Tag Archive: newsletter

Russian President vows victory in Ukraine | World News | English News | Latest News | WON

Russian president drew parallels between the Soviet Union's fight in World War II and the ongoing Russia-Ukraine conflict. He compared the fighting to Nazi Germany's invasion and hinted that Moscow could use nuclear weapons.

Read More »

Read More »

Russian President draws parallel between WWII, Ukraine War | World News | English News | WION

Russian president drew parallels between the Soviet Union's fight in World War II and the ongoing Russia-Ukraine conflict. He compared the fighting to Nazi Germany's invasion and hinted that Moscow could use nuclear weapons.

Read More »

Read More »

Live-Trading mit Rüdiger Born Analyse, Trading-Ideen & Daytrading 07.01.23

Schauen Sie dem Profi-Trader Rüdiger Born jede Woche online und live über die Schulter.

Erleben Sie einen der bekanntesten Daytrader Deutschlands bei der Arbeit: Screening der Märkte, Chartanalyse, Trademanagement und vieles mehr. Dabei anschaulich und in einfacher Sprache auch für Anfänger gut verständlich und nachvollziehbar.

? Unsere täglichen Marktanalysen finden Sie hier: https://www.xtb.com/de/Marktanalysen/Taegliche-Marktanalysen

???...

Read More »

Read More »

The Dollar Pares Yesterday’s Gains but Near-term Change in Sentiment may be at Hand

Overview: The dollar remained firm yesterday, even

after the ECB's hawkish stance, reaffirming its intention to hike rates by

another 50 bp next month. We had expected the greenback to have been sold in

North America yesterday. That this did not materialize warns that despite its

pullback in Asia and especially Europe today, that near-term sentiment may be

changing with the Fed and ECB meetings over and die cast for next month, where

the Fed is...

Read More »

Read More »

Passives Einkommen mit dem neuen Krypto – Banking

Liebst du Banken?

Vermutlich eher weniger: Sie sind teuer, bürokratisch, kontrollierend … und es wird eher schlimmer als besser.

Read More »

Read More »

Bundesregierung hält eigene Frist NICHT ein! (Grundsteuer)

Die Grundsteuer ist das Chaos in Person und selbst der Bund schafft seine eigenen Fristen nicht!

► Mein Merch:

https://shop.marc-friedrich.de/

► Mein neues Buch

Du möchtest das erfolgreichste Wirtschaftsbuch 2021

"Die größte Chance aller Zeiten" bestellen?

Auf Amazon: https://amzn.to/3WePFAu oder mit Signatur:

https://www.marc-friedrich.de/

► Friedrich & Partner Vermögenssicherung

https://www.friedrich-partner.de/

► Social Media...

Read More »

Read More »

Yanis Varoufakis – Europa und seine Austeritätspolitik.

Siehe auch Abspann und Infokarte zum Thema. Ein investigativer Beitrag von Yanis Varoufakis, der von seiner Einschätzung und Klartext zur politischen Praxis in der EU - Finanzpolitik spricht.

Read More »

Read More »

Andrew Moran is the future of Brighton! |2023| HD

Andrew Moran is the future of Brighton and Ireland!

Song: -YnSQkRyk

This content is both in Transformative and Educational nature. Video is in compliance with Content Quality section of YPP Policies as the editing adds creative value which makes the content unique.

#andrewmoran #brightonandhovealbion #ireland

Read More »

Read More »

Vereinigte Staaten von Europa | CBDCs und Abschaffung des Bargeldes | Dr. Stelter Interview

Du willst mehr über Aktien und Aktienhandel lernen? Wie man als Anfänger Aktien an der Börse kauft, oder was ein ETF ist und wie man diesen analysiert?

Read More »

Read More »

Warum ich DIVIDENDEN mehr Traue als der AHV (Gesetzliche Rente)

?Hol dir 100 CHF Trading Credits bei einer Aktien-Depoteröffnung ►► http://sparkojote.ch/swissquote *

(only for swiss residents)

Warum ich Dividenden mehr Traue als der AHV (Gesetzliche Rente) ?

In diesem Video erkläre ich warum ich Dividenden als stabilere und vorhersehbarere Einkommensquelle betrachte als die AHV. Ich gehe auf die Vorteile von Dividenden-Aktien ein und wie man langfristig ein passives Einkommen aufbauen kann. Schauen Sie sich...

Read More »

Read More »

Dirk Müller: Die Zinsen sind zurück Kommt es jetzt anders als gedacht? #shorts

?? Jetzt Cashkurs-Mitglied werden ►► 1 Monat für €9,90 statt €17,70 ►https://bit.ly/Cashkurs9_90

3️⃣ Tage gratis testen ►►► https://bit.ly/3TageGratis

? Gratis-Newsletter ►►►https://bit.ly/CashkursNL

? YouTube-Kanal abonnieren ►►► https://www.youtube.com/@cashkurscom

Cashkurs.com - Wirtschaft. Finanzen. Börse. Ehrlich! Unabhängig! Direkt!

?????? ??? ????? ?? ????! ???? ?ü???? ??? ??? ??????? ????????-???? ?????? ???? ??? ???!

Bildrechte:...

Read More »

Read More »

Wichtige Morning News mit Oliver Klemm #49

Klicke hier, um Dich gemeinsam mit Oli unabhängig zu machen:

? http://bit.ly/oli-ausbildung

Meine Webseite: https://tradingcoacholi.com/

►Mein Telegram Kanal: http://t.me/tradingcoacholi

►Folge Oliver auf Facebook: http://bit.ly/TOFBpage

►Folge Oliver auf Instagram: http://bit.ly/TOInst

►Oli macht auch TikToks: https://www.tiktok.com/@tradingcoacholi

►Abonniere Oliver auf YouTube: http://bit.ly/Oli-Kanal

DIE TRADING COMMUNITY VON OLIVER KLEMM...

Read More »

Read More »

Wie Sie mit Humor ein besseres Leben führen werden (Business und Beziehungen)

Wie Sie die Kraft des Humors einfach nutzen können! Allerdings sollten Sie sich auch in Acht nehmen. Hier erfahren Sie einige Anekdoten und Beispiele als Inspiration für Sie.

Read More »

Read More »

Study: solar panels only pay off in half of Swiss cities

Solar panel installations are only profitable in half of Swiss cities according to a new study. This could create hurdles for the expansion of solar energy in the country.

Read More »

Read More »

Michael Mross: Denn sie weiss nicht, was sie tut

#michaelmross #freiheit #untergang #boom #aktien

Michael Mross ist ein bekannter deutscher Börsenexperte, Buchautor, Wirtschaftsjournalist und Moderator.

Read More »

Read More »

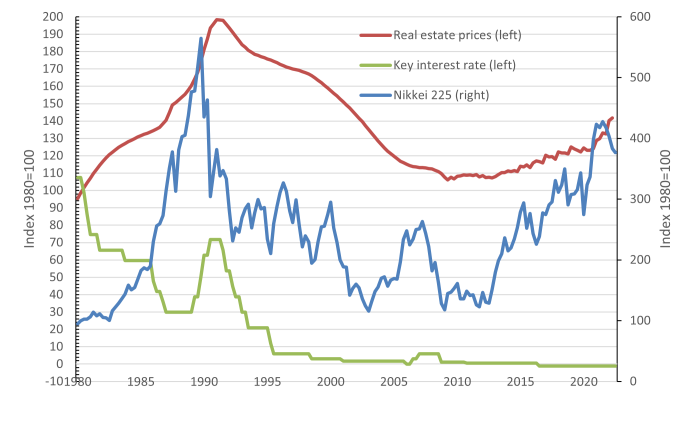

Is the Japanese Low Inflation–Low Interest Rate Model at an End?

The macroeconomic situation in Japan seems to be coming to a head. When the Bank of Japan, under its President Haruhiko Kuroda, announced on December 20, 2022, that it would raise its interest rate ceiling on ten-year Japanese government bonds from 0.25 percent to 0.50 percent, share prices in Tokyo plummeted and the Japanese yen appreciated sharply.

Read More »

Read More »

Triangulation Is One of My Keys to Success

#Triangulation is one of my keys to #success because it gives me #perspective and allows me to stress-test my thinking. From my conversation with @jayshetty2758. #principles #raydalio

Read More »

Read More »