Tag Archive: newsletter

Kommt JETZT die Zeit von GOLD?

► Sichere Dir meine Tipps zu Gold und Silber - 100% gratis: https://www.rendite-report.de/

Kommt JETZT die Zeit von GOLD? Meinen Standpunkt dazu, möchte ich gerne mit euch teilen und ich verspreche euch, was mein Bauchgefühl dazu sagt, wird euch überraschen.

► NEU: Gewinne von bis zu +170%… Mein exklusives Lars-Erichsen-Depot: https://www.rendite-spezialisten.de/video/depot/

--------

► Höre Dir auch meinen Podcast an! Hier findest Du ihn bei:...

Read More »

Read More »

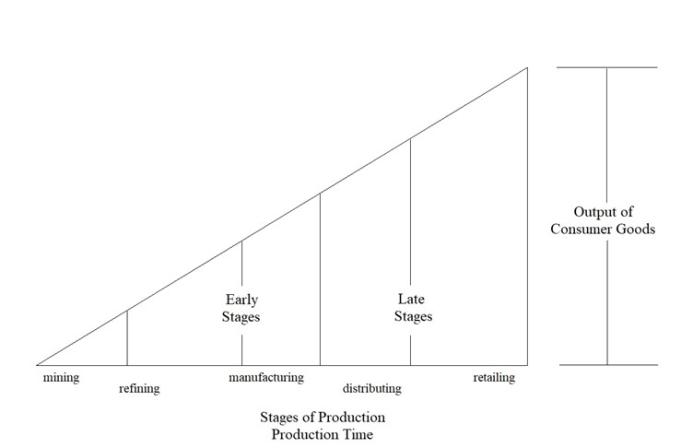

Low Interest Rates and High Taxes Won’t Help against Inflation: The Economy Needs Savings and Real Investment

With the Consumer Price Index (CPI) hitting a forty-year high of 9.1 percent, the Bank of England has responded by raising interest rates to 1.25 percent, up by 0.25 from the previous period. This, alongside ex-chancellor and PM hopeful Rishi Sunak planning to “tackle inflation before tax cuts,” signals a poor plan for combating the rising effects of inflation.

Read More »

Read More »

Neue Weltordnung: Weltkrieg und Investments mit Robert Vitye und Enes Witwit

Ein spannendes Gespräch mit Robert Vitye. Wir sprechen über die neue Weltordnung als Folge des Ukraine Krieges, wie es sich zuspitzen wird und wie man sein Geld in dieser neuen Weltordnung anlegen sollte. Dies ist der zweite Teil des Gesprächs.

Read More »

Read More »

Biden Crows About the Latest 8.5% Annual Inflation Number

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

Precious metals markets continued rallying early this week. They gave back some of their gains on Thursday. The fact that the inflation rate finally came down a tad after months and months of relentless increases gave Joe Biden an opportunity to gloat.

Read the full Transcript Here:...

Read More »

Read More »

Andreas Beck: Darum wird der Euro noch schwächer! + Der Experte privat wie nie

Andreas Beck redet Klartext: Darum sieht er schwarz für den Euro und betrachtet ihn nur noch als Weichwährung! Darum laufen die Aktienmärkte grade so stabil, obwohl die Crashpropheten noch vor Wochen vor dem totalen Untergang gewarnt hatten. Der Mathematiker und Portfolio-Experte erklärt zudem, warum Indizes besser laufen als viele Einzelaktien, wo er sich zuletzt getäuscht und seine Meinung geändert hat. Und Andreas gibt viele private Einblicke:...

Read More »

Read More »

Unsere Energieversorgung – Droht der Blackout – Reupload 9/2021

✘ Werbung:

Mein Buch Allgemeinbildung ► https://amazon.de/dp/B09RFZH4W1/

Teespring ► https://unterblog.creator-spring.com/

Alle Welt (bzw. die Medien) reden von der #Energiewende. Nun hört man auch Stimmen vom Energiedesaster. Ich bin ein Freund regenerativer Energien. Was wir jedoch gerade an politischem #Dilettantismus sehen, ist kaum zu überbieten.

Unsere Stromversorgung basiert auf dem Prinzip 'von der Hand in den Mund'. Was wir benötigen, muss...

Read More »

Read More »

A technical look at the major currency pairs to start the US trading week

The USD moved higher as concerns in China and Europe from slower growth lead to risk-off sentiment to start the week.

The EURUSD and GBPUSD moved lower, moving below key MA levels.

The USDJPY fell more recently on the back of weaker Empire manufacturing data.

The USDCAD is a big mover to the upside helped by sharply lower oil prices.

The AUDUSD is falling on risk off and slower China.

Read More »

Read More »

Ein Hauch von Zinsangst kehrt zurück – US Opening Bell mit Marcus Klebe – 15.08.22

Ein Hauch von Zinsangst kehrt zurück - US Opening Bell mit Marcus Klebe - 15.08.22

Folge uns auf:

Telegramm: https://t.me/jfdbank_de

LinkedIn: https://www.linkedin.com/showcase/jfd...

Facebook: https://www.facebook.com/JFDGermany/

Twitter: https://twitter.com/JFD_Group

Webseite: https://www.jfdbank.com/de

#DowJones #Trading #MarcusKlebe

ÜBER JFD:

WER WIR SIND:

JFD...

Read More »

Read More »

Markets Bullish on a Short Term Basis| 3:00 on Markets & Money

(8/15/22) arkets are very bullish on a short-term basis, and are set to test the 200-DA; that's hard to believe with all the negative economic data that's currently about. Think that's weird? arkets are markets, and they tend to lead the economy, rather than lag. But it's way too early to determine whether markets are telling us the worst of the economic downdraft is behind us. If markets continue to advance, a pullback to support would then...

Read More »

Read More »

Es sieht gut aus! MEHR als 20% PLUS | Blick auf die Woche | 33 KW

► Jetzt Termin vereinbaren und vom Experten beraten lassen!

https://mariolueddemann.com/trading-beratung/

► Von 50.000 € auf 1 Million in 10 Jahren

Willst du wissen, wie das auch für dich geht? Dann melde dich hier zum kostenfreien Beratungsgespräch an: https://deinmillionendepot.com/termin-buchen/

- - -

► Für Trader: sicher dir hier kostenfrei mein E-Book, damit du dein kleines Konto groß tradest: https://mariolueddemann.com/aktuelles/#ebooks

►...

Read More »

Read More »

Why Earnings Estimates Don’t Matter Any More

(8/15/22) Will the impact of inflation on household budgets spur the Fed to back-off rate hike campaign? The bigger question is when might the Fed not just stop the hikes, but reverse the direction of rates? Technical commentary on the Bull vs Bears Battle Royale: How does a bull market continue amidst overwhelming, negative indicators? What could possibly go wrong with the IRS hiring armed agents with the ability to use deadly force? The...

Read More »

Read More »

„Der Herbst kann heiß werden – wir machen weiter“ | Prof. Dr. Max Otte über Politik Spezial

Prof. Dr. Max Otte spricht in diesem Video über die Zukunft bei Politik Spezial und kündigt die beiden nächsten Ausgaben unseres Magazins an. Wir machen weiter, so wie es Markus Gärtner sich gewünscht hätte.

Wir laden zudem unsere Abonnenten zu der Max-Otte-Tour im kommenden Herbst ein. Viele der Veranstaltungen sind bereits nahezu ausverkauft. Sichern Sie sich deshalb heute noch Ihr limitiertes Ticket! Hier finden Sie alle Informationen ?

➡...

Read More »

Read More »

Fällt heute die 14.000er Marke? – “DAX Long oder Short?” mit Marcus Klebe – 15.08.22

HIER geht´s zum kostenlosen JFD Livetradingroom: https://attendee.gotowebinar.com/register/5477297854855570446?source=marcus-social-media

Folge uns auf:

Telegramm: https://t.me/jfdbank_de

LinkedIn: https://www.linkedin.com/showcase/jfd...

Facebook: https://www.facebook.com/JFDGermany/

Twitter: https://twitter.com/JFD_Group

Webseite: https://www.jfdbrokers.com/de...

Read More »

Read More »

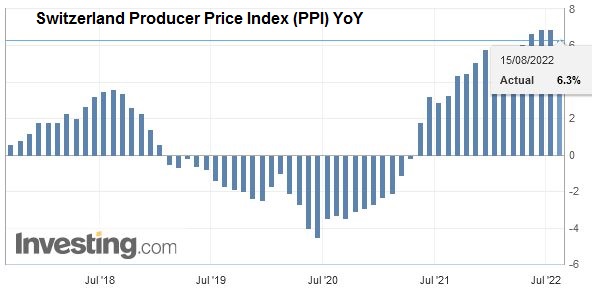

Swiss Producer and Import Price Index in July 2022: +6.3 percent YoY, -0.1 percent MoM

The Producer and Import Price Index fell in July 2022 by 0.1% compared with the previous month, reaching 109.7 points (December 2020 = 100). Lower prices were seen in particular for basic metals and semi-finished metal products. Compared with July 2021, the price level of the whole range of domestic and imported products rose by 6.3%.

Read More »

Read More »

Gravitas LIVE | Crimea blast: Russia’s prestige on the line | Is Moscow raising the nuclear threat?

-Ukraine war escalates: Satellite images show destroyed Russian jets

-Unlike Biden, Xi to get grand welcome in Saudi Arabia

-China promises Aid, Nepal agrees to trans-Himalayan railway

-India debates freebie politics

-Japan’s male minister tried “pregnancy belly”

Read More »

Read More »

Credit Suisse pursues legal claim against SoftBank in $440m dispute

Credit Suisse Group applied to the English High Court last week to initiate formal legal proceedings against Japan’s SoftBank Group Corp over a $440 million (CHF414 million) dispute, according to the Financial Times.

Read More »

Read More »

Economic Causes of War

War is a primitive human institution. From time immemorial, men were eager to fight, to kill, and to rob one another. However, the acknowledgment of this fact does not lead to the conclusion that war is an indispensable form of interpersonal relations and that the endeavors to abolish war are against nature and therefore doomed to failure.

Read More »

Read More »

BTCUSD 24816.27 technical analysis update for 15 Aug

Bitcoin technical analysis update for 15 Aug: Following another "fakie" above the recent high and the 25k mark, bitcoin is testing the diagonal line, now acting as support. Watch for 4 hour candles to close above the recent high or below the VWAP (purple line). The stop loss of the original trade idea, presented in the video at the top of this page, is still active and has not been reached, despite the recent rally. When trading crypto,...

Read More »

Read More »

This Is Why NOW Is the Perfect Time to Buy Silver – Garrett Goggin

Garrett Goggin joins us today to talk about the latest silver price move. We also discuss the fed's pivot, the housing market, and silver Mining stocks.

Garrett's Twitter: https://tinyurl.com/564jd844

Twitter - https://twitter.com/WallStreetSilv

Reddit - https://www.reddit.com/r/WallStreetSilver

Monthly Newsletter - https://www.getrevue.co/profile/wallstreetsilv (NEW)

Instagram - https://www.instagram.com/wallstreetsilver/

Telegram -...

Read More »

Read More »

Taiwan-Konflikt erklärt : Was bedeutet das für Deutschland? (Wirtschaft)

Droht uns eine neue Krise zwischen China und Taiwan? Wie wahrscheinlich ist ein Konflikt und was hätte das für Folgen für uns? Warum Nancy Pelosi bzw. die USA jetzt eine wichtige Rolle spielen, was die Geschichte erzählt und wie gut Taiwan im Ernstfall aufgestellt ist, erfahrt ihr in einer neuen Folge "Finanzielle Intelligenz", viel Spaß!

Beitrag Zeihan:

https://zeihan.com/china-and-taiwan/

► Mein neues Buch

Du möchtest das...

Read More »

Read More »