Tag Archive: British Pound

FX Weekly Review, March 20 – March 25: Dollar Bottom Near?

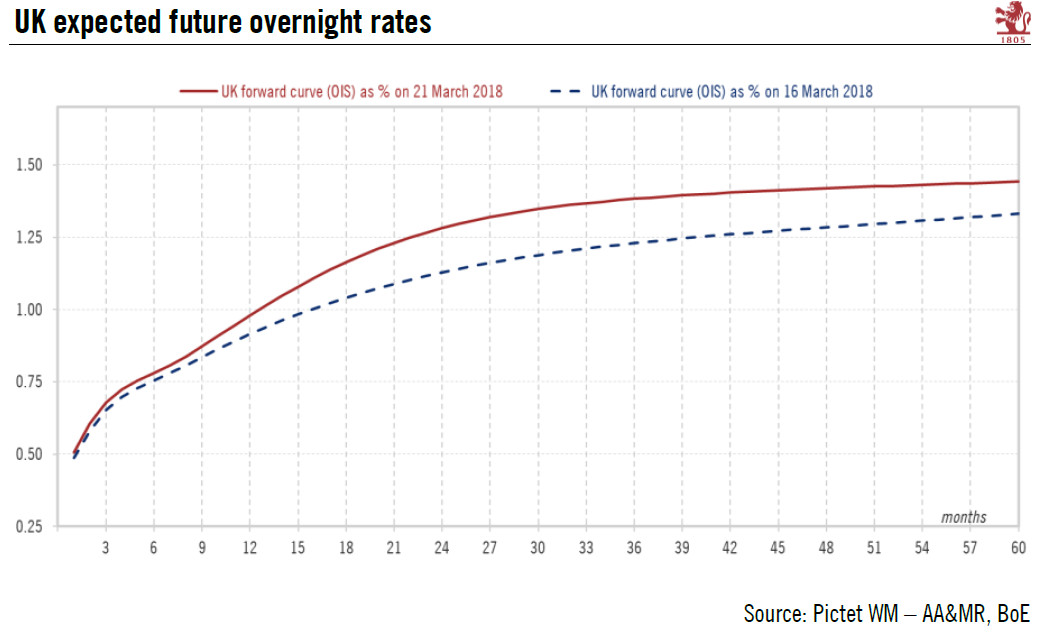

In the last week, the Swiss Franc index recovered and gained about 2%. The dollar index lost 1.5%. Position adjustments: The dollar tended to trade heaviest against those currencies that speculators were short, like the euro, yen, and sterling.

Read More »

Read More »

FX Weekly Review, March 13 – March 18: Fed Disappoints, Dollar Losses

The failure of the Fed to signal an increased pace of normalization and the prospects of other central banks raising rates spurred dollar losses, which deteriorated its technical outlook.

Read More »

Read More »

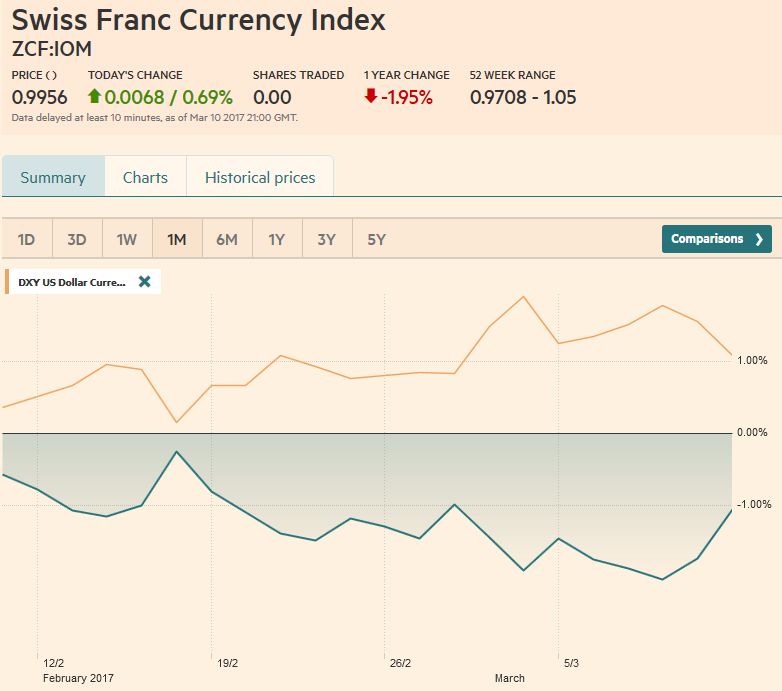

FX Weekly Review, March 06 – March 11: CHF loses against the euro

The Swiss Franc lost this week in particular against the euro, given that Mario Draghi was less dovish than expected. If the stronger euro is driven only by speculators, or also by "real money" (investments in cash, bonds, stocks) will be visible in Monday's sight deposits release.

Read More »

Read More »

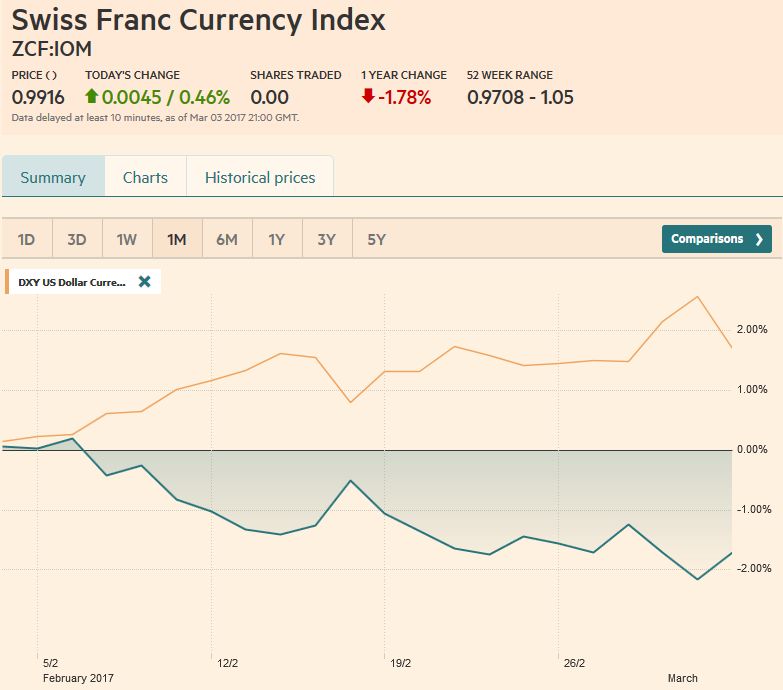

FX Weekly Review, February 27 – March 04: Dramatic Shift in Fed Expectations Spurs Dollar Gains, but Now What?

The pendulum of market sentiment swung hard and fast toward a Fed rate hike in the middle of March. The signals from Fed officials, including Governor Brainard and Powell, spurred the move. According to Bloomberg, the market had discounted a 90% chance of a hike before Yellen and Fischer spoke. A week ago, Bloomberg calculations showed a 40% chance of a move.

Read More »

Read More »

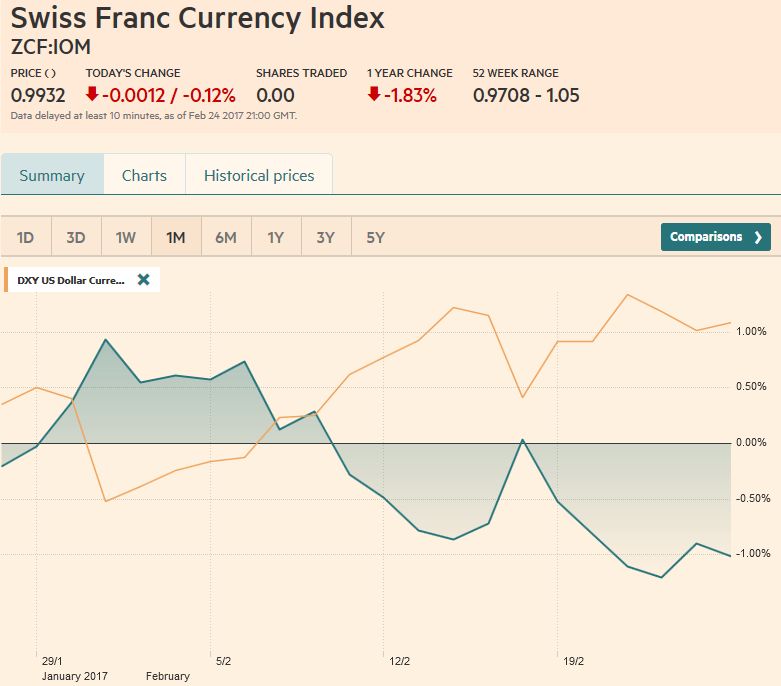

FX Weekly Review, February 20 – 25: Ranges in FX: Respect the Price Action

It is difficult right now to talk about the foreign exchange market using the dollar as the numeraire. The dollar was stronger against most of the major currencies last week, but not the yen or sterling. The Dollar Index itself was little changed, rising less than 0.15%.

Read More »

Read More »

FX Weekly Review, February 13 – 18: Why still long the dollar?

Arguments for being long the dollar: FX investors because of the difference in monetary policy (e.g. higher US rates), Bond investors long US Bonds because higher bond yields, On the other side, European and Swiss equities are not so much overvalued as U.S. stocks are.

Read More »

Read More »

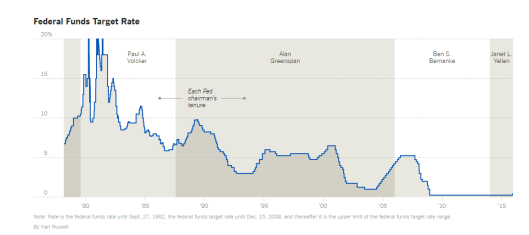

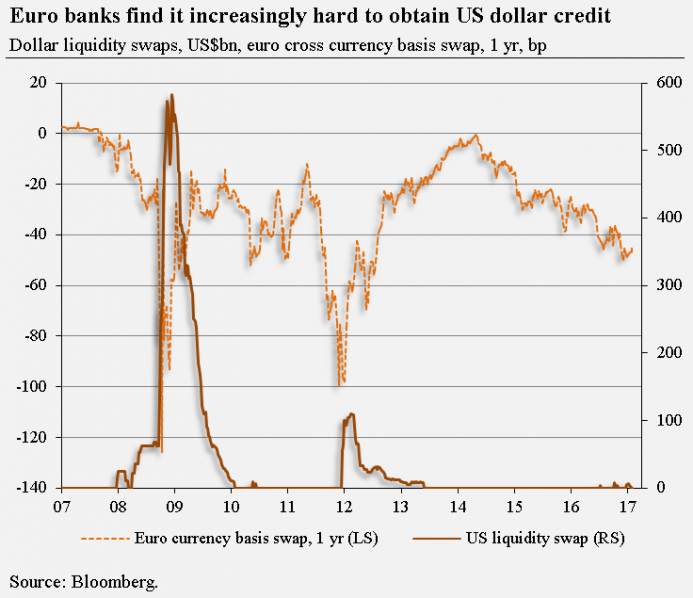

What Will Trump Do About The Central-Bank Cartel?

The US is by far the biggest economy in the world. Its financial markets — be it equity, bonds or derivatives markets — are the largest and most liquid. The Greenback is the most important transaction currency. Many currencies in the world — be it the euro, the Chinese renminbi, the British pound or the Swiss franc — have actually been built upon the US dollar.

Read More »

Read More »

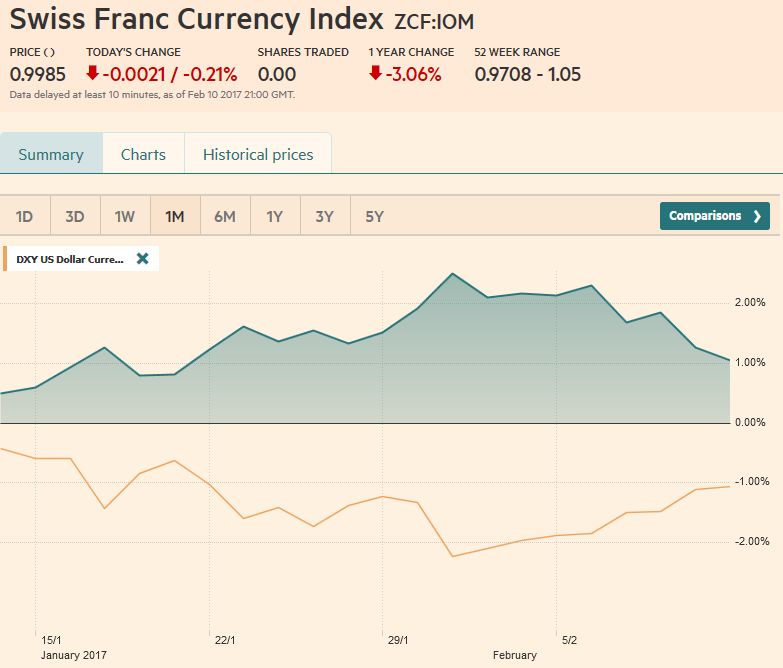

FX Weekly Review, February 06 – 11: Further Dollar and CHF Strength versus Euro weakness ahead?

We are expecting a further strengthening of both dollar and Swiss Franc against the euro over the next 3 months. Reason is the rising Swiss demand the continued dovishness of the ECB, despite rising inflation.

Read More »

Read More »

Great Graphic: Interesting Sterling Price Action

Sterling is having an interesting day. It fell in the face of the US dollar's bounce but has recovered fully. It has not yet traded above yesterday's high (~$1.2510) but it may. It does appear to be tracing out a hammer in Japanese candle stick terms.

Read More »

Read More »

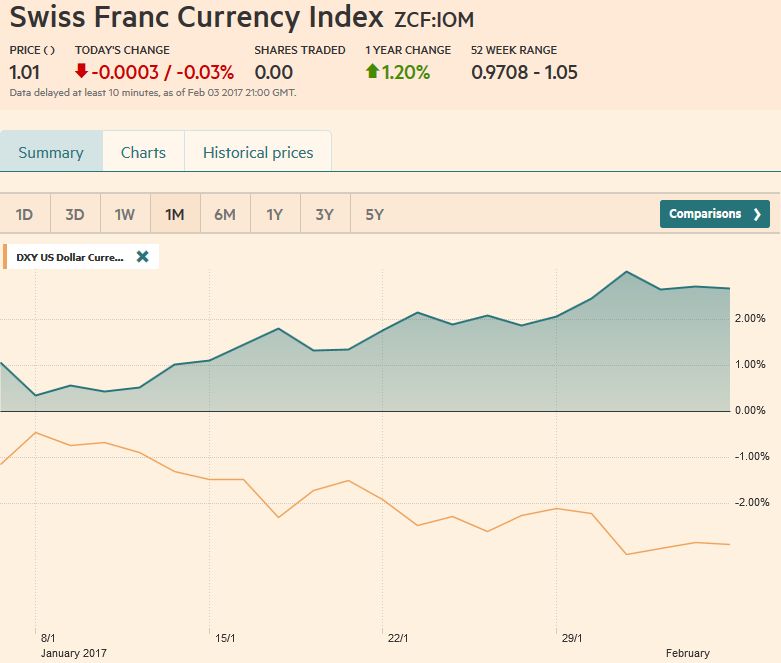

FX Weekly Review, January 30 – February 04: Reversal of Trump Reflation Trade Continues

The Swiss Franc index remained around the 2% gain that for the last month, the recovery from the Trump reflation trade. In this trade, investors preferred U.S. against European stocks. This tendency, however, is reversing now - and with it the franc recovered.

Read More »

Read More »

FX Weekly Review, January 23 – 28: Dollar Downwards and CHF Upwards Correction, for how long?

The US dollar spent the first month of the new year correcting lower after a strong advance in the last several months of 2016. We argue that the correction actually began in mid-December following the Federal Reserve's rate hike.

Read More »

Read More »

UK Supreme Court Decision: Anti-Climactic?

Sterling retreats on court ruling but key supports hold and it recoups initial loss. The US dollar is recovering with the help of firming US yields. Investors are still anxious for details of new US government's tax, deregulation, and infrastructure investment plans.

Read More »

Read More »

FX Weekly Review, January 16 – 21: Dollar Still Appears to Carving out a Bottom

The US dollar turned in a mixed performance over the past week. The technical indicators continue to support our expectation that after correcting since mid-December, following the Fed's hike, the dollar is basing.

Read More »

Read More »

Great Graphic: Is the Pound Sterling?

Sterling's 2.75% rally today is the biggest advance in more than eight years. The UK government has done a good job of managing expectations. Over the last week or so, Prime Minister May and Chancellor of the Exchequer Hammond has made it clear that the intention was a "clean break" from the EU.

Read More »

Read More »

FX Weekly Review, January 09 – 14: Dollar Correction may be Over or Nearly So

For the first week since the election of Trump, the Swiss Franc index had a clearly better performance than the dollar index. It improved by 1.5% in the last ten days.

Read More »

Read More »

SNB announces 24 bn CHF profit for 2016 thanks to rising stock markets.

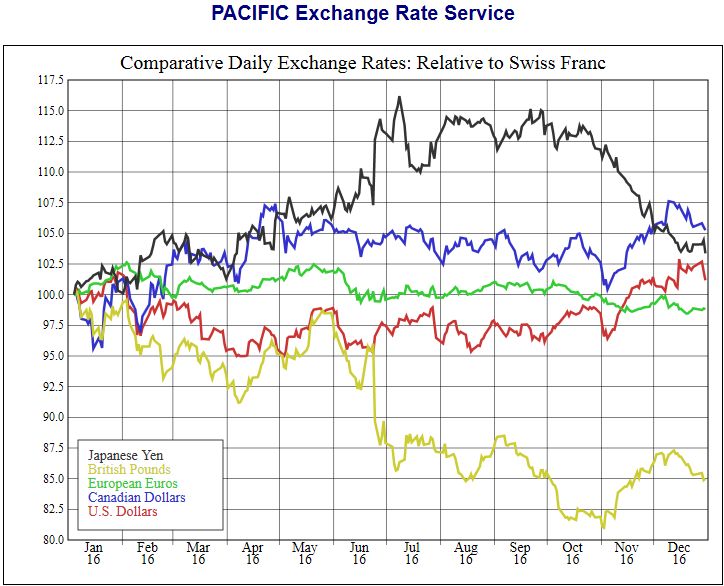

The Swiss National Bank has announced 24 bn profits from 2016. Profits came from the dollar, yen and Canadian dollar, while the pound retreated by 15%. The EUR/CHF is only slightly weaker, mostly because the SNB actively supported the euro.

Read More »

Read More »

FX Weekly Review, January 02 – 07: Is the corrective phase of the dollar over?

The lack of full participation and the resulting choppy conditions may have obscured the signal from the capital markets. That signal we think was one of correction since shortly after the Fed's rate hike in id-December. The question now, after the US employment data showed continued labor market strength and that earnings improvement remains intact, is whether the corrective phase is over.

Read More »

Read More »

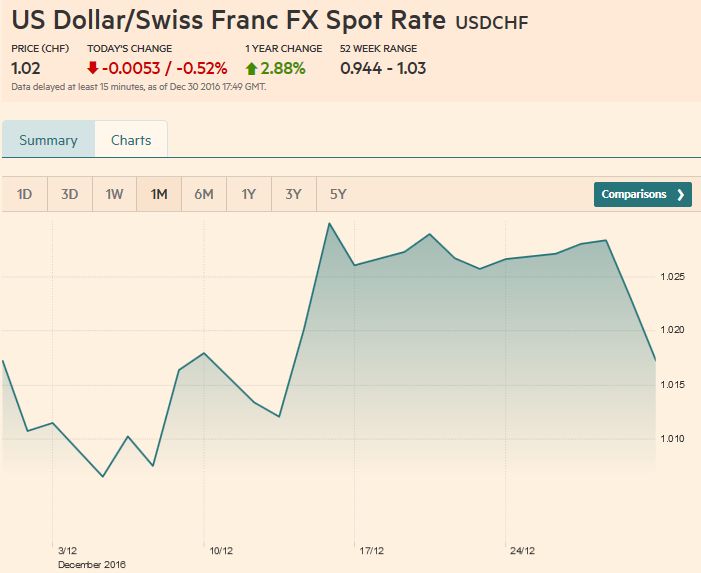

FX Weekly Review, December 26 – 30: Dollar Correction Poised to Continue

The technical condition of the US dollar, which has been advancing through most of the Q4 16, has been deteriorating This led us to anticipate a consolidative or corrective phase.

Read More »

Read More »

FX Weekly Review, December 19 – December 23: Assessment of the Dollar’s Technical Condition

The small adjustment to Fed’s anticipated path for the Fed funds target helped lift the US dollar to its highest level against the euro since 2003, and to ten-month highs against the Japanese yen. The graph shows that the dollar has improved by 25% against the euro, but only by 10% against CHF over the last 3 years.

Read More »

Read More »