, long after health officials in other countries insisted Mexico must do so.

Read More »

Read More »

The Real Diseased Body

Another day, another new Federal Reserve “bailout.” As these things go by, quickly, the details become less important. What is the central bank doing today? Does it really matter?For me, twice was enough. All the way back in 2010 I had expected other people to react as I did to QE2. If you have to do it twice, it doesn’t work.

Read More »

Read More »

FINMA veröffentlicht weitere Aufsichtsmitteilung im Kontext der COVID-19-Krise

Die Eidgenössische Finanzmarktaufsicht FINMA veröffentlicht eine zweite Aufsichtsmitteilung mit Hinweisen für die Beaufsichtigten zu Erleichterungen und Präzisierungen der Aufsichtspraxis im Kontext der COVID-19-Krise.

Read More »

Read More »

Coronavirus: new infections slowing in Switzerland

The number of new recorded Covid-19 cases is slowing in Switzerland. By 8 April 2020 the total number of recorded cases was 23,574 according to Switzerland’s health authority.

Read More »

Read More »

Swiss banks bow to pressure to delay half of dividend payments

Switzerland’s two largest banks, UBS and Credit Suisse, have asked shareholders to accept a delay of several months for half of their dividend payments this year. The move follows a request from the financial regulator to hold on to more cash during the coronavirus pandemic.

Read More »

Read More »

The World Has Changed More Than We Know

Put another way: eras end. While the mainstream media understandably focuses on the here and now of the pandemic, some commentators are looking at the long-term consequences. Here is a small sampling: While each of these essays offers a different perspective, let's focus on the last two: Ugo Bardi's essay on Hyperspecialization and the technological responses described in the MIT Technology Review essay.

Read More »

Read More »

How Risk-Based Healthcare Could Make Us Healthier

It is generally the case that simple concepts in nature produce incredible complexity. This applies to the genome, where simple base pairs have evolved to express complex and multifunctional instructions that would take thousands of lines of code for any human to create. This applies to the economy, where simple ideas such as the price system become infinitely complex at scale.

Read More »

Read More »

Jp Cortez joins Phillip Kennedy on Kennedy Financial

Sound Money Defense League Policy Director Jp Cortez joins Phil Kennedy of Kennedy Financial to discuss sound money on the state and federal level, and the harms of inflation.

Read More »

Read More »

Bleibe ich in P2P-Kredite investiert? ??

Aktuell ist viel los bei P2P-Krediten, viele Leute ziehen aus Angst und Panik und teilweise auch aus berechtigten Gründen ihr Geld ab. Aber wie werde ich mit meinen Investments fortfahren? P2P-Kredite sind auch schon vor der Krise ein extrem risikoreiches Investment gewesen. Ich habe diese nur als Beimischung mit einem sehr kleinen Prozentsatz meines Vermögens genutzt.

Read More »

Read More »