Tag Archive: newsletter

Short Covering in the US Treasury Market Extends the Yield Pullback

Overview: What appears to be a powerful short-covering rally in the US debt market has helped steady equities and weighed on the dollar. Singapore and South Korea joined New Zealand and Canada in tightening monetary policy. Attention turns to the ECB now on the eve of a long-holiday weekend for many members. The tech-sector led the US equity recovery yesterday, snapping a three-day decline. Most of the major markets in Asia Pacific advanced but...

Read More »

Read More »

Staat nutzt Crypto-Börsen zur Kontrolle des Marktes in Indien und Weißrussland

Zentrale Cryptobörsen werden immer mehr zum schwachen Glied in der Kette. In Indien und Weißrussland wurde diese Woche wieder deutlich, wie der Staat die Börsen benutzen kann, um den Cryptomarkt zu kontrollieren. Crypto News: Staat nutzt Crypto-Börsen zur Kontrolle des Marktes in Indien und WeißrusslandIn Indien wurden diese Woche Einzahlungen mit Rupien auf einigen Cryptobörsen unterbunden. Zwei der größeren Börsen des Landes, WazirX und...

Read More »

Read More »

Russian Warship ‘Seriously Damaged,’ Ukraine claims responsibility

While Ukraine and Russia continue to hold ceasefire talks the fighting on ground has only intensified. With Moscow now reporting attack on warship, a Russian flagship was reportedly damaged due to attack at the Black Sea. Russian navy's flagship sea fleet the Moskva missile cruiser was damaged heavily.

Read More »

Read More »

Die 5 wichtigsten Versicherungen

Wie sie gehen und wozu sie gut sind

Mehr zum Thema erfahren? Besuchen Sie uns auf https://www.fintool.ch

?? Auf diesen Kanälen könnt ihr uns erreichen:

–––––––––––––––––––––––––––––––––––––––––––––

►Unsere Website: https://www.fintool.ch

►Unser FACEBOOK: https://www.facebook.com/fintool

►Unser LinkedIn: https://www.linkedin.com/company/fint...

►Unser INSTAGRAM: https://www.instagram.com/fintool.ch/...

Read More »

Read More »

Binance Sets up at Paris’ STATION F to Develop the Web.3 Ecosystem in Europe

Binance, a global blockchain ecosystem and cryptocurrency infrastructure provider, announced the opening of its space in at the startup campus STATION F in Paris.

Read More »

Read More »

You Know What They Say About The Light At The End Of The Tunnel

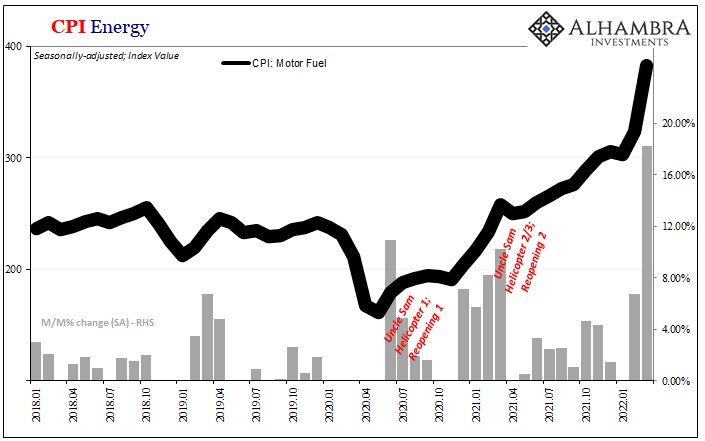

In any year when gasoline prices rise 18%, that’s not going to be good for anyone except maybe oil companies who extract its key ingredient from out of the ground (or don’t, as the case can be). Yet, annual rates of increase that size do happen.

Read More »

Read More »

Swiss property market faces bleak future despite record values

The Covid-19 pandemic has failed to rattle the Swiss property market. Prices for apartment buildings have hit a record high. But now the war in Ukraine and rising interest rates threaten to turn the tide.

Read More »

Read More »

No business can be right in a war that’s wrong

Western companies should end their business relations with Russia. It is their moral duty to contribute to peace-making by their actions, says a group of business ethicists in Switzerland and Austria.

Read More »

Read More »

Achtung Inflation: Wohlstand in Gefahr!

“So act that your principle of action might safely be made a law for the whole world.”

| Immanuel Kant (1724–1804)

Read More »

Read More »

Virginia Ends All Taxes on Purchases of Gold and Silver

(Richmond, Virginia - April 12, 2022) - By signing sound money legislation last night, Virginia Governor Glenn Youngkin has ended Virginia’s discriminatory practice of assessing sales taxes on smaller purchases of gold, silver, platinum, and palladium bullion and coins.

Read More »

Read More »

European leaders flock to Ukraine after US President Joe Biden calls Russian invasion a genocide

European politicians are flocking to Ukraine the latest to do so are the leaders from Poland Lithuania Latvia and Estonia. The visit comes after Biden calls invasion a genocide.

Read More »

Read More »

Wie Du Dein Kapital sicher und ertragreich anlegst! | Kapital Kongress 2022

Aktien, Immobilien, Kryptowährungen oder Edelmetalle? Auf dem Kapital Kongress erfährst Du, wie Du dein Kapital sicher und ertragreich anlegst! Mehr als 35 Speaker sind auf dem Kapital Kongress vertreten und werden Dir vom 05. - 08. Mai 2022 Ihr Wissen vermitteln!

Und das Beste ist: Es ist völlig kostenlos! Außerdem kannst du mit deiner Anmeldung ebenfalls an unserer Verlosung teilnehmen.

Melde Dich hier beim Kapital Kongress an! ►...

Read More »

Read More »

Frei mit Immobilien, Auswandern und Leben in Costa Rica – Interview mit Alexander Raue

Ortsunabhängig Geld verdienen, Auswandern und Costa Rica

Alexander YouTube-Kanal: https://www.youtube.com/c/Vermietertagebuch

Alexander Homepage: https://vermietertagebuch.com/ueber/

Thorsten Homepage: https://thorstenwittmann.com/

Freitagstipps Abonnieren: https://thorstenwittmann.com/klartext/

Frei mit Immobilien, Auswandern und Leben in Costa Rica

Ortsunabhängig Geld verdienen, Auswandern und Costa Rica. Das sind die heutigen Themen im...

Read More »

Read More »

Die Lage ist katastrophal – leere Regale und Bauernsterben (Ukraine)

Die Preise für Lebensmittel explodieren. Immer öfter steht man auch vor leeren Regalen im Supermarkt. Durch den Ukraine-Krieg fallen Weizen, Sonnenblumenöl und Düngerexporte aus. Welche Auswirkungen hat dies auf die Lebensmittelversorgung und auf die Landwirtschaft? Darüber spreche ich heute mit dem Landwirt Anthony Lee.

► Timestamps:

00:00 - 02:23 Intro & Vorstellung

02:23 - 07:17 Droht eine Hungersnot? Stehen wir bald vor leeren Regalen?...

Read More »

Read More »

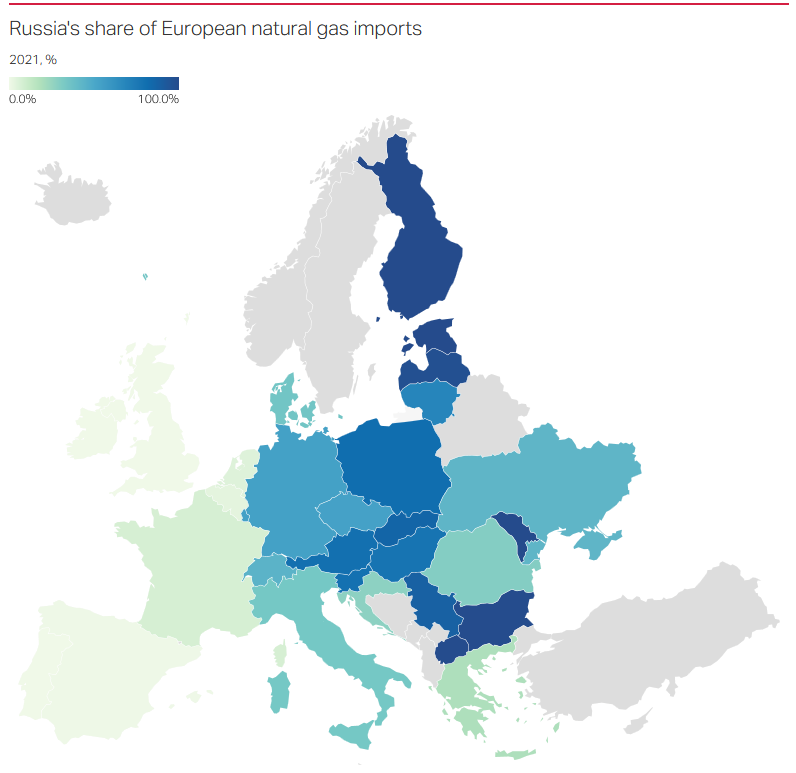

Neue Gefahr für den Euro?

► Höre Dir auch meinen Podcast an! Hier findest Du ihn bei:

• Google Podcasts: https://podcasts.google.com/?feed=aHR0cHM6Ly9lcmljaHNlbi5wb2RpZ2VlLmlvL2ZlZWQvYWFjP3BhZ2U9MQ

• Apple Podcast: https://podcasts.apple.com/de/podcast/erichsen-geld-gold-der-podcast-f%C3%BCr-die-erfolgreiche/id1455853622

• Spotify: https://open.spotify.com/show/1a7eKRMaWXm8VazZH2uVAf

• Amazon Music: https://music.amazon.de/podcasts/9e0da0e4-3a93-4012-bedb-1cad4bea83a2

Der...

Read More »

Read More »

Prof. Sandner über neue Bitcoin- & Krypto-Regulierung! EU-Maßnahmen (MiCA) | Interview 1/2

Im heutigen Video sprechen wir mit Krypto-Experte Prof. Dr. Philipp Sandner über die geplanten EU-Regulierungen von Kryptowährungen.

Read More »

Read More »

Userfrage: Geldanlage durch Reiche – Family Offices und Familienunternehmen

Also nicht Hinz und Kunz, sondern so richtig #Reiche. Wobei der Fragende eines Zusehers von 2 Mio. ausgeht. Kann man heute bei all der #Inflation noch von 2 Mio. als Reichtum sprechen?

Eine hochinteressante Frage, die von unseren Medien grundsätzlich falsch interpretiert und beantwortet wird.

Read More »

Read More »

Inflation außer Kontrolle und Zentralbanken in der Not️

Gleich zwei globale Notenbanken haben heute die Zinsen um 50 BP erhöht. Dennoch bleibt die Inflation weiter hoch und es sieht so aus als wenn der Markt noch nicht alle Implikationen eingepreist hat.

Read More »

Read More »

Etwas Mut im Dax – schauen wir auf die Details – Charttechnik mit Rüdiger Born

Ganz kurzfristig kann man etwas Mut fassen im Dax. Auch schaue ich im folgenden Video genau auf die US-Indizes.

Read More »

Read More »

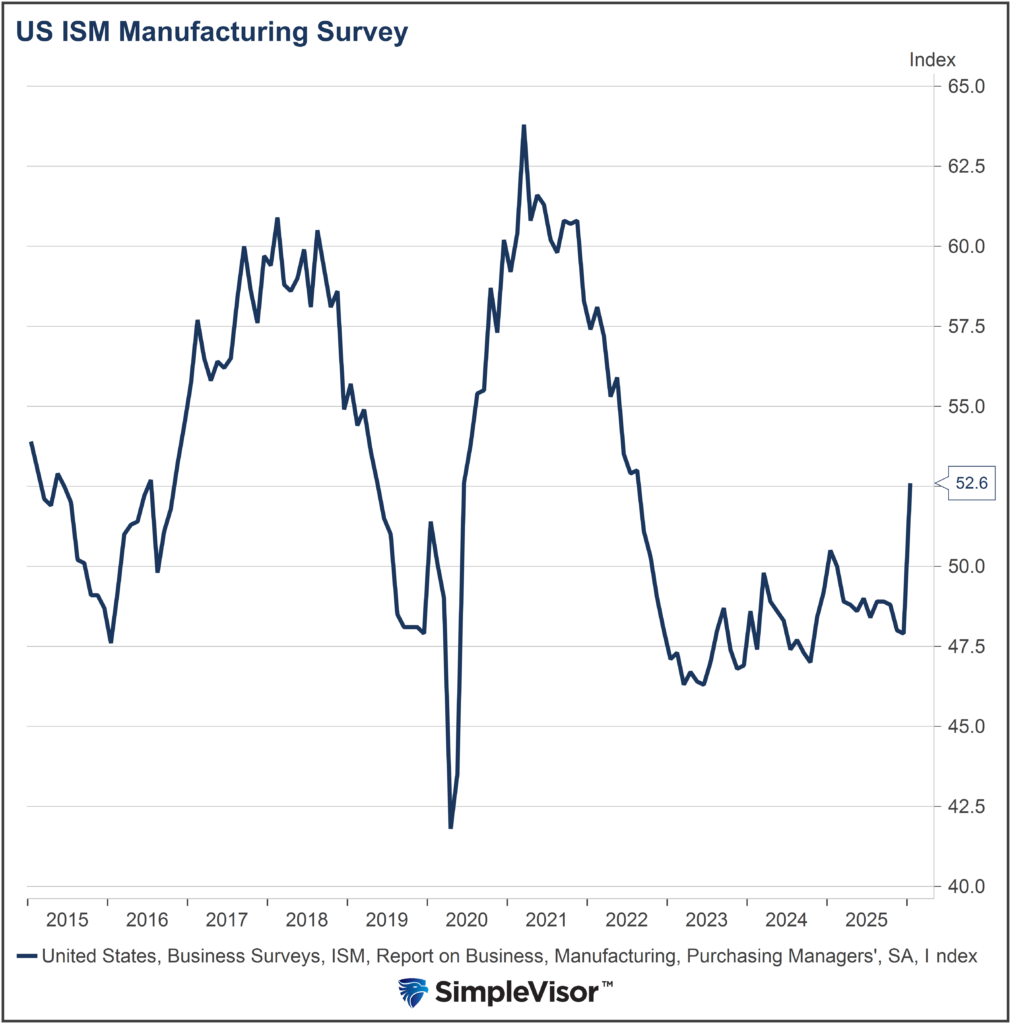

Will an Over-sold Market lead to a Bounce? | 3:00 on Markets & Money

(4/13/22) Markets are back on a sell-signal, and getting back to an over-sold condition, suggestive of a bounce. Coming on the heels of the hottest inflation print since 1981, markets are working to hold support at the 50-DMA. This pattern is not just confined to the S&P 500; International markets are continuing into a very negative downtrend, Emerging Markets have performed terribly this year,. In fact, International and Emerging Markets have...

Read More »

Read More »