Tag Archive: newsletter

Erster Lichtblick in Richtung besserer Inflationsdaten – US Opening Bell mit Marcus Klebe – 29.06.22

Erster Lichtblick in Richtung besserer Inflationsdaten - US Opening Bell mit Marcus Klebe - 29.06.22

Folge uns auf:

Telegramm: https://t.me/jfdbank_de

LinkedIn: https://www.linkedin.com/showcase/jfd...

Facebook: https://www.facebook.com/JFDGermany/

Twitter: https://twitter.com/JFD_Group

Webseite: https://www.jfdbank.com/de

#DowJones #Trading #MarcusKlebe

ÜBER JFD:...

Read More »

Read More »

Warum GELD spirituell ist

In diesem Video betrachten wir Geld mal aus einer etwas spirituelleren Sichtweise. Dazu empfehle ich euch auch ein Buch, das mich sehr fasziniert.

Read More »

Read More »

Wir trauern um Markus Gärtner Ein Nachruf von Prof. Max Otte

Völlig überraschend ist Markus Gärtner verstorben.

Es gab eine Zeit des Umbruchs, da haben Journalisten des "alten Schlages" unseren Weg begleitet... Jürgen Engert...Ruprecht Eser... Joachim Jauer... Klaus Bednarz.... Fritz Pleitgen... Dirk Sager...

Wir leben heute in der Zeit, da begleiten uns mutige Berichterstatter des "neuen Schlages"....Boris Reitschuster (reitschuster.de)... Roland Tichy (Tichys Einblick)... Michael Mross...

Read More »

Read More »

Spanish Inflation Shocks

Overview: The sharp sell-off in US equities yesterday, led by tech, is weighing on today’s activity. Most of the large Asia Pacific markets excluding Japan and India lost more than 1% today.

Read More »

Read More »

DAX kämpft mit 13.150 – Achtung: Zentralbänker – “DAX Long oder Short?” mit Marcus Klebe – 29.06.22

DAX kämpft mit 13.150 - Achtung: Zentralbänker - "DAX Long oder Short?" mit Marcus Klebe - 29.06.22

Folge uns auf:

Telegramm: https://t.me/jfdbank_de

LinkedIn: https://www.linkedin.com/showcase/jfd...

Facebook: https://www.facebook.com/JFDGermany/

Twitter: https://twitter.com/JFD_Group

Webseite: https://www.jfdbrokers.com/de

#DAX #MarcusKlebe #Trading...

Read More »

Read More »

Reaction Vermögen besteuern (KATASTROPHE) (Teil 2)

?Hol dir 100 CHF Trading Credits bei einer Aktien-Depoteröffnung ►► http://sparkojote.ch/swissquote *

(only for swiss residents)

Reaction Vermögen besteuern.

Vermögen besteuern, müssen die REICHEN mehr bezahlen. Heute reagieren wir im 2 Teil auf das Video von ZDF. Wie denkt Ihr darüber, sollte das Steuersystem in DE überarbeitet werden? Schreibt es mir gerne in die Kommentare.

#steuern #vermögensaufbau #Finanzrudel

? Das Finanzrudel Community...

Read More »

Read More »

I Got RICH When I Understood THIS

I Got RICH When I Understood THIS. Charlie Munger is one of the great minds of the 20th century. Below is an attempt to capture that wisdom in one shareable place.

Read More »

Read More »

Letting Retirees Save for Healthcare Tax-Free

Health Savings Accounts (HSA) for retired folks. Isn’t that a novel idea? But it’s being considered in Congress—The Health Savings for Seniors Act, H.R. 3796.

Read More »

Read More »

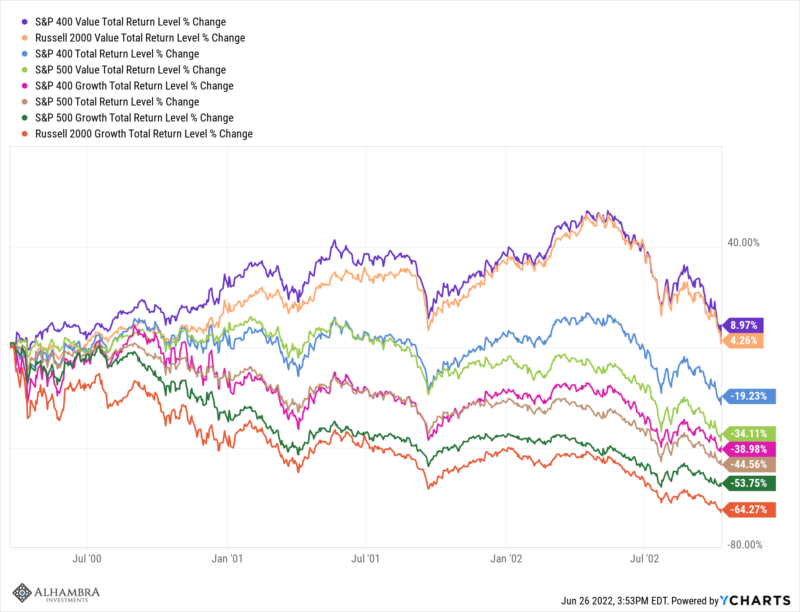

Weekly Market Pulse: Expand Your Horizons

Late last year I wrote a weekly update that focused on the speculative nature of the markets. In that article, I focused on the S&P 500 because I wanted to make a point, namely that owning the S&P 500 did not absolve investment advisers of their fiduciary duty.

Read More »

Read More »

Jetzt geht es auch den Banken an den Kragen! Handyversion

Bisher wurden viele marode Banken durch die Null-Zins Politik der EZB vor der Pleite gerettet. Die Folge ist eine dramatische Inflation, die nicht nur die Bürger sondern auch die Wirtschaft in arge Bedrängnis bringt.

Read More »

Read More »

Contra Ben Bernanke, the Gold Standard Promotes Economic Stability

Currently the world is on a fiat money standard—a government-issued currency that is not backed by a commodity such as gold. The fiat standard is the primary cause behind the present economic instability, and is tempted to suggest that a gold standard would reduce instability. The majority of experts however, oppose this idea on the ground that the gold standard is in fact a factor of instability.

Read More »

Read More »

Novartis to cut 1,400 jobs in Switzerland

Swiss pharmaceutical company Novartis is laying off more than one in ten employees in Switzerland over the next three years – 1,400 of 11,600 jobs will go. It also plans to cut 8,000 of 108,000 jobs worldwide.

Read More »

Read More »

Crypto Companies Put the Brakes on Sports Sponsorship Amid Market Crash

This year’s cryptocurrency crash, which saw the market lose more than half of its value in the span of six months, is threatening to bring sports sponsorship deals to a halt as crypto companies look to cut costs.

Read More »

Read More »

Ist es jetzt noch sinnvoll in Wohnimmobilien zu investieren?

Kanal von Gerd Kommer: https://www.youtube.com/channel/UCwTtEinRdsY8mO8qnDjr5rQ

Folgen Sie mir auf Twitter - https://mobile.twitter.com/rzitelmann

Folgen Sie mir auf Facebook - https://www.facebook.com/r.zitelmann/

Folgen Sie mir auf Instagram - https://www.instagram.com/rainer.zitelmann/

Meine Homepage - http://www.rainer-zitelmann.de/

Read More »

Read More »

Die Inflation geht weiter…

?Hol dir 100 CHF Trading Credits bei einer Aktien-Depoteröffnung ►► http://sparkojote.ch/swissquote *

(only for swiss residents)

#zurich #sparkojote #shorts

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

★ Herzensprojekte von Thomas dem Sparkojoten ★

Ich betreibe viele Projekte die mir ungemein Spass machen. Ich gebe mir Mühe, alle Projekte unter einen Hut zu bekommen: Sparkojote, Amazingtoys.ch, das Finanzrudel… Falls ihr euch für eines der Projekte interessiert,...

Read More »

Read More »

Alasdair Macleod explains inflation, stock market crash and american banking crisis

In latest podcast Alasdair Macleod discusses about inflation and explains what the Fed is doing wrong, that interest rates are rising and the banking crisis is accelerating.

Alasdair Macleod started his career as a stockbroker in 1970 on the London Stock Exchange. He is an educator and advocates for sound money thru demystifying finance and economics. Regarded as one of the country's greatest short story writers.

? Subscribe here:...

Read More »

Read More »

Das RENTEN-PORTFOLIO ?! | Sparkojote Dividenden Dienstag

?Hol dir 100 CHF Trading Credits Aktien-Depoteröffnung ►► http://sparkojote.ch/swissquote *

(only for swiss residents)

Der #DividendenDienstag Livestream findet jeden Dienstag um 19:00 Uhr auf Instagram statt, zusammen mit Johannes Lortz philosophieren wir über #Dividenden #Aktien, das Investieren, die Börse und vieles mehr.

??Kanal von Johannes ►► @Johannes Lortz

#DividendenDienstag #CommunityPortfolio #Finanzrudel

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

★...

Read More »

Read More »

How to Achieve Energy Price Stability

(7/6/22) What do YouTube Censorship and the Biden Energy Policy have in common? Censorship demands on YouTube by Fact Checkers because no one is watching their videos; maybe the problem isn't YouTube? Why are more and more people avoiding The News?

Read More »

Read More »

Wie funktioniert eigentlich Inflation? [Der aktuelle Kommentar 28.06.22]

Die Welt sitzt zurzeit auf dem größten Schuldenberg ihrer Geschichte. Haushalts-, Unternehmens- und Staatsschulden belaufen sich auf geschätzte 300 Billionen Dollar.

Read More »

Read More »