Tag Archive: Germany Composite PMI

FX Daily, June 05: US Dollar Starts Important Week Mostly Stable to Higher

The US dollar is beginning what promises to be an important week on a steady to firmer note against most of the major currencies. It is a holiday in parts of Europe (e.g.,m Germany and Switzerland). Although excitement is not until Thursday's ECB meeting, UK election, and the testimony of former US FBI Director Comey, there are several developments today to note.

Read More »

Read More »

FX Daily, May 23: Greenback Remains Soft

The US dollar cannot get out of its own way, it seems. With a light economic schedule, there is little to offset the continued drumbeat of troubling political developments. The latest turn, as reported first in the Washington Post, that President Trump asked heads of intelligence groups to also publicly deny collusion with Russia.

Read More »

Read More »

FX Daily, May 04: Greenback Struggles to Sustain Upticks, Though Odds of June Hike Rise

The US dollar is struggling to maintain even modest upticks against the euro and sterling despite the recognition of the increased likelihood of a June Fed hike. Bloomberg sees current pricing in the Fed funds as making a hike in June a near certainty (97.5%), while the CME and our own calculation estimates the market is discounting around 70%-75% chance of a hike.

Read More »

Read More »

FX Daily, April 21: Markets Enter Consolidative Mode Ahead of Weekend

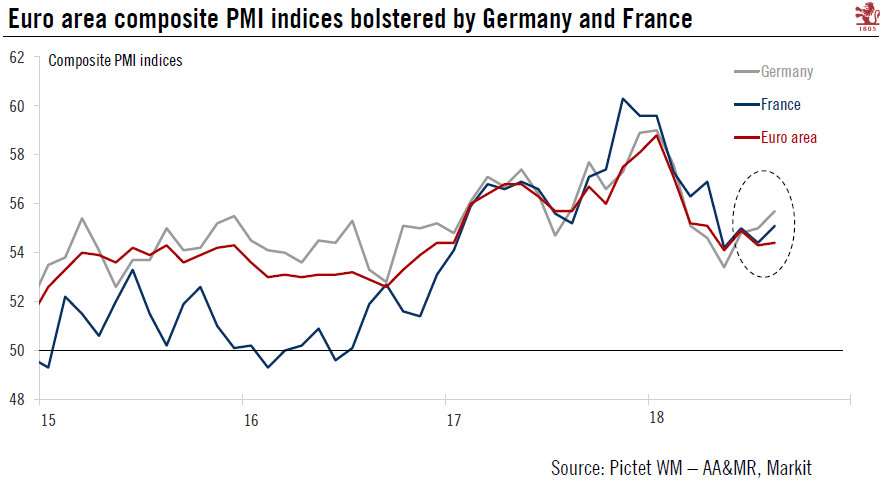

Neither the terrorist attack in Paris nor the strong eurozone flash PMI has managed to shake investors. Judging from the social media, many suspect that the terrorist attack plays into Le Pen's hands, but investors do not seem particularly concerned. The French interest rate premium over Germany has narrowed, and gold is flat. UK retail sales fell sharply, yet sterling is holding on to the bulk of this week's gains, which are the most here in 2017.

Read More »

Read More »

FX Daily, March 24: Dollar Trying to Stabilize Ahead of the Weekend

The US dollar has been stabilizing over the past couple of sessions. This broad stability of the dollar is impressive because of the questions of the prospects of US President Trump's economic agenda. Expectations for tax reform and infrastructure spending have bolstered investor confidence and helped boost equity prices despite what appears to be stretched valuation.

Read More »

Read More »

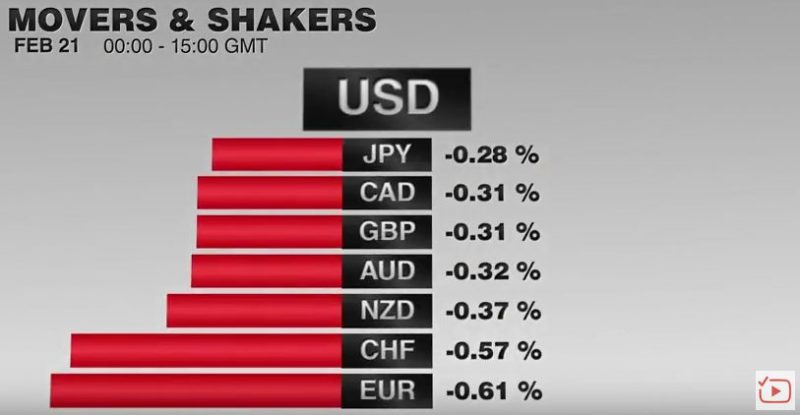

FX Daily, February 21: Dollar Bounces Back

Some profit-taking in the middle of last week pushed the dollar lower and gave rise in some quarters that the run was over. However, the greenback has come back the bid. It is gaining against all the major currencies today and most of the emerging market currencies.

Read More »

Read More »

FX Daily, January 24: UK Supreme Court Requires May to Submit Bill on Brexit to Parliament

As widely expected, the UK Supreme Court ruled that Parliament approval is needed to trigger Article 50 start the divorce proceedings with the EU. The Court decided by an 8-3 majority that a bill needs to be submitted to both chambers, but that the approval of the regional assemblies (e.g. Scotland, Northern Ireland) is not necessary.

Read More »

Read More »

FX Daily, December 05: Dollar Comes Back Bid, but Still Vulnerable to Corrective Pressures

After softening ahead of the weekend, the US dollar has begun the new week on a firm note. It is gaining against most major and emerging market currencies. Outside of what appears to be a staged call between US President Elect Trump and the Taiwanese President, the developments in Europe grabbed the markets' attention. Austria turned back the populist right Freedom Party's bid for the presidency. The Freedom Party does not appear to have carried...

Read More »

Read More »

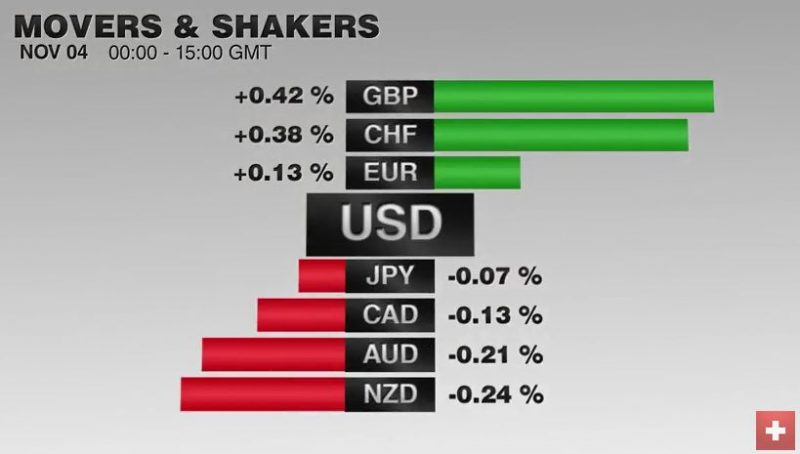

FX Daily, November 04: US Jobs Figures: Another Time the Swiss Franc Strengthens

With the not convincing U.S. jobs number, both the EUR and, in particular, the Swiss Franc could improve. With continuing political uncertainty in the U.S., more speculators closed their short CHF positions

Read More »

Read More »

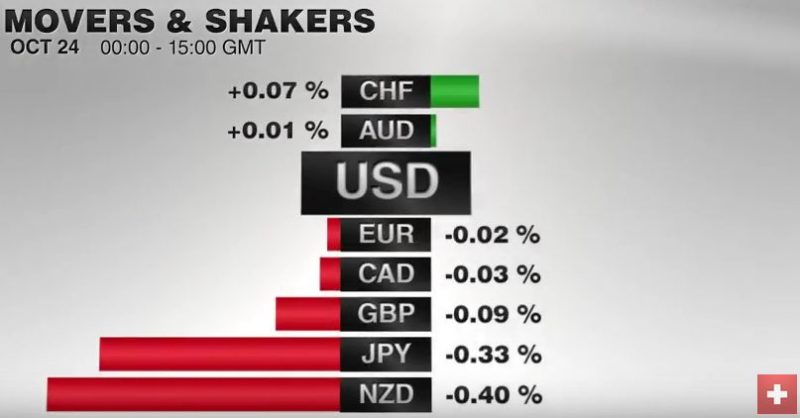

FX Daily, October 24: Dollar Begins Mostly Slightly Lower, and Risk is On to Start the Week

Sterling vs the Swiss Franc has remained close to its lowest level in history caused by the aftermath of the Brexit vote back in June and more recently the announcement that Article 50 will be triggered by March 2017. Confidence in Sterling exchange rates has plummeted recently and until we get some form of assurances as to how the talks may go with the European Union we could see Sterling fall even further against the Swiss Franc than its current...

Read More »

Read More »