Tag Archive: newsletter

#1 World Economic Forum & China – Ernst Wolff #shorts

Das neue Buch "World Economic Forum: Die Weltmacht im Hintergrund" ist hier erhältlich:

►► https://bit.ly/3zuC9jz (Die ersten 2000 signierten Exemplare (Klarsicht Verlag) )

►► http://bit.ly/3Ev6nGg (Bei Hugendubel)

►► http://bit.ly/3O0gtSy (Bei Thalia)

____________________

Auf dem offiziellen YouTube-Kanal vom Wirtschaftsexperten Ernst Wolff, finden Sie verschiedene Formate wie das "Lexikon der Finanzwelt", das dem Zuschauer...

Read More »

Read More »

2023 Retirement Plan Contribution Limits

Worried about saving enough for retirement? You can put away more next year. The IRS has just announced the new retirement plan contribution limits for 2023. The contribution limit for employees who participate in 401(k), 403(b), most 457 plans, and the federal government’s Thrift Savings Plan increases to $22,500, up from $20,500.

Read More »

Read More »

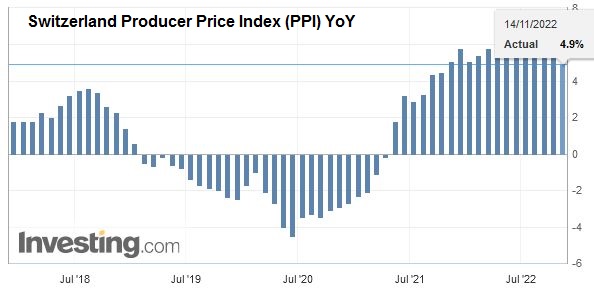

Swiss Producer and Import Price Index in October 2022: +4.9 percent YoY, unchanged MoM

The Producer and Import Price Index remained unchanged in October 2022 compared with the previous month. The index stood at 109.8 points (December 2020 = 100). Natural gas in particular became more expensive. In contrast, petroleum products showed falling prices.

Read More »

Read More »

Where Crypto Went Wrong

You want to fix the world with finance? Then fix this: wages' share of a financialized, globalized, speculative-bubble dependent economy have been falling for decades. Fix this and you really will change the world. Anything less changes nothing.

Read More »

Read More »

SNBs Jordan: IN 2023, sees Swiss growth weaker than this year. USDCHF trades near lows.

SNB's Jordan is on the wires saying that:He sees weaker growth in 2023 than this year.SNB still has credibility that inflation will moderateInflation has broadenedSees limited 2nd round wage effects in SwitzerlandThere is a great probablility that SNB will need to further tighten monetary policy.

Read More »

Read More »

Max Otte: Überwachungskapitalismus ist bereits da

▶︎ EINLADUNG ▶︎ „Die größten Gefahren für Ihr Vermögen“ - Online-Info-Veranstaltung

✅ Hier gratis anmelden: http://bit.ly/3UWznvA

MAX OTTE ONLINE

▶︎ Privatinvestor TV: https://www.youtube.com/c/PrivatinvestorTV

▶︎ Max Ottes Webseite: https://max-otte.de/

▶︎ Max Ottes Buch: "Weltsystemcrash: Krisen, Unruhen und die Geburt einer neuen Weltordnung"

Hier bestellen: https://bit.ly/Max-Otte-auf-Amazon

▶︎ Max Ottes neues Buch: “Auf der Suche...

Read More »

Read More »

Nasdaq futures technical analysis in 5 minutes

NQ analysis starting 15 November. Watch a level for bulls to strengthen their control, or for bears to regain it.

Read More »

Read More »

US Produzentenpreise sollten Bewegung bringen – “DAX Long oder Short?” mit Marcus Klebe – 15.11.22

HIER geht´s zum kostenlosen JFD Livetradingroom: https://attendee.gotowebinar.com/register/5477297854855570446?source=marcus-social-media

Folge uns auf:

Telegramm: https://t.me/jfdbank_de

LinkedIn: https://www.linkedin.com/showcase/jfd...

Facebook: https://www.facebook.com/JFDGermany/

Twitter: https://twitter.com/JFD_Group

Webseite: https://www.jfdbrokers.com/de...

Read More »

Read More »

Darum fürchten die USA Asien…

Klicke hier, um Dich gemeinsam mit Oli unabhängig zu machen:

? http://bit.ly/oli-ausbildung

Meine Webseite: https://tradingcoacholi.com/

►Mein Telegram Kanal: http://t.me/tradingcoacholi

►Folge Oliver auf Facebook: http://bit.ly/TOFBpage

►Folge Oliver auf Instagram: http://bit.ly/TOInst

►Oli macht auch TikToks: https://www.tiktok.com/@tradingcoacholi

►Abonniere Oliver auf YouTube: http://bit.ly/Oli-Kanal

DIE TRADING COMMUNITY VON OLIVER KLEMM...

Read More »

Read More »

CRISIS GEOPOLÍTICA Y EUROPEA

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

Notenbank: “Ohne GOLD sind wir pleite”!

► Den Kanal von Sebastian findest du hier: https://www.youtube.com/c/Hellinvestiert

Etwas extrem einzigartiges ist passiert! Der Präsident der niederländischen Zentralbank hat offen eingestanden, dass seine Bank bald pleite sein könnte und er dies nur abwenden kann, durch die hauseigenen Goldreserven. Welche Rolle Gold hier genau spielt und ob der gesamte Goldmarkt fortan neubewertet werden könnte, bespricht mein Kollege Sebastian Hell in diesem...

Read More »

Read More »

Philipp Vorndran: So darfst Du jetzt nicht investieren + dieses Risiko wird unterschätzt!

"Das werden die großen Verlierer sein", warnt Philipp Vorndran im exklusiven Interview. Der Kapitalmarktstratege von Flossbach von Storch erklärt, wie man jetzt auf keinen Fall investieren sollte und welches Risiko von Politik und Gesellschaft unterschätzt wird. Zudem verrät Vorndran, welche Aktien er zuletzt genau analysiert hat und bei welchem Punkt er seine Meinung geändert hat. Zudem hat der Börsenexperte eine klare Meinung dazu, wie...

Read More »

Read More »

Es gibt wieder interessante Alternativen – DJE- Marktausblick November 2022 (Marketing-Anzeige)

Zinsanstieg, Anleihen, starker Dollar, aber auch Jobabbau bei den Tech-Giganten: Das Umfeld für Kapitalanleger bleibt anspruchsvoll, aber es gilt auch TARA – „there are reasonable alternatives“. Erfahren Sie mehr zur aktuellen Marktsituation im Video-Interview mit DJE-Researchleiter Stefan Breintner und dem Wallstreet-Experten Markus Koch.

00:00:00 Begrüßung und Intro

00:00:00 Der Dax läuft besser als die Wall Street

00:02:53 Entlassungen bei...

Read More »

Read More »

“We Are All In Serious Trouble” – It’s Worrisome…. (Marc Faber)

The Editor and Publisher of The Gloom Boom and Doom Report, Dr Marc Faber about the Fed, Inflation, Governments and the current outlook for the markets.

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

RESOURCES :

? Get $100 Bonus with provided link (Tax-Free Crypto IRA):

? https://itrust.capital/LWL

? Trade Safely and Anonymously with AtlasVPN:

83% OFF with this link

https://partner.vpnatlas.com/SHLK

(These are Affiliate Links)

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

CREDIT:

Dr....

Read More »

Read More »

Deutschland im Herbst – Zur wirtschaftlichen und politischen Lage im Land

✘ Werbung:

Mein Buch Allgemeinbildung ► https://amazon.de/dp/B09RFZH4W1/

--

Der Herbst 2022 zeigt viel Negatives, von dem die ersten zögerlichen Signale sogar von den ablenkenden Medien erwähnt werden. Aus meiner Sicht braut sich der perfekte Sturm zusammen. Dabei teilen sich die Auguren. Die einen sehen eine Megakrise mit Rezession, Depression und bestenfalls Stagflation auf uns zukommen. Andere sehen das Schlimmste an den Börsen bereits vorbei,...

Read More »

Read More »

15 % und mehr mit Aktien in nur 2 Tagen | Blick auf die Woche | KW 46

► Jetzt Termin vereinbaren und vom Experten beraten lassen!

https://mariolueddemann.com/trading-beratung/

► In wenigen Jahren zu deine Millionen

Willst du wissen, wie das auch für dich geht? Dann melde dich hier zum kostenfreien Beratungsgespräch an: https://deinmillionendepot.com/termin-buchen/

- - -

► Für Trader: sicher dir hier kostenfrei mein E-Book, damit du dein kleines Konto groß tradest: https://mariolueddemann.com/aktuelles/#ebooks

►...

Read More »

Read More »