Tag Archive: newsletter

Geldpolitik – Prognose: SNB-Zinserhöhung frühestens in zwei Jahren

Ungeachtet der jüngsten Abschwächung des Frankens dürfte die Schweizerische Nationalbank (SNB) am Donnerstag bei ihrer vierteljährlichen geldpolitischen Lagebeurteilung an ihrem Leitzins von minus 0,75 Prozent festhalten, prognostizieren alle 35 von Reuters befragte Wirtschaftsexperten. Auch die Sichteinlagen von Banken bei der Notenbank ab einem gewissen Freibetrag dürften weiterhin mit einer Gebühr von 0,75 Prozent belastet werden.

"Die SNB...

Read More »

Read More »

Pandemic hurts box office takings at Swiss cinemas

Ticket sales at Swiss cinemas plummeted by two-thirds last year as venues were forced to close their doors. Of the films that could be shown, Swiss movies made up a greater share of the total offering.

Read More »

Read More »

ACHTUNG: BITCOIN & CRYPTO RÜCKSETZER!!

Hat dir das Video gefallen? Gib mir nen DAUMEN HOCH ? bzw. TEILE dieses Video um gemeinsam AT, DE und CH #cryptofit zu machen!

Read More »

Read More »

Ernst Wolff: Die AstraZeneca-Affäre: Was steckt dahinter? [Der aktuelle Kommentar 22.03.21]

Die Berichterstattung der Mainstream-Medien und die Vorgänge im realen Leben haben in unserer Zeit immer weniger miteinander zu tun. Es empfiehlt sich daher, sorgfältig zwischen beiden zu unterscheiden. So auch in der AstraZeneca-Affäre der vergangenen Wochen.

Read More »

Read More »

MAX OTTE: Auf der Suche nach dem verlorenen Deutschland || BUCHVORSTELLUNG || GESANGVEREIN ||

Das Buch "Auf der Suche nach dem verlorenen Deutschland" von Max Otteerscheint am 23. März 2021. In diesem Video spricht Max Otte über seinen Männergesangsverein und Kirche zu Ohle.

Read More »

Read More »

The Real Investment Show [3/22/21]

Market Analysis & Commentary from RIA Advisors Chief Investment Strategist, Lance Roberts, CIO

Read More »

Read More »

Das Moore’sche Gesetz – RISC / CISC Disruption – Apple M1, ARM, Intel, AMD EPYC, Zen 3

Von der Computergemeinde fast nicht bemerkt, vollzieht sich gerade eine disruptive Unterbrechung in der CPU-Entwicklung. Jeder aus der Informationstechnologie kennt das empirische Moore'sche Gesetz, das die Verdopplung der #Prozessorleistung alle 2 Jahre beschreibt.

Read More »

Read More »

2021 03 22 Live Marktanalysen

Unter anderem Analysen des S&P500, Nasdaq, Dollar Index, Mexikanischen Peso, Natural Gas, und einigen Aktien.

Read More »

Read More »

Taler know how Gerd Kommer So solltest Du in 2021 Investieren Vergleich Immobilien, Aktien und ETF

Wie funktioniert Geld / Gerd Kommer So solltest Du in 2021 Investieren Vergleich Immobilien, Aktien und ETF

Hallo Leute ich versuche nützliche Infos zu Geld im Internet zu Finden,

und in meinem Kanal zusammen zu tragen.

Über weiter Tipps und Kommentare würde ich mich sehr freuen.

Schreibt dies doch gleich in die Kommentare.

Follow me on Instergram:https://www.instagram.com/dasberaterteam/?hl=en

Follow me on...

Read More »

Read More »

All-Time-Highs: Jetzt noch einsteigen oder nachkaufen?

All-Time-Highs: Jetzt noch einsteigen oder nachkaufen?

Kostenloses Buch: Die Kunst des Leerverkaufs

https://www.florianhomm.net/leerverkauf-digitalversion

Börsenbrief: https://www.homm-longshort.com *

Website: https://www.florianhomm.net

Facebook: https://www.facebook.com/florian.homm.official/

Instagram: https://www.instagram.com/florian.homm.official/?hl=de

Impressum:

Dr. h.c. Florian Homm

Wilhelm-Bonn-Straße 9

61476 Kronberg im Taunus...

Read More »

Read More »

Jetzt in Tech-Aktien investieren?

Solltest du jetzt in Technologie-Aktien investieren?

? Du möchtest nach dem Weltportfolio-Konzept von Gerd Kommer investieren? Erfahre mehr über den neuen Robo Advisor Gerd Kommer Capital: http://gerd-kommer-capital.de/youtube-promo/ *

ℹ️ Infos zum Video:

Vor allem Dank der tollen Renditen von Tech-Aktien in der jüngeren Vergangenheit fragen sich Privatanleger aktuell, ob sie jetzt verstärkt in diesem Sektor investieren sollten. Daniel wirft...

Read More »

Read More »

Trading-Karriere starten: Wähle eine Trading-Strategie

Melde Dich jetzt bei "Kleines Konto groß traden" an!

https://mariolueddemann.com/kleines-konto-gross-traden/

Trading-Karriere starten: Wähle eine Trading-Strategie

Du willst Trader werden oder als klassischer Börseninvestor 10 % + x ganz bequem erreichen? Dann trag Dich jetzt für Rendite unlimited Online ein: https://mariolueddemann.com/fuer-beginner-rendite-unlimited/

Trage dich jetzt in unseren Newsletter ein, um den "Blick auf...

Read More »

Read More »

Prices Are Set to Soar

"Government,” observed the great Austrian economist Ludwig von Mises, “is the only institution that can take a valuable commodity like paper and make it worthless by applying ink.” Mises was describing the curse of inflation, the process whereby government expands a nation’s money supply and thereby erodes the value of each monetary unit—dollar, peso, pound, franc, or whatever.

Read More »

Read More »

Der Goldpreis wird EXPLODIEREN, BEREITEN sie sich vor !!! [Michael Reagiertauf]

Falls du weitere Fragen oder Anregungen hast, kannst du mir gerne einen Kommentar da lassen. Teile das Video gerne auch mit deinen Kollegen, Freunden oder Verwandten!

Read More »

Read More »

Der wirtschaftliche Untergang Europas? Investmentpunk LIVE am 18.3.

Der gelernte Investmentbanker und Selfmade Multi-Millionär Gerald Hörhan aka. der Investmentpunk, erklärt in diesem LIVE Update vom 02.03.21 wie sich die drohende Inflation bzw. Hyperinflation auf Vermögenswerte wie Anleihen, Immobilien & Co auswirken wird.

Read More »

Read More »

Swiss ‘too big to fail’ banks pose little risk to the economy

Three of Switzerland’s “too big to fail” banks no longer threaten to cause a seismic shift in the economy should they collapse, says the financial regulator. Zurich Cantonal Bank, PostFinance and the Raiffeisen banking group are now deemed to have put into place credible plans for an orderly bankruptcy.

Read More »

Read More »

Community and Civil Society over State

Raghuram Rajan has written a surprising book. Now teaching finance at the University of Chicago, he is an international bureaucrat in good standing, and not a minor one at that; he was chief economist of the International Monetary Fund. Yet far from calling for an increase in “global governance,” as one might expect from someone with his background, he wants to strengthen the local, “proximate,” community.

Read More »

Read More »

Swiss upper house votes to raise pension age for women

As Switzerland’s population ages the number of people paid state pension is rising relative to the number of workers funding it. Since 2014, more has been paid out than has been paid in. The most effective way to fix this imbalance is to raise the pension age. If the average life expectancy of a retiree is 15 years, then raising the pension age by one year will cut the cost by nearly 7%.

Read More »

Read More »

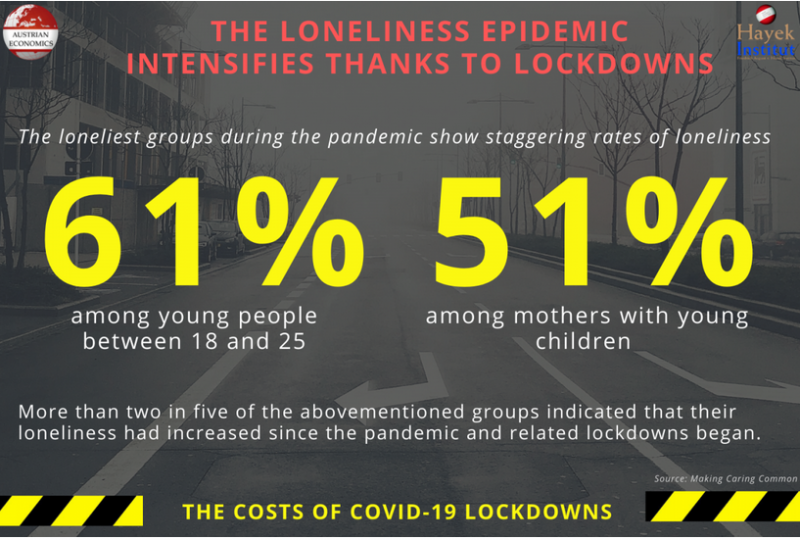

The Loneliness Epidemic intensifies Thanks to Lockdowns

The coronavirus has dominated all of our lives in recent months. Radical paths were taken by politicians in the form of lockdowns to contain the pandemic. But we should recognize that even if the coronavirus is a (major) challenge for us, we always have to keep a holistic view of world events.

Read More »

Read More »