Tag Archive: $JPY

FX Daily, May 18: Some Respite from US Politics as Sterling Surges Through $1.30

Yesterday's dramatic response to the political maelstrom in Washington is over. The appointment of a special counsel to head up the FBI's investigation into Russia's attempt to influence the US election appears to have acted a circuit breaker of sorts. It is not sufficient to boost confidence that the Trump Administrations economic program is back the front burners, but it is sufficient to stem the time for the moment.

Read More »

Read More »

FX Daily, May 17: Drama In Washington Adds To Dollar Woes

The US dollar has drifted lower against most of the major currencies as the culmination of news from Washington, escalating already rising concerns about the economic agenda that was to bolster growth with dramatic tax reform, infrastructure initiative, and re-orienting trade.

Read More »

Read More »

FX Daily, May 16: Greenback and Dollar Bloc Lose Ground to Europe and Yen

Dollar selling pressure emerged at the end of last week, partly in response to disappointing US economic data. This selling pressure carried over into yesterday's activity. It appeared to have been trying to stabilize yesterday in the North American session.

Read More »

Read More »

FX Daily, May 15: Softer Dollar and Yen to Start the Week

The US dollar has opened the week softer against the major currencies, except for the Japanese yen. The disappointing US inflation and retail sales data before the weekend have not been shrugged off, even though the US 10-year yield is a little higher and expectations for a Fed hike next month continue to be elevated.

Read More »

Read More »

Yen is the Weakest Currency in the World over the Past Month

Yen was the strongest currency in the world from mid-March to mid-April. Yen has been the weakest currency over the past month. US rates have risen relative to Japan. Japan has shifted away from QE and toward targeting interest rate.

Read More »

Read More »

FX Weekly Preview: Two Known Unknowns

The Trump Administration seems to be trying to cast the US as a revisionist power. Or perhaps it is like Roman emperors long ago trying to draw greater tribute from others. The outlook of US interest rates is critical to the outlook of the dollar.

Read More »

Read More »

FX Daily, May 12: Markets Becalmed Ahead of US data and Weekend

The foreign exchange market is becalmed, and the major currencies are little changed. The US dollar is mixed, but mostly a little lower. Sterling is the weakest of the majors, off 0.3%, near $1.2850, having been rebuffed by offers in front of $1.30 several times. It has not recovered from the quarterly inflation report and Carney's press conference.

Read More »

Read More »

FX Daily, May 10: Markets Adjust to North Korean Threat, Fifth Fall in US Oil Inventories and Trump Drama

Investors absorbed a few developments that might have been disruptive for the markets with little fanfare. North Korea's ambassador to the UK warned that his country would go ahead with its sixth nuclear test, as South Korea elected a new president who wants to reduce tensions on the peninsula.

Read More »

Read More »

FX Daily, May 09: Dollar Firms amid Position Adjustments

The election of Macron as French President has set off a bout of position adjustment that has seen the euro push back into the $1.0850-$1.0950 range that had confined activity for the two weeks between the first and second rounds of the French presidential election.

Read More »

Read More »

FX Daily, May 08: Euro Bought on Rumor, Sold on Fact

The euro initially opened higher in Asia following confirmation that Macron was elected the next president of France, but quickly fell below $1.0960 before bouncing back toward $1.10 only to be sold again in early Europe below the pre-weekend low near $1.0950. A break now of $1.0930 could signal a return to the lower end of the range seen since the first round of the French election near $1.0850-$1.0870.

Read More »

Read More »

FX Weekly Preview: Dollar Drivers

US retail sales and CPI should help bolster confidence that the Fed was right about the transitory nature of Q1 slowdown. Bank of England meets; Forbes will likely continue with her dissent, but likely failed to convince her other colleagues of the merit of an immediate rate hike. French politics are center stage, but German state election and South Korea's national election are also important.

Read More »

Read More »

FX Daily, May 04: Greenback Struggles to Sustain Upticks, Though Odds of June Hike Rise

The US dollar is struggling to maintain even modest upticks against the euro and sterling despite the recognition of the increased likelihood of a June Fed hike. Bloomberg sees current pricing in the Fed funds as making a hike in June a near certainty (97.5%), while the CME and our own calculation estimates the market is discounting around 70%-75% chance of a hike.

Read More »

Read More »

What is the Bank of Japan to Do?

Policy is on hold. There is several areas which the BOJ can adjust its forecast or forward guidance. BOJ is more likely to err on the side of caution.

Read More »

Read More »

FX Daily, May 02: Dollar and Yen Heavy, Equities Trade Higher and Bonds Lower

The US dollar is sporting a softer profile against most of the major and emerging market currencies. The Japanese yen is the main exception. The greenback is rising against the yen for the fourth session and the sixth of the past seven. The dollar's gains against the yen coincide with the 10-12 bp recovery in the US 10-year yields over the past ten sessions.

Read More »

Read More »

FX Daily, May 01: May Day Calm

Many financial centers are closed for May. Japanese markets were open today, but will be closed for three sessions beginning Wednesday for the Golden Week celebrations. The US dollar is narrowly mixed.

Read More »

Read More »

FX Weekly Preview: Looking Through the FOMC Meeting as it Looks Past Poor Q1 GDP

US jobs and auto sales data may be more important than the FOMC meeting. Norway and Australia's central bank meets. Neither is expected to change policy. All three large countries that reported Q1 GDP figures last week - US, UK, France - disappointed expectations.

Read More »

Read More »

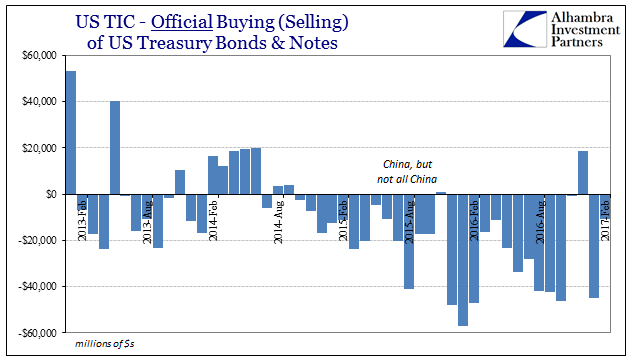

‘Dollar’ ‘Improvement’

According to the headline TIC statistics, foreign central banks have in the past six months sold the fewest UST’s since the 6-month period ended November 2015. That may indicate an easing of “dollar” pressure in the private markets due to “reflation” sentiment.

Read More »

Read More »

FX Daily, April 28: Markets Limp into Month End

Equity markets are stalling into the end of the month. MSCI Asia-Pacific Index is snapping a six-day advance, and the week's gain was sufficient to extend the advancing streak for the fourth consecutive month. The Dow Jones Stoxx 600 is trading off for the second consecutive session, after rallying for six consecutive sessions.

Read More »

Read More »

FX Daily, April 25: Euro Consolidates Gains, Bond Market Sell-Off Continues

The US dollar is again at the fulcrum of the foreign exchange market. The dollar-bloc currencies are under pressure, along with the Japanese yen, while the European complex is posting modest gains. The euro is consolidating in the half cent below $1.09. Yesterday's marked up in early Asia saw the euro complete the 61.8% retracement of the losses since the US election, which was found near $1.0935

Read More »

Read More »

FX Daily, April 24: Dramatic Response to French Election

The results of the first round of the French election spurred a dramatic response in the capital markets. Our thesis that there is no populist-nationalist wave sweeping the world is supported by the previous results in Austria, the Netherlands, and now France.

Read More »

Read More »