Tag Archive: newsletter

Dollar Firm as Risk-Off Sentiment Returns

Risk-off sentiment has picked up from reports that the US will impose new tariffs against the EU; there’s also been a messy set of headlines regarding the virus contagion outlook in the US. The IMF will release updated global growth forecasts today; the dollar is benefiting from risk-off sentiment; another round of fiscal stimulus in the US is in the works.

Read More »

Read More »

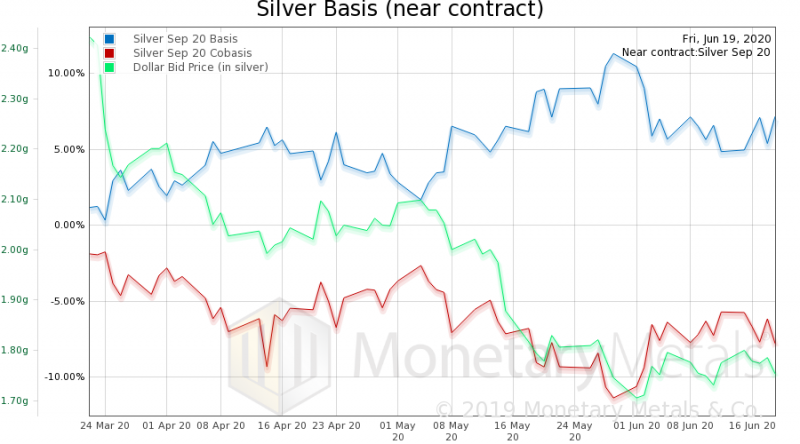

Why the Central Bank “Bailout of Everything” Will Be a Disaster

Despite massive government and central bank stimuli, the global economy is seeing a concerning rise in defaults and delinquencies. The main central banks’ balance sheets (those of the Federal Reserve, Bank of Japan, European Central Bank, Bank of England, and People’s Bank Of China) have soared to a combined $20 trillion, while the fiscal easing announcements in the major economies exceed 7 percent of the world’s GDP according to Fitch...

Read More »

Read More »

Vortrag & Fragen: Kapitalismus ist nicht das Problem, sondern die Lösung

Webseite zum Buch - https://kapitalismus-ist-nicht-das-problem.de/

Folgen Sie mir auf Twitter - https://mobile.twitter.com/rzitelmann

Folgen Sie mir auf Facebook - https://www.facebook.com/r.zitelmann/

Folgen Sie mir auf Forbes.com - https://www.forbes.com/sites/rainerzitelmann/

Meine Homepage - http://www.rainer-zitelmann.de/

Read More »

Read More »

FX Daily, June 24: Risk Appetites Satiated for the Moment

Overview: The rally in risk assets in North America yesterday is failing to carry over into today's activity. Asia Pacific equities were mixed. Korea and Indonesia led the advances with more than 1% gain. China and Taiwan also gained. Japan and Hong Kong. Europe's Dow Jone's Stoxx 600 is giving back yesterday's gains (~1.3%) plus some and US stocks are heavy.

Read More »

Read More »

Restricted Market Trading Comments

There were minimal changes to the status quo as the week commences. Bangladesh has announced revised trading hours on the local exchanges. No change of status in Nigeria and Kenya as they both continue to face limited liquidity. Please see trading comments below.

Read More »

Read More »

The Illusion of Control: What If Nobody’s in Charge?

The last shred of power the elites hold is the belief of the masses that the elites are still in control. I understand the natural desire to believe somebody's in charge: whether it's the Deep State, the Chinese Communist Party, the Kremlin or Agenda 21 globalists, we're primed to believe somebody somewhere is controlling events or pursuing agendas that drive global responses to events.

Read More »

Read More »

The Decline of the Third World

A Failure to Integrate Values. The only region in the world that has proactively tried to incorporate western culture in its societies is East Asia — Singapore, Japan, Hong Kong, South Korea, and Taiwan. China, which was a grotesquely oppressed, poor, Third World country not too far in the past, notwithstanding its many struggles today, has furiously tried to copy the West.

Read More »

Read More »

Central Bankers Will Bring Us Economic Stagnation

“Our country continues to face a difficult and challenging time….People have lost loved ones. Many millions have lost their jobs. There is great uncertainty about the future. At the Federal Reserve, we are strongly committed to using our tools to do whatever we can, for as long as it takes…to ensure that the recovery will be as strong as possible, and to limit lasting damage to the economy” –Jerome Powell, Chairman of the Federal Reserve, June 10,...

Read More »

Read More »

FX Daily, June 23: Weebles Wobble but they Don’t Fall Down

Overview: After early indecision, investors ramped the demand for risk assets, encouraged perhaps by indications that the Trump Administration going to support at least another trillion-stimulus package. The NASDAQ rallied to new record highs, and the dollar got thumped across the board. However, in early Asia activity, Trump adviser Navarro seemed to have told Fox News that the US-China trade deal was over.

Read More »

Read More »

Swiss public transport expected to lose CHF1.5 billion due to Covid-19

The collapse in the number of commuters and other passengers on Swiss trains and buses due to the pandemic is likely to leave a big hole in the finances of public transport companies. The Le Matin Dimanche and SonntagsZeitung newspapers reported on Sunday that Alliance SwissPass, the national public transport organisation, expects the number of yearly national train passes to fall by 6% and half-price annual passes to drop by 1% by the end of the...

Read More »

Read More »

Glencore faces Swiss probe over alleged Congo corruption

The Office of the Attorney General of Switzerland (OAG) has opened a criminal probe into Swiss-based commodity trader and miner Glencore over alleged corruption in the Democratic Republic of the Congo, where it mines copper and cobalt.

Read More »

Read More »

Drivers for the Week Ahead

There are some indexing events this week that could add to market volatility; the IMF will release updated global growth forecasts Wednesday. The regional Fed manufacturing surveys for June will continue to roll out; Fed speaking engagements are somewhat limited this week.

Read More »

Read More »

Some Conservatives Want Americans to Abandon Classical Liberalism. Don’t Listen to Them.

Donald Trump's economic populism, and his break with the established post-war conservative movement, has created an opening for new types of conservatism. Among these is the anti-market wing of the movement characterized by a renewed enthusiasm for trade controls, more spending on welfare programs, and more government regulation in the everyday lives of ordinary Americans.

Read More »

Read More »

FX Daily, June 22: Dollar Begins Week on Back Foot

Overview: Investors begin the new week, perhaps slowed a bit by the weekend developments and the growth of new infections. Equities are mixed. The MSCI Asia Pacific Index snapped a four-day advance, though India bucked the regional trend and gained 1%. Europe's Dow Jones Stoxx 600 is recovering from an early dip to four-day lows. US shares are trading higher after the S&P 500 closed below 3100 ahead of the weekend after reaching 3155.

Read More »

Read More »

Coronavirus: Swiss authorities not open enough in early weeks, says medical expert

The Swiss authorities should have been more open about what they did and didn’t know about the SARS-CoV-2 virus in the early stages, according to Bertrand Kiefer, doctor, ethicist and editor of the Swiss Medical Review.

Read More »

Read More »

Swiss National Bank forecasts deflation until 2022

On 18 June 2020, the Swiss National Bank (SNB) said it would maintain its negative rate of interest (-0.75%) and remains willing to intervene more strongly in the foreign exchange market.

Read More »

Read More »

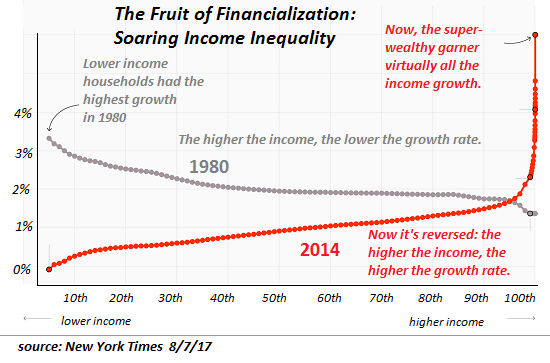

For the Rich to Keep Getting Richer, We Have to Sacrifice Everything Else

They're hoping the endless circuses and trails of bread crumbs will forever distract us from their plunder and the inequalities built into America's financial system.. The primary story of the past 20 years is the already-rich have gotten much richer, with destabilizing economic, social and political consequences.

Read More »

Read More »

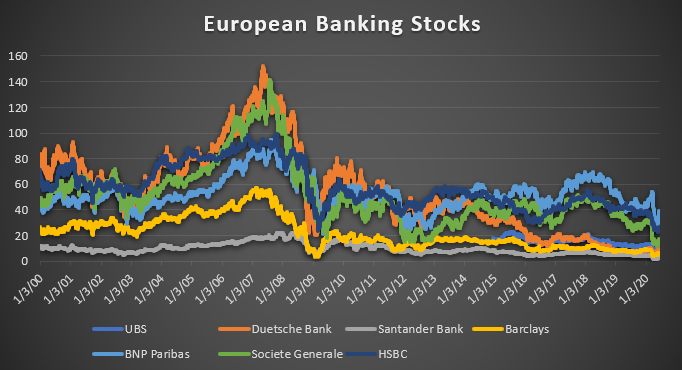

WARNING: The U.S. Banking System ISN’T as Strong as Advertised

Despite a year of tumult on Wall Street and Main Street, the banking system seems to be holding up remarkably well… for now. Whereas previous financial crises were marked by a surge in bank failures, hardly any have gone under so far in 2020. The Federal Deposit Insurance Corporation (FDIC) reports that only 1% of FDIC-insured banks are on the “problem list” for financial weakness.

Read More »

Read More »