Tag Archive: Gold

Silver Goes Foom, Report 24 Jan, 2016

This will be a brief report, as we’re focused on releasing our Outlook 2016 Report which is over 8,000 words of our assessment of the gold, silver, currency, and credit markets. Also, this was a holiday-shortened week (Monday was Martin Luther King D...

Read More »

Read More »

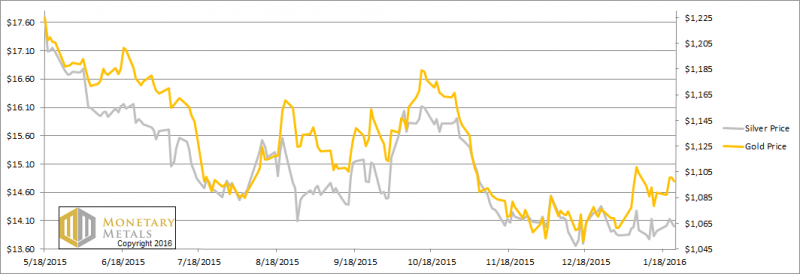

Won’t Get Fooled Again, Report 17 Jan, 2016

There is a great lyric in Won’t Get Fooled Again by The Who: Then I’ll get on my knees and prayWe don’t get fooled again Remember last week, when the price of silver spiked? On Thursday that week, the price was moving sideways around $14. Then around...

Read More »

Read More »

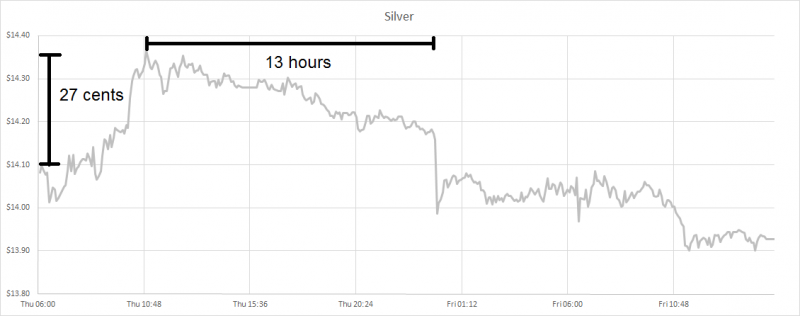

Silver Flash in the Pan, Report 10 Jan, 2016

No doubt, many people were excited on Thursday to see a spike in the silver price. The big news almost seemed like it would be a spike in the silver price. We were not quite so exuberant, tweeting (follow us on Twitter @Monetary_Metals):

Read More »

Read More »

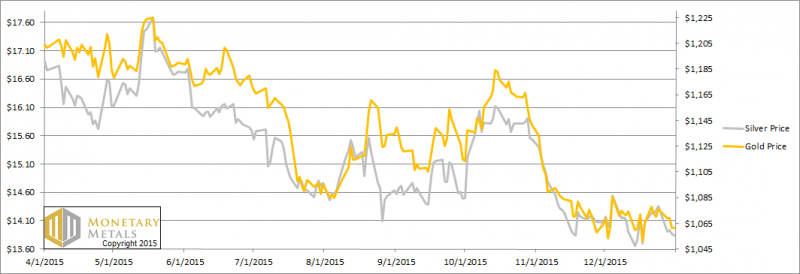

Murphy’s Law of Gold Analysis, Report 3 Jan, 2016

Perhaps it may be lesser known than his other Laws, but Murphy wrote one for the basis analysis. It goes like this. If we observe that the fundamental price of a metal is far removed from the market price, the two won’t likely converge the next week....

Read More »

Read More »

Supply and Demand Report 27 Dec, 2015

The prices of the metals rose a bit this quiet, holiday week. Merry Christmas! Speaking of Christmas, Keith’s brother who is an amateur woodworker of growing skill, gave him this present on Friday.

Read More »

Read More »

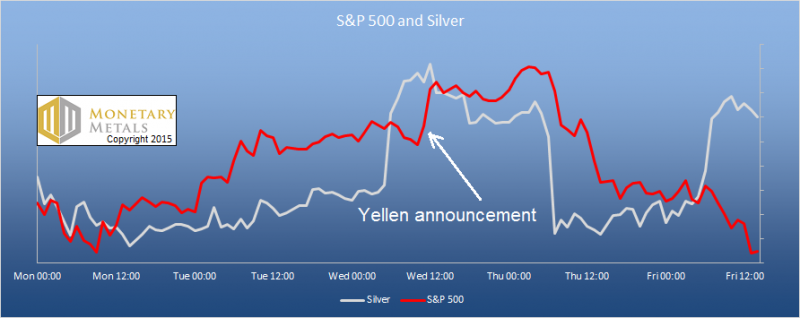

Janet Yellen Lit the Fuse Report 20 Dec, 2015

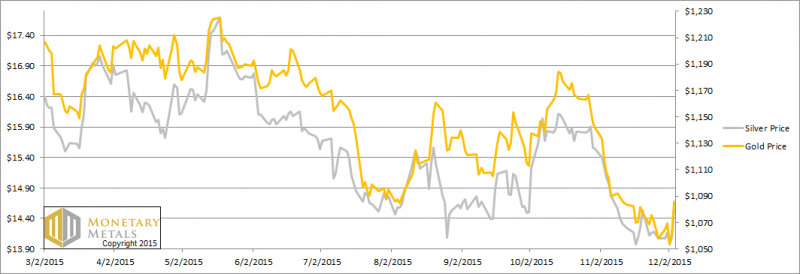

The prices of the metals were sagging. Silver was trading around $13.80. On Wednesday, Janet “Good News” Yellen said the magic words. The Federal Reserve hiked the federal funds rate by 25 basis points. The price of silver was surging in anticipation...

Read More »

Read More »

What Silver Rocket? Report 13 Dec, 2015

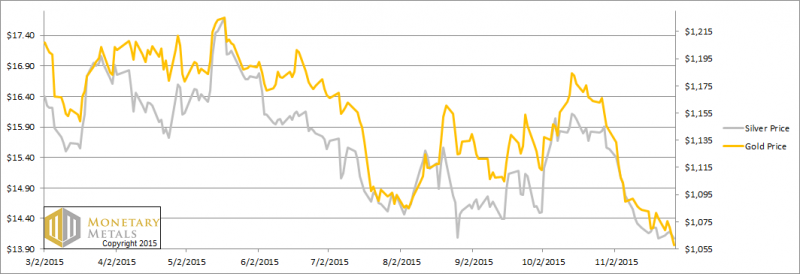

“That [half a dollar of buying] frenzy was not stackers lining up to buy phyz. It was speculators buying paper. Why does that matter? Speculators, who typically use leverage, can’t hold the market price against the tide of the hoarders. They can push...

Read More »

Read More »

Silver Rocket Report 6 Dec, 2015

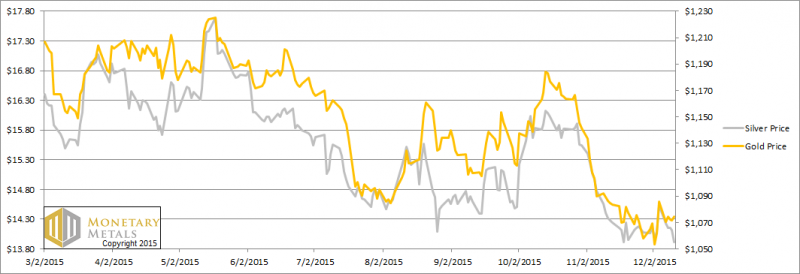

The prices of the metals moved mostly sideways this week. That is, until Friday. Then foom! (Foom is the sound of a rocket taking off.) From 6 to 10am (Arizona time, i.e. 8 to 12 NY time) the price of gold rose from $1,061 to $1,087. Not surprisingly...

Read More »

Read More »

Light Thanksgiving Week Report 29 Nov, 2015

In this holiday-shortened week (Thanksgiving), the price of gold dropped $20 and silver 10 cents. Friday, when the price dropped the most, could not have had much liquidity as most Americans were out of work shopping or partying. Whatever they may ha...

Read More »

Read More »

SNB’s IMF data

This IMF data on the SNB website shows SNB Forex and gold reserves in the last month. It is so-called "IMF Special Data Dissemination Standard (SNB Data)"

Read More »

Read More »

Arizona Governor Ducey Vetoes Gold

Arizona Gov. Doug Ducey vetoed a bill Wednesday that would have made Arizona the third state behind Utah and Oklahoma to recognize gold and silver as legal tender. This isn’t yet another in a long series of articles lamenting the Federal Reserve, power, politicians, corruption, and the hopelessness of fighting the status quo.

Read More »

Read More »

Das Gold-Gschichtli der SNB

Dem Jahresbericht 2014 der SNB entnehmen wir ab Seite 63: Lagerung der Goldreserven Gemäss Art. 99 Abs. 3 der Bundesverfassung hält die Nationalbank einen Teil ihrer Währungsreserven in Gold. Die Nationalbank gab im Frühling 2013 bekannt, dass sie 30...

Read More »

Read More »

Why Did Both Silver and Gold Become Money?

Keith Weiner explains why gold and silver, two shiny metals, have become money. They fill different human needs, and evolved through different paths. Money solves a problem called the coincidence of wants. Moreover he looks on the choice between gold and silver.

Read More »

Read More »

The Six Major Fundamental Factors that Determine Gold and Silver Prices

Gold and silver are the most complicated assets to price. Stocks, currencies, commodities mostly depend on their fundamental data, supply and demand. Gold and silver, however, are priced indirectly.

Read More »

Read More »

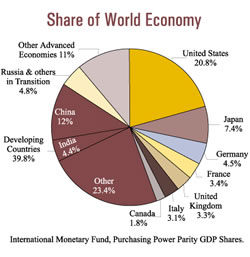

CHF Is No Safe-Haven, but a Safe Proxy for Global Economic Growth

In our view the Swiss franc is not a pure Safe-Haven, but a "Safe Proxy for Global Economic Growth". Global investors want to participate via the purchase of safe Swiss multi-nationals in global growth. This means inflows into Swiss franc denominated assets. Together with the big Swiss trade surplus, this implies a stronger franc. China stands for global economy, its slowing growth has a negative influence on the profits of Swiss multi-nationals...

Read More »

Read More »

Quantitative Easing, its Indicators and the Swiss Franc

The main drivers of demand for Swiss francs are the euro crisis and, even more, the behavior of American investors, who go out of the dollar in the fear of bad US economic data and/or Quantitative Easing (QE). Risk-friendly investors move into risky assets like stocks or currencies of emerging markets, while risk-averse investors fear inflation and buy inflation-resistant assets like Swiss francs.

Read More »

Read More »

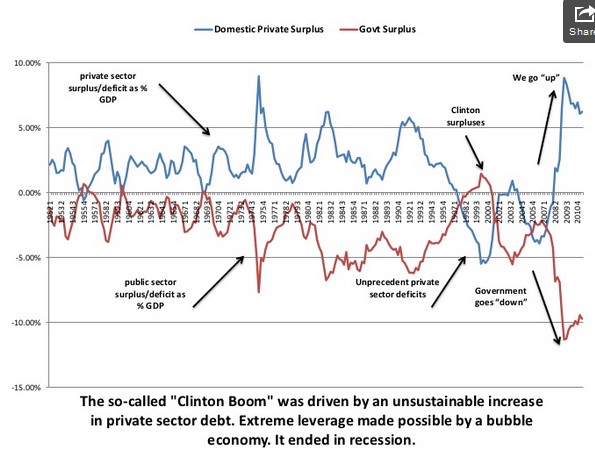

Why was the gold price so low in 1999/2000?

To find further explanations as to why the gold price was weak in the late 1990s we analyze sector balances. Effectively private spending and private debt went in two different directions: a heavy increase in private spending and debt in the US against less growth in private spending and less debt in the rest of world. This combination fostered GDP growth in the US and weakened it in other countries. Real interest rates were positive. Markets...

Read More »

Read More »

Weltwoche nimmt Blogbeitrag zu Gold von unbequemefragen.ch auf

Da habe ich nicht schlecht gestaunt, als sich Markus Schär von der Weltwoche vorgestern Abend bei mir über Twitter gemeldet und verkündet hat, dass er bei seinem Artikel über die Goldverkäufe der SNB sehr prominent meinen Blogbeitag zitiert. Nochmals...

Read More »

Read More »

Bewiesen: Die SNB verkaufte Gold, welches bei der Fed gelagert war

Endlich kommt der Beweis für meine Vermutung! Die SNB hat heute – parallel zur Propaganda des Bundesrats – ein Dokument “Goldinitiative – häufig gestellte Fragen” (PDF) ins Netz gestellt und dabei sogar interessante Fakten preisgegeben. Konkret geht ...

Read More »

Read More »

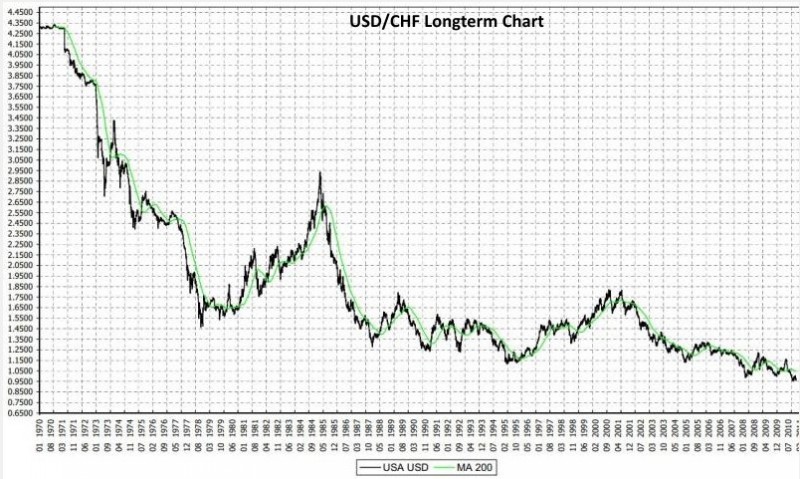

Swiss Franc History: The long-term view and the comparison with gold

We establish a long-term view and history of the Swiss franc. We compare the franc with gold.

Read More »

Read More »