Tag Archive: $JPY

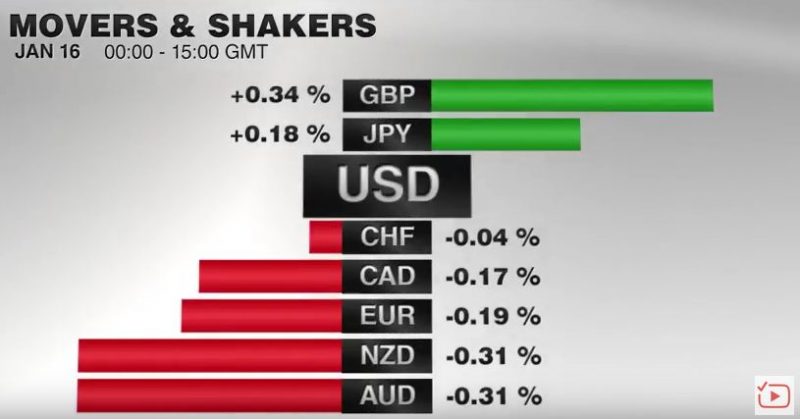

FX Daily, January 16: Hard Exit Talk Sent Sterling Below $1.20

The euro has been sold to $1.0580 in the European morning, a cent lower from the pre-weekend high. In addition to the drag from sterling, the euro appears to have been sold in response to the interview in two European papers of the next US President. Among other things, Trump reported claimed that NATO was obsolete and that other countries will leave the European Union, which is largely a German project.

Read More »

Read More »

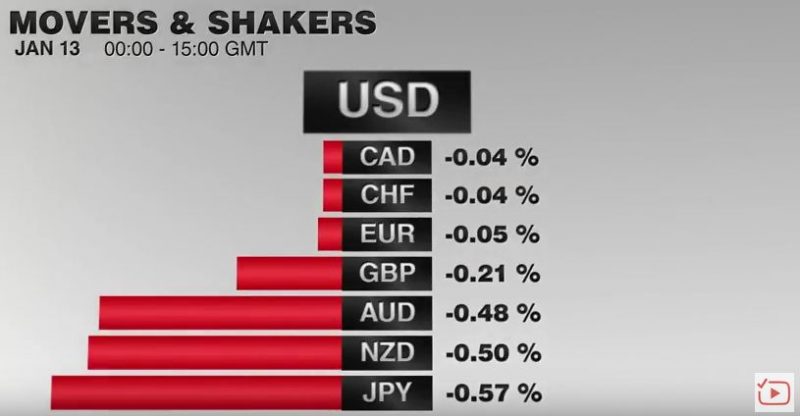

FX Daily, January 13: Corrective Forces Persist

The Supreme Court Judgement on whether parliament will have to O.K the triggering of article 50 is ongoing and when the ruling is announced expect big swings on GBP/CHF. I think the likely outcome will be that parliament will get the vote, most broad sheet papers have indicated the majority of the judges are in favour of the parliamentary vote.

Read More »

Read More »

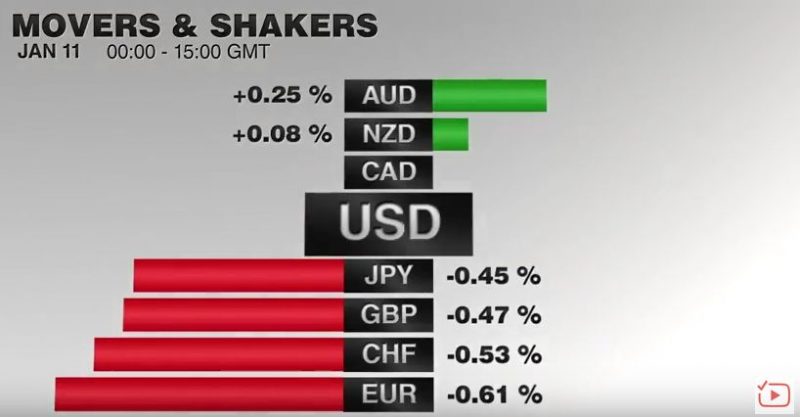

FX Daily, January 11: Dollar Comes Back Bid

The pound has seen a sharp fall following the interview that Theresa May gave with Sky news on Sunday although there has been a small rebound this afternoon. GBP CHF exchange rates are hovering around 1.2350 for this pair.

Read More »

Read More »

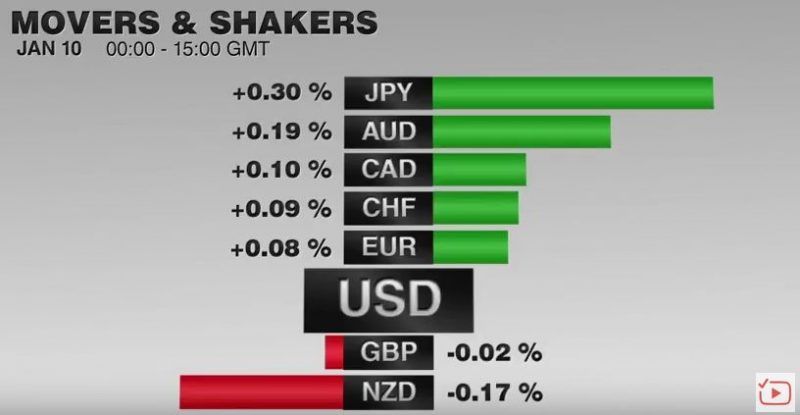

FX Daily, January 10: Positioning more than Fundamentals Give Traders Pause

After strong moves to start the year, the capital markets continue to consolidate. Many observers are suggesting a fundamental narrative behind the loss of momentum, but in discussions with clients and other market participants, it seems as if the main source of caution is coming from an understanding of market positioning rather than a reevaluation of the macro drivers.

Read More »

Read More »

The Better Way: Backing into Smoot-Hawley and Repeating the Flaws of PPP

Part of the US Republican tax reforms call for a border adjustment. It will tax imports fully and not exports. This will likely be challenged at the WTO. Many economists say the dollar will automatically appreciate by 20%. WE are bullish the dollar but skeptical of the logic here.

Read More »

Read More »

US Jobs Details Better than the Headline

The dollar and US yields are recouping more of yesterday’s decline. A break of $1.0480-$1.05 would suggest the euro’s upside bounce is exhausted. A dollar move above JPY116.80-JPY117.25 would also hint that the greenback was going to make an other run toward JPY118.30-JPY118.60. Sterling support is seen in the $1.2285-$1.2310 area.

Read More »

Read More »

FX Daily, January 04: Consolidation in Capital Markets

GBP/CHF rates have jumped during the first official day of trading in 2017, with the pair hitting 1.2657 at today’s high. The Pound gained support this morning following positive UK Manufacturing data, which came in well above market expectation. This increased market confidence in the UK economy and the Pound has ultimately benefited as a result, gaining a cent on the CHF.

Read More »

Read More »

A Few Takeaways from the Latest IMF Reserve Figures

Overall reserve holdings hardly changed in Q3. China continues to bleed its reserves from unallocated to allocated. Sterling's share of new reserves warns it may be losing some allure.

Read More »

Read More »

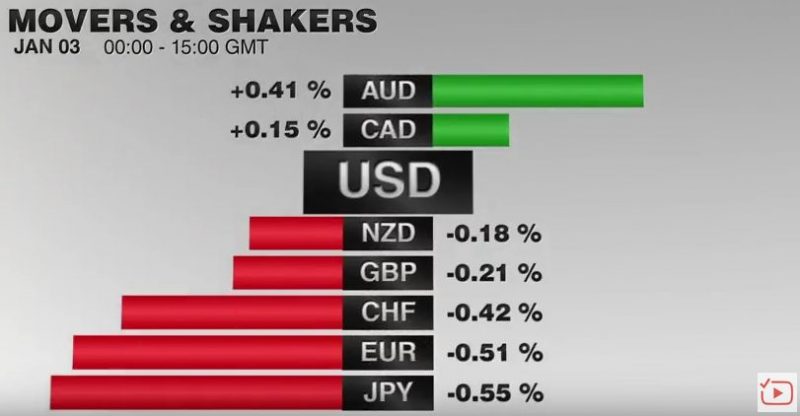

FX Daily, January 03: Dollar-Bloc and Sterling Advance, while Euro and Yen Slip

The US dollar is mixed. After a soft start in Asia, where Tokyo markets were closed, the dollar recovered smartly against the euro and yen. The dollar-bloc and sterling are firmer. Sterling's earlier losses were recouped following news that the manufacturing PMI jumped to 56.1, its highest since June 2014.

Read More »

Read More »

FX Weekly Preview: What You Should Know to Start the First Week of 2017

Data has already been reported. Trends reversed in the last two weeks. US jobs data may disappoint. It will take a few more weeks to lift some of the uncertainty hanging over the markets.

Read More »

Read More »

FX Daily, December 30: Dollar Slips into Year End

In exceptionally thin conditions that characterize the year-end markets, a reportedly computer-generated order lifted the euro from about $1.05 to a little more than $1.0650 in a few minutes early in the Asian sessions.

Read More »

Read More »

FX Daily, December 29: Dollar, Equities and Yields Fall

In thin holiday markets, a correction to the trends seen in Q4 has materialized. The US dollar is heavy. Japanese and European equities are lower. Bonds are firmer.

Read More »

Read More »

FX Daily, December 28: Short Note for Holiday Markets

Economic data: Japan stands out with industrial production in Nov rising 1.5%, the most in five months. It was a little less than expected, but the expectations for Dec (2%) and Jan (2.2%) are constructive.

Read More »

Read More »

FX Daily, December 27: Markets Becalmed in Wait-and-See Mode

As skeleton teams return to the trading desks in New York, the US dollar is largely where they left it at the end last week. Japanese markets were open yesterday, while UK, Australia, New Zealand, Hong Kong and Canadian markets are still closed today.

Read More »

Read More »

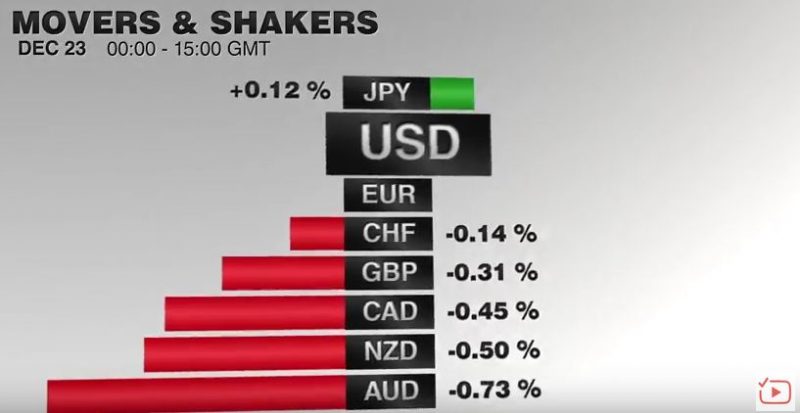

FX Daily, December 23: Markets Edge into Holiday Weekend

Asian shares trade heavily. The MSCI Asia-Pacific Index ex-Japan fell 0.4%. It is the fourth lower close this week and brings the loss to 1.75% for the week. It is fallen in seven of the past nine weeks. The Dow Jones Stoxx 600 is little changed on the session and is nursing a minor loss on the week and could snap a two-week advance.

Read More »

Read More »

FX Daily, December 21: Dollar Mixed in Thinning Activity, Dow 20,000 Watch Continues

The US dollar is narrowly mixed as the holiday markets make for light turnover. Global equity markets are not finding much encouragement from the new record highs by the Dow Jones Industrials. There have been a few developments to note.

Read More »

Read More »

You Know what Happened to Nominal Exchange Rates, but What about Effective Exchange Rates?

Yen is up slightly this year on an effective trade weighted basis. The euro has gained about 1% this year on an effective trade weighted basis. Sterling's decline has been significant on an effective basis. The yuan's decline looks to have corrected overshoot and is still holding an 11-year uptrend on the BIS real effective basis.

Read More »

Read More »

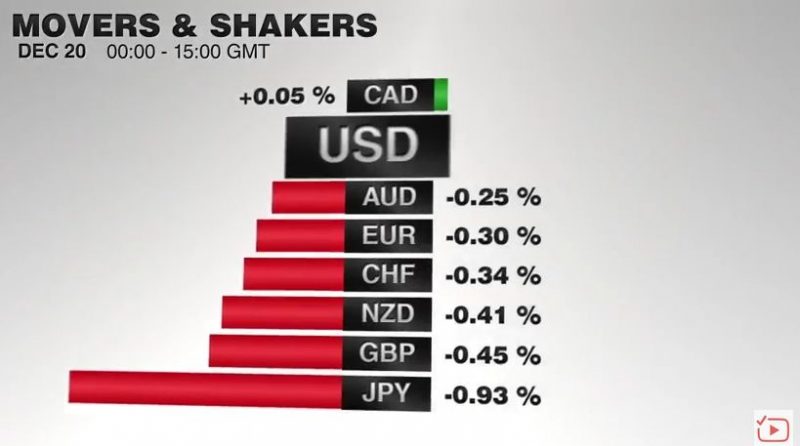

FX Daily, December 20: Yen Surrenders Yesterday’s Gains, while Euro Struggles to Hold above $1.04

The yen's incredible ride this year has been recapitulated in recent days. Consider that before last weekend; the US dollar reached a little above JPY118.40. At its extreme yesterday, the dollar fell to JPY116.55. Today it reached traded near JPY118.25 in the European morning, where it was encountering some offers.

Read More »

Read More »

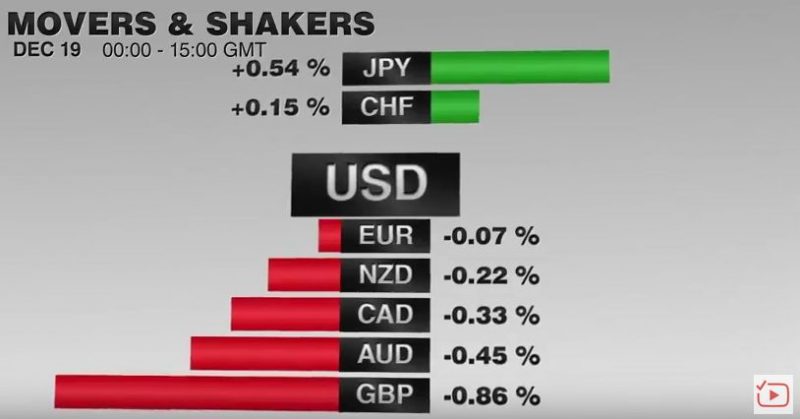

FX Daily, December 19: EUR/CHF Dives under 1.07

Once again a line in sand for the Swiss National Bank is broken. The EUR/CHF falls under 1.07. But trading algorithms are like this: When the EUR/USD is falling, then the EUR/CHF must follow. The SNB decided not to intervene any more at 1.07.

Read More »

Read More »

FX Weekly Preview: Twas the Week Before Christmas, Amidst Powerful Trends

The Nikkei, the dollar-yen and 10 yr US yield have risen nine of the past 11 weeks. The Dollar Index and 2 yr US yields have risen while gold has sold off in eight of past 11 weeks. Issue in next two weeks, profit-taking or trend extension? Spoiler alert: I expect some profit-taking.

Read More »

Read More »