Tag Archive: newsletter

Seed Corn and Dry Powder

On this week's episode, Mark looks at the financial condition of the government and of American citizens on the cusp of the next recession. The financial condition of the United States Treasury, the Federal Reserve, and the American citizenry is weak; debt is high and rising, and this is very worrisome in an economic environment of rising interest rates and a weakening global economy. Please share this episode with a curmudgeon.

The U.S. Debt...

Read More »

Read More »

Bad, Worse, Worst: The Misguided Perfectionism of Gavin Newsom

My grandfather used to sing to me, “Good, better, best / never let them rest / till the good is better / and the better is best.” I appreciated that lesson and have been applying it to try to make sense of a recent bill signed by California governor Gavin Newsom. While the bill may be the result of Newsom’s grandfather singing to him about “bad, worse, and worst,” I have determined it is more likely a case of bad/worse/worst economic thinking. It...

Read More »

Read More »

Sovereign Debt is Eating the World

Sovereign debt is eating the world. Lining up a financial crash that could make 2008 look like a picnic.

How did we get here?

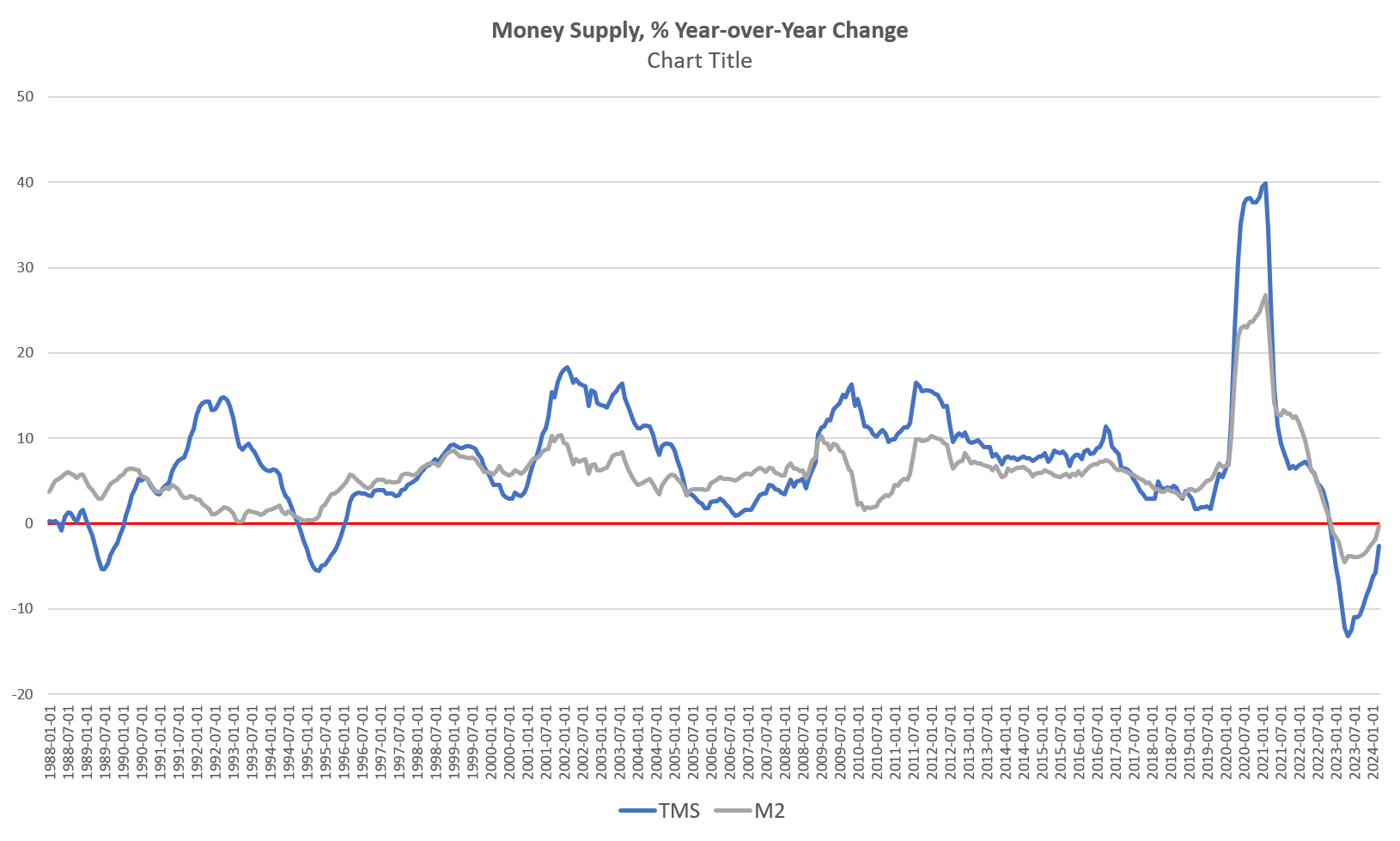

In short, governments and central banks deluded themselves into thinking that unlimited deficit spending financed by unlimited money printing won't do what they've done for literally millennia -- plunge the economy into stagflation.

They are, of course, wrong. And we're seeing the catastrophe unfold before our eyes.

From...

Read More »

Read More »

The Eurozone Disaster: Between Stagnation and Stagflation

The eurozone economy is more than weak. It is in deep contraction, and the data is staggering.

The eurozone manufacturing purchasing managers’ index (PMI), compiled by S&P Global, fell to a three-month low of 43.1 in October, the sixteenth consecutive month of contraction. However, European analysts tend to ignore the manufacturing decline using the excuse that the services sector is larger and stronger than expected, but it is not. The...

Read More »

Read More »

Nächste Faeser Katastrophe!

Nancy Faeser will die Asylverfahren dadurch beschleunigen und vereinfachen, indem sie einfach weniger überprüfen lässt! Wunderbar Frau Faeser, dadurch wird sich die Situation bestimmt verbessern!

Aktiendepot-Empfehlung:

4,2 % Zinsen und 6,12% für Einlagen in USD https://link.aktienmitkopf.de/Depot *

👉🏽5 Euro Startbonus bei Bondora ►► https://goo.gl/434rmp *

Bildrechte: Di Steffen Prößdorf, CC BY-SA 4.0,...

Read More »

Read More »

The Biggest Problem in Our Society Right Now

The biggest problem of our society now is individuals who are highly opinionated and will not exchange open-mindedly about their opinions. From my conversation with @jayshetty. #principles #raydalio #openminded

Read More »

Read More »

How Statism Leads to War

Mises' work explains how laissez-faire economies have incentives to be peaceful with each other, and how, inversely, tariffs and protectionism create isolation, instability, and war. His words are especially prescient today as conflicts rage and tensions between superpowers continue to rise—mirroring the rise in state power across the globe.

Dr. Jonathan Newman joins Bob to break down the history of warfare, how states fund war, and why war is more...

Read More »

Read More »

USDJPY closing up for the 5th consecutive day. Pushes toward 2022 multi-decade high.

The USDJPY has been up for 5 consecutive days this week. The push higher has taken the price closer to the high from 2023 at 151.71. Above that is the 2022 high at 151.93 which represents a multi-decade high for the pair.

Read More »

Read More »

Fed Continues Tough Talk; Silver & Platinum Look Most Undervalued

🔔 SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

As central bankers stubbornly refuse to admit they are done hiking interest rates, precious metals markets are wavering.

Read the Full Transcript Here: https://www.moneymetals.com/podcasts/2023/11/10/fed-officials-refuse-to-admit-theyre-done-hiking-rates-002864

Do you own precious metals you would rather not sell, but need access to cash? Get Started...

Read More »

Read More »

The Dollar See-Saws between Two Views on Fiscal Explosion

As the Biden administration ramps up new government spending—and budget deficits—to unheard-of peacetime levels, reality sets in. No economy and no currency can withstand this explosive assault for very long.

Original Article: The Dollar See-Saws between Two Views on Fiscal Explosion

Read More »

Read More »

What the Technocrats Call “Economic Stability” Is Really Just Inflation

There’s a growing palpable sense of optimism among many economists and journalists that the United States economy is heading toward a growth phase while avoiding recession. They are in turn lauding the Federal Reserve for its strategic handling of inflation—with economic growth and low unemployment rates—as well as praising the efficacy of the Biden administration in reining in prices through social pressure on profit-making and through increases...

Read More »

Read More »

Talkin’ Turkey About Your Money

Richard and Danny take it back to the Old School way, answering live Q&A.

(disclaimer)

1:04 - It's been a tough August, September, October: historical implications of a negative quarter. You really cannot get all-in or all-out of markets. Positioning portfolios for where money will be going.

4:19 - How we do that voodoo that we do: Sell rules & stop losses.

7:25 - The frustration of current market environment.

11:30 - Allocation and Risk...

Read More »

Read More »

Dirk Müller: „Wenn noch immer Menschen in Deutschland frieren….“

👉 𝐂𝐚𝐬𝐡𝐤𝐮𝐫𝐬.𝐜𝐨𝐦: 𝐉𝐞𝐭𝐳𝐭 𝟏 𝐌𝐨𝐧𝐚𝐭 𝐟ü𝐫 𝟏€ 𝐭𝐞𝐬𝐭𝐞𝐧 ►► https://bit.ly/Cashkurs_1

𝗦𝗲𝗵𝗲𝗻 𝗦𝗶𝗲 𝗱𝗮𝘀 𝗴𝗮𝗻𝘇𝗲 𝐕𝐢𝐝𝐞𝐨-𝐔𝐩𝐝𝐚𝐭𝐞 𝘃𝗼𝗻 𝗗𝗶𝗿𝗸 𝗠ü𝗹𝗹𝗲𝗿 𝗵𝗶𝗲𝗿:

https://go.cashkurs.com/DM231107

(Bei diesem Video handelt es sich um einen kurzen Ausschnitt aus dem Marktupdate vom 07.11.2023 auf Cashkurs.com.)

📧 Gratis-Newsletter inkl. täglichem DAX-Update ►►► https://bit.ly/CashkursNL

🔴 YouTube-Kanal abonnieren ►►► https://www.youtube.com/@cashkurscom

Bildrechte: Cashkurs.com /...

Read More »

Read More »

EURUSD reaches 38.2% retracement but fails this week, sellers take control with more work.

EURUSD fails to break above the 38.2% retracement, giving sellers the upper hand. Buyers find support at the 200-hour moving average but face resistance at the 100-hour moving average. Traders watch these levels for a potential breakout.

Read More »

Read More »

USDCHF price action volatile but finds support at key technical levels today. What next?

The USDCHF has experienced ups and downs in its price action, but has found support at important technical levels like the 200-day moving average and the 50% midpoint. Staying above these levels would be bullish, while moving below them would be bearish.

Read More »

Read More »

Exposing Our Fed-Driven Bubble Economy

The Great Money Bubble: Protect Yourself from the Coming Inflation Stormby David A. StockmanHumanix Books, 2022; 229 pp.

David Stockman served for a short while as budget director during Ronald Reagan’s first term as president, but he soon resigned owing to Reagan’s refusal to cut government spending. He has since that time worked as a private investment adviser, at which difficult profession he has been highly successful, and he has written a...

Read More »

Read More »

Immobilie cash aus Vermögen kaufen: Schaffst Du das? | Saidis Senf

Immobilie von Tagesgeld cash bezahlen? Automatischer ETF-Verkauf?

Unsere Depotempfehlungen ► https://www.finanztip.de/wertpapierdepot/?utm_source=youtube&utm_medium=videobeschreibung&utm_campaign=PuLJVbgxQRA

Unsere ETF-Empfehlungen ► https://www.finanztip.de/indexfonds-etf/?utm_source=youtube&utm_medium=videobeschreibung&utm_campaign=PuLJVbgxQRA

🧡 Jetzt Finanztip Unterstützer werden:...

Read More »

Read More »

The Fed and the Fate of the Dollar

Recorded at the Mises Circle in Fort Myers, Florida, 4 November 2023.

Special thanks to Murray and Florence M. Sabrin for making this event possible.

Read Bob's book Understanding Money Mechanics: Mises.org/Mechanics

The Fed and the Fate of the Dollar | Bob Murphy

Video of The Fed and the Fate of the Dollar | Bob Murphy

Read More »

Read More »

AUDUSD dips for 5th consecutive day, Testing key support levels

The AUDUSD has fallen for the 5th day in a row, breaking below key support levels. Traders await further downside towards swing lows from October for potential targets.

Read More »

Read More »

Dringend: WARNUNG vor Digitalem Euro! (CBDC)

Joana Cotar hält eine Brand-Rede im Bundestag über die schwachsinnige Idee des digitalen Euros!

Bravo: https://www.bundestag.de/dokumente/textarchiv/2023/kw45-de-digitaler-euro-973148

Zusammenfassung bei Blocktrainer https://www.blocktrainer.de/erste-pro-bitcoin-rede-im-bundestag/

Aktiendepot-Empfehlung:

4,2 % Zinsen und 6,12% für Einlagen in USD https://link.aktienmitkopf.de/Depot *

👉🏽5 Euro Startbonus bei Bondora ►► https://goo.gl/434rmp *...

Read More »

Read More »