Tag Archive: newsletter

Swiss lawyers seek to keep special ‘advisor’ status in the shadow economy

The Swiss government faces resistance to efforts to tighten anti-money laundering rules that close loopholes for lawyers who act as “advisors” in setting up offshore financial structures. Anti-corruption expert Mark Pieth writes how the lawyer lobby in Switzerland is trying to maintain their special status at the expense of Switzerland’s attempts to improve its reputation as a laundering haven.

Read More »

Read More »

Goodbye to All That: The Demise of Globalization and Imperial Pretensions

The decline phase of the S-Curve is just beginning. Globalization and Imperial Pretensions have been decaying for years; now the tide has turned definitively against them. The Covid-19 pandemic didn't cause the demise of globalization and Imperial Pretensions; it merely pushed the rickety structures over the edge.

Read More »

Read More »

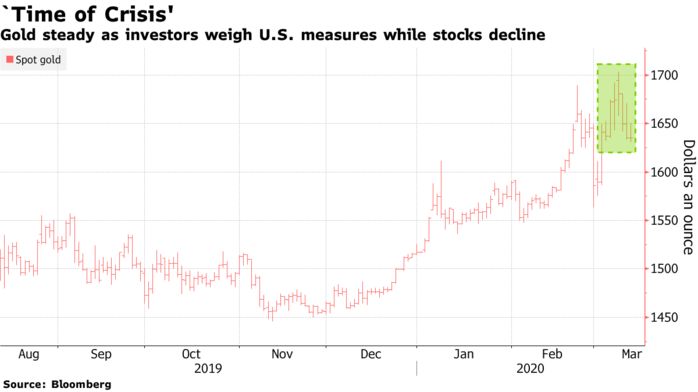

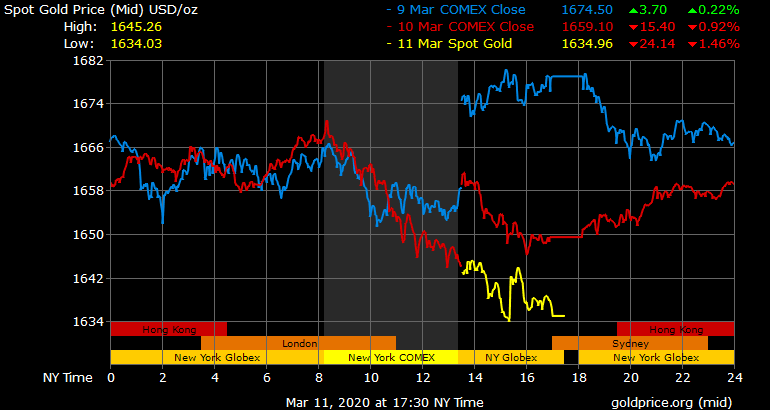

Gold Hedging Stock Market Crash: Euro Stoxx -6 percent, FTSE -5.7 percent and DAX -5.6 percent

◆ Stock markets around the world are collapsing today as the financial and economic implications of the impact of the pandemic on already massively indebted companies and governments is realised.◆ Investors are liquidating en masse risk assets from equities to industrial commodities, while gold has held its ground.

Read More »

Read More »

Modern Monetary Theory Is an Old Marxist Idea

Modern monetary theory, or MMT, has been getting a lot of attention lately, often celebrated as a revolutionary breakthrough. However, there is absolutely nothing new about it. The very basis of the theory, the idea that governments can finance their expenditures themselves and that therefore deficits don’t matter, actually goes back to the Polish Marxist economist Michael Kalecki (1899–1970).

Read More »

Read More »

Aktienmärkte erneut im Panikmodus

Der SMI ist heute morgen teilweise über 6% abgesackt. (Bild: Shutterstock.com/Pavel Ignatov)Die Aktienmärkte erlebten heute erneut einen schwarzen Tag mit Rekordverlusten: Der SMI stürzte um -9,64% auf 8270 Punkte ab, der Euro STOXX 50 um sage und schreibe -12,4% und der DAX tauchte ebenfalls zweistellig um -12,24%. Der Dow Jones lag kurz nach 18 Uhr mit -9,3% ebenfalls im tiefroten Bereich.

Read More »

Read More »

How will we judge multinationals when the epidemic is over?

Our regular analysis of what the biggest global companies in Switzerland are up to. This week: responsible business in an epidemic, child labour on coffee farms, and Responsible Business debate. What has made multinational companies in Switzerland so successful is exactly what is making them particularly vulnerable in a global epidemic.

Read More »

Read More »

Coronavirus: youngest death so far brings Swiss death toll to four

The coronavirus has claimed its fourth victim in Switzerland. A 54 year old man died yesterday in Binningen hospital in the canton of Basel-Landschaft, according to the Federal Office of Public Health (FOPH).

Read More »

Read More »

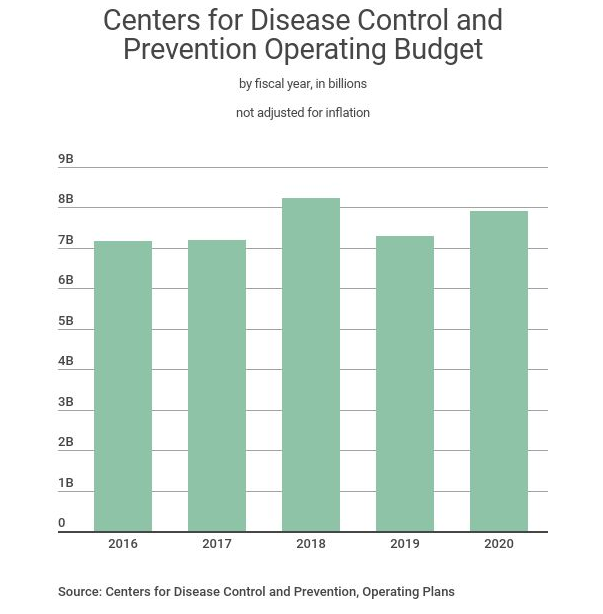

The CDC’s Budget Is Larger Now Than Under Obama

This is how the budget process in Washington begins. Step one: the president submits his budget to Congress. Step two: Congress puts the president's budget in a drawer somewhere and forgets about it. Step three: Congress passes a budget it likes instead.

Read More »

Read More »

Dollar Firms, Equities Sink Ahead of ECB Decision as US Fails to Deliver

President Trump spoke to the nation last night and did little to calm markets; reports suggest that the Democrats are working on a bill. Fed easing expectations are intensifying. The ECB decision will be out at 845 AM ET; over the past 17 ECB decision days, the euro has finished lower in 11 of them.

Read More »

Read More »

Coronavirus: too late to close Swiss borders

Switzerland’s government and health officials presented a coronavirus update yesterday. Key elements of the presentation are set out below. The full coronavirus press update can be viewed above in German.

Read More »

Read More »

New trade barriers could hamper the supply of masks and medicines

Mar 11th 2020IT IS BAD enough when individuals stockpile pasta and toilet paper. It is worse when governments put a protective ring around medical equipment. As the covid-19 pandemic leads to a rush for medical gear, the World Health Organisation (WHO) has warned that supplies of respirators and medical masks will not keep up with demand, and soon global stocks of gowns and goggles will be insufficient too.

Read More »

Read More »

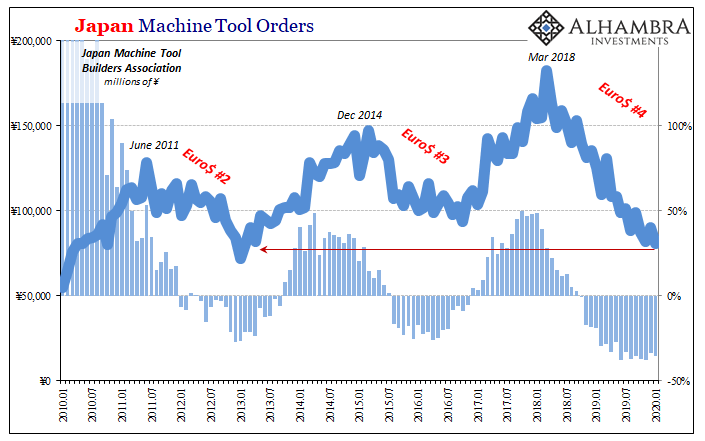

What Happens When Central Banks Buy Stocks (ETFs)? Well, We Already Know

Can we please dispense with all notions that monetary policy works? Specifically balance sheet expansion via any scale asset purchase programs. Nowhere has that been more apparent than Japan. Go back and reread all the promised benefits from BoJ’s Big Bang QQE that were confidently written in 2013. The biggest bazooka ever conceived has fallen short in every conceivable way.

Read More »

Read More »

Why Medicare for All Would Require Huge Tax Increases

Medicare for All is listed as the top priority of Democratic presidential candidate Bernie Sanders. He describes it as a single-payer system that is “free at the point of service” as there will be no premiums, deductibles, copays, or surprise bills. It will cover more services (dental, hearing, vision, long-term care, substance abuse treatment, etc.) than what the present Medicare system covers. It will also stop the “pharmaceutical industry from...

Read More »

Read More »

And Then Came the Lawsuits: Pandemic in a Litigious Society

This is the upside of hyper-litigiousness: prevention is prioritized as the most effective means of limiting future liability. Never mind prevention or vaccines; the big question is "who can we sue after this blows over to rake in millions of dollars?" Yes, this is pathetic, tragic, perverse and evil, but that's reality in a hyper-litigious society like the U.S.

Read More »

Read More »

FX Daily, March 12: Trump Dump as Market Turns to ECB

Overview: After the Bank of England and the UK Treasury announced both monetary and fiscal support, the focus turns to the ECB, but the proximity of the US Congressional recess (next week) without strong fiscal measures being in place sucked the oxygen away from other issues. President Trump's national address in the Asian session failed to reassure investors.

Read More »

Read More »

Aktien Schweiz: SMI hält die Gewinne

So soll EZB-Präsidentin Christine Lagarde die EU-Regierungschefs wegen der Coronavirus-Krise vor einem extremen Schock für die Wirtschaft gewarnt haben. Ohne koordiniertes Vorgehen werde Europa ein Szenario erleben, das viele an die grosse Finanzkrise 2008 erinnern werde, sagte Lagarde am Dienstagabend laut einem Bericht der Nachrichtenagentur Bloomberg während einer Telefonkonferenz des EU-Rats.

Read More »

Read More »

Online shopping breaches CHF10 billion mark

Swiss shoppers spent more than CHF10 billion ($11 billion) online last year, an increase of 8.4% from 2018, according to a study of retail habits. Electronics and fashion goods dominated orders. Food accounted for just 2.8% of the total goods consumed (up from 1.8% in 2018), but the report’s authors expect orders to increase this year with people reluctant to go to supermarkets in view of the coronavirus outbreak.

Read More »

Read More »

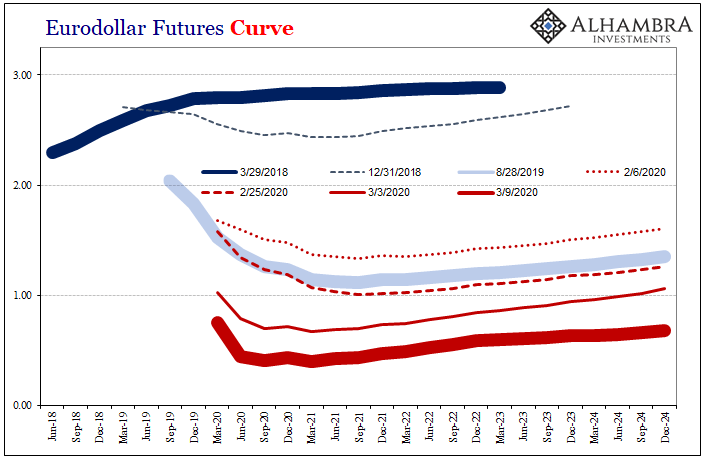

(Almost) Everything Sold Off Today

The eurodollar curve’s latest twist exposes what’s behind the long end. To recap: big down day in stocks which, for the first time in a while, wasn’t accompanied by massive buying in longer maturity UST’s. Instead, these were sold, too. Rumors of parity funds liquidating were all over the place, which is consistent with this curve behavior.

Read More »

Read More »

Dollar Soft as BOE Surprises Ahead of UK Budget

The dollar is stabilizing but remains vulnerable to disappointment as markets await details of US fiscal measures. US reports February CPI; Joe Biden moved closer to clinching the Democratic nomination. BOE delivered a surprise 50 bp rate cut to 0.25% and initiated a new lending scheme; UK government releases its budget today; UK reported weak data.

Read More »

Read More »

Gold Gains As Bank of England Slashes to Emergency Rate of 0.25percent and ECB Warns Of 2008 Style “Great Financial Crisis”

◆ Gold prices rose by 0.6% today as the Bank of England slashed rates in an emergency move to 0.25% and the ECB looks set to follow as it warned of a 2008 style crisis overnight. ◆ The Bank of England slashed its main interest rate to 0.25 percent this morning in a emergency move to combat the fallout from the coronavirus outbreak on the UK economy.

Read More »

Read More »