Tag Archive: Germany Manufacturing PMI

The Manufacturing Purchasing Managers’ Index (PMI) measures the activity level of purchasing managers in the manufacturing sector. A reading above 50 indicates expansion in the sector; below 50 indicates contraction. Traders watch these surveys closely as purchasing managers usually have early access to data about their company’s performance, which can be a leading indicator of overall economic performance.

FX Daily, 01 February: Markets Stabilize, Investors Await Signals from US data and FOMC, and POTUS

(commentary will be sporadic for the next couple of weeks during a European business trip) The US dollar is consolidating yesterday's losses that were spurred speculation that the US was abandoning the more than 20-year old strong dollar policy. The meaning of that policy was clear to global investors even if it was often parodied.

Read More »

Read More »

FX Daily, January 24: UK Supreme Court Requires May to Submit Bill on Brexit to Parliament

As widely expected, the UK Supreme Court ruled that Parliament approval is needed to trigger Article 50 start the divorce proceedings with the EU. The Court decided by an 8-3 majority that a bill needs to be submitted to both chambers, but that the approval of the regional assemblies (e.g. Scotland, Northern Ireland) is not necessary.

Read More »

Read More »

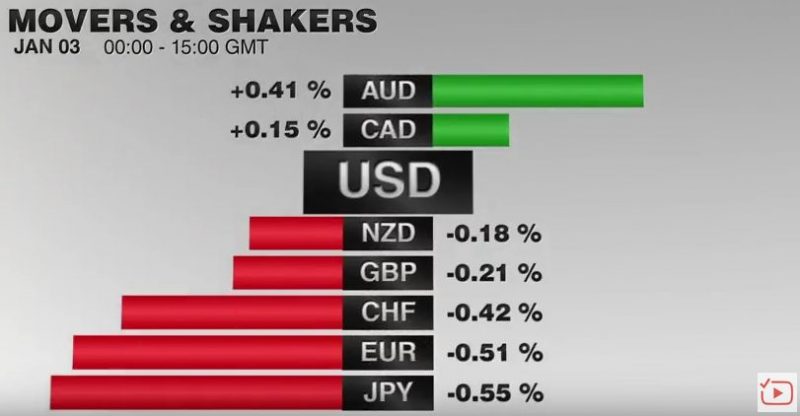

FX Daily, January 03: Dollar-Bloc and Sterling Advance, while Euro and Yen Slip

The US dollar is mixed. After a soft start in Asia, where Tokyo markets were closed, the dollar recovered smartly against the euro and yen. The dollar-bloc and sterling are firmer. Sterling's earlier losses were recouped following news that the manufacturing PMI jumped to 56.1, its highest since June 2014.

Read More »

Read More »

FX Daily, December 01: Dollar is on the Defensive, though Yields Rise

The US dollar is trading heavily against most of the major currencies, but the general tone appears consolidative in nature. Despite a disappointing UK manufacturing PMI (53.4, a four-month low), sterling is near a three-week high above $1.2600.

Read More »

Read More »

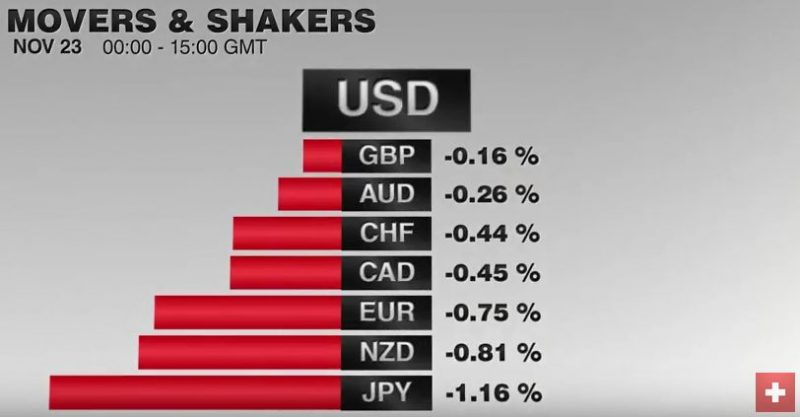

FX Daily, November 23: Dollar Sees Flat Consolidation while the Equity Advance Fizzles in Europe

The US dollar is trading inside yesterday's ranges against the euro and yen. The dollar's tone matches the consolidation in the debt market ahead of today's slew of US data and tomorrow's holiday. Tokyo markets were on holiday.

Read More »

Read More »

FX Daily, November 02: Standpat FOMC Trumped by US Political Jitters

The single biggest driver in the capital markets is the continued narrowing of the US election polls. The prospect of a Trump presidency and the dramatic changes that could entail is rattling investors and spurring position squaring.The dollar is broadly lower as are stocks. The surge in global yields has been arrested.

Read More »

Read More »

FX Daily, October 03: May’s Confirmation Sends Sterling Lower

Sterling has a bad case of the Monday blues. Even the moon looks distraught. Prime Minister May has confirmed earlier suggestions that she will trigger Article 50 to formally begin its divorce proceedings from the EU at the end of Q1 17. Several officials have already hinted this time frame, though many have been skeptical that Article 50 would be triggered at all, given the complexities of the issues.

Read More »

Read More »

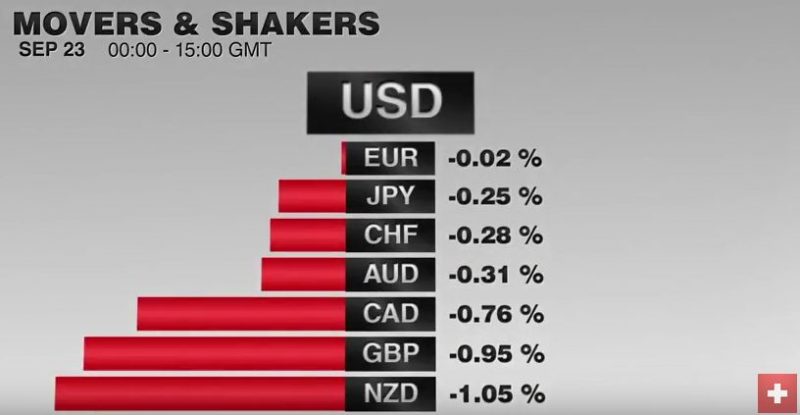

FX Daily, September 23: It is Friday and the Dollar is Firmer Again

As Nassim Taleb instructed, we should not be fooled by randomness. If you see six red results in a row at a roulette table, do not conclude the game is rigged. If you flip a coin, and it is tails six consecutive times, the contest is not necessarily rigged.

Read More »

Read More »

FX Daily, September 01: A Couple of Surprises to Start the New Month

The new month has begun with a couple of surprises. The biggest surprise has been the record jump in the UK manufacturing PMI to 53.3 from 48.3. A much smaller rebound was expected in August after the Brexit shock drop in July.

Read More »

Read More »

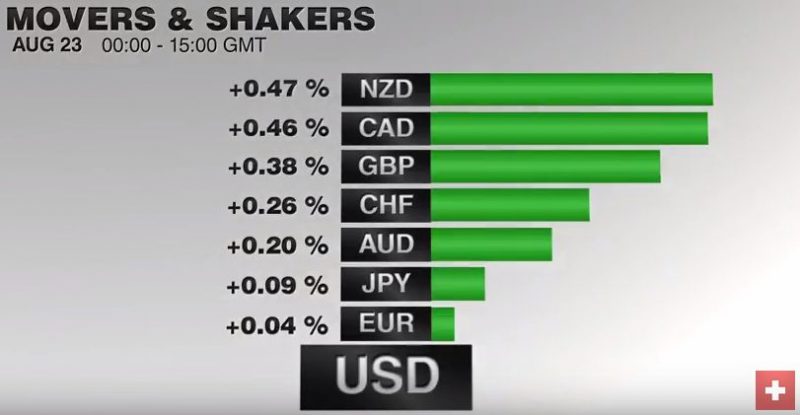

FX Daily, August 23: Broadly Mixed Dollar in a Mostly Quiet Market

The US dollar is mostly little changed against the major, as befits a summer session.There are two exceptions.The first is the New Zealand dollar. Comments by the central bank's governor played down the need for urgent monetary action and suggested that the bottom of cycle may be near 1.75% for the cash rate, which currently sits at 2.0%.This means that a cut next month is unlikely. November appears to be a more likely timeframe.

Read More »

Read More »