Tag Archive: Germany

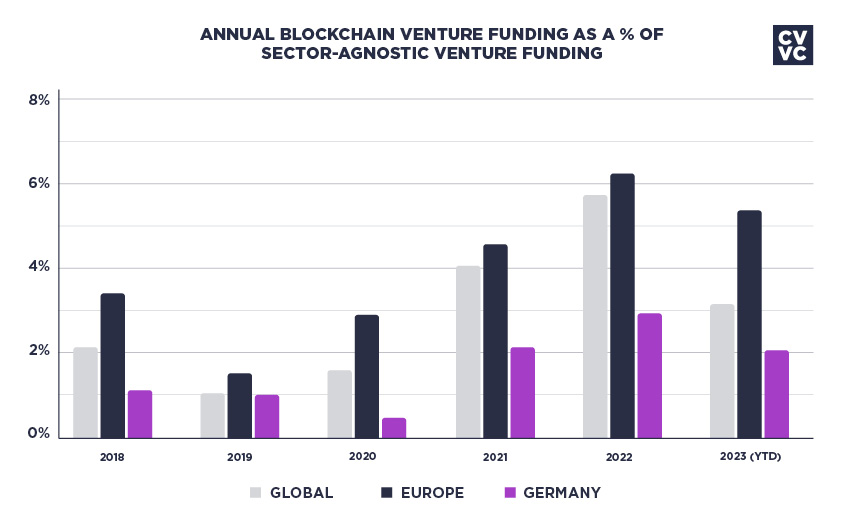

German Regulator BaFin Grants Third Crypto Custody License to Tangany

Tangany has received a license from the German Federal Financial Supervisory Authority (BaFin) as the third regulated service provider for the custody of digital assets in the country to provide crypto custody business. Furthermore, Tangany plans to apply for further licenses in Germany and Europe in the future and has already received preliminary permission from BaFin to manage registers of crypto securities.

Read More »

Read More »

Hope Springs Eternal, or at least enough to Lift Risk Taking Today

Overview: The animal spirits have been reanimated today. Encouraged by the dramatic reversal in oil and gas prices, a deal in the US that pushes off the debt ceiling for a few weeks and talk of a new bond-buying facility in the euro area spurred further risk-taking today, ahead of tomorrow's US employment report.

Read More »

Read More »

Dollar Rallies as Energy Surge Quashes Animal Spirits

Overview: Investors worry that surging energy prices will sap economic activity and boost prices. It is sparking a sharp drop in equities and bonds while lifting the dollar. The Nikkei fell for the eighth consecutive session, and today's 1% drop brings the cumulative decline to 9%. South Korea's Kospi also fell by more than 1%.

Read More »

Read More »

Risk Appetites Didn’t Return from the Weekend

Overview: Investors' mood did not improve over the weekend, and the lack of risk appetites are rippling through the capital markets today. Equities have tumbled, yields have backed off, and the dollar is well bid. Hong Kong and Australia led the sell-off in the Asia Pacific region, off 3.3% and 2.1%, respectively.

Read More »

Read More »

How (Not) to Win Friends and Influence People

Overview: There are two big themes in the capital markets today. The first is the ongoing push of the Chinese state into what was the private sector. Today's actions involve breaking Ant's lending arms into separate entities, with the state taking a stake. This weighed on Chinese shares and Hong Kong, where many are lists. On the other hand, Japanese markets extended their recent gains.

Read More »

Read More »

Rising Rates Underpin the Greenback

Overview: The US dollar remains firm ahead of the July CPI release, and even though Chicago Fed Evans demurred from the hawkish talk, the market is getting more comfortable with the idea of a rate hike next year.

Read More »

Read More »

Gold’s Flash Crash and Limited Follow-Through Greenback Gains

Overview: A flash crash saw gold drop more than $70 an ounce in early Asia. Silver was dragged lower too. The precious metals have stabilized at lower levels, but it signals a rough adjustment to a higher interest rate environment as a hawkish BOE and strong US employment data suggest peak monetary stimulus is at hand.

Read More »

Read More »

Yesterday’s Dollar Recovery Stalls

Overview: US interest rates and the dollar turned higher following comments by the Fed's Vice Chairman Clarida, who appeared to throw his lot with the more hawkish members. The dollar recovered from weakness that had seen it fall to almost JPY108.70, its lowest level since late May, and lifted the euro to $1.19.

Read More »

Read More »

Bond Reversal In Japan, But Pay Attention To It In Germany

Yield curve control, remember that one? For a little while earlier this year, the modestly reflationary selloff in bonds around the world was prematurely oversold as some historically significant beginning to a massive, conclusive regime change.

Read More »

Read More »

FX Daily, July 08: Capital Markets Remain Unhinged

The dramatic move in the capital markets continues. The US dollar is soaring as yields and equities slide. The US 10-year yield has fallen below 1.30 to 1.26% European benchmark yields are 1-4 bp lower, while Australia and New Zealand have seen a 7-9 bp drop today.

Read More »

Read More »

FX Daily, July 07: Dollar Stabilizes at Elevated Levels After Surging Yesterday

The dollar has steadied after surging yesterday and has so far retained the lion's share of its gains, though it remains lower against most major currencies today. The dollar-bloc and Norwegian krone are the best performers while the yen is underperforming.

Read More »

Read More »

A Clear Balance of Global Inflation Factors

Back at the end of May, Germany’s statistical accounting agency (deStatis) added another one to the inflationary inferno raging across the mainstream media. According to its flash calculations, German consumer prices last month had increased by the fastest rate in 13 years.

Read More »

Read More »

FX Daily, June 08: Marking Time ahead of the Week’s Big Events

The capital markets appear to be in a holding pattern ahead of this week's big events, including the US CPI and the ECB meeting. Equities are little changed but with a heavier bias evident. Most of the large bourses in the Asia Pacific region were lower, except Australia, which eked out a small gain.

Read More »

Read More »

FX Daily, June 07: The Greenback Steadies after Retreating on the Jobs Data

After falling to 1.55% after the US employment data, which, while mixing expectations, could hardly be considered weak, the US 10-year yield has come back firmer today (1.58%) This may be lending the greenback a better tone. Equity markets are quiet. Most markets in the Asia Pacific region edged higher.

Read More »

Read More »

FX Daily, May 25: Softer Yields Weigh on the Greenback

The decline in US 10-year rates to two-week lows below 1.59% is helping rebuild bullish enthusiasm for stocks and weighing on the US dollar. The NASDAQ reached two-week highs yesterday, and almost all the large markets in the Asia Pacific region rose, though India struggled.

Read More »

Read More »

FX Daily, May 10: The Dollar Remains on the Defensive

Last week's cyberattack on the largest US gasoline pipeline continues to lift oil and gasoline prices. The June gasoline futures gapped higher to extend last week's 2.4% gain but has subsequently moved lower to enter the gap.

Read More »

Read More »

FX Daily, April 20: Market has Second Thoughts about Timing of First Fed Hike

Overview: Even as US yields edge higher, the dollar struggles. With the 10-year Treasury yields now at 1.62%, nine basis points above last week's lows, the greenback has turned mixed against the major currencies. After briefly slipping below JPY108, the dollar has recovered to around JPY108.55.

Read More »

Read More »

FX Daily, March 15: Big Week Begins Quietly

The capital markets are beginning a new and busy week in a non-committal fashion. Equities are mixed. Except for Japan, Hong Kong, and Australia, most markets in the Asia Pacific region were lower, led Chinese and Indian shares.

Read More »

Read More »

FX Daily, March 9: Turn Around Tuesday Strikes

It is not clear the trigger, but risk-taking appetites rebounded smartly today after the NASDAQ completed a more than 10% pullback from its highs yesterday. Ironically, the Dow Jones Industrials set new record highs yesterday too. Most equity markets in the Asia Pacific region rallied. The notable exceptions were South Korea and China.

Read More »

Read More »

FX Daily, January 28: A Sea of Red Gives the Dollar a Bid

The steepest loss in US equities since last October is rippling through the capital markets in the form of de-risking. The rout is not over, and the S&P 500 is poised to gap lower. Many of the largest markets in the Asia Pacific region were off around 2%.

Read More »

Read More »