Tag Archive: Switzerland KOF Economic Barometer

Fundamentals,FX,Gold and CHF: Week October 28 to November 3

This week had a focus on – due to the government shut-down – the long awaited U.S. data: Highest importance: The ISM Manufacturing Purchasing Manager Index (PMI) for October came in at 56.4, higher than the 55 expected. The value for new orders and for production remained above 60 despite the government shutdown. The value …

Read More »

Read More »

Fast CHF and Gold Price Movements

Our CHF and Gold News Bar on our home page explains daily CHF and gold price movements based on the most important fundamental indicators in a few sentences. Keep in mind that the only Swiss fundamental data that is able to move the CHF must come from the SNB and from Swiss inflation data – … Continue reading »

Read More »

Read More »

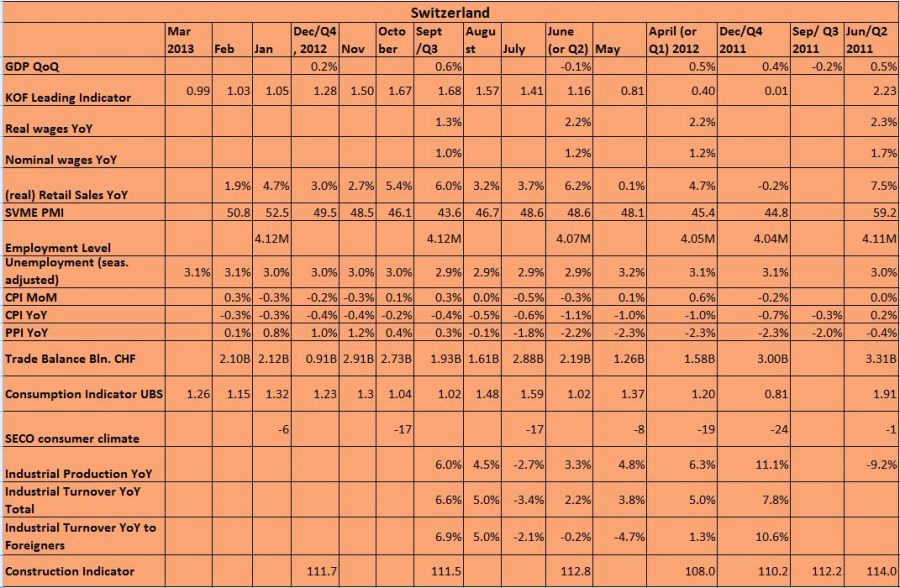

Swiss Economic Indicators, March 2013

Switzerland continues to see a robust economy, even if the leading KOF indicator fell to 0.99 after highs of 1.68 in September. On other side, real and nominal wages continue to increase. As opposed to the KOF value, the UBS consumption indicator is rising. This shows that the internal economy is able to balance … Continue...

Read More »

Read More »

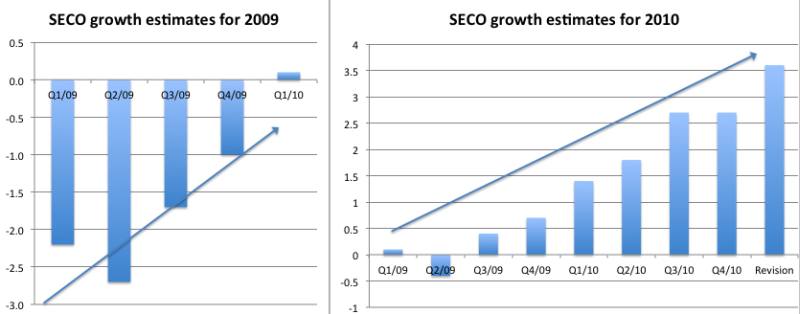

The history of wrong forecasts by Swiss economists: details

Or how to talk down an economy with wrong forecasts Read the introductory post here, if you haven’t yet. Details of SECO forecasts In the following we give the details about the SECO, the Swiss government economic agency’s, forecasts. Forecast Q1/2009 Sharp recession in 2009, gradual stabilization in 2010 Bern, 17.03.2009 – Economic …

Read More »

Read More »

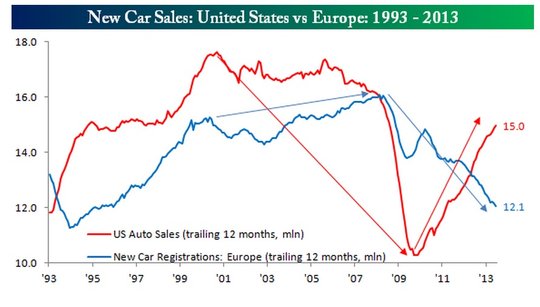

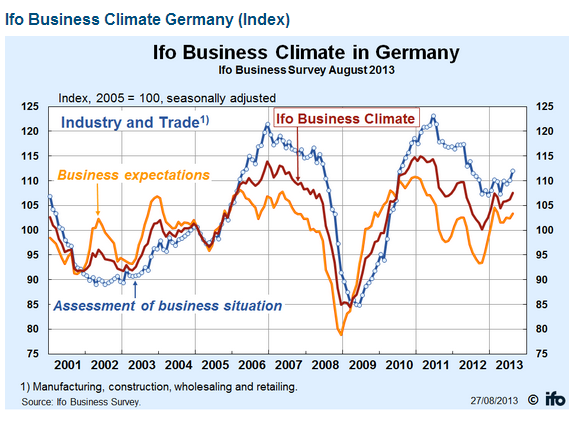

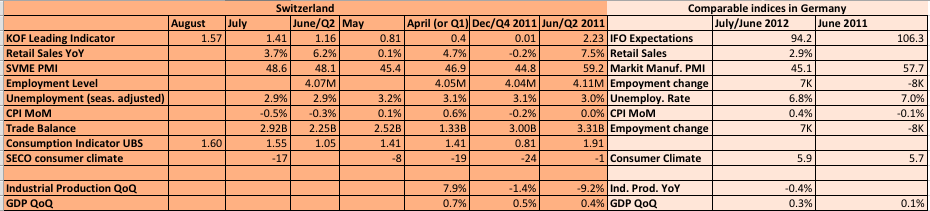

Swiss and German Economic Indicators, Update November 1

Euro Crisis Has Affected Germany, Switzerland Still Immune Most Recent Events The Swiss SVME PMI has risen from 43.9 to 46.1. This PMI is dominated by machinery, metallurgical and electric equipment exporters organized in the Swissmem organization. As opposed to the chemical industry, they were not innovative enough to adapt to the stronger franc; but …

Read More »

Read More »

Euro Crisis Has Affected Germany, Switzerland Still Immune

Swiss and German Economic Indicators, October 2012 Both Swiss and German economic indicators show continued signs of stability, but the German situation has become worse and might affect the Swiss. Especially low unemployment, rising real wages and strong trade balances are signs of robustness. Despite that, Germany’s industrial production is weaker than last year, …

Read More »

Read More »

Economic Indicators: In Switzerland and Germany the Euro Crisis Seems to Be Far Away

Swiss vs. German Economic Indicators, August 2012 Both Swiss and German economic indicators show continued signs of stability. Especially low unemployment, good retail sales and strong trade balances are signs of robustness. The German trade surplus has improved compared to last year, whereas the strong franc harmed the Swiss trade surplus just a bit. …

Read More »

Read More »

The Swiss National Bank and the EUR/CHF floor have become a political football

How the SNB Chairman Jordan has invited hedge funds and smart investors to a risk-free, high-return guaranteed investment in Swiss francs A wrap-up of Swiss newspapers for non-German literates In parallel to the start of the UEFA Euro 2012, the Swiss National Bank and its policy towards the EUR/CHF exchange rate has become a political …

Read More »

Read More »

EUR/CHF, A History of Interventions: May 2012

FT A Wee Bit Late To The Party… Notices Europeans have been buying Swiss francs and dollars. Who knew? By Jamie Coleman || May 30, 2012 at 19:43 GMT AUD/USD, NZD/USD Dragged Higher As EUR Recovers As Gerry mentioned earlier, the talk of a rescue fund for EZ banks seems to have set off some short covering … Continue reading »

Read More »

Read More »

EUR/CHF, A History, Market Betting on Floor Hike: January 2012

1.2034 The EUR/CHF Low As Risk-Off Resumes 1.2025 barrier supposedly in play while the 1.2000 peg below will act as a magnet if broken. There is something about the forex mindset that prompts markets to reach out and touch things that are not meant to be touched. EUR/US fell to 1.3063, triggering a few … Continue reading »

Read More »

Read More »

EUR/CHF, A History, Market Betting on Floor Hike: November 2011

Rumour Of A Softer KOF Swiss Leading Indicator… Expected 0.63 vs previous 0.80, but the number now being touted is 0.35 EUR/CHF is getting a leg up on this around 1.2283 now from 1.2260 earlier By Pete Jackson || November 30, 2011 at 10:21 GMT Large Corporate Bids In EUR/CHF…. At 1.2250 I’m told it relates to … Continue reading...

Read More »

Read More »

EUR/CHF: A History of Interventions: September 2011: The Floor Introduction

SNB Spotted In The Cross Today… Traders say the SNB was seen on the bid in lumpy size on the quick slide toward 1.2120 shortly after the open of US equity cash markets at 13:30. We’ve quickly bounced to 1.2170. By Jamie Coleman || September 30, 2011 at 14:20 GMT Category: All, Americas, Mkt Talk, Regions || Tags: EUR/CHF || 0 comments || Add …

Read More »

Read More »

EUR/CHF: A History of Interventions: August 2011: the Top

EUR/CHF Kicked Lower Again Hitting a new low this week of 1.1545 and is down over 300 pips on the day. The moved largely initiated by a major swiss name earlier apparently in conjunction with a hedge fund. Comments from the Swiss Econ Min over the last hour hardly helping matters, after the govt aid package … Continue reading »

Read More »

Read More »

EUR/CHF: One Year of Free Market (07/2010-07/2011): July 2011

ForexLive Asian Market Open EUR/USD is trading around 1.4390 and USD/JPY is at 77.20 as the market awaits the latest developments out of Washington. Risk pairs like EUR/JPY and EUR/CHF are likely to be whippy this morning as the headlines hit the newswires. Good luck out there. By Sean Lee || July 31, 2011 at 20:49 … Continue reading »

Read More »

Read More »

EUR/CHF: One Year of Free Market (07/2010-07/2011): June 2011

Specs Scrambling For Cover In EUR/CHF The Armageddon trade is being taken off in dramatic size in thin-month-end markets, driving EUR/CHF above 1.2200. USD/CHF is nearing resistance at 0.8440. Traders not talk of significant interest from real money accounts to buy both USD/CHF and USD/JPY at the fixing at 15:00 GMT. The danger now is … Continue reading »

Read More »

Read More »

EUR/CHF: One Year of Free Market (07/2010-07/2011): March 2011

March 2011 Swiss KOF Leading Growth Indicator 2.24 In March Up from revised 2.19 in February (initial 2.18.) Stronger than median forecast of 2.15. Bit of a surprise. EUR/CHF lower, presently at 1.2978. By Gerry Davies || March 30, 2011 at 09:39 GMT EUR/USD: Look To The Crosses For Guidance EUR/JPY has made a significant move … Continue reading...

Read More »

Read More »

EUR/CHF: One Year of Free Market (07/2010-07/2011): February 2011

February 2011 EUR/USD Outlook EUR/CHF looks like its forming important technical support at 1.2700 and should go higher. EUR/GBP and EUR/JPY are best described as choppy but the EUR/AUD is also exhibiting some ‘basing’ tendencies. With the USD in sell mode, the path of least resistance for EUR/USD would seem to be up. It will not … Continue reading...

Read More »

Read More »

EUR/CHF: A History of Interventions, March 2010

, March 2010 Big Barrier Eyed In EUR/CHF Traders report a large barrier option is in play at the 1.4200 level in EUR/CHF. Nothing attracts price action like a big barrier. The owner of the option wants to protect his investment while the bank that sold the option wants to knock it out to erase … Continue reading »

Read More »

Read More »

EUR/CHF: A History of Interventions, December 2009

December 2009 EUR/CHF Selling Off EUR/CHF is down at 1.4835 from an early 1.4865, the swissy bulls happy to probe for signs of meaningful SNB interest. Many are voicing surprise at the lack of interest being show by the Swiss National Bank to curtail the recent burgeoning swissy strength. There is talk of 1.4800 barrier … Continue reading »

Read More »

Read More »

Recent History of the Swiss franc, August 2009

A market view history of the EUR/CHF from the website ForexLive August 2009 Swiss KOF Leading Indicator Much Stronger Than Expected The Swiss KOF leading indicator for August has come in at -0.04 from a revised -0.85 in July, much stronger than the median forecast of -0.60. The indicator’s m/m rise in August is the strongest … Continue reading...

Read More »

Read More »

Receive a Daily Mail from this Blog

Live Currency Cross Rates

On Swiss National Bank

On Swiss National Bank

-

SNB’s Chairman Schlegel: A few months of negative inflation wouldn’t be a problem

13 days ago -

SNB Sight Deposits: decreased by 3.6 billion francs compared to the previous week

2025-12-17 -

2025-07-31 – Interim results of the Swiss National Bank as at 30 June 2025

2025-07-31 -

SNB Brings Back Zero Percent Interest Rates

2025-06-26 -

Hold-up sur l’eau potable (2/2) : la supercherie de « l’hydrogène vert ». Par Vincent Held

2025-06-24

Main SNB Background Info

Main SNB Background Info

-

SNB Sight Deposits: decreased by 3.6 billion francs compared to the previous week

2025-12-17 -

The Secret History Of The Banking Crisis

2017-08-14 -

SNB Balance Sheet Now Over 100 percent GDP

2016-08-29 -

The relationship between CHF and gold

2016-07-23 -

CHF Price Movements: Correlations between CHF and the German Economy

2016-07-22

Featured and recent

-

Der wahre Grund? #politik #krieg #deutschland #europa #wirtschaft #russland #ukraine #putin #usa

Der wahre Grund? #politik #krieg #deutschland #europa #wirtschaft #russland #ukraine #putin #usa -

Warum Lebensverlängerung nicht das eigentliche Problem löst.

Warum Lebensverlängerung nicht das eigentliche Problem löst. -

Silber & Gold: Kommen jetzt neue Rekorde?

Silber & Gold: Kommen jetzt neue Rekorde? -

Private Credit Funds Falling Out Of Favor

Private Credit Funds Falling Out Of Favor -

Wichtige Morning News mit Oliver Klemm #537

Wichtige Morning News mit Oliver Klemm #537 -

Quartalszahlen Crash – United Health Aktie 22% im Minus!

Quartalszahlen Crash – United Health Aktie 22% im Minus! -

Covid ist nicht vorbei – die Folgen bleiben

Covid ist nicht vorbei – die Folgen bleiben -

Gold, Silber, Bitcoin: Jetzt einsteigen?

Gold, Silber, Bitcoin: Jetzt einsteigen? -

Bitcoin: Ich kaufe JETZT!

Bitcoin: Ich kaufe JETZT! -

Was kocht man einem Multimillionär?

More from this category

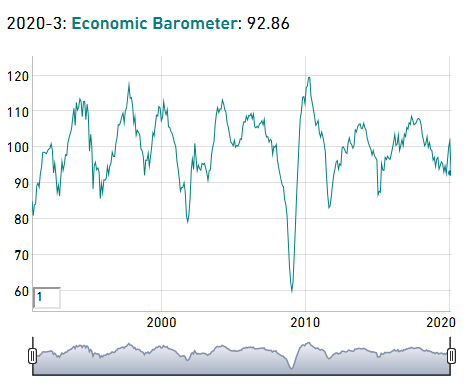

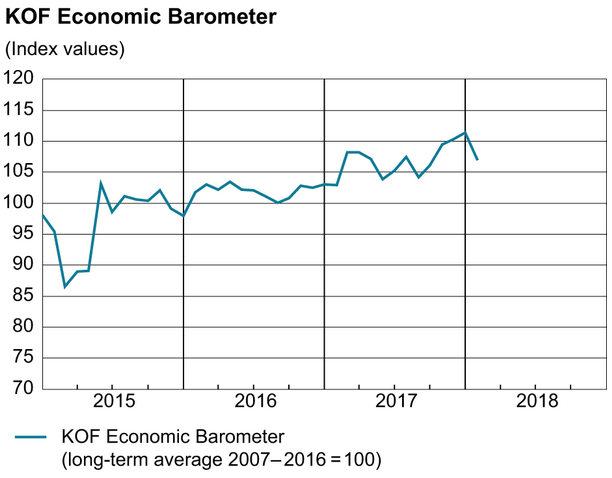

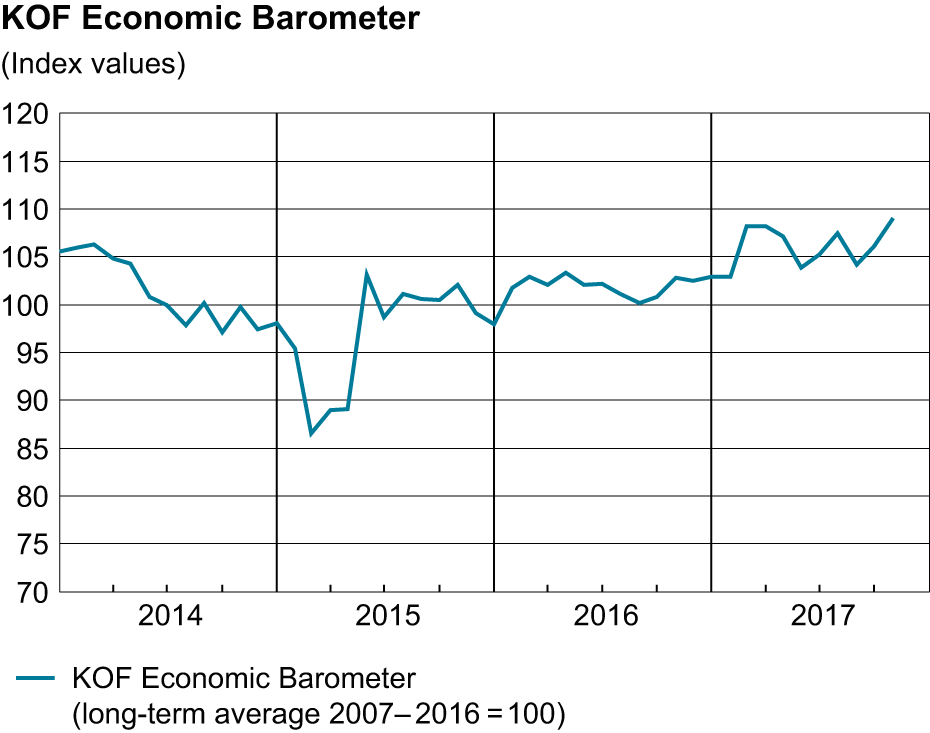

KOF Economic Barometer: Strongest monthly plunge since 2015

KOF Economic Barometer: Strongest monthly plunge since 201531 Mar 2020

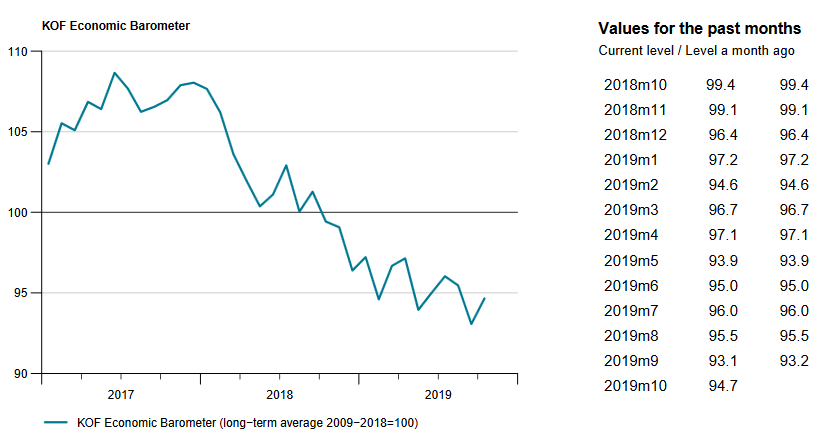

KOF Economic Barometer: Stabilization at a low level

KOF Economic Barometer: Stabilization at a low level30 Oct 2019

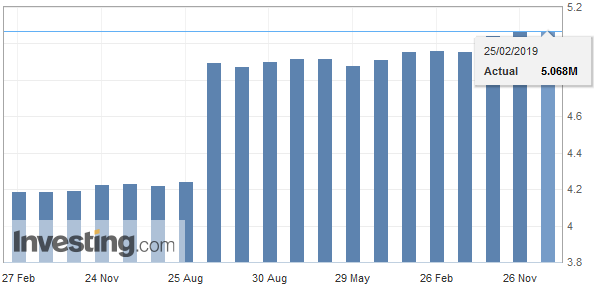

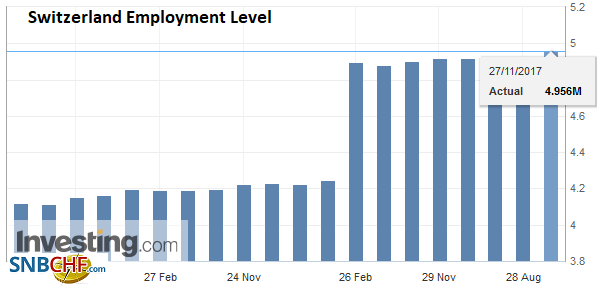

Switzerland Employment Barometer in the Q4 2018: Situation Sustained

Switzerland Employment Barometer in the Q4 2018: Situation Sustained25 Feb 2019

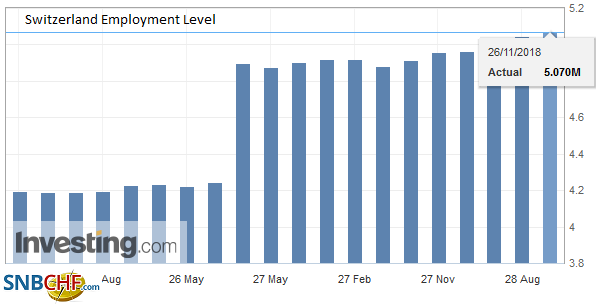

Employment Barometer in the Q3 2018: Solid Employment Growth

Employment Barometer in the Q3 2018: Solid Employment Growth26 Nov 2018

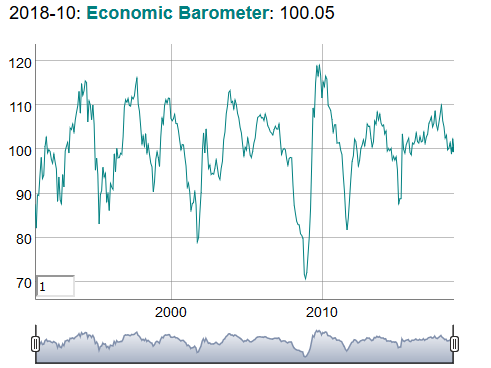

KOF Economic Barometer: Upswing Sets a More Leisurely Pace

KOF Economic Barometer: Upswing Sets a More Leisurely Pace30 Oct 2018

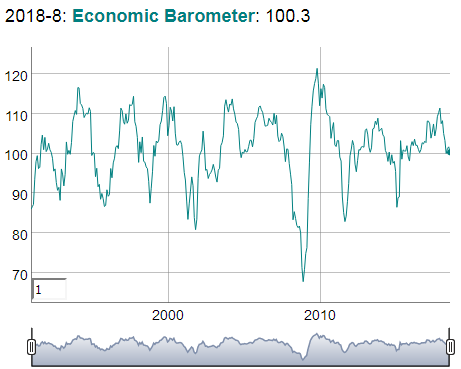

KOF Economic Barometer: Falling

KOF Economic Barometer: Falling30 Aug 2018

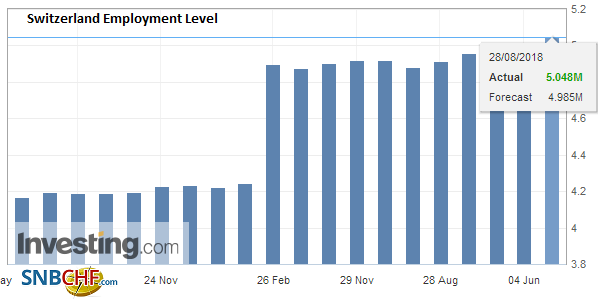

Employment Barometer in the Q2 2018: Sharp Rise in Employment in Switzerland

Employment Barometer in the Q2 2018: Sharp Rise in Employment in Switzerland28 Aug 2018

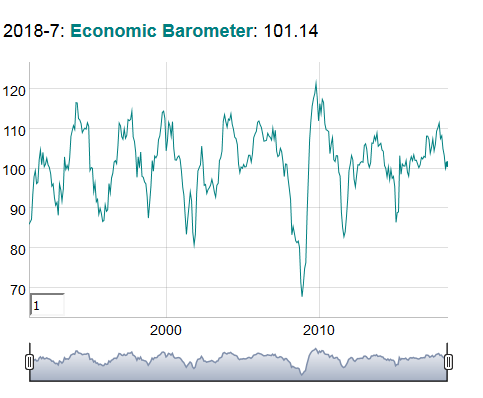

KOF Economic Barometer, July: Remains Practically Unchanged

KOF Economic Barometer, July: Remains Practically Unchanged30 Jul 2018

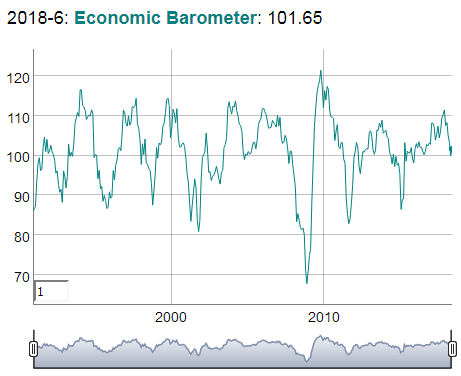

KOF Economic Barometer, June: Economic Outlook Improves Slightly

KOF Economic Barometer, June: Economic Outlook Improves Slightly29 Jun 2018

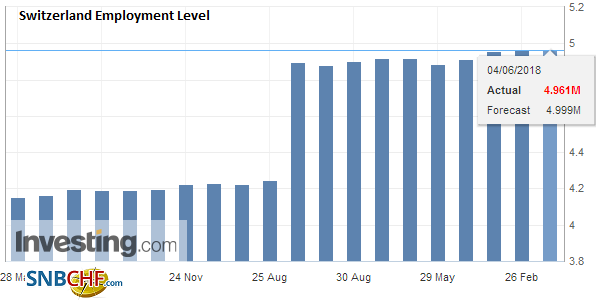

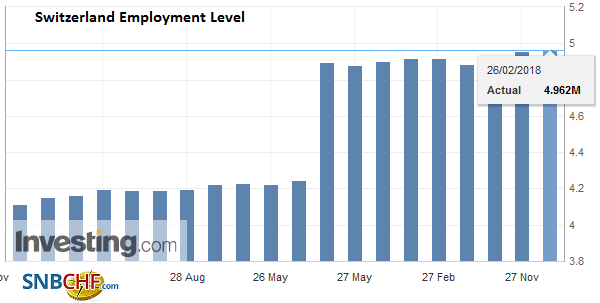

Employment barometer in the Q1 2018: Fastest growth in employment in industry for 10 years

Employment barometer in the Q1 2018: Fastest growth in employment in industry for 10 years4 Jun 2018

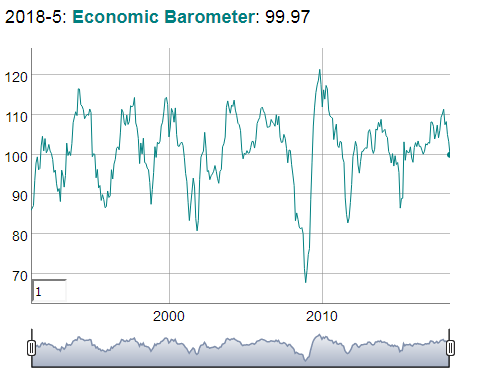

KOF Economic Barometer: Falls Back to its Long-term Average

KOF Economic Barometer: Falls Back to its Long-term Average30 May 2018

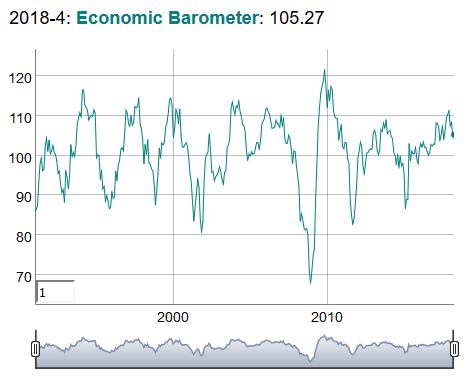

KOF Economic Barometer: Economic Outlook Remains Stable

KOF Economic Barometer: Economic Outlook Remains Stable30 Apr 2018

KOF Economic Barometer is Falling

KOF Economic Barometer is Falling29 Mar 2018

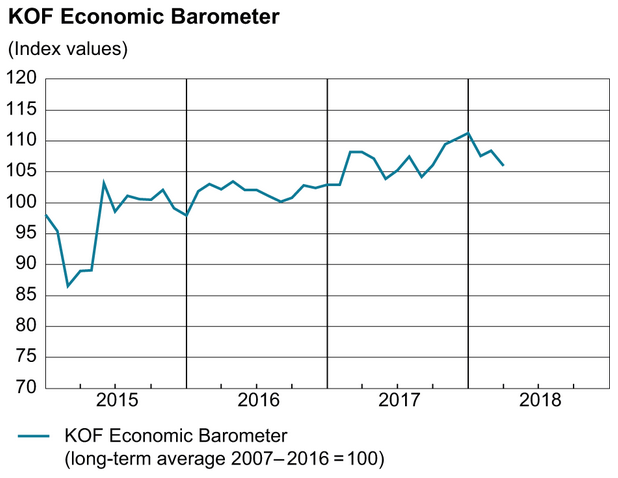

KOF Economic Barometer Stabilises at a High Level

KOF Economic Barometer Stabilises at a High Level28 Feb 2018

Employment barometer in the Q4 2017: Number of jobs rose by 0.8 percent YoY and 0.4 percent QoQ

Employment barometer in the Q4 2017: Number of jobs rose by 0.8 percent YoY and 0.4 percent QoQ26 Feb 2018

KOF Economic Barometer: Easing

KOF Economic Barometer: Easing30 Jan 2018

KOF Economic Barometer: Swiss Economy Gains Pace

KOF Economic Barometer: Swiss Economy Gains Pace30 Nov 2017

Employment barometer in the Q3 2017: Employment continues to increase in the Q3 2017

Employment barometer in the Q3 2017: Employment continues to increase in the Q3 201727 Nov 2017

KOF Economic Barometer: Prospects for the Swiss Economy Continue to Brighten Up

KOF Economic Barometer: Prospects for the Swiss Economy Continue to Brighten Up30 Oct 2017

KOF Economic Barometer: Outlook for the Swiss Economy Remains Favourable

KOF Economic Barometer: Outlook for the Swiss Economy Remains Favourable29 Sep 2017