Our monetary system is failing, but explaining that isn’t easy. The most popular argument is that the dollar has falling purchasing power and rising inflation. The problem with this argument is that consumer prices aren’t skyrocketing now. So, of course, people remain skeptical.

Yields across all markets were falling worldwide. This causes the income generated from assets to fall. I wrote about this serious problem last time, introducing the concept of yield purchasing power—which is how much you can buy with the interest on your savings.

Today, there is little to no interest, which forces retirees to spend down their principal. This is no accident. It’s the vision of economist John Maynard Keynes. Nearly 80 years ago, he called for the “euthanasia of the rentier”—his pejorative term for retirees and others on fixed income. Today Federal Reserve Chair Janet Yellen calls herself a New Keynesian.

To picture the plight of the retiree living on fixed income, let’s use the example of a poor farmer. Every year, his harvest shrinks. With a smaller and smaller crop, it’s harder and harder to live. So he commits the sin of eating some of his seed corn. Smaller plantings only accelerate the decline in his crops.

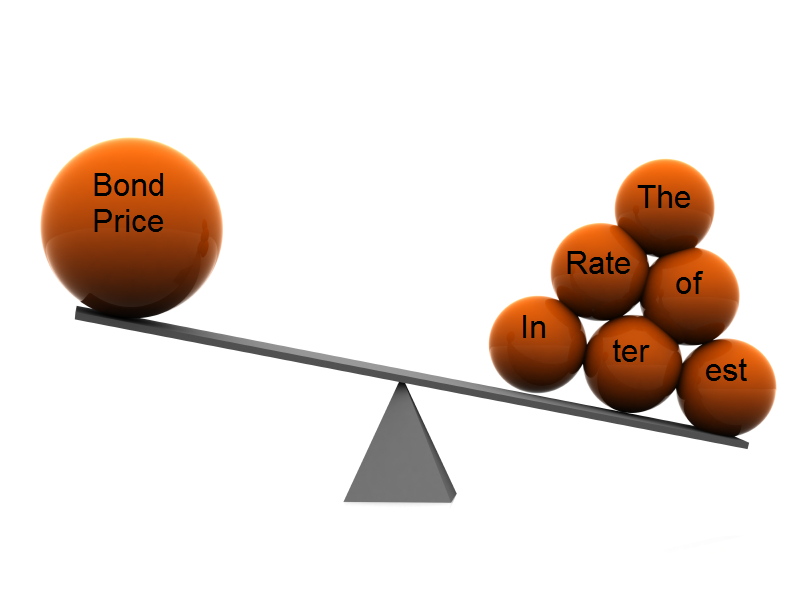

Our paper currency causes falling productivity, though not in terms of bushels per acre. What falls is productivity per dollar or euro of savings. This is the real meaning of the falling interest rate. When the rate was 10 percent, $1,000 of principal produced $100 of return. When it falls to two percent, then the same capital generates a return of only $20. Now with the Swiss 10-year bond, CHF 1,000 earns only CHF 1.3.

Every farmer understands a falling crop yield. However, few investors see the problem with a falling interest rate. Let’s use another farm example to help clarify. A dealer wants to buy the farmer’s tractor. He offers $10,000 for it. The farmer says no. Next week, he increases his offer to $11,000. Still no. The dealer keeps coming back with higher offers, until the farmer finally accepts $50,000. He can live for a year on that. Unfortunately, he’s given up his most important tool. Now he’s not consuming his seed corn, but his capital stock. Next year’s harvest will be even more meager.

Falling interest forces you to spend your principal, because it starves you of return. At the same time it feels rather pleasant, because you can sell your assets at higher and higher prices. Everyone loves a bull market, because they’re all making money. Alas, the process of relentlessly higher asset prices is totally corrupt. Let’s drill down into this, because it’s the key to understanding why our system is failing. Finally prices of the principal have started to fall. The Great Bond Sell-Off has started (from JGBs, over German Bunds to US Treasuries).

Normally, to make money you must first produce something. This means either working, or else putting your capital to work. Our monetary system now breaks this economic law. Falling yields and rising assets seemingly offer you a profit for doing nothing. You are not putting your capital to work, using your tractor to plant a food crop. You are consuming it, selling the tractor to pay for food. It’s not a real profit. A society cannot live by consuming previously-accumulated capital. Consumption without production is unsustainable.

This is how our money is being devalued, debased, debauched, and destroyed. Money was once a tool to help people coordinate their production and trade. Now, it has devolved into a lever to deprive retirees of the return on their life savings.

Forget about consumer prices, the CPI, those measurements of inflation!

The problem is much more serious than that. We’re destroying the productivity of capital, and rewarding instead its consumption.

The Yield Purchasing Power is more important, the yield of your life insurance investments.

1 comment

5 pings

Anonymous

2015-08-25 at 17:13 (UTC 2) Link to this comment

good

Are Hedge Funds Worth More Than Kindergartens? | Timber Exec

2015-05-27 at 10:54 (UTC 2) Link to this comment

[…] However, in their desire to oppose the other team, they are missing the elephant in the room—rising assets, and falling yields. They too assume that we have capitalism. The reality is that all capital markets are massively […]

Are Hedge Funds Worth More Than Kindergartens? - Exploring the News

2015-05-27 at 12:04 (UTC 2) Link to this comment

[…] However, in their desire to oppose the other team, they are missing the elephant in the room—rising assets, and falling yields. They too assume that we have capitalism. The reality is that all capital markets are massively […]

Are Hedge Funds Worth More Than Kindergartens? | Parcbench

2015-05-27 at 15:08 (UTC 2) Link to this comment

[…] However, in their desire to oppose the other team, they are missing the elephant in the room—rising assets, and falling yields. They too assume that we have capitalism. The reality is that all capital markets are massively […]

Are Hedge Funds Worth More Than Kindergartens? - Capitalism Magazine

2015-05-27 at 16:52 (UTC 2) Link to this comment

[…] However, in their desire to oppose the other team, they are missing the elephant in the room—rising assets, and falling yields. They too assume that we have capitalism. The reality is that all capital markets are massively […]

The Economy is in Liquidation Mode |

2016-09-26 at 14:01 (UTC 2) Link to this comment

[…] have used a family farm as an example to paint a clear picture of capital consumption. Imagine using your farm, not to grow food, but to […]