Tag Archive: Eurozone

Nomi Prins’ Political-Financial Road Map For 2017

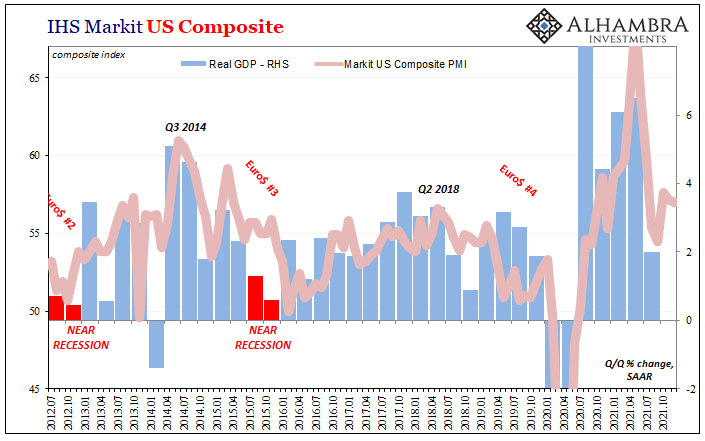

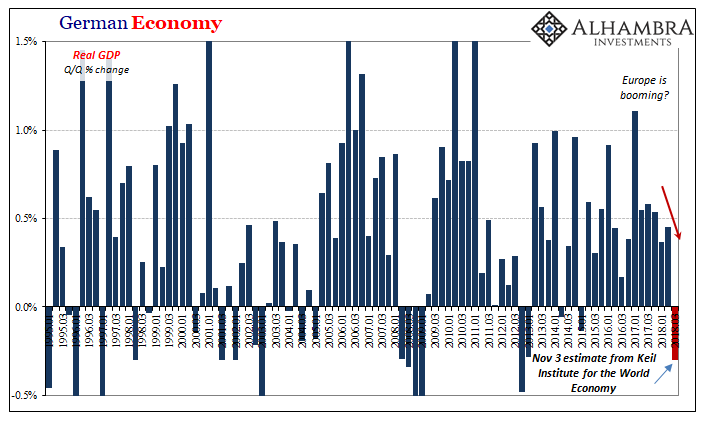

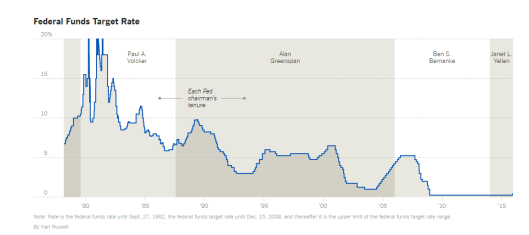

As tumultuous as last year was from a global political perspective on the back of a rocky start market-wise, 2017 will be much more so. The central bank subsidization of the financial system (especially in the US and Europe) that began with the Fed invoking zero interest rate policy in 2008, gave way to international distrust of the enabling status quo that unfolded in different ways across the planet.

Read More »

Read More »

European Stocks Greet The New Year By Rising To One Year Highs; Euro Slides

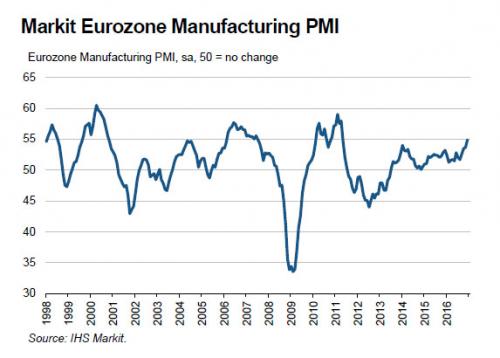

While most of the world is enjoying it last day off from the 2017 holiday transition, with Asia's major markets closed for the New Year holiday, along with Britain and Switzerland in Europe and the US and Canada across the Atlantic, European stocks climbed to their highest levels in over a year on Monday after the Markit PMI survey showed manufacturing production in the Eurozone rose to the highest level since April 2011.

Read More »

Read More »

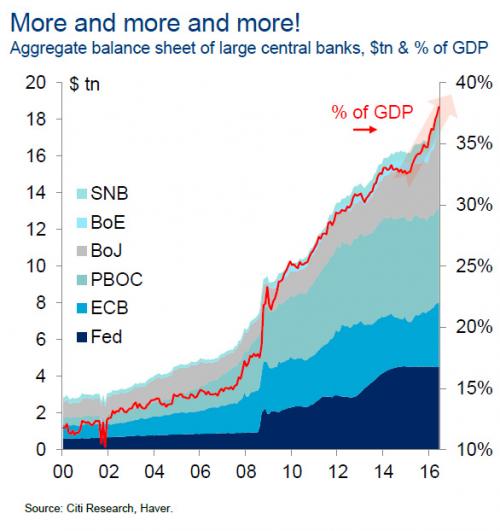

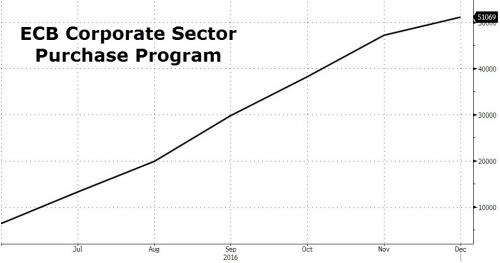

ECB Assets Hit 35 percent Of Eurozone GDP; Draghi Owns 9.2 percent Of European Corporate Bond Market

As global markets bask in the glow of the Trumpflation recovery, the ECB continues to be busy providing the actual levitating power behind what DB recently dubbed global "helicopter money", by buying copious amounts of bonds on a daily basis (at least until tomorrow when the ECB goes on brief monetization hiatus, and Italy will be on its own for the next two weeks).

Read More »

Read More »

Swiss 10 year bond yields still negative, but approaching zero.

The global bond rout returned with a bang, sending 10Y US Treasury yields as much as six basis points higher to 2.53%, the highest level in over two years. The selloff happened as oil prices surged by more than 5% following Saturday's agreement by NOPEC nations agreed to slash production, leading to rising inflation pressures. At last check, the 10Y was trading at 2.505%, up from 2.462% at Friday and on track for its highest close since September...

Read More »

Read More »

Italian Euro Exit: Why it Might Come in some Years and Why it Will Help the Euro Zone and Italy

Italy has three options: 1. exit the euro zone and devalue the currency; 2. remain in the euro zone and devalue salaries. 3. go for Japan-like decades-long slow growth with stagnating wages, but also with falling inflation and (positive news!) falling bond yields.

Read More »

Read More »

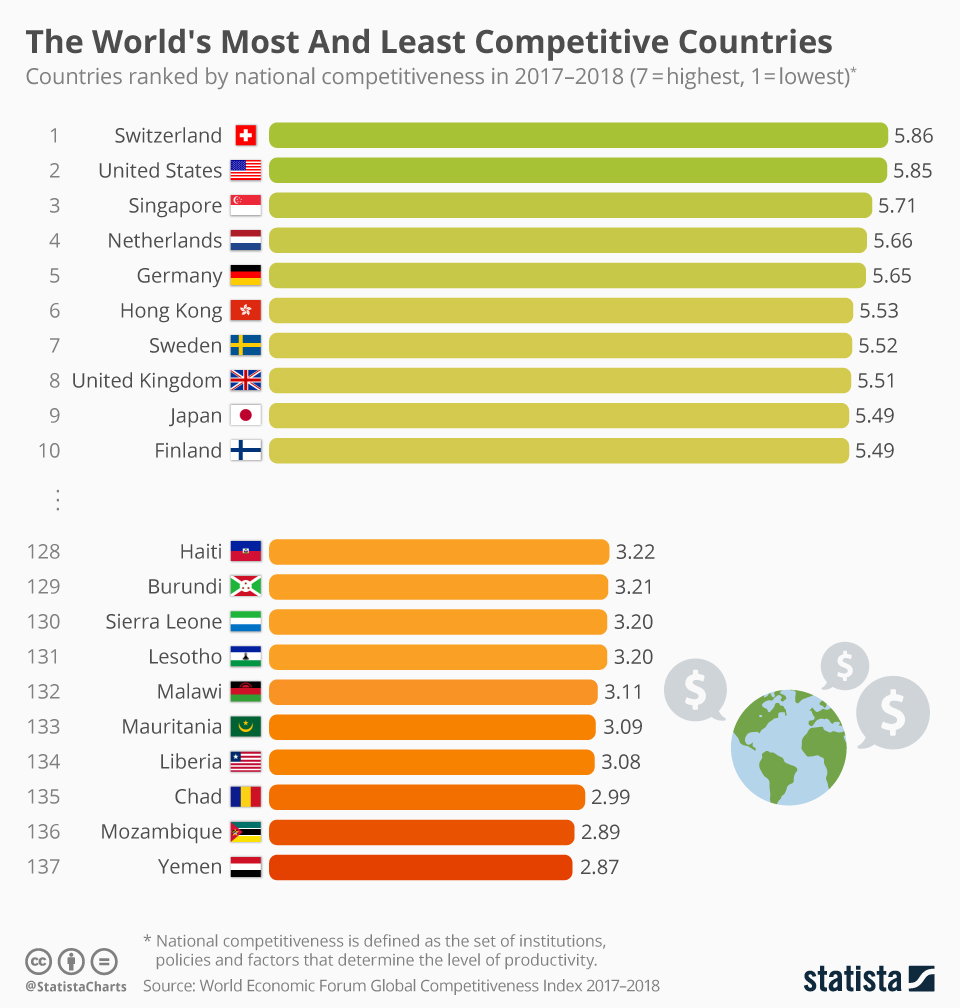

You’ll Only Understand Trump and Brexit If You Understand the Failure of Globalization

You can only understand the victory of Donald Trump and Brexit once you understand the failure of globalization… Trump made rejection of globalization a centerpiece of his campaign. In his July 21st acceptance speech as the Republican nominee, he said: Americanism, not globalism, will be our credo.

Read More »

Read More »

European Central Bank gold reserves held across 5 locations. ECB will not disclose Gold Bar List.

The European Central Bank (ECB), creator of the Euro, currently claims to hold 504.8 tonnes of gold reserves. These gold holdings are reflected on the ECB balance sheet and arose from transfers made to the ECB by Euro member national central banks, mainly in January 1999 at the birth of the Euro. As of the end of December 2015, these ECB gold reserves were valued on the ECB balance sheet at market prices and amounted to €15.79 billion.

Read More »

Read More »

FX Daily, October 21: Greenback Ending Week on Firm Note

The US dollar is firm especially against the European complex and emerging market currencies. The yen continues to be resilient, and exporters are thought be capping the dollar above JPY104. The dollar is lower against the yen for the fourth consecutive session and set to snap a three-week advancing streak.

Read More »

Read More »

Will The ECB Buy Stocks?

Debate about the ECB’s stimulus options have continued to rage, with an equity purchase plan mentioned as a possibility. We think the ECB could legally buy ETFs that fit its requirements… but it would be controversial and we question the benefits. An ETF programme could total EUR 200bn, which would not be large compared to the overall QE programme.

Read More »

Read More »

Rogoff Warns “Cash Is Not Forever, It’s A Curse”

Kenneth Rogoff, Professor of Public Policy at Harvard University, postulates to get rid of cash. In his opinion, killing big bills would hamper organized crime and make negative interest more effective. Kenneth Rogoff makes a provocative proposal. One of the most influential economists on the planet, he wants to phase out cash.

Read More »

Read More »

Negative Rates and The War On Cash, Part 1: “There Is Nowhere To Go But Down”

As momentum builds in the developing deflationary spiral, we are seeing increasingly desperate measures to keep the global credit ponzi scheme from its inevitable conclusion. Credit bubbles are dynamic — they must grow continually or implode — hence they require ever more money to be lent into existence.

Read More »

Read More »

‘Last Economist Standing’ John Taylor Urges “Less Weird Policy” At Jackson Hole

I attended the first monetary-policy conference there in 1982, and I may be the only person to attend both the 1st and the 35th. I know the Tetons will still be there, but virtually everything else will be different. As the Wall Street Journal front page headline screamed out on Monday, central bank Stimulus Efforts Get Weirder. I’m looking forward to it.

Read More »

Read More »

Richard Koo: If Helicopter Money Succeeds, It Will Lead To 1,500 percent Inflation

After today's uneventful Fed announcement, all eyes turn to the BOJ where many anticipate some form of "helicopter money" is about to be unveiled in Japan by the world's most experimental central bank. However, as Nomura's Richard Koo warns, central banks may get much more than they bargained for, because helicopter money "probably marks the end of the road for believers in the omnipotence of monetary policy who have continued to press for further...

Read More »

Read More »

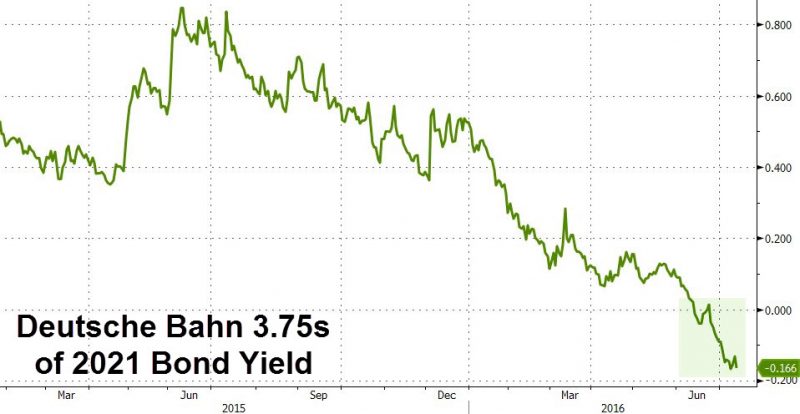

Germany Sells First Ever Negative-Yielding 10Y Treasury, Corporate Bonds

Overnight, we previewed what was about to be a historic for the eurozone bond auction, when this morning Germany sold its first ever 10Y bonds with a zero coupon.

Read More »

Read More »

Stockman Rages: Ben Bernanke Is “The Most Dangerous Man Walking This Planet”

Ben Bernanke is one of the most dangerous men walking the planet. In this age of central bank domination of economic life he is surely the pied piper of monetary ruin. At least since 2002 he has been talking about “helicopter money” as if a notion which is pure economic quackery actually had some legitimate basis.

Read More »

Read More »

BofA: To Save Markets Central Banks Just Made Inequality And Populism Even Worse

There is a large dose of irony to the post-Brexit market response: while on one hand stocks have soared and as of today the S&P500 has already recouped more than half its post-Brexit losses (the SPX sank 5.7% peak-to-trough since the referendum and has since bounced 3.5%) an even sharper reaction has been observed in bonds.

Read More »

Read More »