Tag Archive: Japan Trade Balance

The balance of trade, commercial balance, or net exports (sometimes symbolized as NX), is the difference between the monetary value of a nation’s exports and imports over a certain period. Sometimes a distinction is made between a balance of trade for goods versus one for services. If a country exports a greater value than it imports, it is called a trade surplus, positive balance, or a “favourable balance”, and conversely, if a country imports a greater value than it exports, it is called a trade deficit, negative balance, “unfavorable balance”, or, informally, a “trade gap”.

FX Daily, May 22: Dollar Pushes Back

After being shellacked last week, the US dollar is trading with a firmer bias against all the major currencies, but the euro and New Zealand dollar. To be sure, it is not that a new development has emerged to take investors' minds from intensifying political uncertainty in the US.

Read More »

Read More »

FX Daily, April 20: Dollar and Yen Push Lower

With the exception of the yen, the US dollar is lower against all the major currencies. US Treasury yields are firm, extending yesterday's rise a little. This may help keep the dollar straddling JPY109, but unwinding long yen cross positions is helping underpin the other major currencies. The Dollar Index is making a new low for the week and appears poised to test support around 98.85-99..00.

Read More »

Read More »

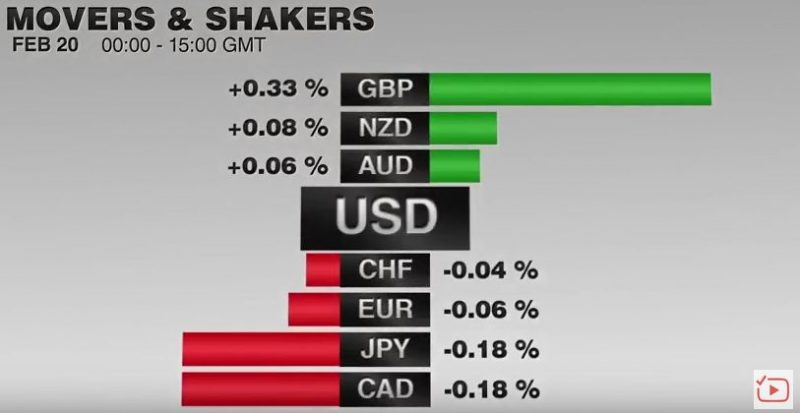

FX Daily, February 20: Marking Time on Monday

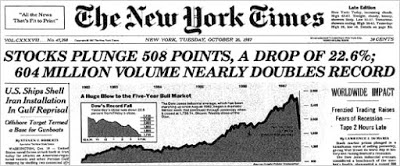

US markets are closed for the Presidents' Day holiday, but it hasn't prevented its pre-weekend gains giving a bullish tone to global equities. The S&P 500 and NASDAQ recovered from early weakness to close at new record levels before the weekend. Global equity markets are following suit today.

Read More »

Read More »

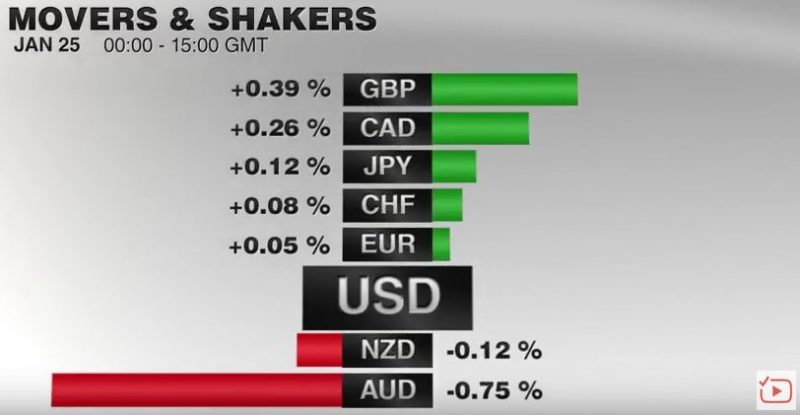

FX Daily, January 25: Dollar is on the Defensive Despite Firmer Rates

The US dollar is softer against nearly all the major currencies. Participants appear to be growing increasingly frustrated with emerging priorities of the new US Administration. They want to hear more details and discussion of the tax reform, deregulation, and infrastructure plans.

Read More »

Read More »

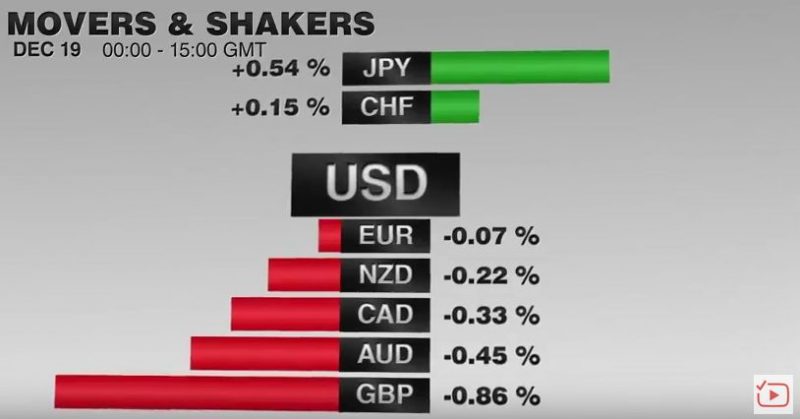

FX Daily, December 19: EUR/CHF Dives under 1.07

Once again a line in sand for the Swiss National Bank is broken. The EUR/CHF falls under 1.07. But trading algorithms are like this: When the EUR/USD is falling, then the EUR/CHF must follow. The SNB decided not to intervene any more at 1.07.

Read More »

Read More »

FX Daily, November 21: Flattish Consolidation Hides Dollar Strength

The news over the weekend is primarily political in nature. Sarkozy is going to retire (again) after taking a drubbing in the Republican Party primary in France. Fillon, the self-styled French Thatcher unexpected beat Juppe, but without 50% and therefore the results set up the run-off this coming weekend. It is as if, knowing their candidate will likely face Le Pen in the final round next spring, the Republican Party might as well chose the most...

Read More »

Read More »

FX Daily, September 21: BOJ Can’t Weaken Yen, Fed keeps Rates Unchanged, CHF Stronger

The EUR/CHF accelerated its decline since yesterday's strong Swiss trade balance data. The second reason was certainly the Fed decided to keep rates unchanged.

We know that the Swiss Franc has similar "counter-dollar" status as gold.

Read More »

Read More »

FX Daily, August 18: US Dollar Pushed Lower, but Do FOMC Minutes Really Trump Dudley?

A bad day for the dollar means a good day for CHF, that appreciates against both euro and dollar. It is not a good day for the US dollar. It is being sold across the board. The seemingly dovish FOMC minutes released late yesterday appears to have gotten the ball rolling. The takeaway for many was that any officials wanted more time to assess the data at the July meeting.

Read More »

Read More »

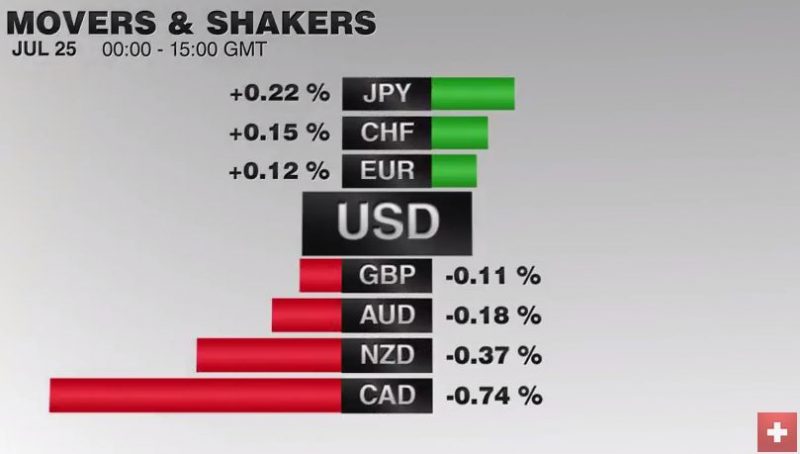

FX Daily, July 25: Big Week Begins Slowly

What promises to be a busy week has begun off slowly. The US dollar has been largely confined to its pre-weekend ranges against most of the major currencies. Equity markets are mostly firmer following the new record highs on Wall Street. The MSCI Asia Pacific Index eked out a small gain (0.1%), with losses in Japan, Taiwan, and Singapore offsetting gains elsewhere.

Read More »

Read More »

FX Daily, June 20: Brexit not the main Swiss Franc Driver

Recently I enumerated the different drivers for the continuing strength of the franc. Most commentators mentioned Brexit fears, but I insisted on the low rate and yield environment in the United States after the last Non-Farm Payroll report and the FOMC.

Today's jump in sterling confirmed my view. This anticipation of an Anti-Brexit vote was not followed by a franc decline against USD. This also implies that a Brexit will not entrench a huge...

Read More »

Read More »