Tag Archive: Germany

Can’t Blame COVID For This One

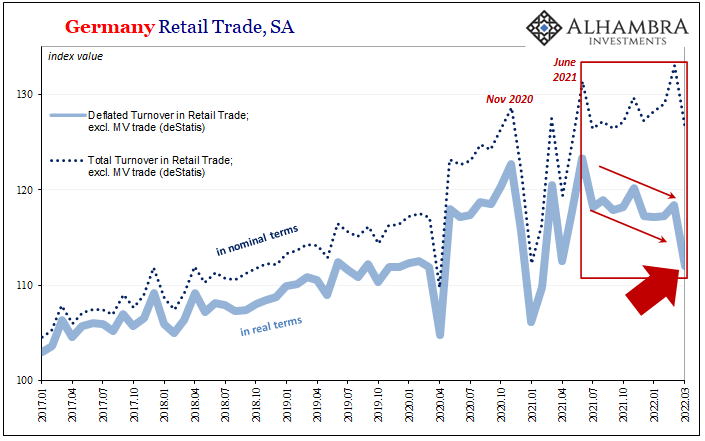

Late in March 2021, then-German Chancellor Angela Merkel announced a reverse. Several weeks before that time, Merkel’s federal government had reached an agreement with the various states to begin opening the country back up, easing more modest restrictions to move daily life closer to normal.

Read More »

Read More »

Industrial Synchronized Demand

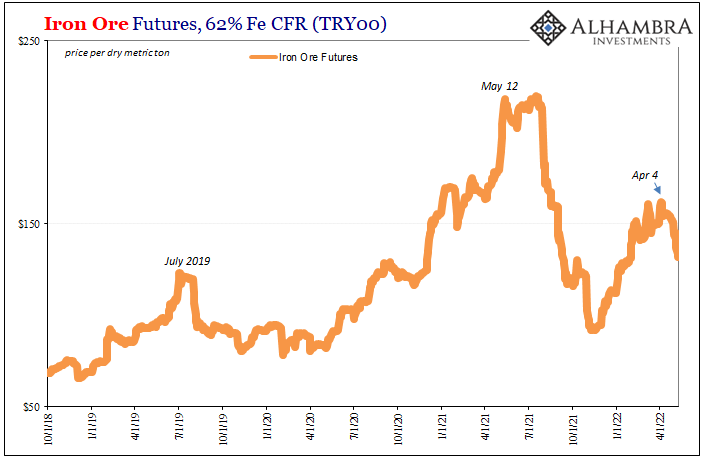

Are the industrial commodities starting to get a whiff of demand side rejection? Short run trends suggest that this could be the case. From copper to iron and the highest (formerly) of the high flyers, aluminum, this particular group has been exhibiting a rather synchronized setback going back to the end of March, start of April.

Read More »

Read More »

China Then Europe Then…

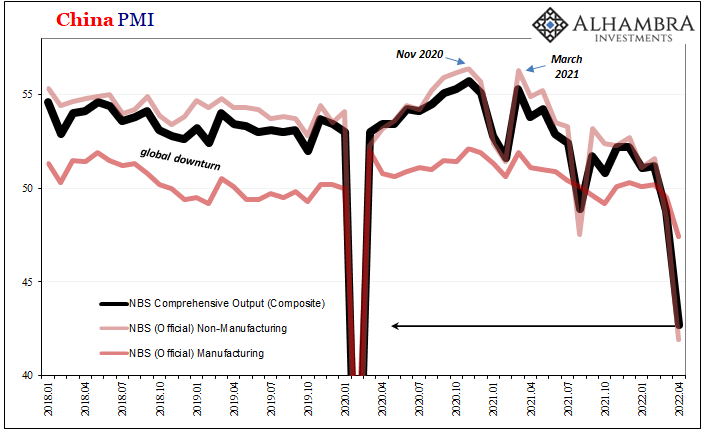

This is the difference, though in the end it only amounts to a matter of timing. When pressed (very modestly) on the slow pace of the ECB’s “inflation” “fighting” (theater) campaign, its President, Christine Lagarde, once again demonstrated her willingness to be patient if not cautious.

Read More »

Read More »

China’s Covid Sends Commodities Lower and helps the Dollar Extend Gains

Overview: Fears that the Chinese lockdowns to fight Covid, which have extended for four weeks in Shanghai, are not working, and may be extended to Beijing has whacked equity markets, arrested the increase in bond yields, and lifted the dollar.

Read More »

Read More »

Produzentenfenster Globale Rezessionsuhr

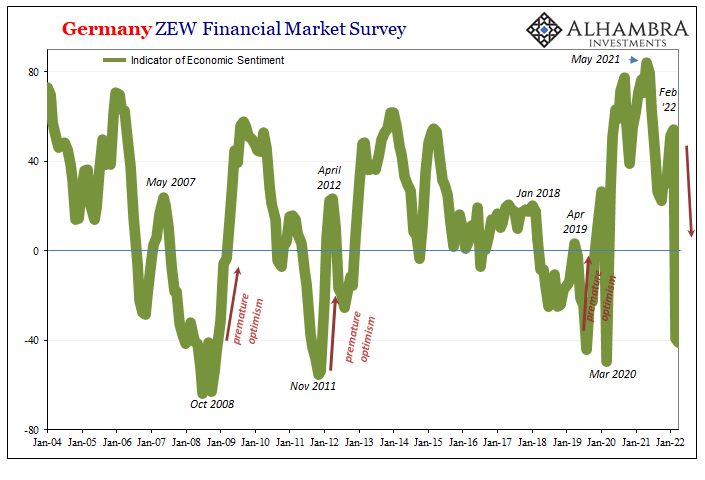

German optimism was predictably, inevitably sent crashing in March and April 2022. According to that country’s ZEW survey, an uptick in general optimism from November 2021 to February 2022 collided with the reality of Russian armored vehicles trying to snake their way down to Kiev. Whereas sentiment had rebounded from an October low of 22.3, blamed on whichever of the coronas, by February the index had moved upward to 54.3.

Read More »

Read More »

New Day, Same as the Old Day

Overview: It is a new day, but with the continued rise in interest rates and weaker equities, it feels like yesterday. Only China and Hong Kong among the major markets in Asia Pacific resisted the pull lower. Europe's Stoxx 600 is off by more than 0.5% led by health care and real estate. It is the fourth loss in five sessions and brings the benchmark to its lowest level since March 18. US futures are flattish.

Read More »

Read More »

Equities Finding a Bid in Europe After Sliding in Asia Pacific

Overview: The capital markets are calmer today. The market is digesting the FOMC minutes, where officials tipped an aggressive path to shrink the balance sheet and confirmed an "expeditious" campaign to lift the Fed funds rate to neutrality. Benchmark 10-year yields are softer, with the US off a couple basis points to 2.58%. European yields are 1-3 bp lower.

Read More »

Read More »

Capital and Commodity Markets Strain

Overview: The capital and commodity markets are becoming less orderly. The scramble for dollars is pressuring the cross-currency basis swaps. Volatility is racing higher in bond and stock markets. The industrial metals and other supplies, and foodstuffs that Russia and Ukraine are important providers have skyrocketed. Large Asia Pacific equity markets, including Japan, Hong Kong, China, and Taiwan fell by 1%-2%, while South Korea, Australia,...

Read More »

Read More »

As The Fed Seeks To Justify Raising Rates, Global Growth Rates Have Been Falling Off Uniformly Around The World

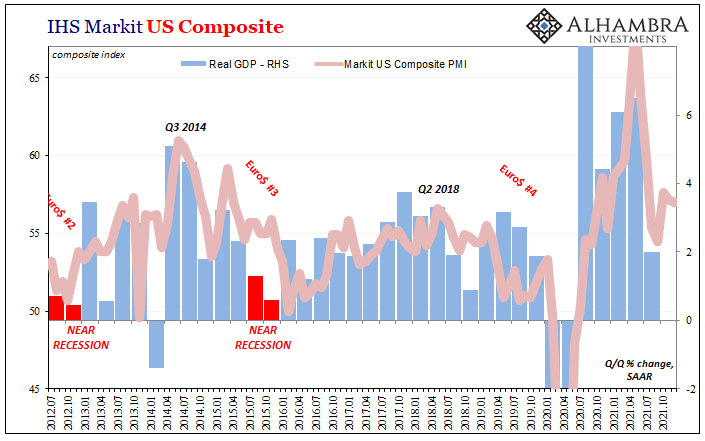

Sentiment indicators like PMI’s are nice and all, but they’re hardly top-tier data. It’s certainly not their fault, these things are made for very times than these (piggy-backing on the ISM Manufacturing’s long history without having the long history). Most of them have come out since 2008, if only because of the heightened professional interest in macroeconomics generated by a global macro economy that can never get itself going.

Read More »

Read More »

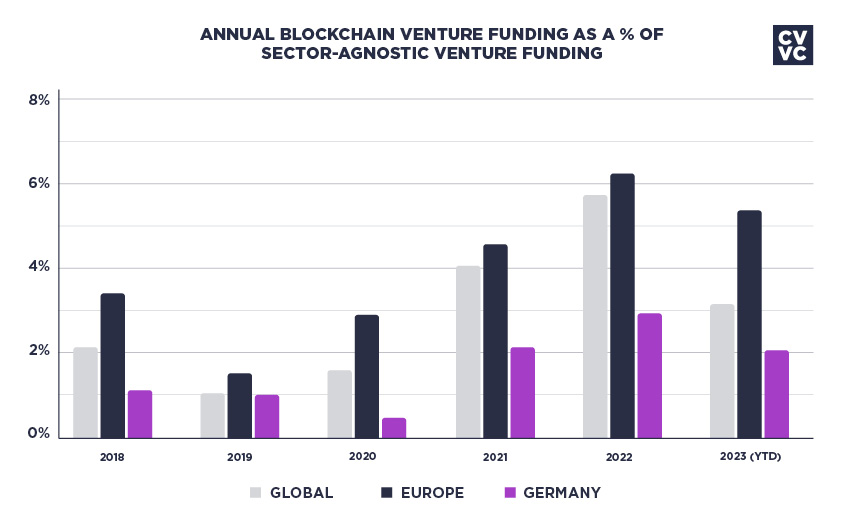

Roll Out of Digital Euro Could Transform Payments in Germany

A digital programmable euro is essential for innovative business models in Germany, according to the Frankfurt School Blockchain Centre (FSBC).

Read More »

Read More »

Markets Turn Cautious Ahead of Tomorrow’s US CPI

Overview: The euro has come back offered after its seemingly inexplicable advance yesterday. The dollar is firmer against most major currencies today, with the yen an exception after JPY114.00 held on yesterday's advance. Most emerging market currencies are also softer, with a handful of smaller Asian currencies proving a bit resilient. Most large bourses advance in the Asia Pacific region, except Japan and Australia. Europe's Stoxx 600 is...

Read More »

Read More »

Markets Calmer, Awaiting Fresh Incentives

Overview: The capital markets are calmer today, and the fear that was evident at the end of last week remains mostly scar tissue. Led by gains in Japan, China, Australia, New Zealand, and India, the MSCI Asia Pacific Index extended yesterday's gains. Europe's Stoxx and US futures are firm. The US 10-year yield is softer, around 1.43%, while European yields are mostly 1-2 bp lower. The Norwegian krone and euro lead major currencies higher...

Read More »

Read More »

Animal Spirits Roar Back

Overview: A return of risk appetites can be seen through the capital markets today, arguably encouraged by ideas that Omicron is manageable and China's stimulus. Led by Hong Kong and Japan, the MSCI Asia Pacific rose by the most in three months, while Europe's Stoxx 600 gapped higher, leaving a potentially bullish island bottom in its wake. US futures point to a gap higher opening when the local session begins. The bond market is taking it in...

Read More »

Read More »

The ‘Growth Scare’ Keeps Growing Out Of The Macro (Money) Illusion

When Japan’s Ministry of Trade, Economy, and Industry (METI) reported earlier in November that Japanese Industrial Production (IP) had plunged again during the month of September 2021, it was so easy to just dismiss the decline as a product of delta COVID.

Read More »

Read More »

Turkey gets a Reprieve before US Thanksgiving, but Capital Strike may not be Over

Overview: The dramatic collapse of the Turkish lira was like an accident one could not help look at, but it was not an accident, but the result of a disregard for the exchange rate and compromised institutions. The lira was off around 15% at its worst yesterday, before settling 11.2% lower. After falling for 11 sessions, it has steadied today (~2.7%) but the capital strike may not be over. On the other hand, the Reserve Bank of New Zealand...

Read More »

Read More »

FX Daily, November 9: Falling Yields Give the Yen a Boost

Overview: Reports that the Fed's Brainard was interviewed for the Chair helped soften yields a bit, not that they needed extra pressure, on ideas she is more dovish than Powell. In turn, the lower yields saw the yen rise to its best level in nearly a month and led the major currencies higher against the dollar.

Read More »

Read More »

The Real Tantrum Should Be Over The Disturbing Lack of Celebration (higher yields)

Bring on the tantrum. Forget this prevaricating, we should want and expect interest rates to get on with normalizing. It’s been a long time, verging to the insanity of a decade and a half already that keeps trending more downward through time. What’s the holdup?

Read More »

Read More »

An Anti-Inflation Trio From Three Years Ago

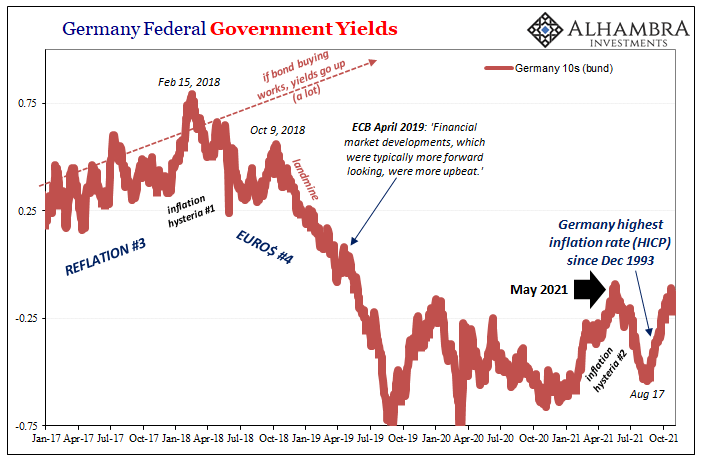

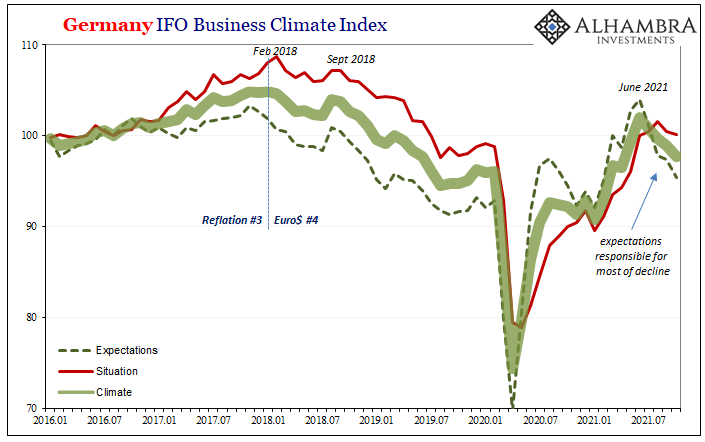

Do the similarities outweigh the differences? We better hope not. There is a lot about 2021 that is shaping up in the same way as 2018 had (with a splash of 2013 thrown in for disgust). Guaranteed inflation, interest rates have nowhere to go but up, and a certified rocking recovery restoring worldwide potential.

Read More »

Read More »

Consolidative Session as Markets Await Fresh Incentives

Overview: The markets lack a clear direction today and await fresh incentives. After gaining almost 1% yesterday, the MSCI Asia Pacific Index slipped. Japan, Hong Kong, and Australia are among the few equity markets that rose.

Read More »

Read More »

The Euro Remains Within Last Wednesday’s Range

Overview: A weak close in US equity trading yesterday and the widening of China's "cultural revolution" for a two-month investigation of the financial sector stopped a three-day advance in the MSCI Asia Pacific Index. China, South Korea, and Taiwan saw more than a 1% decline in their major indices.

Read More »

Read More »