Tag Archive: Monetary Policy

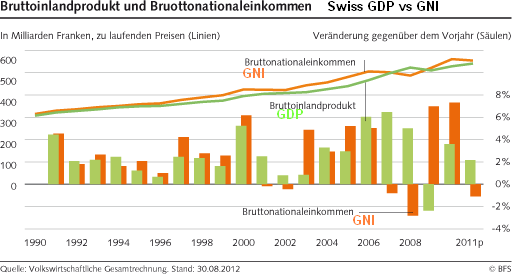

History of SNB monetary policy assessments vs. economic data

History of SNB monetary policy assessments vs. the Swiss gross national product (GDP) and gross national income (GNI).

Read More »

Read More »

SNB Monetary Policy Assessment December 2012: (Nearly) Full Text

The SNB decided to maintain the floor at 1.20 and the Libor target between 0% and 0.25%. As we expected in our outlook on the assessment, there were still important downwards drivers of inflation after the strong appreciation of the franc. Therefore, the SNB has moved its inflation expectations downwards for 2013 to minus 0.1% …

Read More »

Read More »

SNB Monetary Policy Assessment Outlook

On Thursday, December 13th, 2012, at 09.30 CET, the Swiss National Bank (SNB) holds its quarterly monetary policy assessment meeting. As we explained in the “drivers of Swiss inflation” post, inflation pressures will remain subdued for the next 2-3 years, because the effects of the quick rise of the franc and weakening global growth need to …

Read More »

Read More »

SNB Monetary Data Week October 26

Seasonal effects, the good months for the SNB and the US economy, but weaker ones for emerging markets and Switzerland Despite the seasonal effects between October and March, the SNB is not able to sell currency reserves consistently. Traditionally the USD gets stronger and stocks rise over the autumn months till January. This year’s stocks appreciation was possibly already anticipated …

Read More »

Read More »

SNB Monetary Data Week October 19

Seasonal effects, the good months for the SNB and the US economy, but weaker ones for emerging markets and Switzerland Given that the seasonal effects between October to March have started, the SNB might be able to sell some currency reserves. Traditionally both the USD gets stronger and stocks rise over the autumn months till January. This year’s stocks appreciation was …

Read More »

Read More »

SNB Monetary Data Week October 12

Seasonal effects, the good months for the SNB and the US economy, but weaker ones for emerging markets and Switzerland, have started Given that the seasonal effects between October to March have started, the SNB might be able to sell some currency reserves. Traditionally both the USD gets stronger and stocks rise over the autumn months till January. This year’s stocks …

Read More »

Read More »

SNB Monetary Data Week October 5

Seasonal effects, the good months for the SNB and the US economy, but weaker ones for emerging markets and Switzerland, have started Given that the seasonal effects between October to March have started, the SNB might be able to sell some currency reserves. Traditionally the United States and the USD dollar become stronger and stocks rise over the autumn months …

Read More »

Read More »

SNB Monetary Data Week of September 28

Seasonal effects, the good months for the SNB and the US economy, but weaker ones for emerging markets and Switzerland, have started Given that the seasonal effects between October to March have started, the SNB might be able to sell some currency reserves. Traditionally the United States and the USD dollar become stronger over the autumn months till …

Read More »

Read More »

Do Swiss companies prefer to hold cash at the SNB instead of local banks ?

The most recent SNB monetary data show that more and more companies are increasing their deposits at the central bank at a quicker speed than local banks. Might this be missing trust in the Swiss banking system ?

Read More »

Read More »

Isn’t it wonderful to trade with a strong central bank behind you?

Isn’t it wonderful to have a strong central bank like the SNB sitting behind you when trading Forex? Losses are limited to the floor of 1.20 and in the meantime you can gain forward swaps with the higher euro zone interest rates. Today the Swiss National Bank (SNB) decided in its monetary policy assessment …

Read More »

Read More »

What’s this crazy movement in EUR/CHF ? SNB Floor Hike ?

On Friday there was a big movement in the EUR/CHF. First it went up to 1.2154, fell later down to 1.2080 in the main American trading and rose again to 1.21 in the low-volume trading time. We repeat our entry from Friday, because we continuously updated the post after new developments, e.g. after the … Continue reading »

Read More »

Read More »

The Full English Translation of the Interview with Thomas Jordan

Here a translation of the interview with the president of the Swiss National Bank, Thomas Jordan, in the finance magazine ECO of the Swiss television SF1. Here the original German video. Question: Given that the SNB has reserves of over 200 bln. Euros, are you still able to sleep ? Jordan: We are in a … Continue reading...

Read More »

Read More »

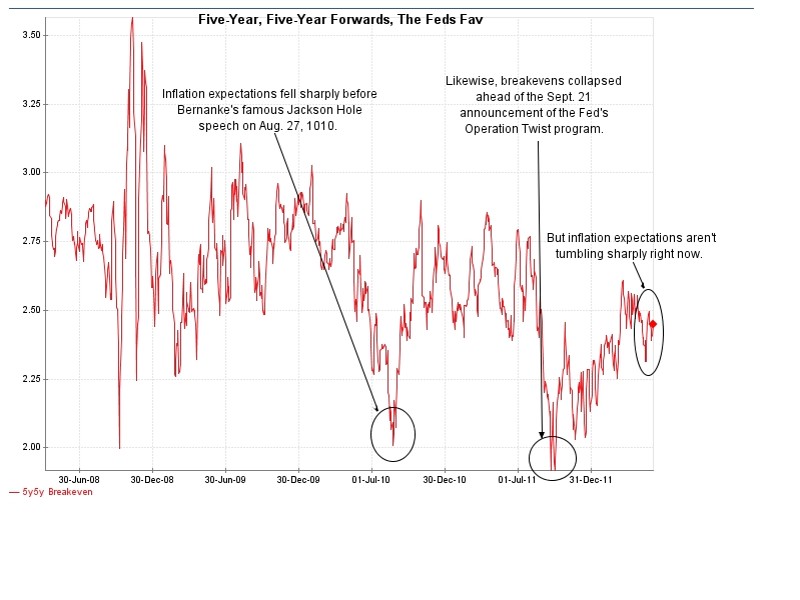

Brad DeLong on Jackson Hole and Quantitative Easing

Berkeley Professor Brad DeLong has delivered a nice allegorical entry in his type pad on a quick Quantitative Easing. Letting speak old greek mythological figures he hides his personal opinion. A half now completely written platonic dialogue on what the Federal Reserve is Doing — or not Doing — Right Now DeLong explains the …

Read More »

Read More »

How former central bankers stepped up against the central banks

There are already three former European central bankers who criticize more or less openly the European Central Bank (ECB).

Read More »

Read More »

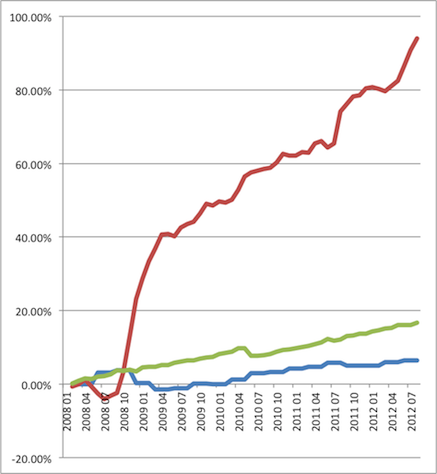

Quantitative Easing Indicators, June 2012

The main drivers for demand for Swiss francs are the Euro crisis, but even more the behavior of American investors, who go out of the dollar in the fear of further bad US economic data and in the fear of Quantitative Easing. This will push down the dollar and safe-havens like the CHF, gold or the … Continue reading »

Read More »

Read More »

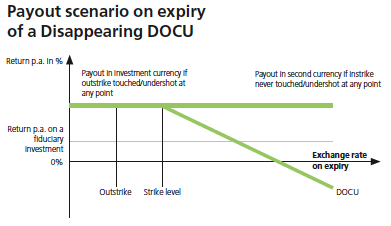

Capital controls: The poison cupboard of the SNB

The SNB has already tried a lot to weaken the franc. A (google) translation of a list of capital controls of the Never Mind the Markets blog. The fear of the economic effects Brake by an overvalued franc increases. Massive interventions by the Swiss National Bank (SNB) with € purchases are now ineffective fizzles. Does it …

Read More »

Read More »

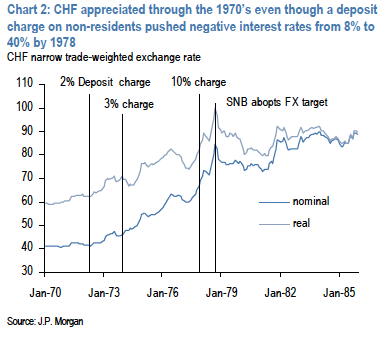

JP Morgan: Reflections on negative interest rates in Switzerland

Negative interest rates naturally attract attention given Switzerland’s use of these between 1972-1978.

Read More »

Read More »

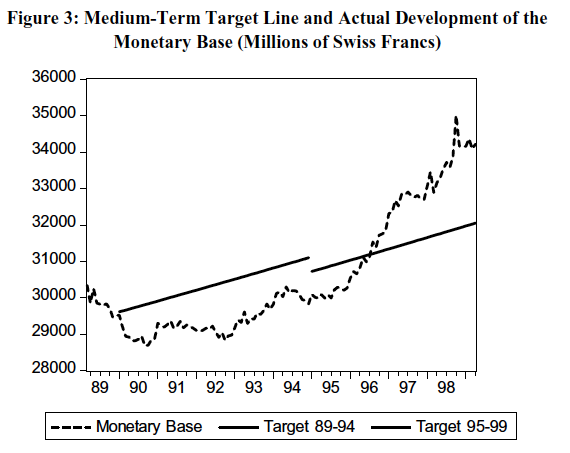

Swiss Inflation, GDP, Monetary Base between 1974 and 2000

Some background statistics on the Swiss monetary policy in the 1970s from Swiss Monetary Targeting 1974-1996: The role of internal policy analysis. More details and monthly data on inflation here.

Read More »

Read More »