Tag Archive: Gold

Bi-Weekly Economic Review: The New Normal Continues

There has been a lot of talk about the economic impact of the recent tax reform. All of it, including the analyses that include lots of fancy math, amounts to nothing more than speculation, usually informed by little more than the political bias of the analyst. I am guilty of that too to some degree but I don’t let my personal political views dictate how I view the economy for purposes of investing.

Read More »

Read More »

Weekly Technical Analysis: 12/03/2018 – USDJPY, EURUSD, GBPUSD, Gold

The USDCHF pair traded negatively yesterday to break 0.9488 and settles below it, which stops the positive effect of the recently mentioned bullish pattern and push the price to decline again, targeting heading towards 0.9373 initially.

Read More »

Read More »

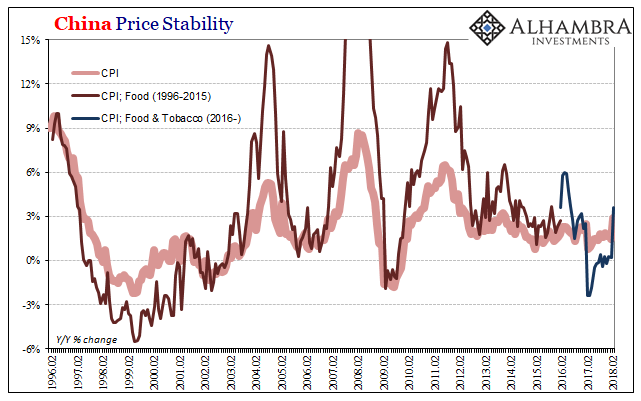

China Prices Include Lots of Base Effect, Still Undershoots

By far, the easiest to answer for today’s inflation/boom trifecta is China’s CPI. At 2.9% in February 2018, that’s the closest it has come to the government’s definition of price stability (3%) since October 2013. That, in the mainstream, demands the description “hot” if not “sizzling” even though it still undershoots. The primary reason behind the seeming acceleration was a more intense move in food prices.

Read More »

Read More »

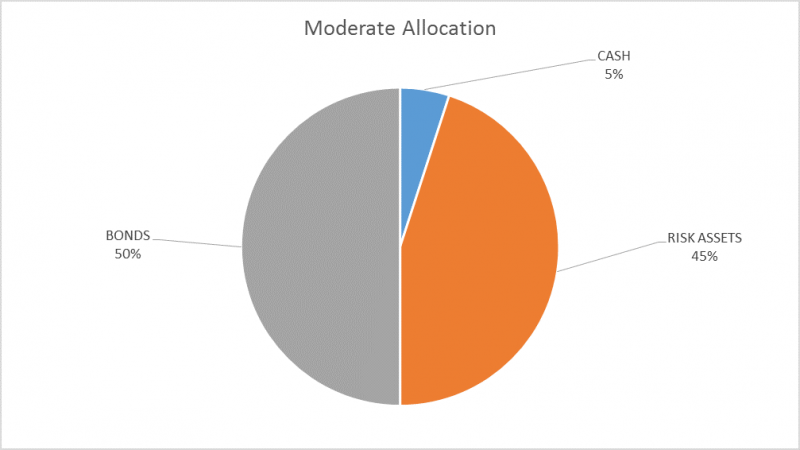

Global Asset Allocation Update: Tariffs Don’t Warrant A Change…Yet

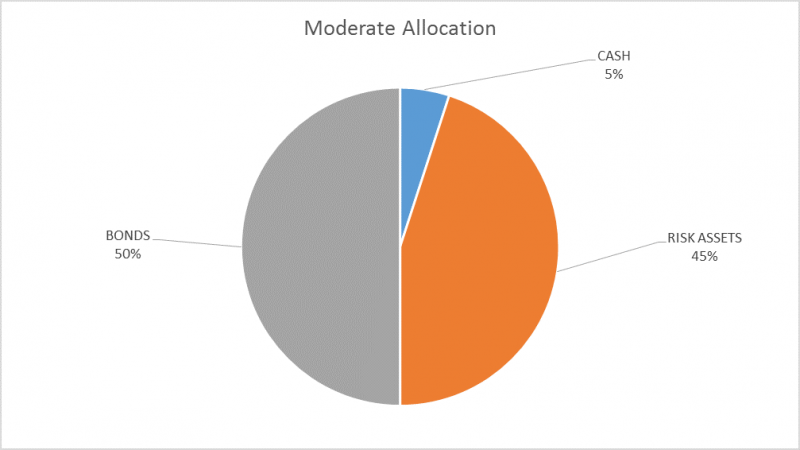

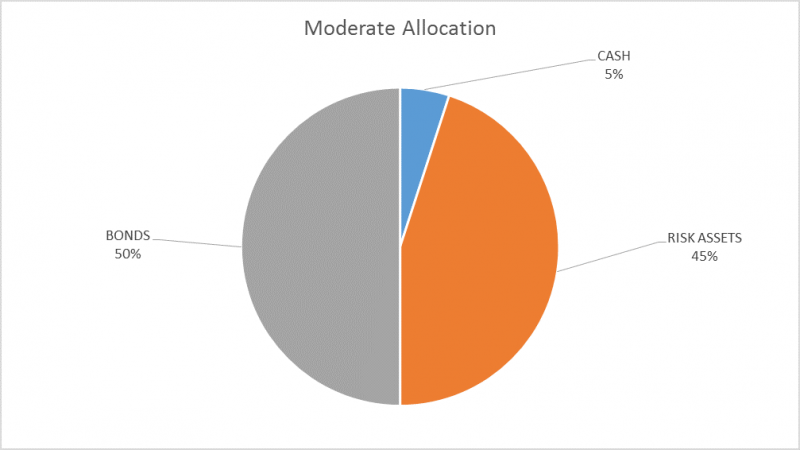

There is no change to the risk budget this month. For the moderate risk investor the allocation to bonds is 50%, risk assets 45% and cash 5%. We have had continued volatility since the last update but the market action so far is pretty mundane. The initial selloff halted at the 200 day moving average and the rebound carried to just over the 50 day moving average.

Read More »

Read More »

Weekly Technical Analysis: 05/03/2018 – USDJPY, EURUSD, GBPUSD, EURGBP, AUDUSD

The USDCHF pair shows sideways trading around the EMA50, noticing that the EMA50 shows clear negative signals on the four hours’ time frame, while the price settles below the intraday bullish channel’s support line that appears on the chart.

Read More »

Read More »

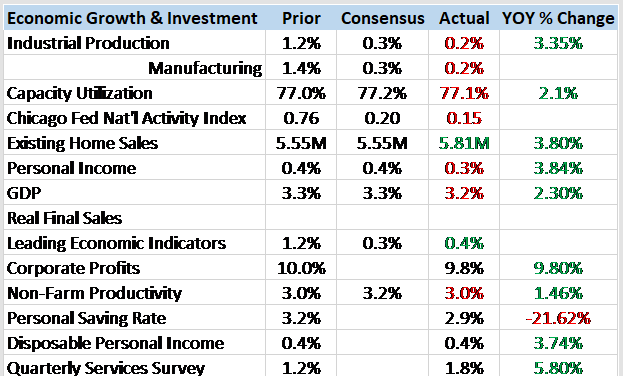

Bi-Weekly Economic Review: One Down, Three To Go

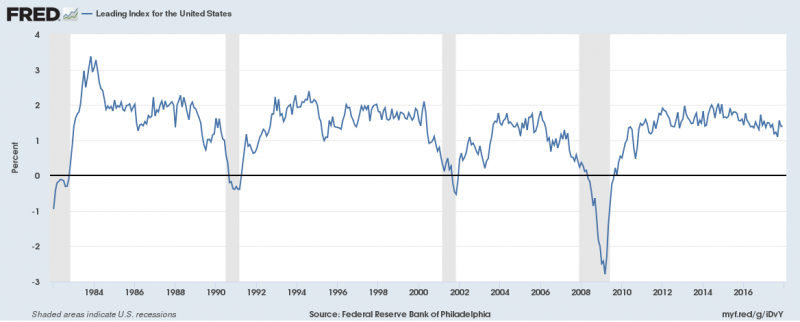

We pay particular attention to broad based indicators of growth. The Chicago Fed National Activity Index and the Conference Board’s Leading Economic Indicators are examples. We watch them because we are mostly interested in identifying inflection points in the broad economy and aren’t as interested in the details. Why? Because, while bear markets do happen outside of recession, it is rare and unpredictable.

Read More »

Read More »

Weekly Technical Analysis: 20/02/2018 – USD/JPY, EUR/USD, GBP/USD, USD/CAD, USD/CHF

The USDCHF pair approached our waited target yesterday, represented by the bearish channel’s resistance that appears on the above chart, noticing that the price faces good resistance at the EMA50, which forms negative pressure that we expect to push the price to resume its main bearish track again.

Read More »

Read More »

Bi-Weekly Economic Review

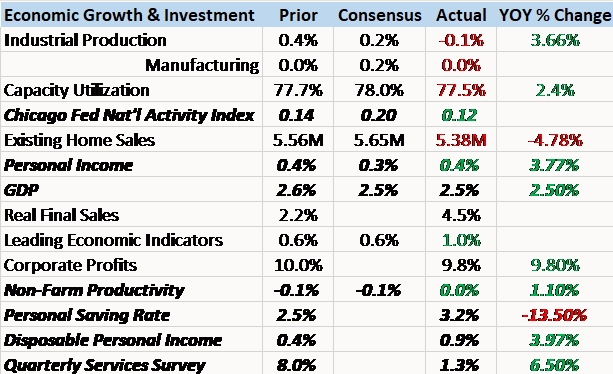

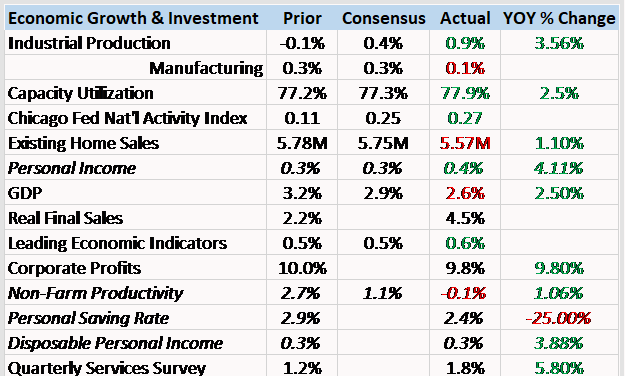

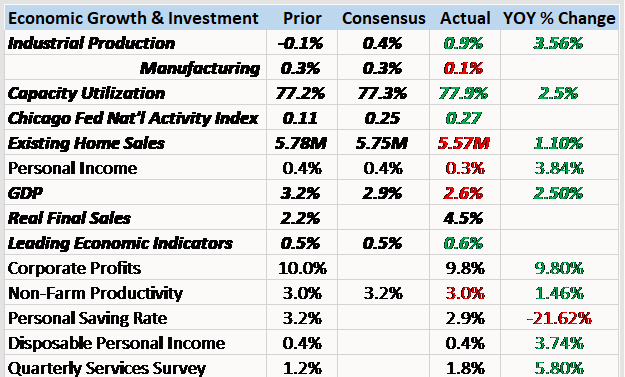

Personal income for December was better than expected at up 0.4% on the month and 4.11% year over year. Wages and salaries were up 0.5%. Unfortunately, that rate of rise is not even up to the lower end of the range we’ve seen in past expansions when 5% income growth was a precursor to recession. Still, it is, sadly, about average for this expansion.

Read More »

Read More »

Weekly Technical Analysis: 12/02/2018 – USD/JPY, EUR/USD, GBP/USD, WTI Oil Futures, USD/CHF

The USDCHF pair trading settles below the previously broken support that appears in the image, while stochastic provides negative overlapping signal on the four hours time frame, which supports the continuation of our bearish trend expectations in the upcoming sessions, reminding you that our next target at 0.9254.

Read More »

Read More »

China: CNY, Not Imports

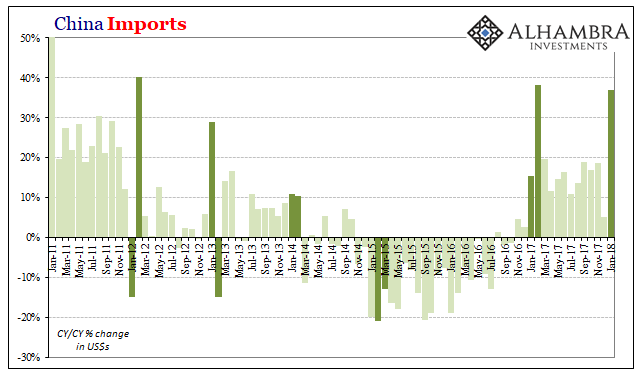

In February 2013, the Chinese Golden Week fell late in the calendar. The year before, 2012, New Year was January 23rd, meaning that the entire Spring festival holiday was taken with the month of January. The following year, China’s New Year was placed on February 10, with the Golden Week taking up the entire middle month of February.

Read More »

Read More »

Global Asset Allocation Update:

There is no change to the risk budget this month. For the moderate risk investor the allocation to bonds is 50%, risk assets 45% and cash 5%. Despite the selloff of the last week I don’t believe any portfolio action is warranted. While the overbought condition has largely been corrected now, the S&P 500 is far from the opposite condition, oversold. At the lows this morning, the S&P 500 was officially in correction territory, down 10% from the...

Read More »

Read More »

Weekly Technical Analysis: 05/02/2018 – USD/JPY, EUR/USD, GBP/USD, AUD/USD, USD/CHF

The USDCHF pair traded with clear negativity yesterday to approach our waited target at 0.9418, to keep the bullish trend scenario active until now, being away that it is important to monitor the price behavior when touching the mentioned level, as breaching it will push the price to extend its gains and head towards 0.9530 as a next station, while its stability will push the price to decline again.

Read More »

Read More »

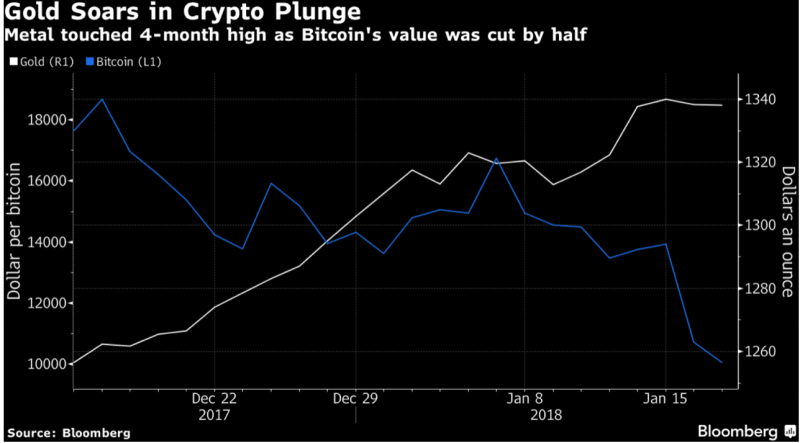

Gold Rises As Global Stocks Plunge and Bitcoin Crashes 70 percent

Gold gains 0.6% in USD and surges 1.7% in euros and pounds. European stocks fall more than 3% at the open after sharp falls in Asia. DJIA falls 1,175 points, S&P 500 down 4.1% and Nikkei plummets 4.7%. Gold rises from $1,330 to $1,342, £942 to £960 and €1,067 to €1,085 /oz. Bitcoin crashes another 10% and has now plummeted by 70% to below $6,000. Increased risk aversion will drive safe haven demand for gold as its hedging properties are appreciated...

Read More »

Read More »

Weekly Technical Analysis: 29/01/2018 – USDJPY, EURUSD, GBPUSD, GBPJPY

The USDCHF pair shows some bullish bias to approach retesting the previously broken support that turns into key resistance now at 0.9418, noticing that stochastic loses its bullish momentum clearly to reach the overbought areas, while the EMA50 forms continuous negative pressure against the price.

Read More »

Read More »

Bi-Weekly Economic Review: Markets At Extremes

Production ended the year on a strong note but early readings from January are not as positive. The December industrial production report headline was strong at a 0.9% gain but a lot of that strength was in the mining (oil drilling) and utility sectors. Mining has actually led the way the last year as rig count has risen with drilling activity. I’d love to see our economy less dependent on the price of oil but that is what we’ve become over the...

Read More »

Read More »

Weekly Technical Analysis: 22/01/2018 – USD/JPY, EUR/USD, GBP/USD, USD/CHF

The USDCHF pair found solid support at 0.9564 barrier, which forced the price to rebound bullishly to approach testing the key resistance 0.9655, met by the EMA50 to add more strength to it, while stochastic shows clear overbought signals now.

Read More »

Read More »

Digital Gold Flight To Physical Gold Coins and Bars

‘Digital Gold’ Bitcoin Flight To Safe Haven Physical Gold. Latest bitcoin, crypto crash causes gold coin and bar demand to surge. Bitcoin down 40% from high, Ripple down 50% and Ethereum down 30%. Ripple and ‘Digital gold’ Bitcoin fall past key psychological price levels. $300bn wiped from cryptocurrency fortunes in just 36 hours. New research says that there is ‘Price Manipulation in the Bitcoin Ecosystem’.

Read More »

Read More »

Weekly Technical Analysis: 15/01/2018 – USDJPY, EURUSD, GBPUSD, WTI Oil Futures

The USDCHF pair succeeded to break 0.9656 level and hold with a daily close below it, which confirms opening the way to extend the bearish wave towards our yesterday's mentioned next target at 0.9566, noticing that the price approaches retesting the broken level now.

Read More »

Read More »

Bi-Weekly Economic Review: A Weak Dollar Stirs A Toxic Stew

We received several employment related reports in the first two weeks of the year. The rate of growth in employment has been slowing for some time – slowly – and these reports continue that trend. The JOLTS report showed a drop in job openings, hires and quits.

Read More »

Read More »

Global Asset Allocation Update

There is no change to the risk budget this month. For the moderate risk investor the allocation to bonds is 50%, risk assets 45% and cash 5%. The extreme overbought condition of the US stock market persists so I will continue to hold a modest amount of cash. There are some minor changes within the portfolios but the overall allocation is unchanged.

Read More »

Read More »