Tag Archive: newsletter

Yes, the US Government Has Defaulted Before

The regime is trying to whip up maximum hysteria or the chances that the US government could default on its debts if the debt ceiling is not raised. Anyone whose been paying attention for a while, however, knows there's a 99.99 percent chance that the parties involved will soon raise the debt ceiling and the US will go back to adding to its $30-trillion-plus debt hoard as usual.

Read More »

Read More »

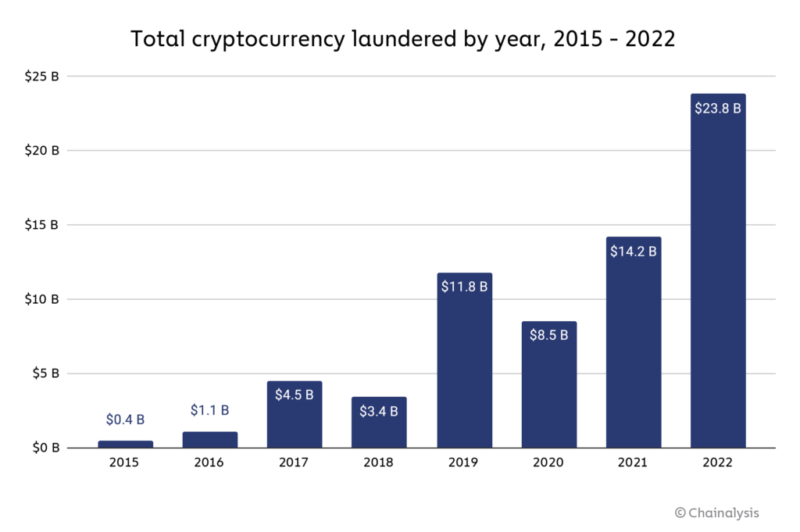

Crypto Money Laundering Reaches New Heights; Totaled US$23.8B in 2022

In 2022, cryptocurrency money laundering reached a new record, with illicit addresses sending US$23.8 billion worth of crypto, a figure which represents a 68% year-on-year (YoY) increase, new data from Chainalysis, an American blockchain analysis firm, show.

Total cryptocurrency laundered by year, 2015-2022 Source: Chainalysis, Jan 2023

Just under half of the funds sent from these addresses traveled directly to centralized exchanges, making these...

Read More »

Read More »

Viertel nach Acht – 08. Februar 2023 | mit Peter Hahne, Henryk M. Broder, Patricia Platiel

Viertel nach Acht, heute mit:

- Prof. Dr. Dr. Hans-Werner Sinn / Wirtschaftswissenschaftler und emeritierter Präsident des ifo Instituts

- Peter Hahne / Journalist und Autor

- Michael Grosse-Brömer / CDU-Bundestagsabgeordneter und Vorsitzender des Wirtschaftsausschusses des Deutschen Bundestags

- Henryk M. Broder / Publizist und Autor

Moderatorin: Patricia Platiel

Inhalt

0:00 Intro

1:35 Schlagzeile des Tages – Bundestag gönnt sich...

Read More »

Read More »

ENTHÜLLUNG: Die Wahrheit kommt raus! (Corona, Pfizer)

Das Corona Narrativ bröckelt immer mehr und die Wahrheit bricht sich ihren Weg. Immer mehr Lügen der letzten drei Jahre kommen heraus. Enthüllungsjournalisten haben in den USA einen führenden Pfizer Forscher heimlich gefilmt und unglaubliches zu hören bekommen…

Reaction-Hauptvideo:

https://twitter.com/Project_Veritas/status/1618405890612420609

Pfizers Statement:

https://www.pfizer.com/news/announcements/pfizer-responds-research-claims

Gezeigte...

Read More »

Read More »

CHINA ERSETZT UNS!

Klicke hier, um Dich gemeinsam mit Oli unabhängig zu machen:

? http://bit.ly/oli-ausbildung

Meine Webseite: https://tradingcoacholi.com/

Inhaltsverzeichnis:

►Mein Telegram Kanal: http://t.me/tradingcoacholi

►Folge Oliver auf Facebook: http://bit.ly/TOFBpage

►Folge Oliver auf Instagram: http://bit.ly/TOInst

►Oli macht auch TikToks: https://www.tiktok.com/@tradingcoacholi

►Abonniere Oliver auf YouTube: http://bit.ly/Oli-Kanal

►Folge Oliver auf...

Read More »

Read More »

So analysieren wir Dividenden-Aktien bevor wir Investieren. | Sparkojote Dividenden Donnerstag

?Hol dir 100 CHF Trading Credits Aktien-Depoteröffnung ►► http://sparkojote.ch/swissquote *

(only for swiss residents)

Der #DividendenDonnerstag Livestream findet jeden Donnerstag um 19:00 Uhr auf YouTube statt, zusammen mit Johannes Lortz philosophieren wir über #Dividenden #Aktien, das Investieren, die Börse und vieles mehr.

??Kanal von Johannes ►► @Johannes Lortz

#DividendenDonnerstag #2023 #Finanzrudel

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

★...

Read More »

Read More »

Japanese Candlesticks, Samurai Swords, and a 2023 Economic Outlook – Robert Kiyosaki, Gary Wagner

For most people, the concept of making money when the market is going up is easy. However, many are stumped when thinking of ways to make money when the market goes down.

Read More »

Read More »

Schulden-Explosion – so endet alles!

► Hier kannst Du Dich für die Teilnahme und Aufzeichnung des kostenfreien Webinars am 08.02. um 18:00 Uhr anmelden: https://onlineseminar.lars-erichsen.de/

Mit dem heutigen Video möchte ich auf ein Problem aufmerksam machen. Immer weiter wachsende Schulden führen irgendwann zu einem Problem. Ein Privathaushalt kann seine Schulden nicht immer weiter steigern, denn er hat keine eigene Notenbank. Aber, wir können uns gegen steigende Schulden schützen...

Read More »

Read More »

Ukraine: Das Droht uns jetzt!

Könnte auch Deutschland zur Kriegspartei werden?

? bis zu 100 Euro bei Depoteröffnung ► http://link.aktienmitkopf.de/Depot *

??5 Euro Startbonus bei Bondora ►► https://goo.gl/434rmp *

? Tracke deine Dividenden mit dieser App http://myfinances24.de/mydividends24

? Mein Buch! Der Rationale Kapitalist ►►http://amzn.to/2kludNT

?JETZT auch als Hörbuch bei Audible ►► https://goo.gl/iWvTRR

? Meine Shirts & Hoodies ►► http://kapitalisten.shop

Du...

Read More »

Read More »

Aktienrente: Grundlegender Systemwechsel oder Tropfen auf dem heißen Stein? Christian Lindner 2/2

So plant Finanzminister Lindner die Aktienrente: Christian Lindner im Interview 2/2

ostenloses Depot eröffnen: ►► https://link.finanzfluss.de/go/depot?utm_source=youtube&utm_medium=569&utm_campaign=comdirect-depot&utm_term=kostenlos-25&utm_content=yt-desc *?

In 4 Wochen zum souveränen Investor: ►►...

Read More »

Read More »

Hörbuch Allgemeinbildung: Kapitel 18/22 – Sex, Kinder und die Partnerwahl

✘ Werbung:

Mein Buch Allgemeinbildung ► https://amazon.de/dp/B09RFZH4W1/

Mit die wichtigste #Entscheidung im #Leben ist die #Partnerwahl. Greift man hier daneben, kann das Leben unangenehm bis sehr unschön werden. Dieses Kapitel handelt über die evolutionär angelegte Auswahl des Partners und wie die heutige Zeit gegen die Evolution spielen kann.

Fußnoten

► https://helenfisher.com/books/ Buchverzeichnis, Webseite von Helen Fisher, PhD.

►...

Read More »

Read More »

DIE BESTEN TRADE-SETUPS DER WOCHE | Martin Goersch

Profitrader Martin Goersch wird für Sie die besten Trading-Setups im aktuellen Börsenmarktumfeld identifizieren. Dabei arbeitet er sich von den besten Sektoren, über die besten Branchen hin zu den besten Aktien dieser Branchen vor.

Weiterführende Links:

CapTrader PLUS: https://www.captrader.com/login/

Depot bei CapTrader eröffnen: https://bit.ly/3OUcuGS

Demokonto bei CapTrader testen: https://bit.ly/3Auxxvf

Newsletter: https://bit.ly/3AytT3x...

Read More »

Read More »

Swiss Economist Marc Faber on Black Swans, Bad Government Policy and WEF

Featuring: Marc Faber, Editor & Publisher, Gloom, Boom & Doom Report

#angelorobles #Marcfaber #inflation #ai #stockmarket #investing #recession #centralbanking #chatgpt #economy #currency

00:00 Intro

01:51 What Makes This Recession Different?

08:43 Is There Too Much Cash On The Sideline?

10:47 Will Inflation Fall to 2% This Year?

12:52 Global Employment

14:34 Stock Market

18:31 Artificial Intelligence

19:26 Does The Mental State of...

Read More »

Read More »

MASSIVE Fall In Gold and Silver Price Incoming – Keith Weiner | Gold Silver Price Forecast

MASSIVE Fall In Gold and Silver Price Incoming - Keith Weiner | Gold Silver Price Forecast

#gold #silver #fed #financedaily

--------------

⬇ Inspired By: ⬇

Financial Crisis Is Already Here, Don’t Let the Market Exuberance Fool You Warns Lynette Zang

-tnozmGa4

Fed’s Credibility is Destroyed, Why Cash, Gold and Silver Will Be Best Lifeline | Outlook 2022

Silver spikes through $27 level in early trading, up $.83

_U

Those Who Don't Own Gold &...

Read More »

Read More »

Get your trading day started right. A technical look at some of hte major currency pairs

Start your trading day off right with the latest morning report! In this video, I delve into the technicals of the EURUSD, USDJPY, GBPUSD, and USDCAD currencies and highlight their key levels in play. But it's not just about the levels - I also explain the reasons behind the price action, giving you a complete understanding of the market. Get valuable insights to help guide your trades and make informed decisions. Watch now!

Read More »

Read More »

Timing the Markets and Getting Back to Even

HAVE YOU SUBSCRIBED TO "Before the Bell?" https://www.youtube.com/channel/UCFmyKJKseEMQp1d14AjvMUw

(2/8/23) Whose comments yesterday were more impactful for you: Joe Biden's SOTU address or Jerome Powell's post-Fed clarification speech? Markets loved the latter, and on a weekly basis, the bullish trend continues as economic data becomes "less bad." Fair warning, fellas, that Valentine's Day is approaching; prepare accordingly....

Read More »

Read More »

Markets Calm after Dramatic Swings on Powell’s Comments

The US dollar is mostly trading with a downside bias today against the G10 and most emerging market currencies. It had begun the week extending the gains spurred by the dramatic jump in nonfarm payrolls and the strong ISM services survey. Market expectations for the trajectory of Fed policy in the first part of this year converged with the Fed's December dot plot. The market now leans toward two more quarter-point hikes this year.

Read More »

Read More »