Tag Archive: newsletter

The Bank of England: Money Creation in Their Own Words

Central banks usually don't admit their guilt in the destruction of money, but the Bank of England unwittingly comes clean.

Original Article: "The Bank of England: Money Creation in Their Own Words"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

Tagesschau: NZZ DEMONTIERT ARD Klima Bericht!

Die ARD hat einen Bericht vorgelegt, indem gezeigt wird, dass die Deutschen VIEL MEHR Klimawandel (Klimakrise) Themen in der Tagesschau wünschen. Doch eine Schweizer Zeitung (Nzz) hat dies nun eindrucksvoll widerlegt

Aktien kostenlos kaufen hier ►► https://link.aktienmitkopf.de/Depot

??5 Euro Startbonus bei Bondora ►► https://goo.gl/434rmp *

? Tracke deine Dividenden mit dieser App http://myfinances24.de/mydividends24

? Mein Buch! Der Rationale...

Read More »

Read More »

Dirk Müller: Deutsche Bank massiv unter Beschuss – DAS rächt sich jetzt

????? ??? ??? ????? ??????????? ??? ???? ?ü???? ????:

https://bit.ly/230327_Marktupdate

(Bei diesem Video handelt es sich um einen kurzen Ausschnitt aus dem Marktupdate vom 27.03.2023 auf Cashkurs.com.)

?Jetzt Cashkurs-Mitglied werden ►► 1 voller Monat für €9,90 ► https://bit.ly/Cashkurs9_90

3️⃣ Tage gratis testen ►►► https://bit.ly/3TageGratis

? Gratis-Newsletter ►►► https://bit.ly/CashkursNL

? YouTube-Kanal abonnieren ►►►...

Read More »

Read More »

Will Commercial Real Estate be the Next to Fall?(3/27/23)

(3/27/23) In the aftermath of the bank fail and bailout fiasco, the Fed's QT is essentially being negated by bond buys; despite that, markets are setting a rising trend. Gold buyers read real interest rates; stock buyers read earnings estimates. While the Fed continues to focus on inflation, markets are pricing-in a 110-bp rate cut by Summer's end. 15-years after Bear-Stearns, the component missing for full financial crisis is a lack of faith in...

Read More »

Read More »

Finanzwelt in Panik: Das war erst der Anfang – Ernst Wolff im Gespräch mit Dominik Kettner

Finanzwelt in Panik - Könnte der USA Bankencrash auch auf Europa überschwappen? Hat man den Crash herbeigeführt, um die CBDC's einzuführen? Wird eine Insolvenzwelle in Deutschland kommen? Diese Fragen und viele mehr klären Ernst Wolff und Dominik Kettner in diesem Video.

Das neue Buch "World Economic Forum: Die Weltmacht im Hintergrund" ist hier erhältlich:

►► https://bit.ly/3zuC9jz (Die ersten 2000 signierten Exemplare (Klarsicht...

Read More »

Read More »

¡PILLADO! Escrivá Cazado con el Agujero de las Pensiones

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

The Last Lie Government Will Ever Tell

The more powerful a government, the more likely it is to engage in war and conquest. Case in point: US involvement in Ukraine.

In 2014 the US led a coup that displaced a “democratically elected” president, Viktor Yanukovych.

In November 2013, . . . Yanukovych rejected a major economic deal he had been negotiating with the EU and decided to accept a $15 billion Russian counteroffer instead. That decision gave rise to antigovernment demonstrations...

Read More »

Read More »

Calmer Markets to Start the New Week

Overview: There did not appear to be any negative

surprises over the weekend, and this is helping calm investors' nerves at the

start of the new week. Deutsche Bank shares have recovered most of the

pre-weekend loss in the German market, and Stoxx bank index is posting a gain

for the first time in four sessions. The AT1 ETF is slightly softer. In Japan,

the Topix bank index slipped around 0.5%, its fourth decline in the past five

sessions. Asia...

Read More »

Read More »

Banking crisis: The new bailout strategy

Part I of II

The recent turmoil that has roiled the global banking sector has placed central bankers in an impossible position: Cut rates and avert a domino-style disaster in the industry and a possible deep and prolonged recession in the wider economy or stay the hiking course to combat the still untamed inflationary pressures? Arguably the great losers in both cases will be the taxpayers and the average working household.

The recent...

Read More »

Read More »

Knockout fürs Bargeld! 7.000 Euro OBERGRENZE droht Morgen! ???

Schon morgen wird das EU Parlament über die nächste Herabsetzung der Bargeldobergrenze abstimmen! Mit der altbewährten Salami-Taktik wird das Bargeld nach und nach abgeschafft.

FAZ Artikel https://www.faz.net/aktuell/wirtschaft/eu-parlament-will-bargeld-obergrenze-weiter-senken-18777887.html

? 30 Tage kostenlos Aktien kaufen ► http://link.aktienmitkopf.de/Depot *

??5 Euro Startbonus bei Bondora ►► https://goo.gl/434rmp *

? Tracke deine Dividenden...

Read More »

Read More »

Wichtige Morning News mit Oliver Klemm #80

Freitag 31.03. 18.00 Webinar mit The Trading Pit! Thema: So bestehst Du die Challenge!

https://us02web.zoom.us/webinar/register/4016798976947/WN_V8mY17mNRei1AObHTU5JPw

Kostenfreies Video-Training (Durch Trading in 2023 absichern)

? https://oliverklemmtrading.com/casestudy-1?utm_source=youtube&utm_medium=social&utm_campaign=tradingcoacholi&utm_term=morning-news&utm_content=1

Klicke hier, um dich direkt gemeinsam mit Oli unabhängig...

Read More »

Read More »

DIE LETZTE WOCHE IN Q1 2023. WAS STEHT UNS BEVOR??

Die letzte Woche des Q1 in 2023 steht an. Was wird im Kryptobereich passieren? Werden wir weiterhin so gut performen wie Anfang des Jahres oder gibt es einen Rücksetzer? Oder doch was ganz anderes und es ist einfach eine ruhige Woche? Erfahre in diesem Video alle Details.

----------

? DR. JULIAN HOSP's Special Insights: https://newsletter.julianhosp.com

? Kostenlose DeFi Academy: https://academy.julianhosp.com/de

? Kostenlose Crypto Quiz:...

Read More »

Read More »

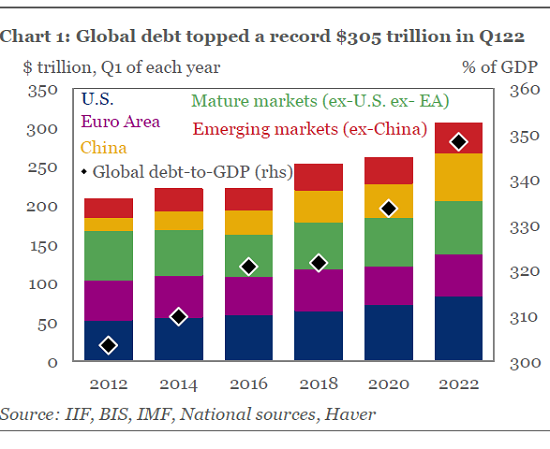

The Everything Bubble and Global Bankruptcy

The resulting erosion of collateral will collapse the global credit bubble, a repricing/reset that will bankrupt the global economy and financial system. Scrape away the complexity and every economic crisis and crash boils down to the precarious asymmetry between collateral and the debt secured by that collateral collapsing.

Read More »

Read More »

Deutsche Bank jetzt fällig? Bankensterben auch bei uns?

✘ Werbung:

Mein ch Allgemeinbildung ► https://amazon.de/dp/B09RFZH4W1/

Aktuell kriselt es an allen Orten. Zuerst in UK mit der #Anleihekrise. Dann in #USA mit der Silicon Valley Bank und schließlich bei der #CreditSuisse in der Schweiz. Kommt diese Krise jetzt auch zu uns? Unter allem brodelt die Inflation und die laufende Immobilienkrise.

Silicon Valley Bank ►

UK-Anleihekrise ► -LM6eX5TI

FDP ►

Core Inflation ►...

Read More »

Read More »

Vorsicht! Finger weg von ESG und grünen Investments (lieber Baum pflanzen)

Heute im Gastinterview mit Inside Wirtschaft besprechen wir die turbulenten und doch auch spannenden Zeiten. Sehen wir eine zweite Welle der Inflation, können die Notenbanken das Erhöhen der Zinsen aufrecht halten und wie stehe ich zum Hype um die grünen Investments?

Originalinterview:

? EVENT: Marc lädt Dich ein nach Schwäbisch Gmünd!

https://www.marc-friedrich.de/

► Mein Merch:

https://shop.marc-friedrich.de/

► Mein neues Buch

Du möchtest...

Read More »

Read More »

The GBPUSD fell to support on Friday, and buyers stepped in. Buyers in control.

In this video, we'll take a closer look at the recent movement of the GBPUSD, which fell to support on Friday before buyers stepped in. With the buyers now more in control heading into the new trading week, we'll explore the key levels to watch and potential trading opportunities that could arise.

Join us as we provide you with valuable insights and analysis that can help you navigate the Forex market and make informed trading decisions.

Read More »

Read More »

USDJPY: The USDJPY has a small bullish bias heading into the new trading week

In this video, we'll analyze the current state of the USDJPY and examine the potential bullish bias heading into the new trading week. Despite the recent move to the downside, the USDJPY is showing some technical signs of strength, and we'll explore the key levels to watch and the potential trading opportunities that could arise.

Join us as we provide you with valuable insights and analysis that can help you navigate the Forex market and make...

Read More »

Read More »

A drill down look at the EURUSD

In this video, we'll take a drill-down look at the EURUSD and examine the key levels in play from both a short-term and long-term perspective to start the trading week. Whether you're a short-term or long-term trader, we've got you covered with valuable insights and analysis that can help you make informed trading decisions.

Join us as we explore the latest trends and provide you with actionable strategies that can help you succeed in the volatile...

Read More »

Read More »