Tag Archive: Japan Gross Domestic Product

Gross Domestic Product (GDP) measures the annualized change in the inflation-adjusted value of all goods and services produced by the economy. It is the broadest measure of economic activity and the primary indicator of the economy’s health. A stronger than expected number should be taken as positive for the EUR and a lower than expected number as negative to the EUR.

FX Daily, August 14: Sigh of Relief Weighs on Yen and Gold, while Lifting Equities and the Dollar

The lack of new antagonisms over the weekend between the US and North Korea has prompted the markets to react accordingly. Already before the weekend, we detected some signs that at least some market participants had begun looking past the dramatic rhetoric.

Read More »

Read More »

FX Daily, June 08: Thursday’s Show

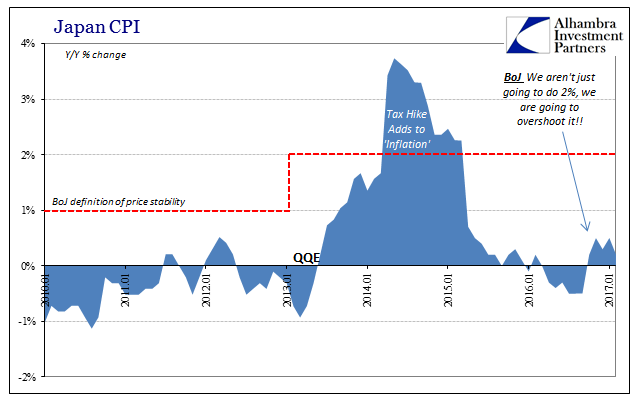

Today has an anti-climactic feel to it. Yesterday's leak of what is purported to be the ECB staff forecasts point to small downward revisions to inflation forecasts and an ever small upward tweak to growth. This would be in line with only mild changes in the forward guidance language. The clear indication is that inflation is still not the conditions of a self-sustaining path toward the target.

Read More »

Read More »

FX Daily, May 18: Some Respite from US Politics as Sterling Surges Through $1.30

Yesterday's dramatic response to the political maelstrom in Washington is over. The appointment of a special counsel to head up the FBI's investigation into Russia's attempt to influence the US election appears to have acted a circuit breaker of sorts. It is not sufficient to boost confidence that the Trump Administrations economic program is back the front burners, but it is sufficient to stem the time for the moment.

Read More »

Read More »

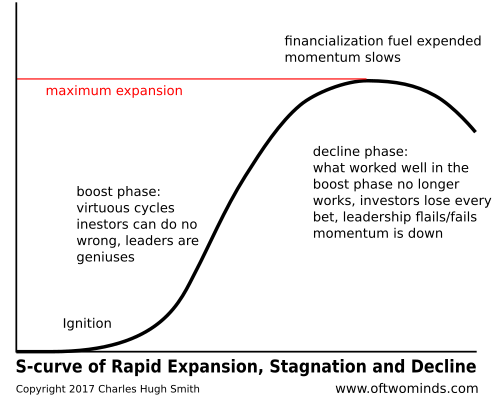

Who’s Playing The Long Game–and What’s Their Game Plan?

When we speak of The Long Game, we speak of national/alliance policies that continue on regardless of what political party or individual is in office. The Long Game is always about the basics of national survival: control of and access to resources, and jockeying to diminish the power and influence of potential adversaries while strengthening one's own power and influence.

Read More »

Read More »

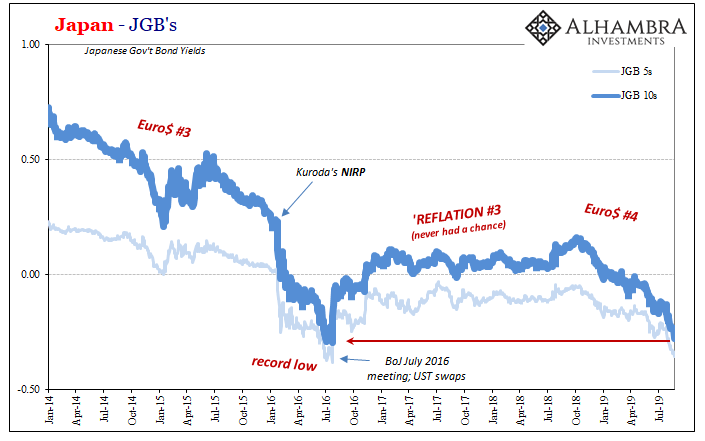

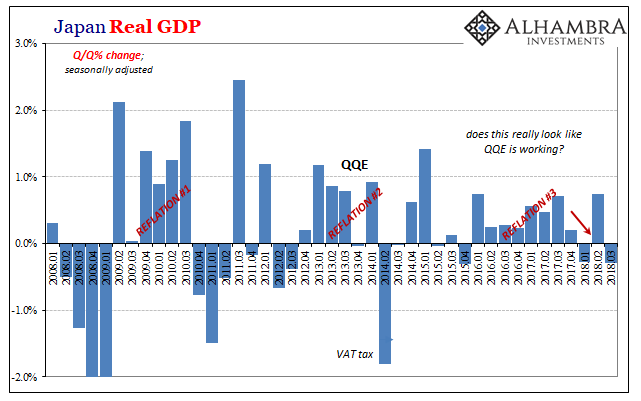

Systemic Depression Is A Clear Choice

Looking back on late 2015, it is perfectly clear that policymakers had no idea what was going on. It’s always easy, of course, to reflect on such things with the benefit of hindsight, but even contemporarily it was somewhat shocking how complacent they had become as a global group.

Read More »

Read More »

FX Daily, February 13: Quiet Start of Busy Week

With inflation and growth reports due out this week and Federal Reserve Chair Yellen's testimony before Congress, it promises to be a busy week for investors. However, the week has begun off fairly quietly, while the recent rally in equities continues.

Read More »

Read More »

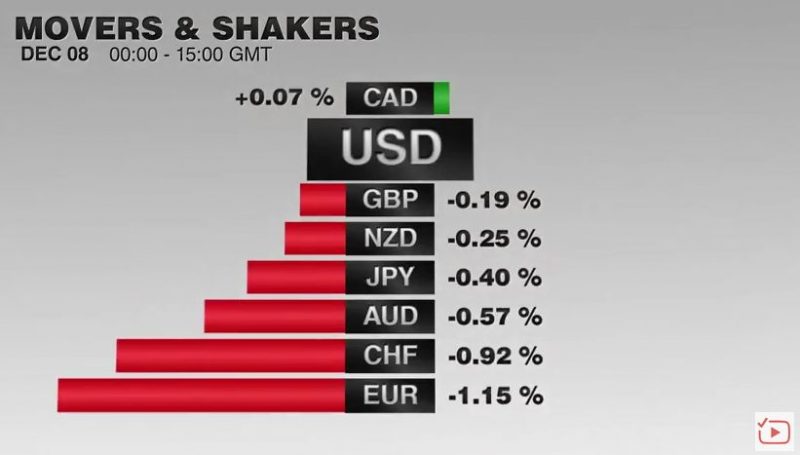

FX Daily, December 08: Dollar Heavy into ECB

The ECB prolonged its bond purchases, which came unexpected for markets. Consequently the EUR/CHF lost nearly half of its big gains that it registered in the beginning of the week. The ECB expects lower inflation for longer, which makes the life for the SNB harder for longer.

Read More »

Read More »

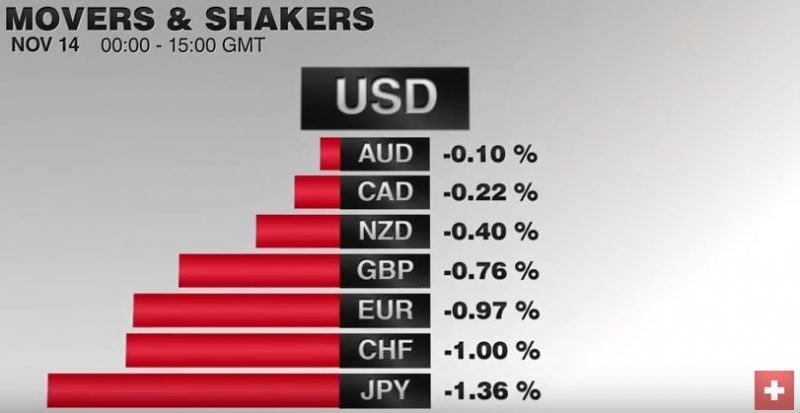

FX Daily, November 14: Dollar Steps Up to Start Week

The US dollar rally that moved into a higher gear in the second half of last week has begun the new week with a bang. It is up against nearly all the major and emerging market currencies. Even sterling, which last week, managed to eke out modest gains against the greenback is under pressure today.

Read More »

Read More »

FX Daily, August 15: Dollar Eases to Start the New Week

The US dollar closed the pre-weekend session well off its lows that were seen in response to the disappointing retail sales report. It has been unable to sustain the upside momentum, and as North American dealers prepare to return to their posts, it is trading lower against most of the major currencies. The notable exceptions are the Scandi-bloc, which are consolidating last week's gains, and sterling, which remains pinned near $1.29.

Read More »

Read More »

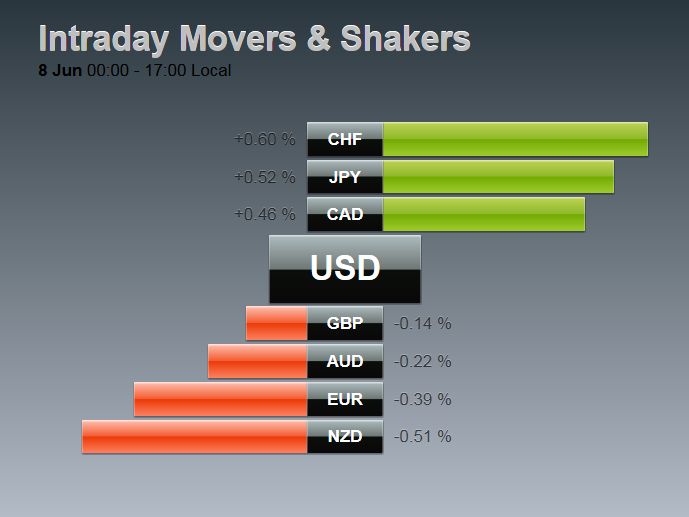

FX Daily, June 8: Currencies Broadly Stable, but Greenback is Vulnerable

Once again the Swiss Franc appreciates both against EUR and USD.

The euro topped at 1.1095 shortly before the US payroll data and has fallen to 1.0932. The dollar has fallen from 0.9947 to 0.9596.

The foreign exchange market is quiet. The euro remains confined to the

narrow range seen on Monday between $1.1325 and $1.1395. We continue to

look for higher levels near-term as the

drop from May 3 (~$1.1615) to May 30 (just be...

Read More »

Read More »