Tag Archive: gold price

Run On The Pound? Jeremy Corbyn Says Should Plan For

Run On The Pound ? Jeremy Corbyn Says Should Plan For. Right to plan for ‘run on pound’ if Labour wins says Corbyn and Labour party . British pound already down 20% since Brexit, collapse already in play. Run on the pound likely due to Labour’s ‘command economy’ approach. Collapse in Sterling would undermine UK financial system. Portfolios holding sterling and related assets would be significantly affected. Pension funds and property the most...

Read More »

Read More »

Dollar & Stocks Jump; Bonds & Bullion Dump In Lowest Volatility September Ever

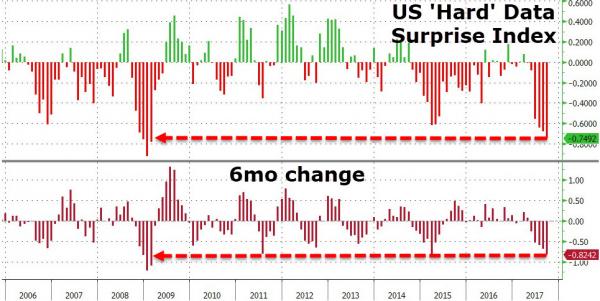

It has now been 318 trading days since the S&P 500 suffered a 5% drawdown - the 4th-longest streak since 1928... So everything is awesome...BUT...US 'hard' economic data has not been this weak (and seen the biggest drop) since Feb 2009...Q3 Was a Roller-Coaster...Q3 was the 8th straight quarterly gain in a row for The Dow - the longest streak since Q3 1997.

Read More »

Read More »

“Backdrop For Gold Today Is As Bullish As It Has Been In A Long Time” – GoldCore Dublin

Gold finished sharply higher on Monday, recouping roughly half of last week’s loss, as declines in the U.S. stock market and growing tensions between the U.S. and North Korea lifted prices for the yellow metal to the highest settlement in more than a week.

Read More »

Read More »

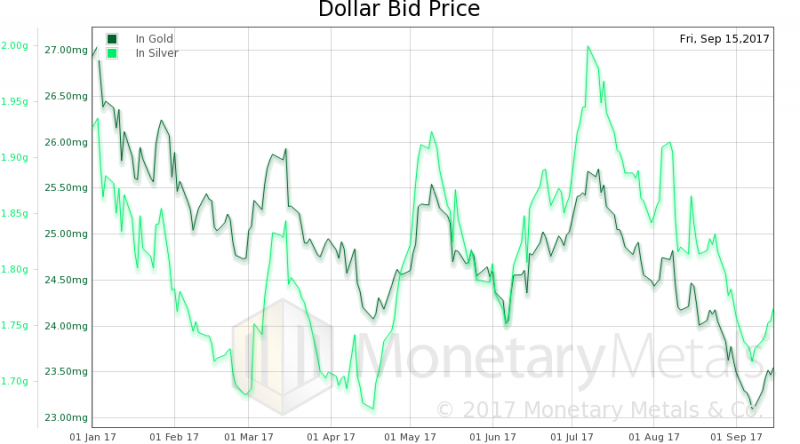

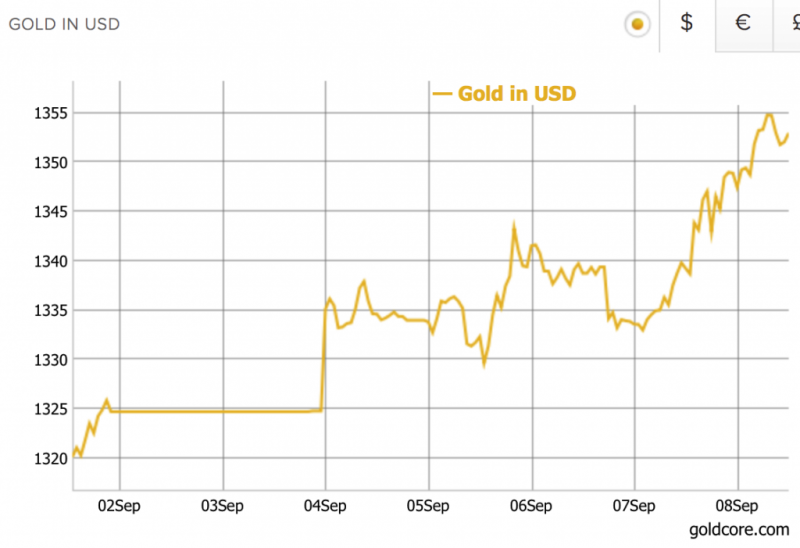

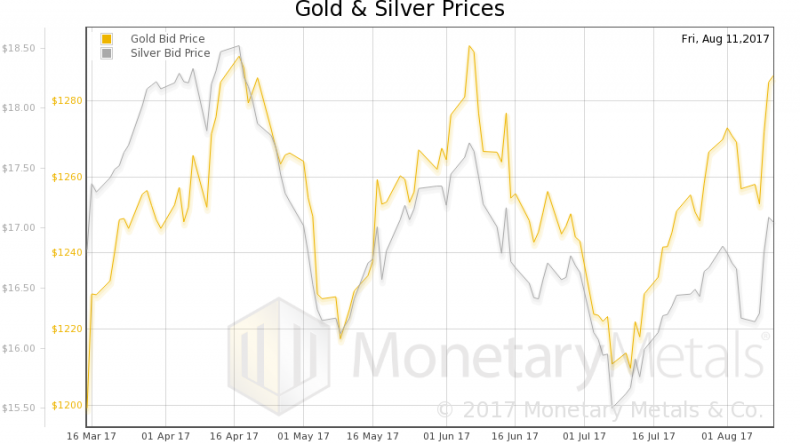

Gold Has 2 percent Weekly Gain, 18 percent Higher YTD – Trump’s Debt Ceiling Deal Hurts Dollar

Gold hits $1,355/oz as USD at 32-month low -concerns about Trump, US economy. Silver and platinum 2.3% and 1.2% higher in week; palladium 3% lower. Euro Stoxx flat for week – S&P 500, Nikkei down 0.65% and 2.2%. Geo-political concerns including North Korea, falling USD push gold 2.1% in week. Gold prices reach $1,355 this morning following Mexico earthquake. Safe haven demand sees gold over one year high, highest since August 2016.

Read More »

Read More »

Le retour de l’or sur la scène monétaire mondiale?

Mars 2009, le gouverneur de la Banque populaire de Chine M Zhou Xiaochuan revint dans le cadre d’une conférence intitulée Reform the international Monetary System sur la vision de Keynes au sujet du bancor.Pour lui, le système centré sur le dollar américain et les taux de changes flottants, plus ou moins librement, devrait être repensé.

Read More »

Read More »

Physical Gold In Vault Is “True Hedge of Last Resort” – Goldman Sachs

Physical gold is “the true currency of the last resort” – Goldman Sachs. “Gold is a good hedge against geopolitical risks when the event leads to a debasement of the dollar” . Trump and Washington risk bigger driver of gold than risks such as North Korea. Recent events such as N. Korea only explain fraction of 2017 gold price rally. Do not buy gold futures or ETFs rather “physical gold in a vault” [is] the “true hedge”.

Read More »

Read More »

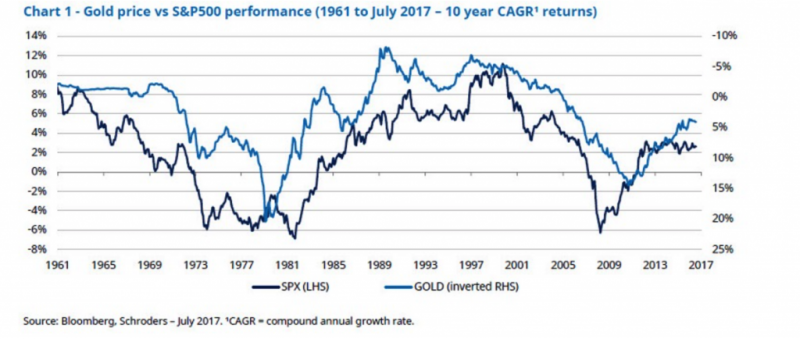

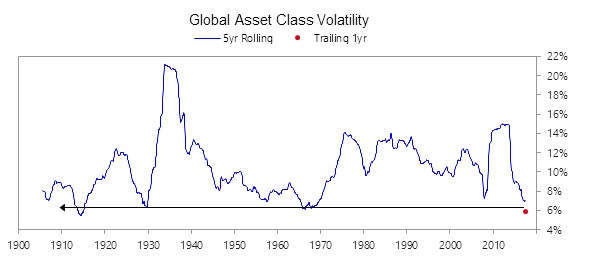

4 Reasons Why “Gold Has Entered A New Bull Market” – Schroders

4 reasons why “gold has entered a new bull market” – Schroders. Market complacency is key to gold bull market say Schroders. Investors are currently pricing in the most benign risk environment in history as seen in the VIX. History shows gold has the potential to perform very well in periods of stock market weakness (see chart). You should buy insurance when insurers don’t believe that the “risk event” will happen. Very high Chinese gold demand,...

Read More »

Read More »

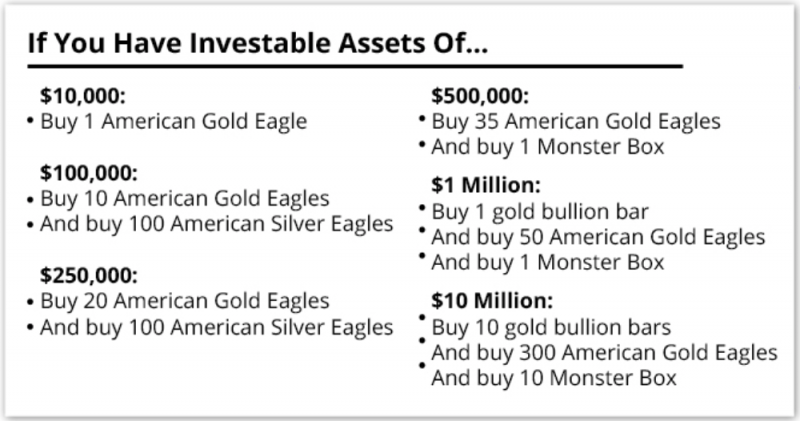

Gold Reset To $10,000/oz Coming “By January 1, 2018” – Rickards

Trump could be planning a radical “reboot” of the U.S. dollar. Currency reboot will see leading nations devalue their currencies against gold. New gold price would be nearly 8 times higher at $10,000/o. Price based on mass exit of foreign governments and investors from the US Dollar. US total debt now over $80 Trillion – $20T national debt and $60T consumer debt. Monetary reboot or currency devaluation seen frequently – even modern history. Buy...

Read More »

Read More »

Gold Surges 2.6 percent After Jackson Hole and N. Korean Missile

Gold surges as N. Korea fires ballistic missile over Japan. Safe haven buying sees gold break out to 10-month high after Jackson Hole and rising North Korea risk of attack on Guam. South Korea’s air force dropped eight MK 84 bombs near Seoul; simulating the destruction of North Korea’s leadership.

Read More »

Read More »

Diversify Into Gold On U.S. “Political Instability” Advise Blackrock

Gold set to shine as Washington stumbles. “Bet on gold’s diversifying properties rather than political stability”. World’s largest asset manager believes Trump and political drama in the U.S. means gold likely to rise. Real rates flattening out and rising political instability – Blackrock’s Koesterich. “For now my bias would be to stick with gold” – Blackrock. U.S. debt ceiling issue to be fractious as bankrupt U.S. hits $20 trillion debt....

Read More »

Read More »

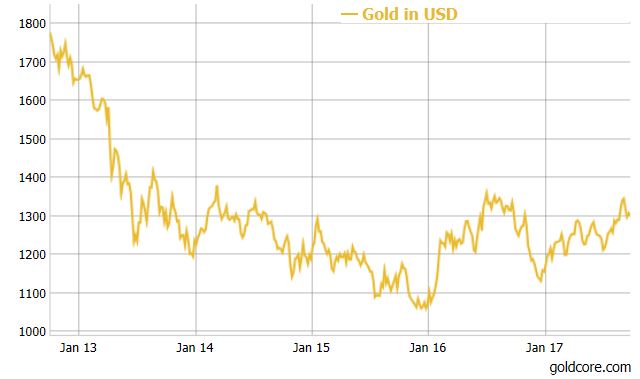

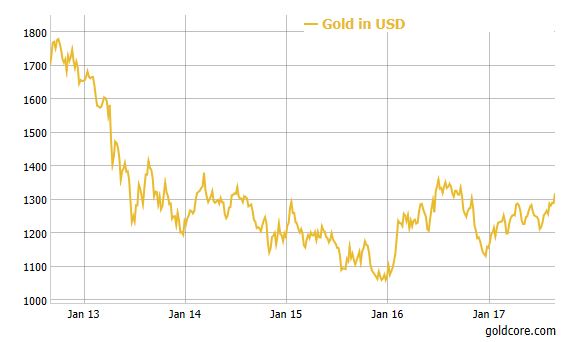

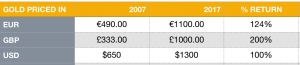

Global Financial Crisis 10 Years On: Gold Price Rises 124 percent From €490 to €1,100

Gold up over 100% in major currencies since financial crisis. Gold up 100% in USD, 124% in EUR and surged 200% in GBP. Gold has outperformed equity, bonds and most assets. Gold remains an important safe-haven in long term.

Read More »

Read More »

“Under Any Analysis, It’s Insanity”: What War With North Korea Could Look Like

Now that the possibility of a war between the US and North Korea seems just one harshly worded tweet away, and the window of opportunity for a diplomatic solution, as well as for the US stopping Kim Jong-Un from obtaining a nuclear-armed ICBM closing fast, analysts have started to analyze President Trump’s military options, what a war between the US and North Korea would look like, and what the global economic consequences would be.

Read More »

Read More »