Tag Archive: Gold

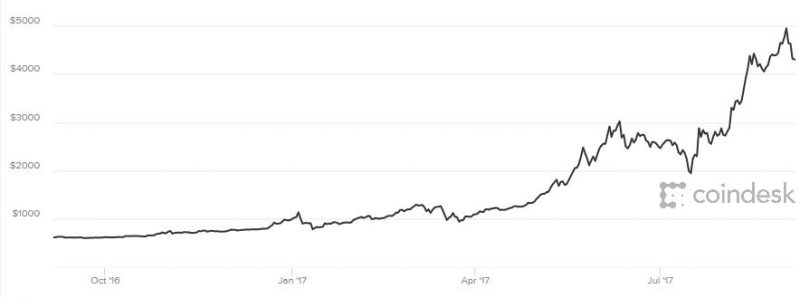

Bitcoin Falls 20 percent as Mobius and Chinese Regulators Warn

Bitcoin falls 20% as Mobius and Chinese regulators warn. “Cryptocurrencies are beginning to get out of control” – warns respected investor Mark Mobius. Mobius believes governments will begin to clamp down on cryptocurrencies sparking rush to gold. Yesterday China’s PBOC ruled Initial Coin Offerings (ICOs) are illegal and all related activity to halt. China is home to majority of bitcoin miners.

Read More »

Read More »

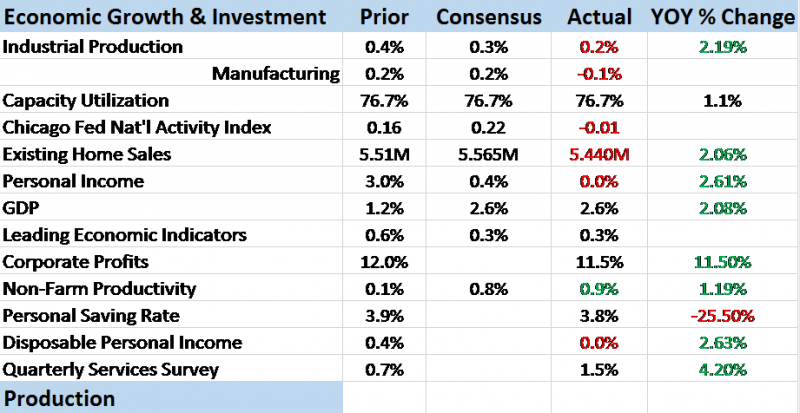

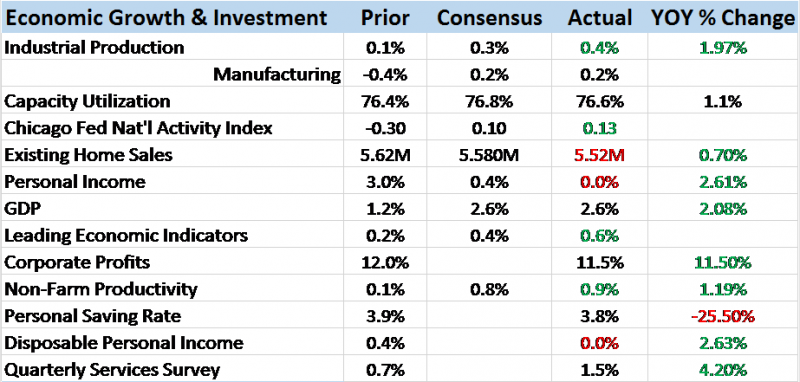

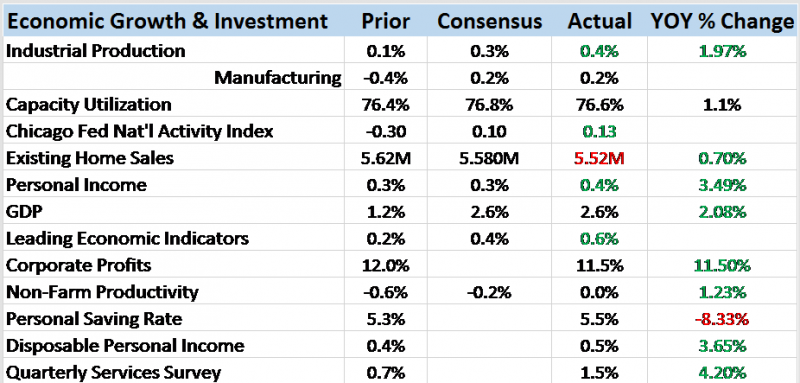

Bi-Weekly Economic Review: Don’t Underestimate Gridlock

The economic reports released since the last update were slightly more upbeat than the previous period. The economic surprises have largely been on the positive side but there were some major disappointments as well. The economy has been doing this for several years now, one part of the economy waxing while another wanes and the overall trajectory not much changed. Indeed, the broad Chicago Fed National Activity index probably says it all, coming...

Read More »

Read More »

The Truth About Bundesbank Repatriation of Gold From U.S.

Bundesbank has completed a transfer of gold worth €24B from France and U.S. Germany has completed domestic gold storage plan 3 years ahead of schedule. In the €7.7 million plan, 54,000 gold bars were shipped and audited.

Read More »

Read More »

U.S. Treasury Secretary: I Assume Fort Knox Gold Is Still There

US Treasury Secretary Steve Mnuchin visits Fort Knox Gold

Later tweeted ‘Glad gold is safe!’

Only the third Treasury Secretary to visit the fortified vault, last visit was 1948

Read More »

Read More »

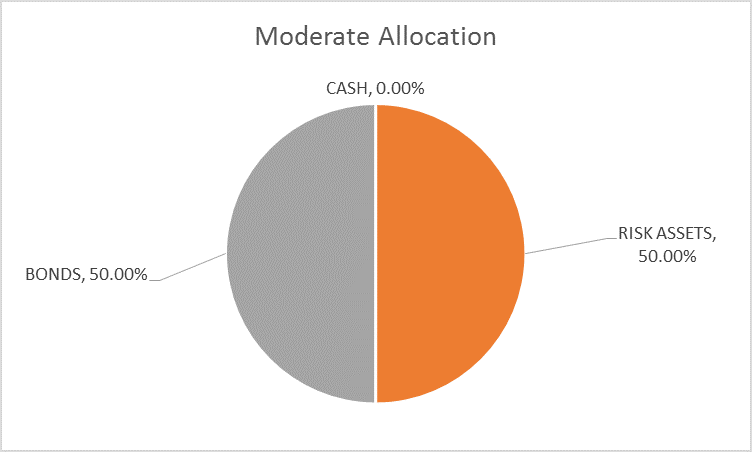

Global Asset Allocation Update: No Upside To Credit

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are other changes to the portfolio though so please read on. As I write this the stock market is in the process of taking a dive (well if 1.4% is a “dive”) and one can’t help but wonder if the long awaited and anticipated correction is finally at hand.

Read More »

Read More »

FX Weekly Preview: Transitioning to a New Phase

Jackson Hole marks the end of the investors' summer and a beginning of a challenging several weeks. The abandonment of national business leaders from Trump's advisory board and strong words by Republican Senator Corker, followed by the dismissal of the controversial Bannon, could be a turning point. Neither Yellen nor Draghi may not even address the current policy stance as they discuss the topic at hand, "Fostering Dynamic Global Economy", which...

Read More »

Read More »

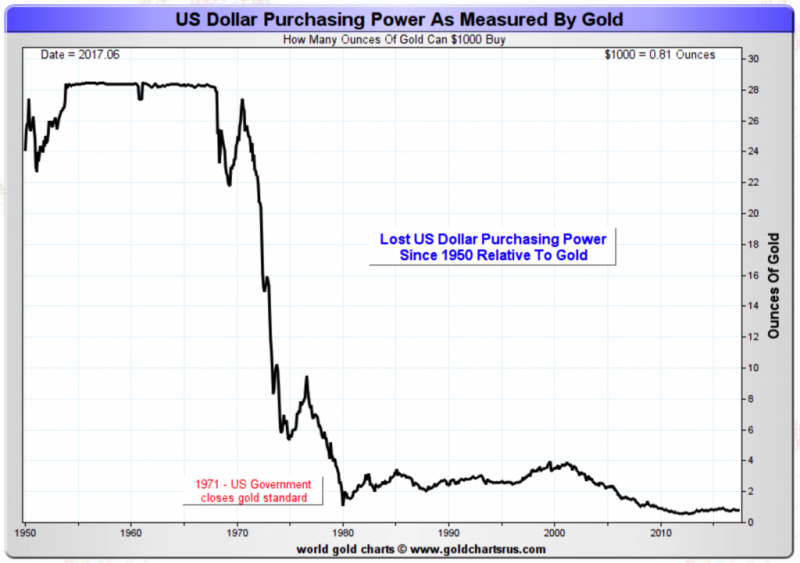

Gold Hedges USD Devaluation, Rise in Oil, Food and Cost of Living Since 1971 – Must See Charts

Gold hedges massive ongoing devaluation of U.S. Dollar. 46th anniversary of ‘Tricky Dicky’ ending Gold Standard (see video). Savings destroyed by currency creation and now negative interest rates. Long-term inflation figures show gold a hedge against rising cost of fuel, food and cost of living. $20 food and beverages basket of 1971 cost $120.17 in 2017.

Read More »

Read More »

Bi-Weekly Economic Review: Ignore The Idiot

Of the economic releases of the past two weeks the one that got the most attention was the employment report. That report is seen by many market analysts as one of the most important and of course the Fed puts a lot of emphasis on it so the press spends an inordinate amount of time dissecting it.

Read More »

Read More »

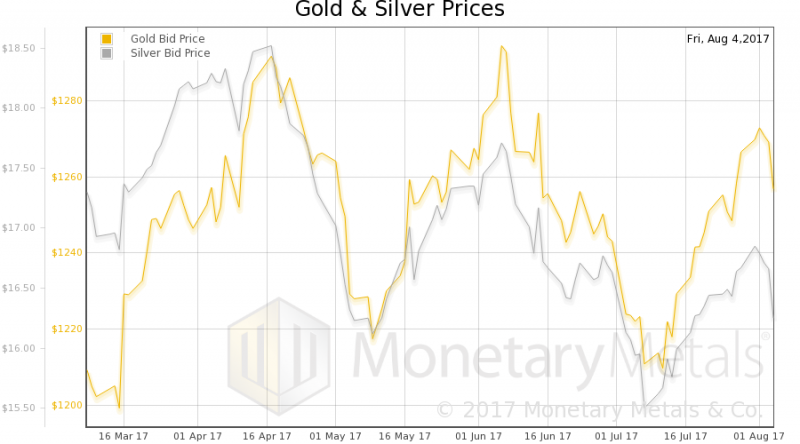

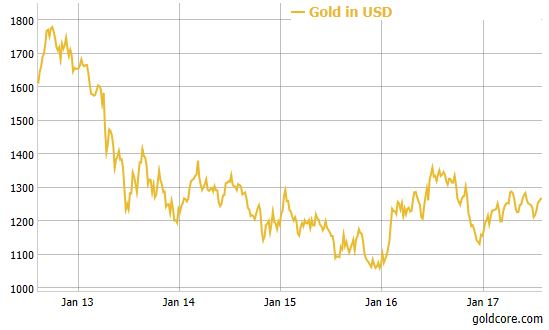

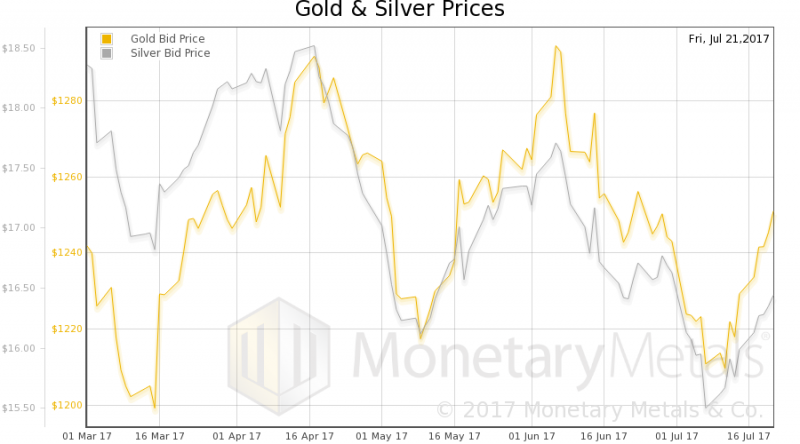

Gold Consolidates On 2.5percent Gain In July After Dollar Has 5th Monthly Decline

Gold consolidates on 2.5% gain in July as the dollar has fifth monthly decline. Trump administration and vicious “civil war” politics casting shadow over America and impacting dollar. All eyes on non farm payrolls today for further signs of weakness in U.S. economy. Gold recovers from 1.7% decline in June as dollar falls. Gold outperforms stocks and benchmark S&P 500 YTD.

Read More »

Read More »

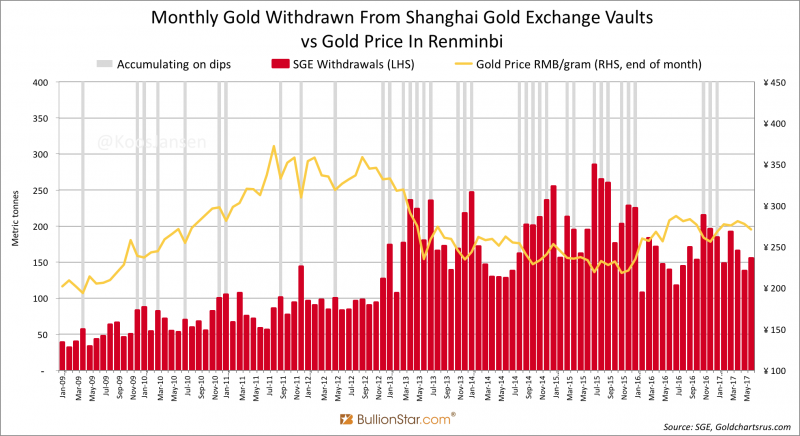

Estimated Chinese Gold Reserves Surpass 20,000t

My best estimate as of June 2017 with respect to total above ground gold reserves within the Chinese domestic market is 20,193 tonnes. The majority of these reserves are held by the citizenry, an estimated 16,193 tonnes; the residual 4,000 tonnes, which is a speculative yet conservative estimate, is held by the Chinese central bank the People’s Bank of China.

Read More »

Read More »

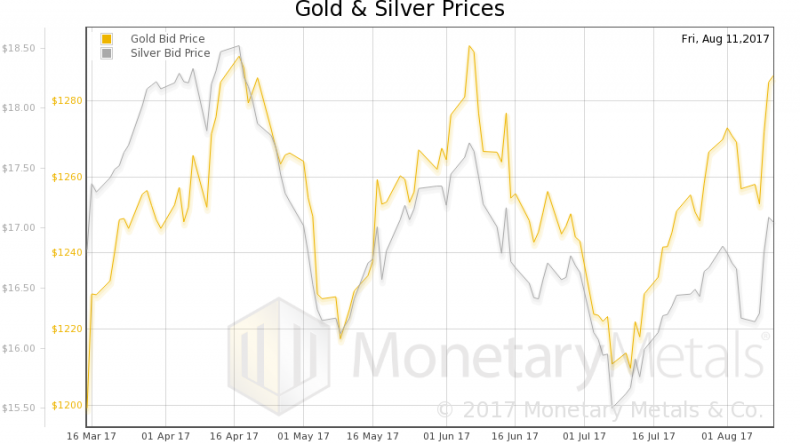

Bi-Weekly Economic Review: Extending The Cycle

This economic cycle is one of the longest on record for the US, eight years and counting since the end of the last recession. It has also been, as almost everyone knows, a fairly weak expansion, one that has managed to disappoint both bull and bear.

Read More »

Read More »

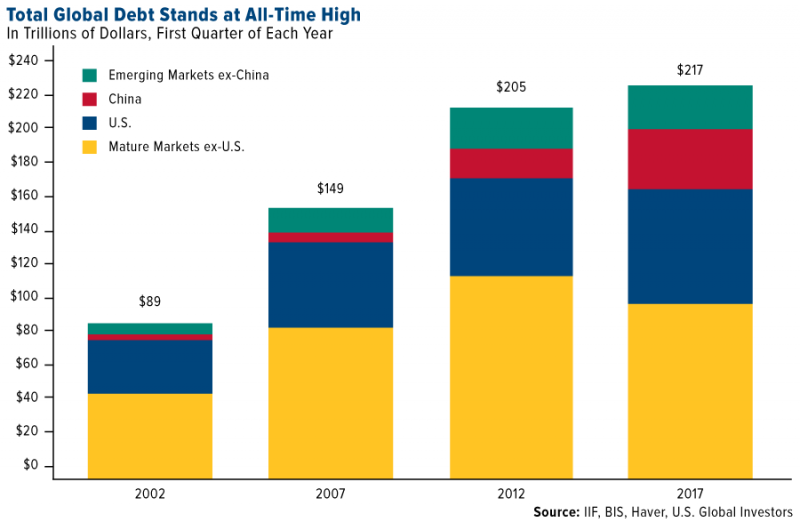

Gold A Good Store Of Value – Protect From $217 Trillion Global Debt Bubble

‘Mother of all debt bubbles’ keeps gold in focus. Global debt alert: At all time high of astronomical $217 T. India imports “phenomenal” 525 tons in first half of 2017. Record investment demand – ETPs record $245B in H1, 17. Investors, savers should diversify into “safe haven” gold. Gold good ‘store of value’ in coming economic contraction.

Read More »

Read More »

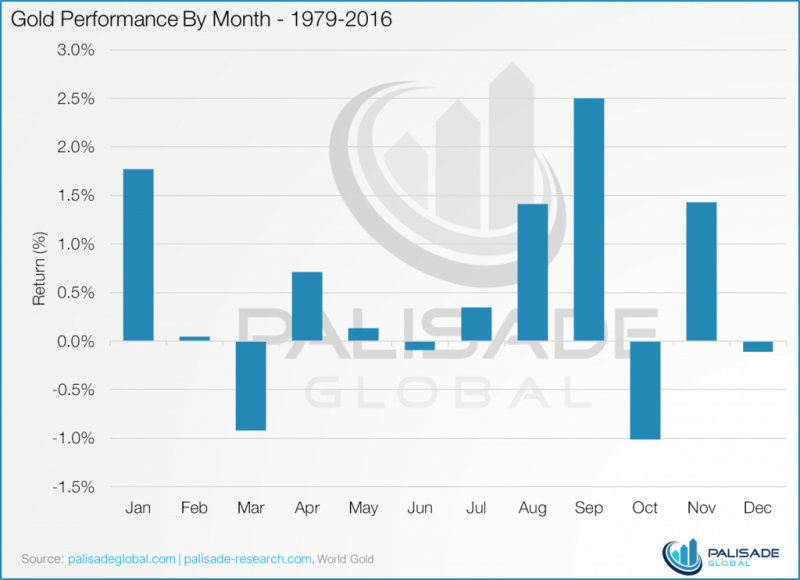

Gold Seasonal Sweet Spot – August and September – Coming

Gold seasonal sweet spot – August and September – is coming. Gold’s performance by month from 1979 to 2016 – must see table. August sees average return of 1.4% and September of 2.5%. September is best month to own gold, followed by January, November & August.

Read More »

Read More »

Le prix de l’or est manipulé. Egon von Greyerz

La léthargie estivale des marchés a tendance à insuffler un sentiment de fausse sécurité. Les actions et l’immobilier approchent de leurs plus hauts historiques, les taux d’intérêt sont à un plus bas de 72 ans, et la plupart des investisseurs se sentent plus riches que jamais. Les banques centrales envoient les signaux d’économies fortes en annonçant des hausses de taux et une réduction de leurs bilans.

Read More »

Read More »