Tag Archive: newsletter

Intel kürzt dramatisch Dividende – Jetzt kaufen oder verkaufen

Nach der Dividendenkürzung bei Intel stellt sich vielen die Frage, ob man Aktienbestände abstoßen sollte, oder ob der fallende Kurs eine Kaufgelegenheit bietet. Wie ich bei der Lösung der Fragestellung vorgehe, erkläre ich dir im heutigen Video.

Sicher dir jetzt Tickets für das kommende Mindset- Seminar

https://jensrabe.de/mindset

0:00 Intel Chartbild

3:24 Darum war ich kritisch

4:40 Beispiel Kraft Heinz

7:53 Beispiel Wells Fargo

9:47...

Read More »

Read More »

Technical analysis for the S&P 500. What Put option should I buy here? Unattractive bet.

Even if it works out, that bet is challenging due to the unattractive reward vs. risk. When you short, you need to be early to th party and this does not seem like the best timing.

Trade at your own risk.

Visit ForexLive.com for additional views.

Read More »

Read More »

Jeremy Bentham: From Laissez-Faire to Statism

[An Austrian Perspective on the History of Economic Thought (1995)]

Jeremy Bentham (1748–1832) began as a devoted Smithian but more consistently attached to laissez-faire. During his relatively brief span of interest in economics, he became more and more statist. His intensified statism was merely one aspect of his major — and highly unfortunate — contribution to economics: his consistent philosophical utilitarianism. This contribution, which...

Read More »

Read More »

Why the 1787 Constitution Did Not Bring Republican Government to America

It's a myth that the "Founding Fathers" made America a republic in 1787. It was the state governments and their constitutions that did this. But the top-down myth glorifying the central government endures.

Original Article: "Why the 1787 Constitution Did Not Bring Republican Government to America"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

AMERIKA IST NICHT MEHR DAS WAS ES MAL WAR…

NEUER GRATIS TRADING WORKSHOP (3. - 5. März 2023):

? https://us02web.zoom.us/webinar/register/9216758012881/WN_XKE_2oV-QjWsy2PgXG8xDQ

Jetzt anmelden!! Plätze begrenzt...

Klicke hier, um Dich gemeinsam mit Oli unabhängig zu machen:

? http://bit.ly/oli-ausbildung

Meine Webseite: https://tradingcoacholi.com/

Inhaltsverzeichnis:

►Mein Telegram Kanal: http://t.me/tradingcoacholi

►Folge Oliver auf Facebook: http://bit.ly/TOFBpage

►Folge Oliver auf...

Read More »

Read More »

Top-Ökonom ist sicher: Extremistischer Klimaschutz ruiniert die Industrie

Es sind gewohnt deutliche Worte, die Ökonom Hans-Werner Sinn findet. Die deutsche Bundesregierung setze mit ihrer Klimapolitik ein Negativbeispiel für die ganze Welt. Er fordert ein Ende von Alleingängen beim Klimaschutz – und Deutschland solle auf China zugehen.

Besuchen Sie uns doch auch auf unseren anderen Kanälen:

https://www.eXXpress.at

https://www.instagram.com/exxpress.at

https://www.facebook.com/exxpress.at

Read More »

Read More »

Just Say No to the New Forever War

American and European political elites seem to be wanting the Russia-Ukraine war to be fought to the last Ukranian and have done nothing to bring peace. It's time for a change.

Original Article: "Just Say No to the New Forever War"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

“DAX Long oder Short?” mit Marcus Klebe – 07.03.23

HIER geht´s direkt Zur Webinar-Serie: Traden mit kleinem Konto

https://register.gotowebinar.com/register/3876278094922468952?source=mk

Ich freue mich über eure Daumen ???

#DAX #MarcusKlebe #Trading

ÜBER JFD:

WER WIR SIND:

JFD ist eine führende Unternehmensgruppe, die Finanz- sowie Investmentdienstleistungen und -aktivitäten anbietet. Die Muttergesellschaft, JFD Group Ltd, wurde im Dezember 2011 gegründet und ist heute ein international...

Read More »

Read More »

“DAX Long oder Short?” mit Marcus Klebe – 10.03.23

HIER geht´s direkt Zur Webinar-Serie: Traden mit kleinem Konto

https://register.gotowebinar.com/register/3876278094922468952?source=mk

Ich freue mich über eure Daumen ???

#DAX #MarcusKlebe #Trading

ÜBER JFD:

WER WIR SIND:

JFD ist eine führende Unternehmensgruppe, die Finanz- sowie Investmentdienstleistungen und -aktivitäten anbietet. Die Muttergesellschaft, JFD Group Ltd, wurde im Dezember 2011 gegründet und ist heute ein international...

Read More »

Read More »

Marc Faber: The lies of mainstream are now exposed

Marc Faber: The lies of mainstream are now exposed

Marc Faber: The lies of mainstream are now exposed

__________________________________________________

#marcfaber

__________________________________________________

Enjoyed the video? Comment below! ?

? Subscribe to KAIZ ADAM here ?? https://www.youtube.com/channel/UCKqG4UIYFN0R5APuuhtM7dQ?sub_confirmation=1

❤️ Enjoyed? Hit the like button! ?

__________________________________________________...

Read More »

Read More »

Week Ahead: February ISM Services and Auto Sales to Show January US Data were Exaggerated

A key issue facing

businesses and investors is whether the US January data reflects a

reacceleration of the world's largest economy or whether it was mostly a

payback for extremely poor November and December 2022 data and seasonal

adjustments and methodological distortions. Given the centrality of the US

economy and rates, it is not simply a question for America, the Federal

Reserve, and investors, but the implications are much broader. The issue...

Read More »

Read More »

Business Cycle Intel Report

Mark uses Intel Corporation, the computer chip manufacturer, as a barometer of the business cycle. He looks at the stock price in recent years, its production capacity expansion, and the company's very recent cost- and dividend-cutting moves.

Check out Mark Thornton's free book, The Skyscraper Curse: And How Austrian Economists Predicted Every Major Economic Crisis of the Last Century: Mises.org/Curse

Be sure to follow Minor Issues at...

Read More »

Read More »

Making Nonsense from Sense: Debunking Neo-Calvinist Economic Thought

A few years ago I wrote about some of the errors made by economists who try to apply what they believe are Christian principles to both Austrian and neoclassical economic analysis. These economists believe that the standard economic way of thinking is not only fatally flawed but actually immoral, and that an entire new paradigm must be brought to economics.

In the mid-1990s, I taught economics as an adjunct at a Christian college near Chattanooga,...

Read More »

Read More »

Digitale Diktatur? – CO2-Konto auf Ebay!

► Mein Merch:

https://shop.marc-friedrich.de/

► Mein neues Buch

Du möchtest das erfolgreichste Wirtschaftsbuch 2021

"Die größte Chance aller Zeiten" bestellen?

Auf Amazon: https://www.amazon.de/shop/marcfriedrich oder mit Signatur:

https://www.marc-friedrich.de/

► Friedrich & Partner Vermögenssicherung

https://www.friedrich-partner.de/

► Social Media

Twitter: http://www.twitter.com/marcfriedrich7

Instagram:...

Read More »

Read More »

Schulden am Limit + Marktausblick

⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️

▬ ANGEBOT ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

https://www.andre-stagge.de/mastermind-seminar-tradingpsychologie/

Wir leben in einer Welt mit:

• Hohen Schulden

• Hohen Zinsen (im Verhältnis zu den letzten 10 Jahren)

• Hoher Inflation

Was das für Dich und Deine Investments bedeutet?

Die immer weiter steigenden globalen Renditen sind ein Problem in einer hoch verschuldeten Welt. Notenbanken können die Zinsen nicht...

Read More »

Read More »

Dr. Andreas Beck & Fabian Behnke: Vanguard steigt aus!

Dr. Andreas Beck & Fabian Behnke im Gespräch: Anleger sollen nachhaltig investieren, so will es die EU Regulierung. Aber wollen die Anleger das auch? Warum geht mit Vanguard einer der größten Asset Manager einen anderen Weg?

► Zum Global Portfolio One von Dr. Andreas Beck: https://globalportfolio-one.com/

► Zum E-Book „Grüne Geldanlagen nur für Farbenblinde“ von Dr. Andreas Beck und Lucas von Reuss: https://esgi-index.com/...

Read More »

Read More »

Fed President Worries the Fed Risks a Repeat of the 1970s!

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

Since the Fed’s last move, incoming economic data is emboldening the hawks. A superficially strong U.S. jobs report combined with stubbornly high inflation readings suggest central bankers have more work to do.

Read the Full Transcript Here: https://www.moneymetals.com/podcasts/2023/02/24/fed-risks-triggering-1970s-do-over-new-sound-money-win-002688

Do you own precious...

Read More »

Read More »

The Politicization of Procreation: The Ultimate in “the Personal Is Political”

Gloria Steinem declared, "The personal is political." Today, politics has reached into family life and even procreation itself, an unhappy trend for unhappy people.

Original Article: "The Politicization of Procreation: The Ultimate in "the Personal Is Political""

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

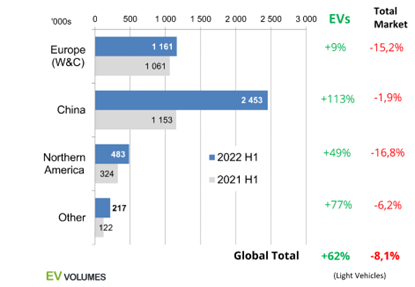

China’s Emerging Global Leadership Isn’t Just the Result of Subsidies: Entrepreneurship Still Matters in This Market

China has become a global leader in the electric vehicles (EVs) sector, and Western governments are worried that its comparative advantage will become entrenched. Once again, mainstream pundits blame China’s success on government subsidies and unfair competition. This is just a pretext to argue for more government support in a sector which, from the very beginning, has not been driven by genuine consumer demand but by a political green agenda....

Read More »

Read More »