Tag Archive: Janet Yellen

Fighting Recessions with Hot Air

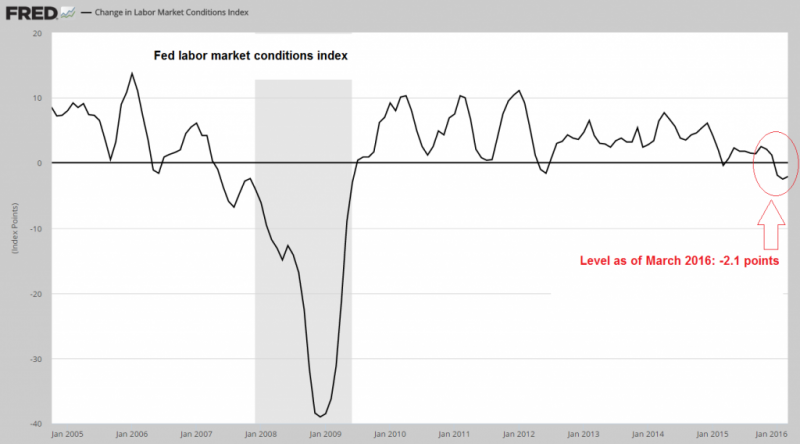

“Prepping” for Recession GUALFIN, Argentina – Stocks are going up all over the world. Meanwhile, it appears to us that the U.S. economy is going down. Go figure. For instance, a labor-market index created by Fed economists… and closely watched by ...

Read More »

Read More »

A Fatal Flaw in the System

The Hard Rocks of Real Life BALTIMORE – The Dow dropped 174 points on Thursday, the biggest fall in six weeks. Not the end of the world. Maybe not even the end of this year’s bounce-back bull run. As you’ll recall, stocks sold off at the beginning ...

Read More »

Read More »

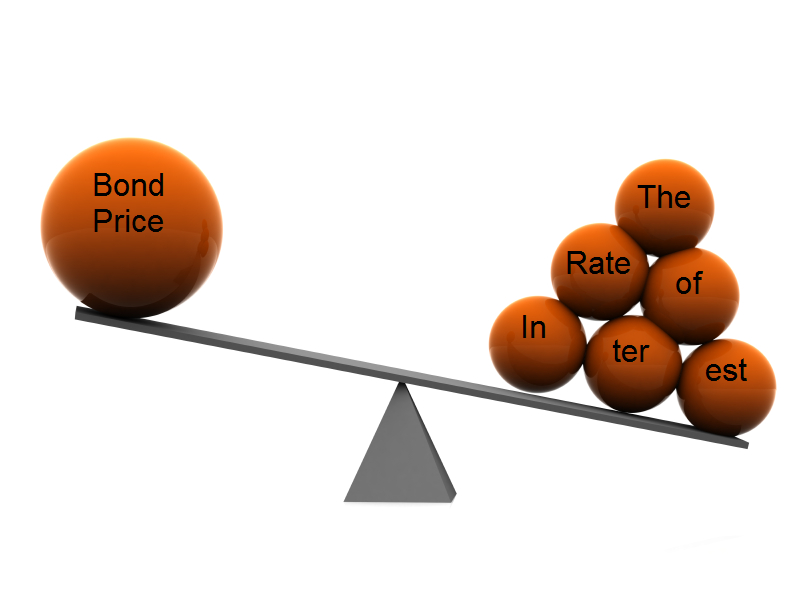

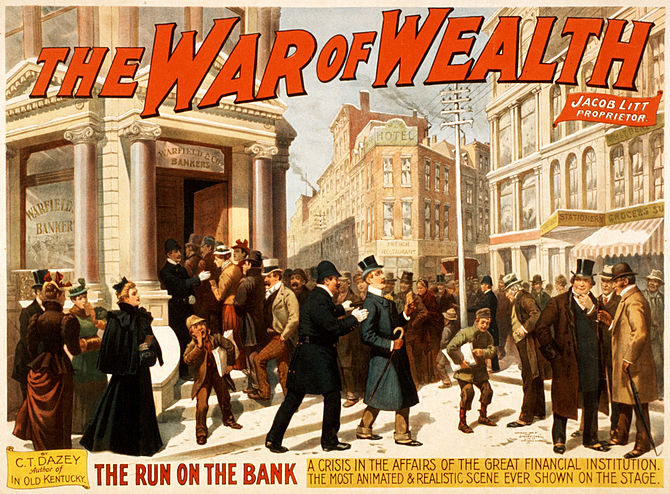

Why Janet Yellen Can Never Normalize Interest Rates

Bill Bonner explains why the Fed will normalize interest rates.

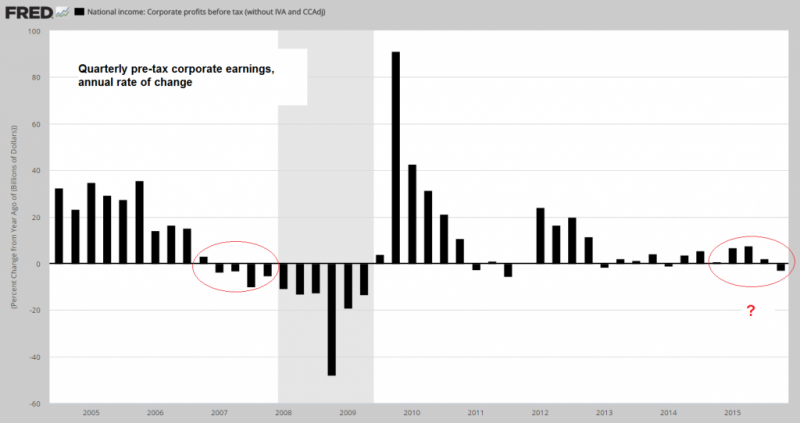

With higher rates, Yellen risks corporate profits and bond defaults.

With higher rates, Yellen risks not only bond defaults, but also bank defaults.

Read More »

Read More »

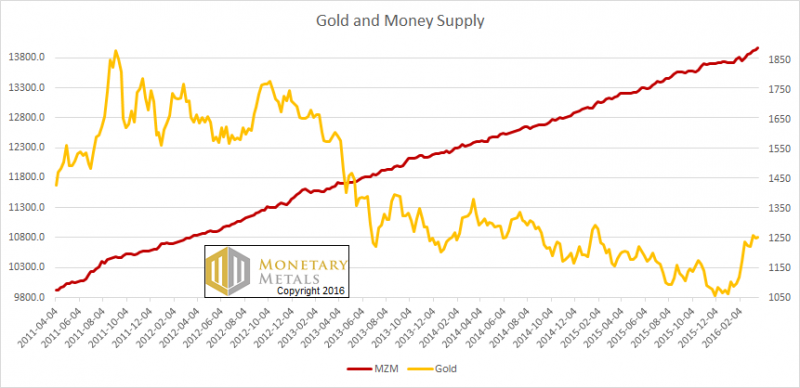

The Gold Money Supply Correlation Report, 3 Apr, 2016

There were some fireworks this week. Gold went up on Tuesday (it was a shortened week due to Easter Monday), from a low of $1,215 to $1,244 over the day, a move of over 2 percent. Silver moved from $15.02 to $15.44, almost 3 percent. What happened on...

Read More »

Read More »

Federal Devolution

Leaning Into the Wind BALTIMORE – During our lifetime, three Fed chiefs have faced a similar challenge. Each occupied the chairman’s seat at a time when “normalization” of interest rates was in order. Recently, we remembered William McChesney Mar...

Read More »

Read More »

Swiss Politicians Slam Attempts To Eliminate Cash, Compare Paper Money To A Gun Defending Freedom

As we predicted over a year ago, in a world in which QE has failed, and in which the ice-cold grip of NIRP has to be global in order to achieve its intended purpose of forcing savers around the world to spend the taxed product of their labor, one thi...

Read More »

Read More »

Janet Yellen Fights the Tide of Falling Interest

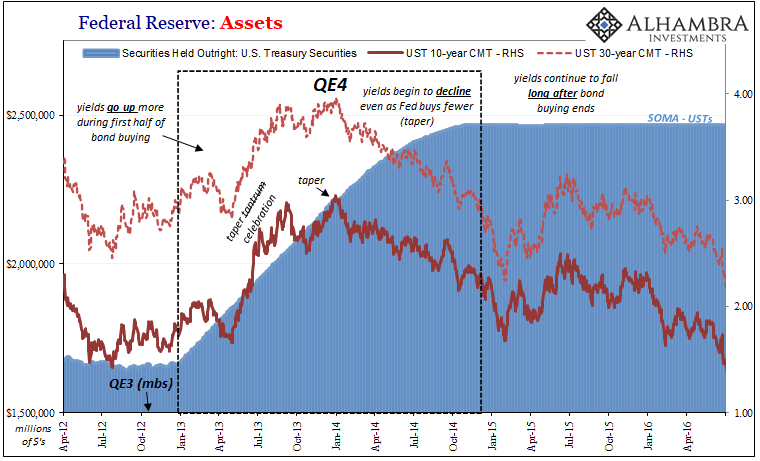

The Fed is going to have to take back this interest rate hike (Dec 16). The process that sets the interest rate is complex. I have written many words on its terminal decline. However, there are two simple reasons why the trend remains downward.

Read More »

Read More »

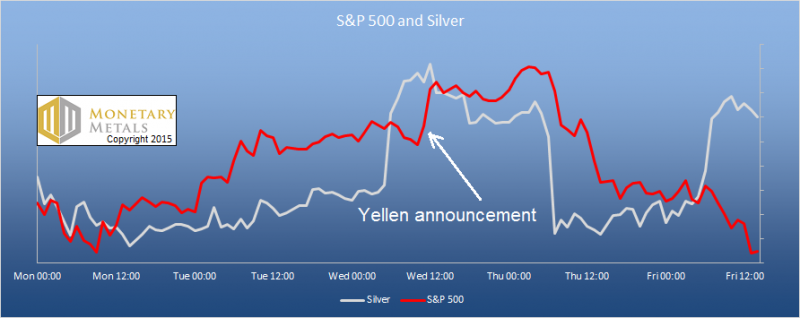

Janet Yellen Lit the Fuse Report 20 Dec, 2015

The prices of the metals were sagging. Silver was trading around $13.80. On Wednesday, Janet “Good News” Yellen said the magic words. The Federal Reserve hiked the federal funds rate by 25 basis points. The price of silver was surging in anticipation...

Read More »

Read More »

Falling Yields, Rising Asset Prices -Rising Yields,Falling Prices

Our paper currency causes falling productivity, though not in terms of bushels per acre. What falls is productivity per dollar or euro of savings. This is the real meaning of the falling interest rate. When the rate was 10 percent, $1,000 of principal produced $100 of return. When it falls to two percent, then the same capital generates a return of only $20. Now with the Swiss 10-year bond, CHF 1,000 earns only CHF 1.3. Keith Weiner argues that one...

Read More »

Read More »

A Gold Man In Monetarist Territory

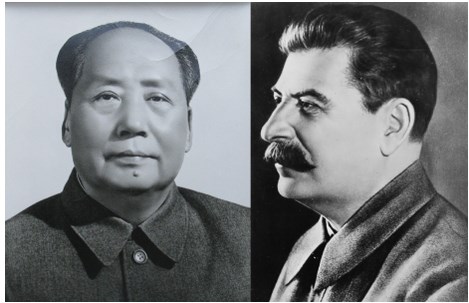

Keith Weiner suggests that one should abstract from economic variables like CPI, U6 unemployment measure, M0 or GDP. We know that the Fed manipulates key variables of the economy; hence we live in a world of central planners, a socialist world, not much better than the period of Mao or Stalin. The gold standard is free of central bank manipulation.

Read More »

Read More »

The Gold Standard For Democrats

Keith Weiner describes how the Fed pushes down the interest rate and due to that, it drives up prices of food and rents. This implies that businesses are clearly priviliged against workers. The gold standard does the opposite, if prefers savings and workers. Hence Democrats should be fan of the gold standard.

Read More »

Read More »

Why Can’t The Fed Spot Bubbles?

The topic of whether the Federal Reserve can see bubbles in advance, and what they can do about them, is hotly debated. The price of an earning asset depends directly on the interest rate. This is because of time preference. It is better to have your cash today than tomorrow. The Fed’s problem is that the calculation depends on a rate of interest that it heavily influences. Its analysis is therefore circular and self-fulfilling. It’s like taking a...

Read More »

Read More »

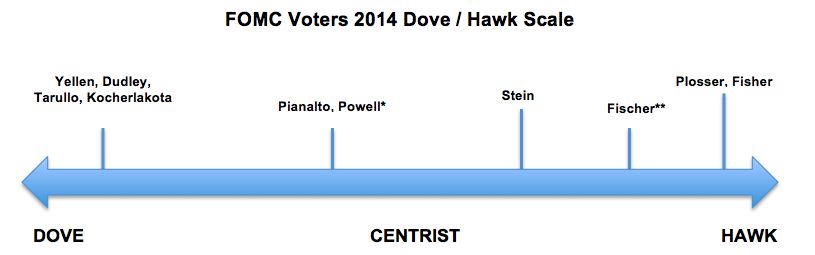

Fed FOMC: Who is Hawk, Who is Dove? 2015 Update

Composition of the Fed's Federal Open Market Committee (FOMC composition), needed to know if the Fed is opting for quantitative easing or not.

Read More »

Read More »

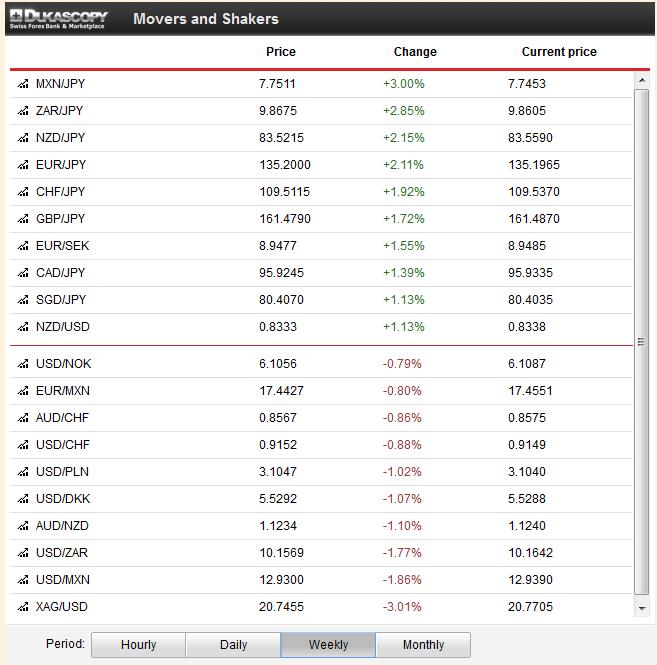

Fundamentals,FX,Gold and CHF:Week November 11 to November 15

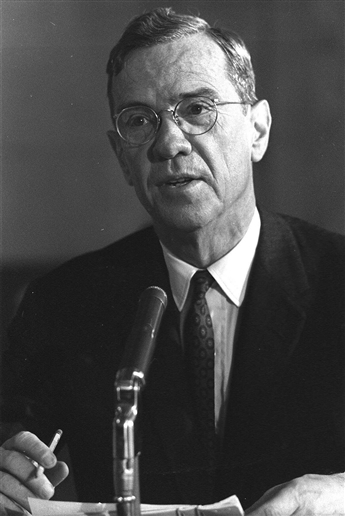

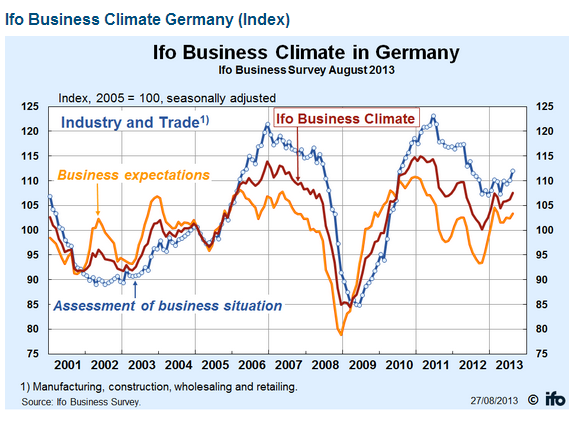

Fundamentals with highest importance: In Janet Yellen’s hearing at the Senate Banking Commission, the future Fed chair emphasized the need to provide support to the economic recovery and to overcome low inflation. Her speech supported equities, gold and US Treasuries. GDP in the Euro zone rose by 0.1% QoQ in line with expectations, but less …

Read More »

Read More »

Janet Yellen’s Fed Has The Makings Of A Potential Disaster

In 2013, President Obama nominated Janet Yellen to be the next Federal Reserve Chairman. We need to know what she stands for if we want to predict what the central bank will do to us next. Clearly, Yellen will continue Bernanke’s Quantitative Easing, but her papers and speeches show that she is quite different from her predecessor.

Read More »

Read More »