Tag Archive: Germany

FX Daily, January 7: Dollar Bounces after Insurrection Put Down

Overview: After the National Guard were called to put down an insurrection in Washington, DC, the dollar is having its best day in around a week. The euro's three-day rally has been halted even though German factory orders surprised on the upside.

Read More »

Read More »

Seizing The Dirt Shirt Title

In mid-December 2019, before the world had heard of COVID, China’s Central Economic Work Conference had released a rather startling statement for the world to consume. In the West, everything was said to be on the up. Central banks had responded, forcefully, many claimed, more than enough to deal with that year’s “unexpected” globally synchronized downturn.

Read More »

Read More »

Meanwhile, Outside Today’s DC

With all eyes on Washington DC, today, everyone should instead be focused on Europe. As we’ve written for nearly three years now, for nearly three years Europe has been at the unfortunate forefront of Euro$ #4. We could argue about whether coming out of GFC2 back in March pushed everything into a Reflation #4 – possible – or if this is still just one three-yearlong squeeze of a global dollar shortage.

Read More »

Read More »

FX Daily, August 27: After much Build-Up, Could Powell be Anti-Climactic?

The strong rally in US equities yesterday, with the fifth consecutive gain in the S&P 500 and a big outside up day in gold, failed to spur follow-through buying today. Asia Pacific equities were mixed. China, Australia, and India rose while most of the rest of the regional markets fell.

Read More »

Read More »

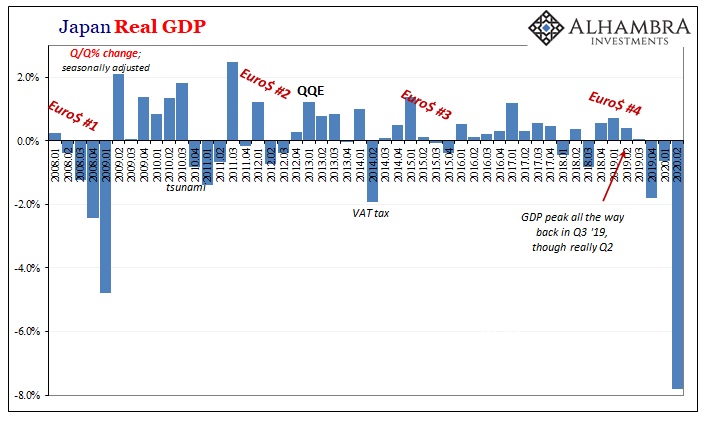

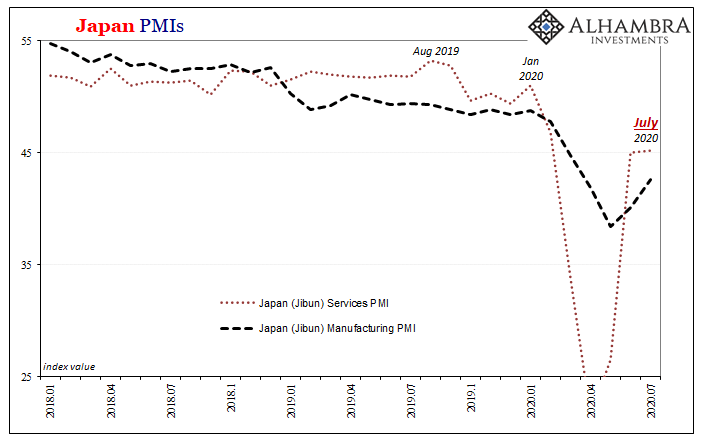

It Was Bad In The Other Sense, So Now What?

According to the latest figures, Japan has tallied 56,074 total coronavirus cases since the outbreak began, leading to the death of an estimated 1,103 Japanese citizens. Out of a total population north of 125 million, it’s hugely incongruous.

Read More »

Read More »

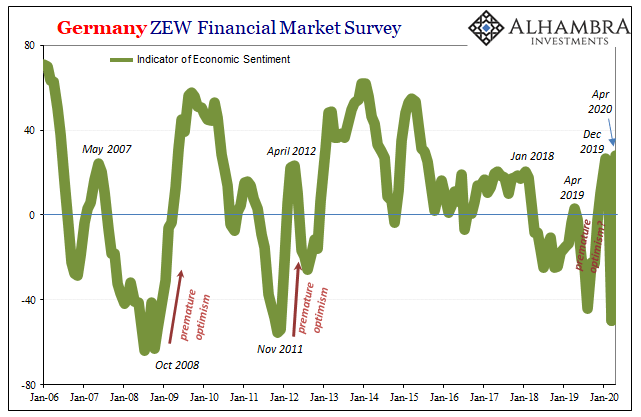

Science of Sentiment: Zooming Expectations Wonder

It had been an unusually heated gathering, one marked by temper tantrums and often publicly expressed rancor. Slamming tables, undiplomatic rudeness. Europe’s leaders had been brought together by the uncomfortable even dangerous fact that the economic dislocation they’ve put their countries through is going to sustain enormously negative pressures all throughout them. What would a “united” European system do to try and fill in this massive hole?The...

Read More »

Read More »

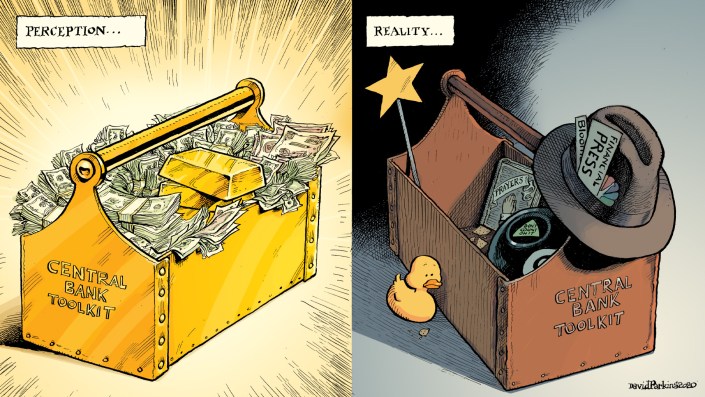

Accusing the Accused of Excusing the Mountain of Evidence

Why not let the accused also sit in the jury box? The answer seems rather obvious. While maybe the truly honest man accused of a crime he did commit would vote for his own conviction, the world seems a bit short on supply of those while long and deep offering up practitioners of pure sophistry in their stead.

Read More »

Read More »

A Japanese Stall?

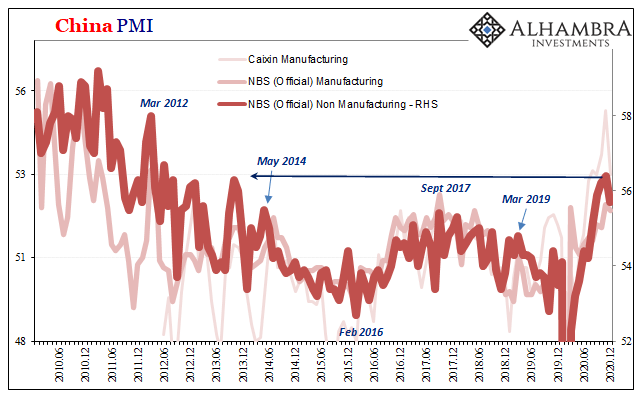

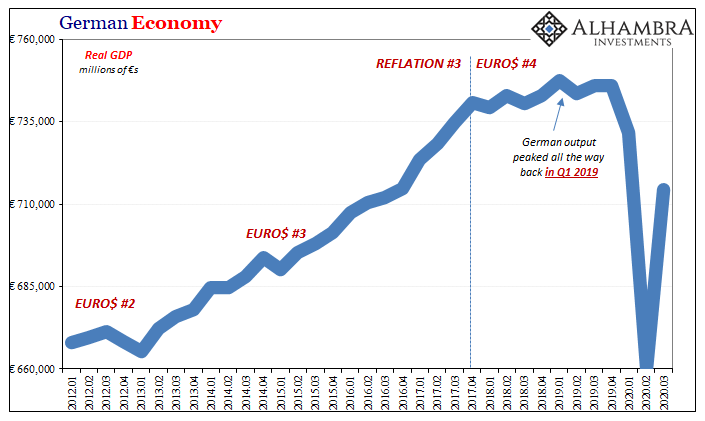

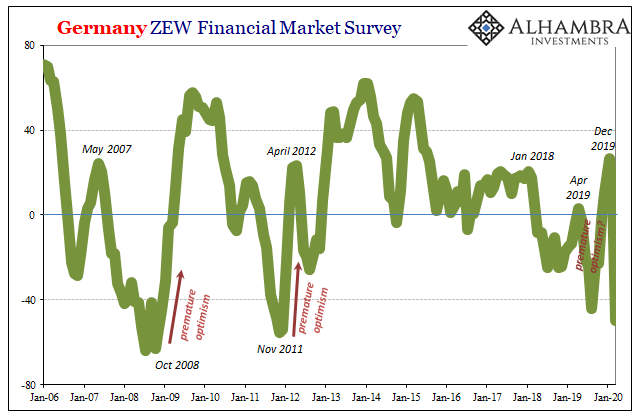

In sharp contrast to the sentimental deference towards central bank stimulus exhibited by Germany’s ZEW, for example, similar Japanese surveys are starting to describe potential trouble developing. Like Germany, Japan is a bellwether country and a pretty reliable indicator of global economy performance.

Read More »

Read More »

FX Daily, June 4: Risk Taking Pauses Ahead of the ECB

Overview: After several days of aggressive risk-taking, investors are pausing ahead of the ECB meeting. Equities were mostly higher in the Asia Pacific region, though China was mixed, and Indian shares slipped. Europe's Dow Jones Stoxx 600 is snapping a five-day advance, and US shares are trading with a heavier bias. The S&P 500 gapped higher yesterday, and that gap (~3081-3099) offers technical support.

Read More »

Read More »

FX Daily, May 15: Much Talk but Little Action

Overview: The S&P 500 staged an impressive recovery yesterday, a sell-off that took it to its lowest level since April 21, to close more than 1% higher on the day, helped set the tone in the Far East and Europe today. Gains in most Asia Pacific markets, but Hong Kong, Shanghai, and India, trimmed this week's losses. Australia's 1.4% rally today managed to turn ASX positive for the week, extending leg up for a third consecutive week.

Read More »

Read More »

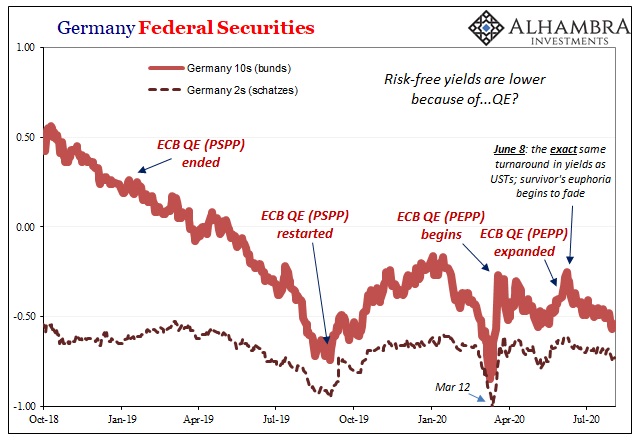

The global economy doesn’t care about the ECB (nor any central bank)

The monetary mouse. After years of Mario Draghi claiming everything under the sun available with the help of QE and the like, Christine Lagarde came in to the job talking a much different approach. Suddenly, chastened, Europe’s central bank needed assistance. So much for “do whatever it takes.”They did it – and it didn’t take.Lagarde’s outreach was simply an act of admitting reality.

Read More »

Read More »

FX Daily, May 6: The Euro is Knocked Back Further

Overview: The late sell-off in US stocks yesterday has not prevented gains in Asia and Europe. Most of the equity markets, including the re-opening of China, gain more than 1%. Australia was a notable exception, falling about 0.4%, and Taiwan was virtually flat. European bourses opened higher but made little headway before some profit-taking set in, while US shares are trading higher.

Read More »

Read More »

FX Daily, May 5: German Court Adds to the Euro’s Woes

Overview: The S&P 500 recovered yesterday after dipping trading below the 20-day moving average for the first time in a month. The key area is the gap between the April 30 low (~2892.5) and the May 1 high (~2869). Oil reversed higher as well. June crude was off nearly 9% in the US morning and closed 7% higher on the day and above $21 for the first time since April 21, the day of negative oil prices.

Read More »

Read More »

FX Daily, May 4: Monday Blues

Overview: The constructive mood among investors in April has given way to new concerns as May gets underway. Japan and China are still on holiday, but most of the other markets in Asia fell, led by 4.5%-5.5% declines in Hong Kong and India, and more than 2% in most other local markets. Australia bucked the trend a gained 1.4% after shedding 5% before the weekend.

Read More »

Read More »

The Greenspan Bell

What set me off down the rabbit hole trying to chase modern money’s proliferation of products originally was the distinct lack of curiosity on the subject. This was the nineties, after all, where economic growth grew on trees. Reportedly. Why on Earth would anyone purposefully go looking for the tiniest cracks in the dam?

Read More »

Read More »

FX Daily, March 23: Greenback Demand Not Satisfied by Swap Lines

Overview: In HG Wells' "War of the Worlds," the common cold repelled a Martian invasion. Now, a novel coronavirus is disrupting everything and everywhere. Global equities continue to get hammered, though the apparent relative resilience of Japan may have spurred some buying of Japanese equities.

Read More »

Read More »

Stagnation Never Looked So Good: A Peak Ahead

Forward-looking data is starting to trickle in. Germany has been a main area of interest for us right from the beginning, and by beginning I mean Euro$ #4 rather than just COVID-19. What has happened to the German economy has ended up happening everywhere else, a true bellwether especially manufacturing and industry.

Read More »

Read More »

FX Daily, March 20: Markets Ending the Week on Better Note

Overview: Dramatic price action continues but in the other direction. Stocks and bonds have rallied strongly, and the US dollar is snapping a strong advance with a sharp and broad setback. The immediate trigger is hard to identify. Some accounts linking it to fears that the California shutdown will be repeated throughout the country, deepening the coming downturn.

Read More »

Read More »

FX Daily, March 06: Panic Deepens, US Employment Data Means Little

The sharp sell-off in US equities and yields yesterday is spurring a mini-meltdown globally today. Many of the Asia Pacific markets, including Japan, Australia, Taiwan, and India, saw more than 2% drops, while most others fell more than 1%. The MSCI Asia Pacific Index snapped the four-day advance had lifted it about 2.8% coming into today.

Read More »

Read More »

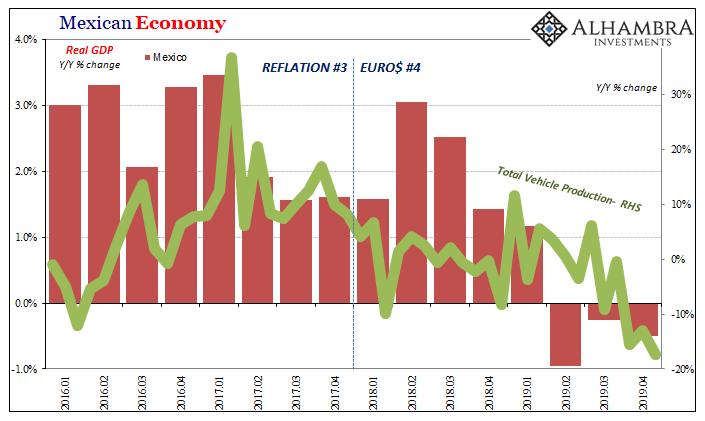

Economy: Curved Again

Earlier today, Mexico’s Instituto Nacional de Estadística y Geografía (INEGI) confirmed the country’s economy is in recession. Updating its estimate for Q4 GDP, year-over-year output declined by 0.5% rather than -0.3% as first thought. On a quarterly basis, GDP was down for the second consecutive quarter which mainstream convention treats as a technical recession.

Read More »

Read More »