Tag Archive: newsletter

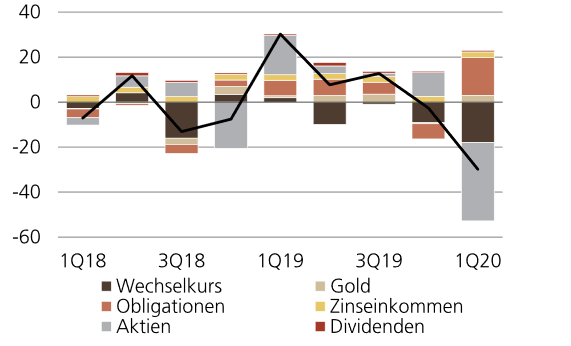

SNB dürfte im ersten Quartal 30Milliarden Franken verlieren

Die SNB dürfte im ersten Quartal des laufendenJahres einen Verlust von rund CHF 30 Mrd.ausweisen. Die Coronakrise führte zu einem Kurssturz anden Aktienmärkten und zu einer Aufwertung desFrankens auf breiter Basis, beides schadete demErgebnis der SNB.

Read More »

Read More »

FX Daily, April 22: Investors Catch Collective Breath, but Sentiment remains Fragile

Overview: Risk-appetites appear to have stabilized for the moment. Most equity markets are higher. Japan and Malaysia were exceptions, but the MSCI Asia Pacific Index rose for the first time this week. In Europe, the Dow Jones Stoxx 600 is recouping about a third of yesterday's loss.

Read More »

Read More »

5 Schritte um mit dem Vermögensaufbau zu Beginnen ??

Heute möchte ich mit euch über die 5 Schritte sprechen, mit denen ihr Vermögen aufbauen könnt. Dieser Beitrag richtet sich eher an die Leute, die mit dem Vermögensaufbau beginnen wollen. Ich gebe euch heute eine kleine Guideline, wie man die ersten Schritte richtig macht. Vieles davon ist aus meiner eigenen Erfahrung, wie ich mit meinem heutigen Wissen nochmal starten würde.

Read More »

Read More »

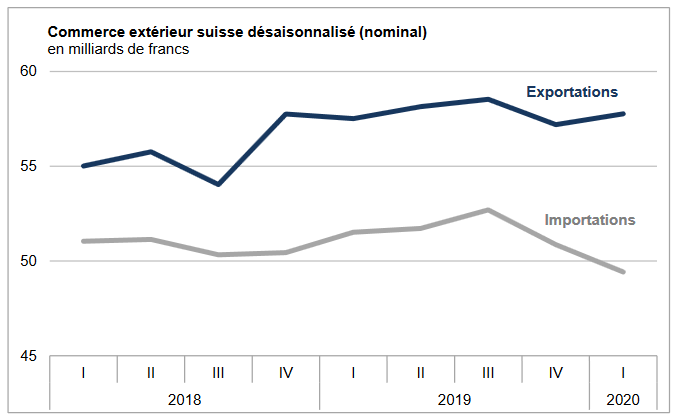

Swiss Trade Balance Q1 2020 : chemistry-pharma keeps exports in black numbers

The boom in chemicals and pharmaceuticals enabled Swiss exports to increase in March as well as in the first quarter of 2020 (+ 2.2% respectively + 1.0%). Despite the global economic situation linked to the “Covid-19”, the performance of this sector offset the decline suffered by most of the other groups. As in the previous quarter, seasonally adjusted imports fell (- 2.8%). The trade balance for the first three months of 2020 ends with a surplus...

Read More »

Read More »

The Greenspan Bell

What set me off down the rabbit hole trying to chase modern money’s proliferation of products originally was the distinct lack of curiosity on the subject. This was the nineties, after all, where economic growth grew on trees. Reportedly. Why on Earth would anyone purposefully go looking for the tiniest cracks in the dam?

Read More »

Read More »

The Experts Have No Idea How Many COVID-19 Cases There Are

In the early days of the COVID-19 panic—about three weeks ago—it was common to hear both of these phrases often repeated: "The fatality rate of this virus is very high!" "There are far more cases of this out there than we know about!"

Read More »

Read More »

FX Daily, April 21: Oil Drilled Below Zero, Equity Rally Stalls, Greenback Advances

Overview: Oil's wild ride has been joined by two other developments that are keeping investors off-balance. First, reports suggest that North Korea's Kim Jong-Un maybe in critical condition after surgery. He apparently was absent from last week's events celebrating his grandfather.

Read More »

Read More »

Is Venezuela’s gold a liability for Switzerland?

Venezuela is illegally mining and trading in gold, and Switzerland could be one of its clients, according to Swiss media reports. swissinfo.ch spoke to law enforcement, customs and financial authorities to find out whether they are taking action.

Read More »

Read More »

Rothbard on Why We Need Entrepreneurs

In his Man, Economy, and State, Murray N. Rothbard investigates not only the role of the capitalist but also that of the entrepreneur in a market economy. Rothbard uses the theoretical concept of the evenly rotating economy (ERE) to compare the role of the capitalist to that of the entrepreneur. Entrepreneurs earn profits in so far as they successfully correct the maladjustments in the real economy and move it closer to the ERE without ever...

Read More »

Read More »

Dollar Firm as Equities and Oil Start the Week Under Pressure

The lockdown vs. opening debate continues in just about every country; the dollar is consolidating recent gains. Reports suggest the White House and House Democrats are nearing a deal on another aid package worth nearly $500 bln; the extra fiscal stimulus will add to downward ratings pressure on the US.

Read More »

Read More »

Coronavirus called a ‘decisive test’ for the UN system

The pandemic is testing the limits of the United Nations system, say Geneva and New York-based experts, amid funding challenges and an ongoing blame game between the United States and China. The UN is marking its 75th anniversaryexternal link this year. What could have been a year of celebration is becoming a year of crisis.

Read More »

Read More »

Surviving Covid-19: the Swiss economy’s strengths and weaknesses

The current pandemic will plunge the world economy into recession, at least in the first part of the year. What tools does Switzerland have to minimise the economic and social damage of this crisis? And what factors could jeopardise the prospects for an economic recovery?

Read More »

Read More »

How Government Makes a Pandemic More Deadly

In the early days of the outbreak, pundits rushed to the ramparts of Twitter to proclaim that “there are no libertarians in a pandemic.” However, this glee at the apparent failure of markets was soon dashed as more evidence accumulated showing that government intervention was actually the main impediment to success.

Read More »

Read More »

Digital grassroots response to government bailouts

The CHF60 billion Swiss state bailout of companies is well underway. But there is a feeling that government funds that hand out loans and pay workers’ wages will not be enough. How do companies maintain contact with customers and develop their brands during a lockdown?

Read More »

Read More »

Coronavirus: numbers in Switzerland slow further

By 14 April 2020, a total 25,936 cases of Covid-19 infection had been recorded in Switzerland, a rise of 3,683 over the preceding 7 days. However, despite the continued rise in cases there are indications measures to slowdown the spread of the virus are working.

Read More »

Read More »

Overcapacity / Oversupply Everywhere: Massive Deflation Ahead

The price of a great many assets will crash, out of proportion to the decline in demand. Oil is the poster child of the forces driving massive deflation: overcapacity / oversupply and a collapse in demand. Overcapacity / oversupply and a collapse in demand are not limited to the crude oil market; rather, they are the dominant realities in the global economy.

Read More »

Read More »

How to Think About the Fed Now

[This text is excerpted from the introduction to The Anatomy of the Crash, a Mises Institute ebook to be released in April 2020.] The Great Crash of 2020 was not caused by a virus. It was precipitated by the virus, and made worse by the crazed decisions of governments around the world to shut down business and travel. But it was caused by economic fragility.

Read More »

Read More »

Between a Rock and a Hard Place: Pandemic and Growth

There is no way authorities can limit the coronavirus and restore global growth and debt expansion to December 2019 levels. Authorities around the world are between a rock and a hard place: they need policies that both limit the spread of the coronavirus and allow their economies to "open for business." The two demands are inherently incompatible, and so neither one can be fulfilled.

Read More »

Read More »

Interest groups present demands for coronavirus exit plans

Political parties, trade unions and other interest groups have published their proposals for the government to relax restrictions introduced to stem the Covid-19 pandemic. The calls come a day ahead of the government’s decision on a nationwide coronavirus exit strategy, notably a staggered resumption of business activities and the reopening of schools.

Read More »

Read More »