Tag Archive: newsletter

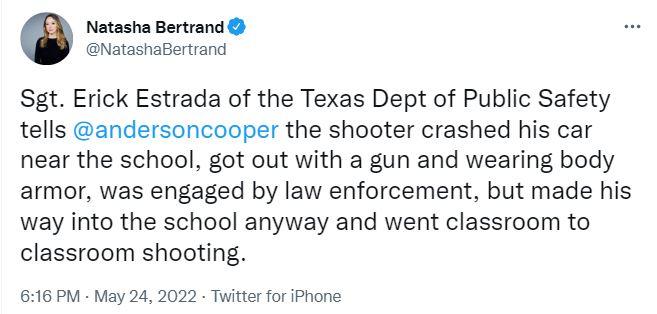

Police Botched the Uvalde Standoff. Now Gun Controllers Want to Give Police More Power.

First it was Columbine. Then it was Parkland. Now, we learn that at Robb Elementary School, police officers again stood around outside a school while the killer was inside with children.

Read More »

Read More »

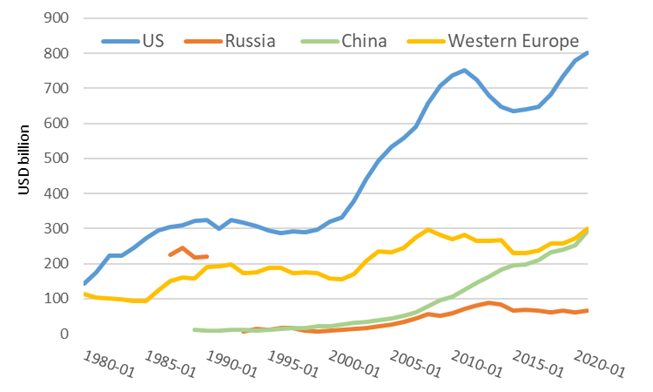

Peace through Strength? Excessive US Military Spending Encourages More War

The Russian invasion of Ukraine has brought America’s foreign policy interventions under the limelight once again. Ryan McMaken argues that the US administration’s claim that countries should not have the right to a sphere of influence, implicitly addressing Russia, is hypocritical.

Read More »

Read More »

Warum ist der Schweizer Franken so stark?

Nehmen Sie an unserer kostenlosen wöchentlichen online Kaffeepause und Aktiendiskussion teil: https://www.eventbrite.ch/e/kaffeepause-okonomie-und-philosophie-tickets-149113349041?aff=video

Was hinter der Stärke des Schweizer Frankens steckt - Dr. Hermann Stern erklärt es in einem unserer Online Kaffeepause Aktien Gespräche.

Datum: 10. Februar 2022

Read More »

Read More »

Target Date Funds: The Rule of Dumb

(5/27/22) (5/27/22) Will the Memorial Day weekend see lots of "revenge travel?" Never under-estimate the ability of a bear market to suck you in one more time; a reflexive rally is not an all-clear sign for investors. Listen to screeching sound of a dead-cat bounce; how are companies responding; how long can a reflexive rally last? ESG funds are just S&P funds in a green skirt. Target Date Funds: The Rule of Dumb. Why Target Date Fund...

Read More »

Read More »

Andre Stagge Erfahrungen – Endlich eine seriöse Ausbildung zum Portfolio- Experten?!

Heute teilen wir mit euch unsere Portfolio Manager Erfahrungen von Andre Stagge:

➡ Blog Artikel: https://gesundheits-booster.com/andre-stagge-erfahrungen

➡ Kurs: https://gesundheits-booster.com/intensivausbildung

Die Portfolio Manager Ausbildung soll Menschen dabei helfen, durch attraktive Renditen finanziell frei zu werden und die Börse zu verstehen. Wir haben uns einen Zugang zu den Inhalten besorgt und für Dich auf den Prüfstand gestellt mit...

Read More »

Read More »

This Investment is Over 9% Guaranteed! – [StockCast Ep. 78]

We NEVER say something is guaranteed on this show. NEVER! Until today.

So, if you want to learn about this investment that gives you a 9%+ return you are going to want to pay close attention to this show.

When you are listening, you will understand why Andy is such an

AMAZING teacher. If you’d like to get some of his FREE training: http://www.stockcastbonus.com

#financialeducation #cashflow #stockmarket

https://www.richdad.com/

Facebook:...

Read More »

Read More »

Global Financial Elite Consider Central Bank Digital Currencies

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

As global elites met in Davos this week to discuss their latest plans for a Great Reset, ordinary investors are hoping for a great rebound in their portfolios.

Read the Full Transcript Here: https://www.moneymetals.com/podcasts/2022/05/27/global-financial-elite-consider-central-bank-digital-002534

Do you own precious metals you would rather not sell, but need access to...

Read More »

Read More »

DIE BESTE BASKETBALL LEKTION FÜR INVESTOREN

Heute möchte ich dir eine Geschichte aus meinem persönlichen Leben erzählen, aus meinen Zeiten, als ich Basketball gespielt habe. Dazu gebe ich dir eine Lektion mit, die du als Investor daraus lernen kannst. Lass mir gerne deine Meinung dazu in den Kommentaren da!

Hat dir das Video gefallen? Gib mir nen DAUMEN HOCH ? bzw. TEILE dieses Video um gemeinsam AT, DE und CH cryptofit zu machen!

#JulianHosp #Bitcoin #Blockchain

? Kein Video mehr...

Read More »

Read More »

Die Risiken sind eingepreist / Hans A. Bernecker im Gespräch vom 25.05.2022

Themen-Check mit Hans A. #Bernecker ("Die Actien-Börse") - in diesem Video als verkürzte FreeTV-Variante des ansonsten umfangreicheren Gesprächs im Rahmen von Bernecker.tv vom 25.05.2022. Schlaglichter:

++ #Ukraine - Nur noch geringes Börsenrisiko

++ #Inflation - Risiko zum großen Teil eingepreist

++ #Zinsen - Unterschiedliche Wirkungen in der Wirtschaft

++ Tech-Blase - Erst fallen die Kleinen, dann die Großen

++ Rezessionsrisiko: Mehr...

Read More »

Read More »

Reupload 12/2020: Geldsystem – Wie Zentralbankgeld und Giralgeld durch die Banken getrennt sind, EZB

✘ Werbung:

Mein Buch Allgemeinbildung ► https://amazon.de/dp/B09RFZH4W1/

Teespring ► https://unterblog.creator-spring.com/

✘ Werbung: https://www.Whisky.de/shop/

Kaum ein #Bürger versteht, wie unser Geldsystem wirklich funktioniert. Zwar ist mittlerweile unter den #Wissenden bekannt, dass Giralgeld von der Bank an uns geschuldetes Geld ist. Aber wie Zentralbankgeld mit Giralgeld zusammenhängt ist unbekannt. Asche auf mein Haupt. Ich wusste es bis...

Read More »

Read More »

278104379_398699975034677_8754194916957630870_n.mp4

Für berufstätige Investoren: monatliche Mieteinnahmen auf Aktien - ohne hohe Risiken und mit einem Minimum an Zeit. Wenn du 10 Minuten pro Woche hast, kannst du an der Börse mit diesem System sicher und einfach zweistellige Renditen bekommen! https://traderiq.net/stillhalter

Im neuen Webinar „Geheimnisse der Stillhalter“ lege ich das komplette System offen und handle im Echtgeldkonto vor Deinen Augen. Du wirst selbst sehen, wie einfach das System...

Read More »

Read More »

EZB-Chefin prognostiziert Ende der Negativzinsen ab September

Link zu meinen Onlinekursen: https://thomas-anton-schuster.coachy.net/lp/finanzielle-unabhangigkeit

Vortrags- und Seminartermine, sowie kostenlose Anforderung des Aktienbewertungsblatts: https://aktienerfahren.de

Read More »

Read More »

Crash am Aktien- und Krypto-Markt – Was jetzt tun? Verkaufen oder Nachkaufen?

Wie du mit dem Krypto- und Aktiencrash umgehen solltest

Geldtraining: https://thorstenwittmann.com/geldsicherheit-garantiert/

Freitagstipps abonnieren: https://thorstenwittmann.com/klartext/

Blitz-Crash und Blutbad, was nun?! Dieses Video ist bares Geld wert

„Alle Jahre wieder …“ dieses Weihnachtsslogan erinnert mich etwas an den aktuellen Blitz-Crash an den Aktien- und Kryptomärkten. Die großen Fragen sind dabei für dich:

Wie solltest du...

Read More »

Read More »

HEUTE PFLANZEN WIR BÄUME!?

?Hol dir 100 CHF Trading Credits bei einer Aktien-Depoteröffnung ►► http://sparkojote.ch/swissquote *

(only for swiss residents)

HEUTE PFLANZEN WIR BÄUME!?

Heute eine spannende Geschichte über einen Bauern und seinen Hof von welcher Ihr vieles lernen könnt. Was hat dies mit Aktien zu tun und wie kannst du daraus lernen für deine Erfolge beim Investieren. Welcher Bauer bist du? Schreib es mir gerne in die Kommentare.

#Einkommen #Lebensweisheiten...

Read More »

Read More »

Economic divide: how equal is Switzerland’s wealth distribution?

While the gap between rich and poor has been steadily widening in many countries, the situation in Switzerland has remained stable over the past decades, according to recent statistics. Yet while income distribution in the Alpine nation is relatively egalitarian, wealth is more concentrated in the hands of the rich.

Read More »

Read More »

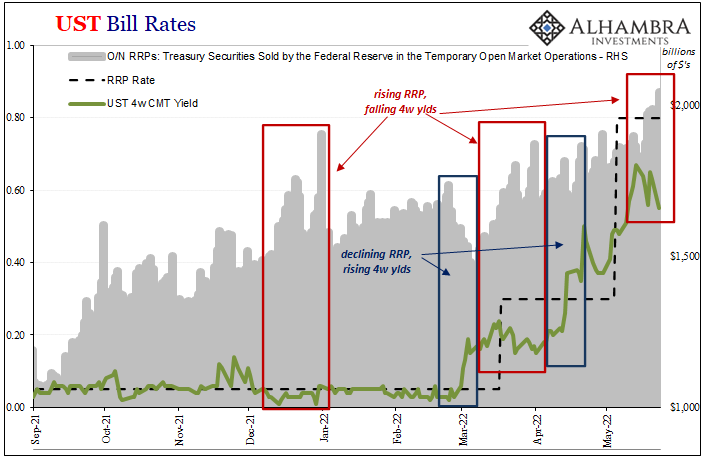

RRP (use) Hits $2T, SOFR Like T-bills Below RRP (rate), What Is (really) Going On?

You might not know it, but front-end T-bill yields are not the only market spaces which are making a mockery of the Federal Reserve’s “floor.” There are others, including the same money number the same Fed demanded the world (or whatever banks in its jurisdiction it could threaten) ditch LIBOR over.

Read More »

Read More »

Snap Goes The Economy

“…the macro environment has deteriorated further and faster than we anticipated when we issued our quarterly guidance last month.” -Snap CEO Evan Spiegel

Read More »

Read More »

Government Spending Is the Real Tax; Deficits Are a Sideshow

Many economists believe that during an economic slump government should run large budget deficits in order to keep the economy going with increases in government outlays, with the consequent budget deficit giving individuals more disposable money.

Read More »

Read More »