Tag Archive: Gold

Democracies Like Bubbles, Totalitarian Regimes Hate Them

Totalitarian regimes, like China, fear bubbles and revolutions. Strangely, these regimes help to prevent asset bubbles, and the resulting unequal distribution of wealth between rich asset owners and the poor without assets. Today’s FT article shows how Chinese authorities fear the bubble and the revolution. China cash crunch deepens as PBOC withholds funding Short-term interbank …

Read More »

Read More »

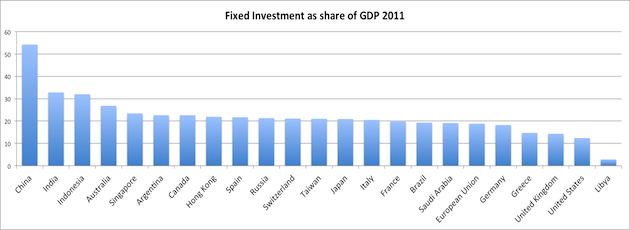

The Cyclical and Exchange-Rate Induced Chinese Slowing

We believe in the Chinese economy, but it has just gone into a cyclical and a exchange-rate induced slowing. Any Cassandra views like recently by Charles Dumas, chief strategist of Lombard Research, but also some of Richard Koo’s earlier views, that there will be a burst of the Chinese housing bubble, are exaggerated. Markets Insight: …

Read More »

Read More »

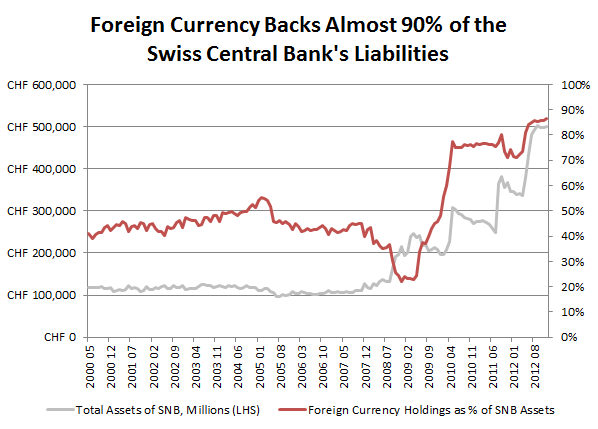

How Modern Monetary Policy Changed CHF from Gold-Backed to a USD and Euro-Backed Currency

we slowly move into an inflationary environment and prices of German Bunds and US Treasuries are falling.... ECB and Fed interest rates seem to be nailed to zero for years.

Read More »

Read More »

Pictet Become “Secular Dollar Bulls” and Gold Bashers: Our Response

Precisely at the moment when the dollar undergoes a secular bashing with a 6% loss against the yen and 3% against the euro, Pictet publish their “secular dollar bull era” video and recommend investors to avoid gold. “Secular movements” in currency markets are mostly driven by current account (CA) surpluses or deficits, while housing …

Read More »

Read More »

EUR/CHF to 1.25?

Chinese economy is weaker, the Brent oil price under 100$ , the German DAX near 7500, the USD/JPY near 100, the Australian dollar is dipping. Most assets that are positively correlated to CHF are weaker. Time for EUR/CHF to rise?

Read More »

Read More »

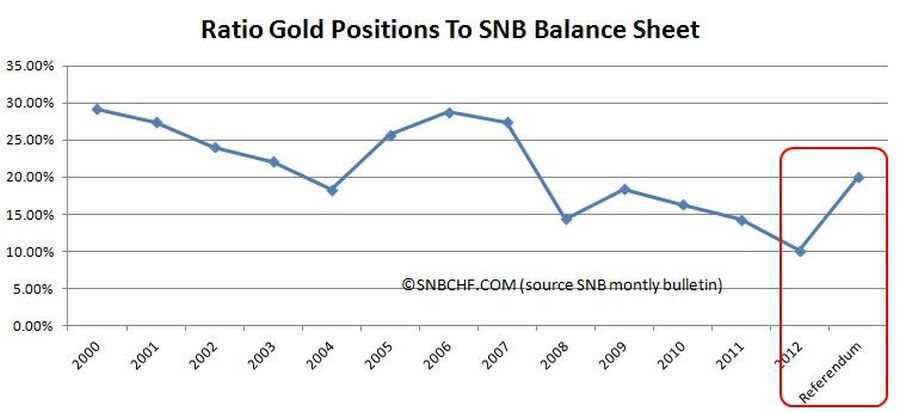

“SNB Concerned”: Does a Yes to the Swiss Gold Referendum Imply an End of the CHF Cap?

If the upcoming referendum "Save our Swiss gold" wins, the SNB must increase gold holdings from 10% to 20% of its balance sheet. Gold purchases and/or sales of fiat money implies an end of CHF cap.

Read More »

Read More »

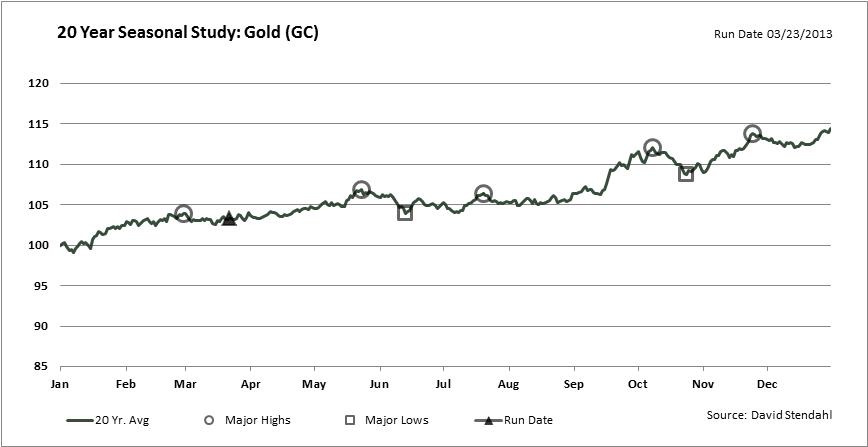

Seasonal Factors on Gold, the 19 February Short Trade

Gold came under pressure in early February when stock market strength but also U.S. gas prices rose. US purchases, however, help to improve foreign economies and therefore also the gold price.

Read More »

Read More »

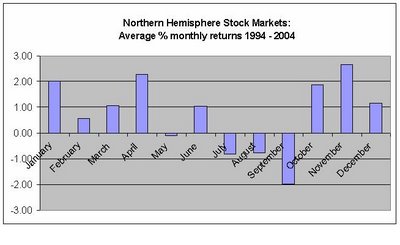

The “Get Stress in May and Relax in October Effect” for the SNB

The U.S. economy regularly improves between October and March. The SNB should use the moment to sell some currency reserves. From May on, the typical seasonal effects will push the SNB into a defense.

Read More »

Read More »

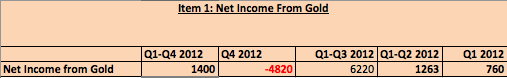

SNB Profit 6 Billion CHF over the Year, 10.9 Billion Loss in Q4/2012

The Swiss National Bank (SNB) obtained a profit of around 6 billion francs for the year 2012 (full statement). The profit was reduced from 16.9 billion francs between Q1 and Q3 2012, which means that in Q4/2012 the bank had a loss of around 10.9 billion francs. The profit in gold fell from 6.2 billion …

Read More »

Read More »

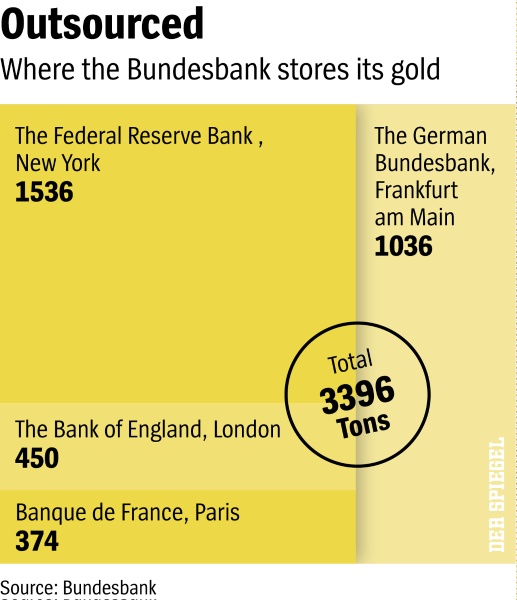

German Currency and Gold Reserves and the German Trade Surplus

During the Bretton Woods system, Germany managed to obtain current account surpluses. They converted these surpluses into gold. At the time they bought it at 35$ per ounce at a relatively cheap price – at the end of the 1960s the price was augmented to 42$. At the end of the 1960 and with …

Read More »

Read More »

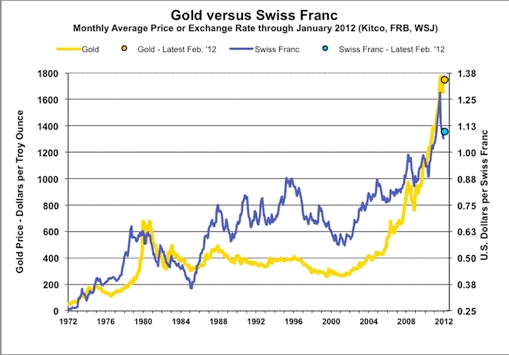

Quantitative Easing, Gold and the Swiss Franc

The main drivers of demand for Swiss francs are the euro crisis, but even more, the behavior of American investors, who go out of the dollar in the fear of further bad US economic data and of Quantitative Easing. This will push down the dollar, and safe-havens like the CHF, gold or the Japanese Yen up. … Continue reading »

Read More »

Read More »

Correlations Between the Swiss Franc, Gold and the German Economy

In yesterday’s post we focused on several economic events that weakened the position of the Swiss National Bank (SNB). In this extended replacement post, we give several reasons for recent movements in the gold price and explain the correlation between German economic data, gold and the Swiss franc. IFO data shows that Germany will not …

Read More »

Read More »

Gold, CHF, Brent Arbitrage Trading after Negative CS, UBS Interest Rates

Credit Suisse and UBS will charge negative interests for cash clearing clients above a threshold. Last year such news was worth 250 bps, on December 3 only 28 bips. One remembers August 26, 2011, when UBS only spoke of negative interests and consequently EUR/CHF rose from 1.1420 to 1.1688. At the time FX traders …

Read More »

Read More »

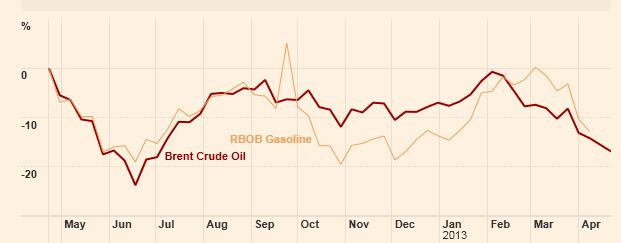

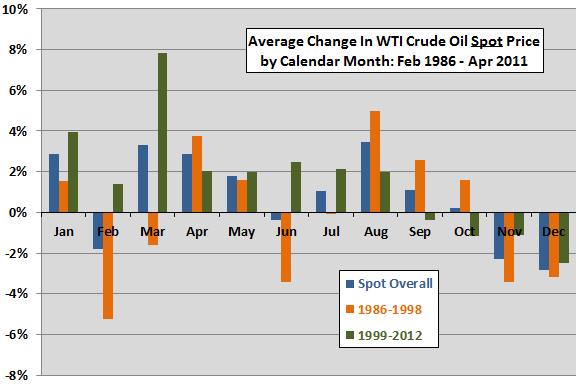

Seasonal Factors on Oil

Evidence from simple tests supports perhaps some belief that crude oil tends to have strong and weak months of the year, Q4 is often the weakest quarter and Q1 and Q2 the best.

Read More »

Read More »

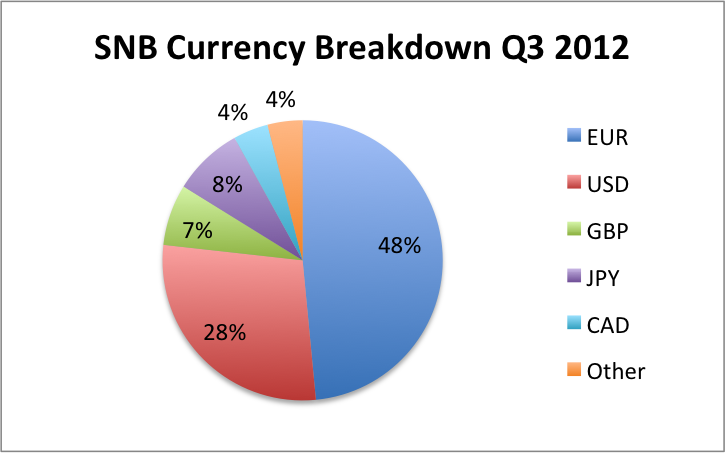

SNB Results Q3 2012: SNB Radically Reduces Euro Share from 60% to 48%

SNB Q3 Profits: 10 billion francs The Swiss National Bank (SNB) radically reduced its euro share, in the third quarter from 60% to 48%, and bought US dollars and sterling instead. In the second quarter, however, it increased the euro share from 51% to 60% and concentrated on buying euros. Given that the EUR/USD was … Continue reading...

Read More »

Read More »

IMF Data: SNB Forex Reserves and Gold in September 2012

This link on the SNB website shows the data the central bank provides to the International Monetary Fund (IMF). It shows the SNB Forex and gold reserves in the last month. It is so-called “IMF Special Data Dissemination Standard (SNB Data)” It is released together with the international investment position, some monetary aggregates and the balance of payments two weeks after …

Read More »

Read More »

Marc Faber: Assets are overpriced, we short metals and Brent now

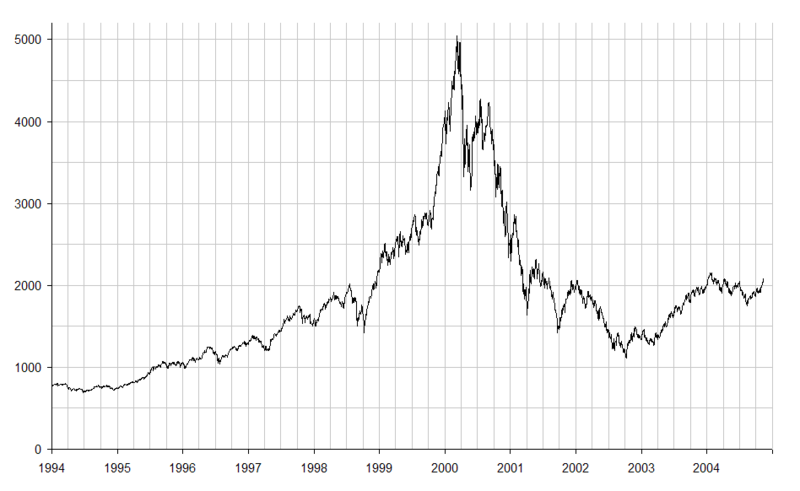

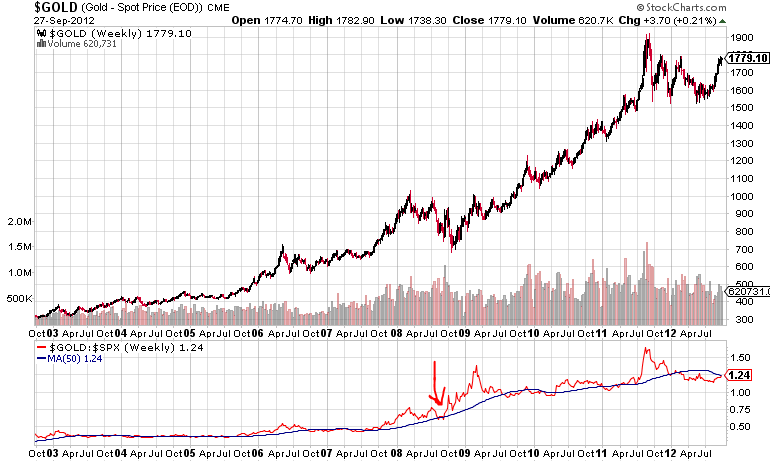

As we predicted on October 5 or one day later on DailyFX, metals have started their descent, silver lost one dollar, from levels around 35$ last week to 34$ now. Marc Faber joins our view and says that asset prices are quite vulnerable. “I’m not 100% in cash, for the simple reason that I could … Continue reading »

Read More »

Read More »