Tag Archive: newsletter

Live-Trading mit Rüdiger Born | 28.06.2022 | XTB

Schauen Sie dem Profi-Trader Rüdiger Born jede Woche online und live über die Schulter. Kostenlose Anmeldung: https://de.xtb.com/born-live

? Unsere täglichen Marktanalysen finden Sie hier: https://www.xtb.com/de/Marktanalysen/...

? Folgen Sie uns auf Facebook: https://www.facebook.com/xtbde

? Folgen Sie uns auf Instagram: https://www.instagram.com/xtb_de

? Folgen Sie uns auf Twitter: https://www.twitter.com/xtbde

CFD sind komplexe Instrumente...

Read More »

Read More »

Wir steuern auf ein schlechtes 1. Halbjahr zu – US Opening Bell mit Marcus Klebe – 22.06.22

Wir steuern auf ein schlechtes 1. Halbjahr zu - US Opening Bell mit Marcus Klebe - 22.06.22

Folge uns auf:

Telegramm: https://t.me/jfdbank_de

LinkedIn: https://www.linkedin.com/showcase/jfd...

Facebook: https://www.facebook.com/JFDGermany/

Twitter: https://twitter.com/JFD_Group

Webseite: https://www.jfdbank.com/de

#DowJones #Trading #MarcusKlebe

ÜBER JFD:

WER WIR...

Read More »

Read More »

What Happens to Oil Prices After Big Spikes? | 3:00 on Markets & Money

(6/22/22) Markets bounced 2% following a long weekend break. This morning's early morning sell-off may keep prices suppressed. Consolidations lead to failures and short-term increases, making it difficult for investors to make any returns. Oil prices are beginning to exhibit this behavior, too, down about 4% after big run up. We're looking for a bounce at about $96 to $100/bbl. As demand slows down as the economy weakens, the diminished demand for...

Read More »

Read More »

Vermögensregister und Lastenausgleich – Volkszählung 2022 (Zensus)

In diesem Video erzähle ich dir meine Erfahrungen und Bedenken zur Volks-, Gebäude und Wohnungszählung 2022

Read More »

Read More »

Who Sets the Price You Pay for Gasoline?

(6/22/22) Markets rallied +2% following a three-day weekend; gasoline prices took a slight slide, while mortgage rates spiked. Who sets the price you pay for gasoline? Not the major oil companies; why a gas tax "holiday" won't work; the real oil company profit margin story. The truth about home ownership, and why Millennials can't afford a house (Netflix has nothing to do with it.) Houses are not assets; financialization of everything,...

Read More »

Read More »

Risk Appetites are Fickle

Overview: Yesterday’s strong US equity gains failed to carry over into today’s session. Japanese and Australian shares fared the best among the large Asia Pacific market, with the Nikkei off less than 0.4% and the ASX off less than 0.25%.

Read More »

Read More »

Dirk Müller – Dramatische Wende: USA lässt Ukraine fallen wie eine heiße Kartoffel

????? ??? ??? ????? ?????? ??? ???? ??̈???? ????:

https://bit.ly/Marktupdate220621

(Bei diesem Video handelt es sich um einen kurzen Ausschnitt aus dem Update vom 21.06.2022 auf Cashkurs.com.)

Sie sind noch kein Mitglied?

Zum Einstiegspreis anmelden und vollen Zugriff auf alle Artikel und Videos holen - Sie erhalten den ersten Monat für nur 9,90 Euro - http://bit.ly/ck-registrieren

https://www.cashkurs.com – Ihre unabhängige...

Read More »

Read More »

DAX geht wieder auf Tauchstation – “DAX Long oder Short?” mit Marcus Klebe – 22.06.22

DAX geht wieder auf Tauchstation - "DAX Long oder Short?" mit Marcus Klebe - 22.06.22

Folge uns auf:

Telegramm: https://t.me/jfdbank_de

LinkedIn: https://www.linkedin.com/showcase/jfd...

Facebook: https://www.facebook.com/JFDGermany/

Twitter: https://twitter.com/JFD_Group

Webseite: https://www.jfdbrokers.com/de

#DAX #MarcusKlebe #Trading

ÜBER JFD:

WER...

Read More »

Read More »

ICH GEHE JETZT (wirklich) RAUS AUS P2P-KREDITEN… (zu wenig Rendite) ?

?Hol dir 100 CHF Trading Credits bei einer Aktien-Depoteröffnung ►► http://sparkojote.ch/swissquote *

(only for swiss residents)

ICH GEHE JETZT (wirklich) RAUS AUS P2P-KREDITEN... (zu wenig Rendite)

Ich möchte mehr Gold und Krypto in meinem Portfolio. Wie ich das mache, jetzt vorgehen werde und warum ich dafür raus aus P2P-Krediten gehe. Wie seht Ihr das? Schreibt mir eure Gedanken dazu gerne in die Kommentare.

#p2pkredite #gold #Finanzrudel

?...

Read More »

Read More »

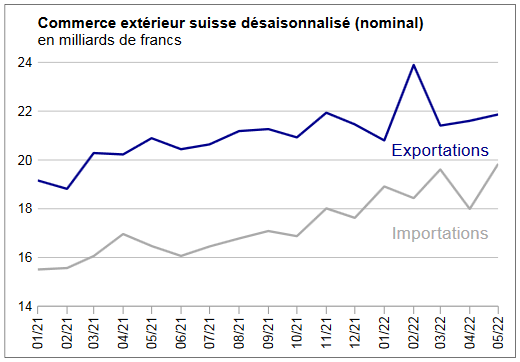

Swiss Trade Balance May 2022: surge in imports towards a level record

In May 2022, Swiss foreign trade strengthened in both directions of traffic: seasonally adjusted exports increased by 1.2% while imports jumped by 10.3%. The latter thus confirmed their upward trend despite strong fluctuations. Due to the different pace of growth at the outflow and the inflow, the trade balance surplus stood at CHF 2.0 billion.

Read More »

Read More »

ZKB-Ökonomen senken Konjunkturprognose für die Schweiz

Neu wird für 2022 mit einem Wachstum des Bruttoinlandprodukts (BIP) von 2,7 Prozent nach bisher 3,0 Prozent gerechnet und für 2023 mit einem solchen von 1,5 Prozent nach 1,7 Prozent, wie aus einer am Dienstag veröffentlichten Publikation hervorgeht.

Read More »

Read More »

The Difference Between a Forecast and a Guess

Every forecast or guess has one refreshing quality: one will be right and the rest will be wrong. What's the difference between a forecast and a guess? On one level, the answer is "none": the future is unknown and even the most informed forecast is still a guess.

Read More »

Read More »

In Defense of Defaulting on the National Debt

With the acknowledged national debt now a politically and economically unpayable $30 trillion (in reality, its unfunded liabilities are far greater), Americans should start to become acclimated to the realities of the United States’ eventual, inevitable default.

Read More »

Read More »

Sag deinem Wohlstand adieu! Handyversion

Wohlstand adieu - In diesem Video erklärt euch Markus Krall, wie es um unser Volksvermögen bestellt ist und wie die Inflation auch eure Ersparnisse auffrisst. Und das nur, damit die Unmengen an gedrucktem Geld auf deine Kosten vernichtet werden.

Read More »

Read More »

Juneteenth and Secular Holidays as Tool of the Regime

Last year Congress officially declared Juneteenth a federal holiday. While Very Serious talking heads attempted desperately to convince those that would listen that Juneteenth was a long-celebrated American holiday, the reality is that it was largely unknown around the nation prior to congressional action. The episode is a useful illustration of how the state weaponizes secular holidays to promote a larger cultural agenda.

Read More »

Read More »

How the U.S. can avoid decline based on lessons from history

Here’s how the U.S. can avoid decline based on the lessons of #history. #principles #raydalio #shorts

Read More »

Read More »

Wie kann ein Depot mit 6 ETFs aussehen? | Sparkojote Dividenden Dienstag

?Hol dir 100 CHF Trading Credits Aktien-Depoteröffnung ►► http://sparkojote.ch/swissquote *

(only for swiss residents)

Der #DividendenDienstag Livestream findet jeden Dienstag um 19:00 Uhr auf Instagram statt, zusammen mit Johannes Lortz philosophieren wir über #Dividenden #Aktien, das Investieren, die Börse und vieles mehr.

??Kanal von Johannes ►► @Johannes Lortz

#DividendenDienstag #CommunityPortfolio #Finanzrudel

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

★...

Read More »

Read More »