Tag Archive: newsletter

Today Only: Donate and Receive the New Institute Magnet!

The mission of the Mises Institute is to preserve, promote and advance the ideas that can create a better, freer, and more prosperous world.

Read More »

Read More »

Today Only: Donate and Receive the New Institute Magnet Along with the New Hayek Book

The mission of the Mises Institute is to preserve, promote and advance the ideas that can create a better, freer, and more prosperous world.

Read More »

Read More »

Tag 87

@MarkusElsaesser1 👈

Um immer up-to-date zu sein, tragen Sie sich jetzt in den Mailverteiler ein

👉 https://www.elsaessermarkus.de/newsletteranmeldung

Read More »

Read More »

NZDUSD Technicals: The NZDUSD continues to trade above and below the 200 day MA.

Traders in the NZDUSD are taking a breath as it prepares for the next momentum move

investingLive is a real-time market news and analysis platform, built on the legacy of ForexLive. Covering forex, stocks, commodities, and global markets, it delivers fast, reliable updates to support informed trading and investment decisions. With a global team of expert analysts, investingLive combines speed and clarity to keep professionals ahead of market...

Read More »

Read More »

Gold and Silver Keep Breaking Records… But Are We Still Early?

Gold is smashing through all-time highs and silver is surging to levels not seen in decades. But here’s the question: is the rally already over or are we just getting started?

In this video, we break down:

Why the Federal Reserve’s rate cuts are just the excuse, not the cause

Kenneth Rogoff’s warning on U.S. debt and inflation

Central banks buying record amounts of physical gold

Silver’s structural supply deficit and looming shortage

Why...

Read More »

Read More »

Goldminen: Der Fehler, den viele gerade machen

Im heutigen Video prüfe ich einen X-Post, analysiere historische Charts von Gold, Silber und Minen-ETFs wie GDX und erkläre, warum es so wichtig ist, Behauptungen kritisch zu hinterfragen, um Bestätigungsfehler zu vermeiden und realistisch zu investieren.

JETZT zum Webinar anmelden:

https://www.jensrabe.de/WebinarSep25

Vereinbare jetzt dein kostenfreies Strategiegespräch:

https://jensrabe.de/Q3Termin25

Börsen-News:...

Read More »

Read More »

AUDUSD Technicals: AUDUSD sellers “stay in play” below the 100 hour MA.

Can the AUDUSD sellers make a run for it with another break below a swing area between 0.6888 and 0.6898?

investingLive is a real-time market news and analysis platform, built on the legacy of ForexLive. Covering forex, stocks, commodities, and global markets, it delivers fast, reliable updates to support informed trading and investment decisions. With a global team of expert analysts, investingLive combines speed and clarity to keep professionals...

Read More »

Read More »

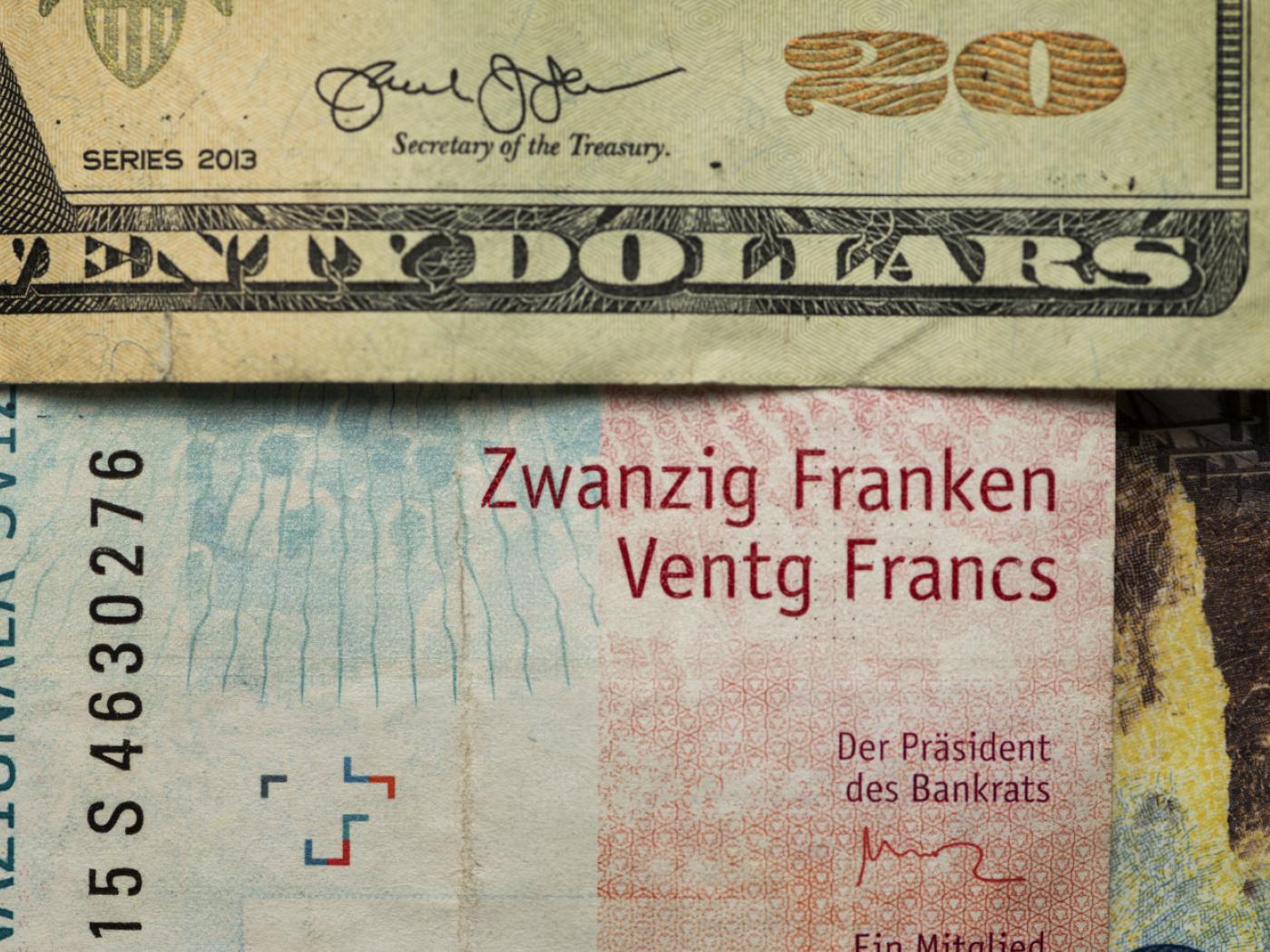

USDCHF Technicals: The USDCHF stays below the 200 hour MA keeping sellers in control.

If the USDCHF stays below the 200-hour MA at 0.79296, the sellers remain in control

investingLive is a real-time market news and analysis platform, built on the legacy of ForexLive. Covering forex, stocks, commodities, and global markets, it delivers fast, reliable updates to support informed trading and investment decisions. With a global team of expert analysts, investingLive combines speed and clarity to keep professionals ahead of market...

Read More »

Read More »

Trump administration considers bailout for Argentina’s Milei

A weak showing for Milei’s party in provincial elections last week jolted investors and forced the country to start selling “every last dollar” to defend the peso.

Read More »

Read More »

Our Economy Has Never Needed an “Elastic” Currency

Mainstream economists have justified the creation of the Federal Reserve because they claim that a growing economy—especially the banking system—needs an “elastic” currency. In other words, the economy “needs” at least some inflation. Austrian economists know better.

Read More »

Read More »

Gold price nears $3,800 as China says it wants to be custodian of foreign gold reserves

The People’s Bank of China has reportedly pitched central banks on storing the yellow metal on their behalf, inside China.

Read More »

Read More »

¡Estás Estancado Por Esto! Aprende A Liberarte Y Avanzar – Fernando González & Carla Olivieri

👉 https://realmentor.net/rd 👈 ¡ENTRA AQUÍ Y Descubre el SISTEMA de PADRE RICO que me hizo MILLONARIO! Construye INGRESOS PASIVOS y alcanza la LIBERTAD FINANCIERA con Fernando González-Ganoza, mentor de habla hispana y representante oficial de Robert Kiyosaki por más de 30 años.

🌟 ¿Qué pasa cuando un emprendedor no avanza a pesar de trabajar más horas cada día?

En este episodio grabado en Lima, Perú, junto a Carla Olivieri, reconocida líder y...

Read More »

Read More »

Same technical story, different day for the USDCAD. Price is above converged MAs at 1.3804

The 100 and 200 bar MAs on the 4-hour chart at 1.3804 is a key barometer for the buyers and sellers in the USDCAD.

investingLive is a real-time market news and analysis platform, built on the legacy of ForexLive. Covering forex, stocks, commodities, and global markets, it delivers fast, reliable updates to support informed trading and investment decisions. With a global team of expert analysts, investingLive combines speed and clarity to keep...

Read More »

Read More »

Das größte Depot, dass du gesehen hast? #reddit

Das größte Depot, dass du gesehen hast? 💬 #reddit

Thomas beantwortet EURE Fragen! | Reddit AMA:

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine persönlichen Finanzen in den Griff...

Read More »

Read More »

Trumps Schock-Dekret: Konsequenzen für Deutschland!

✅ Meine Depotempfehlung 👉 https://link.aktienmitkopf.de/Depot *

Beginne mit dem Investieren beim Freedom24-Broker:

Mehr als 40.000 Aktien und ETFs mit transparenter Preisgestaltung

Direkter Zugang zu 15 globalen Börsen und Märkten

Kostenloser persönlicher Assistent und Anlageideen

Erhalte bis zu 20 Aktien gratis dazu für die Aufladung deines Kontos:

https://link.aktienmitkopf.de/Depot *

Trete der Aktien mit Kopf ProLounge bei und erhalte...

Read More »

Read More »

Jerome Powell’s Tuesday speech on the 2025 Economic Outlook

" Job gains have slowed ...At the same time, inflation has risen recently and remains somewhat elevated."

Read More »

Read More »

“Hate Speech” Isn’t Real and Pam Bondi Is an Enemy of Freedom

“Hate speech” does not exist. At all. That’s a concept the Left invented to justify state-enforced censorship of speech the Left doesn't like.

Read More »

Read More »

So liest du die Cashflow-Rechnung richtig – und erkennst Gefahren sofort!

Zu meinen Onlinekursen: https://thomas-anton-schuster.coachy.net/lp/finanzielle-unabhangigkeit

Vortrags- und Seminartermine, sowie kostenlose Anforderung des Aktienbewertungsblatts: https://aktienerfahren.de

Read More »

Read More »

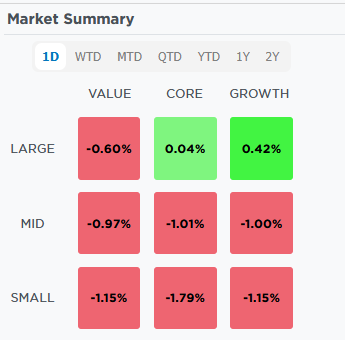

The USD is steady vs the major currencies to start the US session. Fed Powell to speak.

The Fed Chair will likely reiterate the message that the Fed cut was a risk management move to guard against rising unemployment.

investingLive is a real-time market news and analysis platform, built on the legacy of ForexLive. Covering forex, stocks, commodities, and global markets, it delivers fast, reliable updates to support informed trading and investment decisions. With a global team of expert analysts, investingLive combines speed and...

Read More »

Read More »

France: UBS pays €835 million to settle tax dispute

UBS has settled an old tax dispute in France and will pay a total of 835 million euros (CHF780.7 million) to put an end to this case dating from 2004 to 2012, it announced on Tuesday. +Get the most important news from Switzerland in your inbox The €835 million to be paid breaks down into … Continue reading »

Read More »

Read More »