Tag Archive: Eurozone Industrial Production

Industrial Production measures the change in the total inflation-adjusted value of output produced by manufacturers, mines, and utilities.

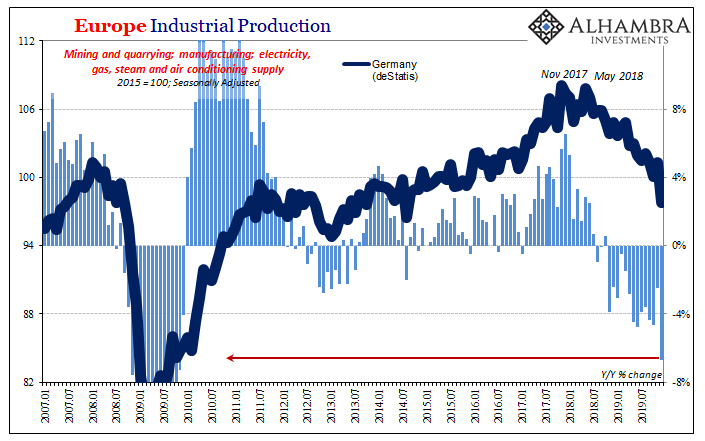

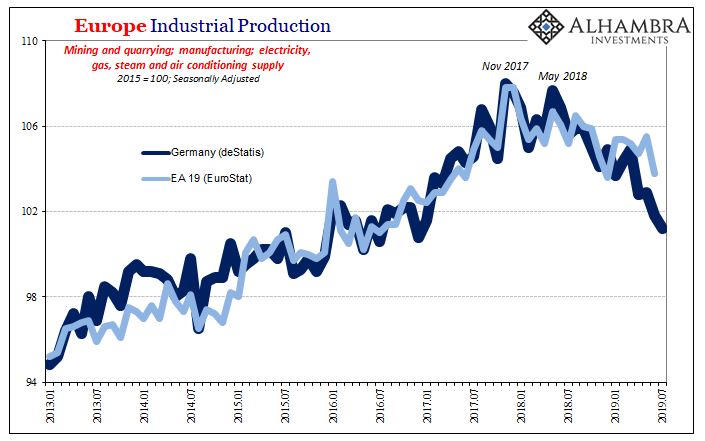

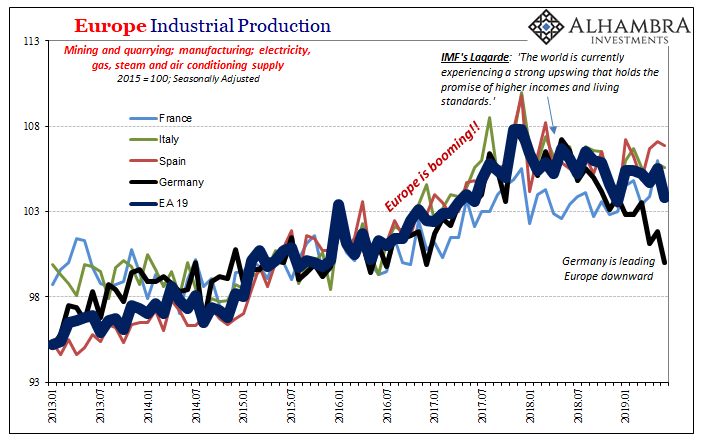

Why You Should Care Germany More and More Looks Like 2009

What if Germany’s economy falls into recession? Unlike, say, Argentina, you can’t so easily dismiss German struggles as an exclusive product of German factors. One of the most orderly and efficient systems in Europe and all the world, when Germany begins to struggle it raises immediate questions about everywhere else.

Read More »

Read More »

FX Daily, July 12: Greenback Limps into the Weekend

Overview: Higher than expected US CPI and the second tepid reception to a US bond auction this week pushed US yields higher and helped stall the equity momentum. Asia Pacific yields, especially in Australia and New Zealand jumped 8-10 bp in response, and Spanish and Portuguese bonds bore the burden in Europe.

Read More »

Read More »

FX Daily, June 13: Financial Statecraft or Whack-a-Mole

Overview: After roiling the markets by threatening escalating tariffs on Mexico, US President Trump has threatened China that if Xi does not meet him and return to the positions that the US claims it had previously, he will through on imposing tariffs to the remaining goods the US buys from China that have not already been penalized.

Read More »

Read More »

FX Daily, April 12: Euro Bid Above $1.13 for the First Time this Month

Overview: The consolidative week in the capital markets is drawing to a close. Equity markets are narrowly mixed. In Asia, most indices outside of the greater China (China, Taiwan, and Hong Kong) edged higher, leaving the MSCI Asia Pacific Index slightly lower on the week. The MSCI Emerging Markets Index snapped a ten-day rally yesterday and is little changed so far today.

Read More »

Read More »

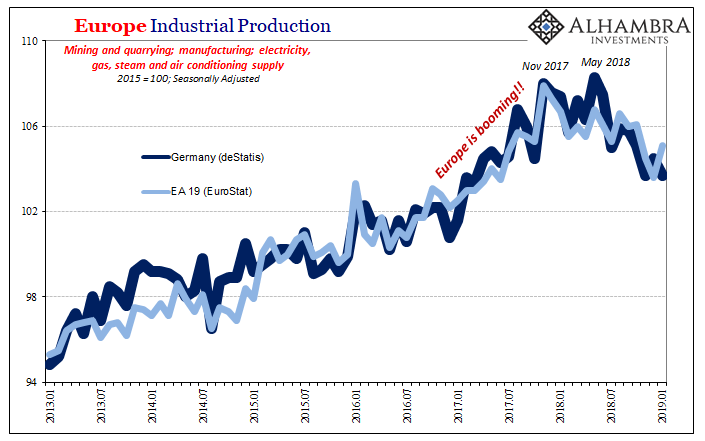

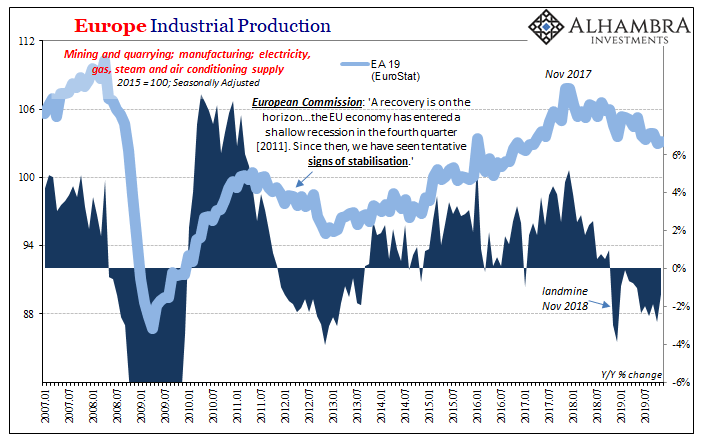

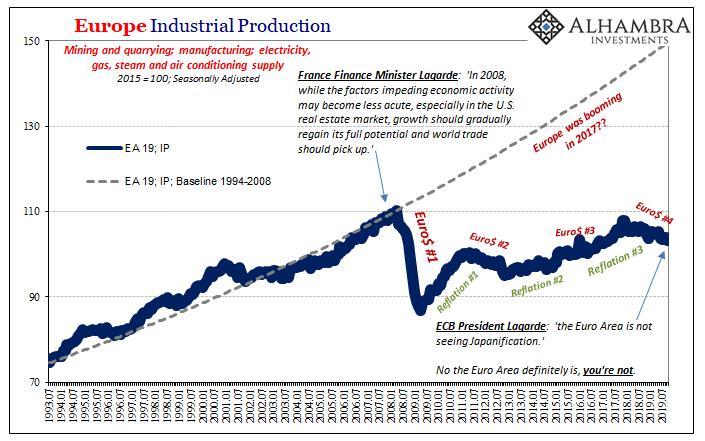

The World Economy’s Industrial Downswing

As economic data for 2019 comes in, the numbers continue to suggest more slowing especially in the goods economy. Perhaps what happened during that October-December window was a soft patch. Even if that was the case, we should still expect second and third order effects to follow along from it.

Read More »

Read More »

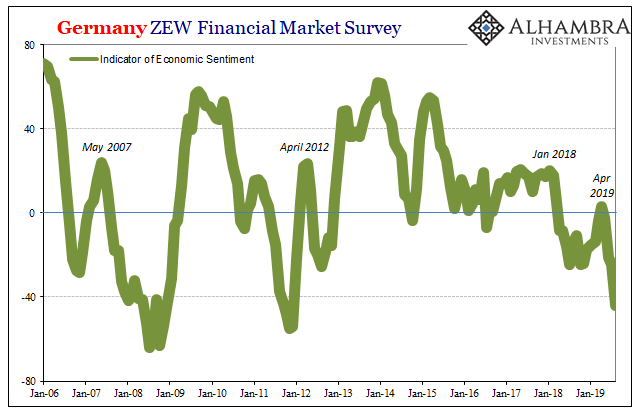

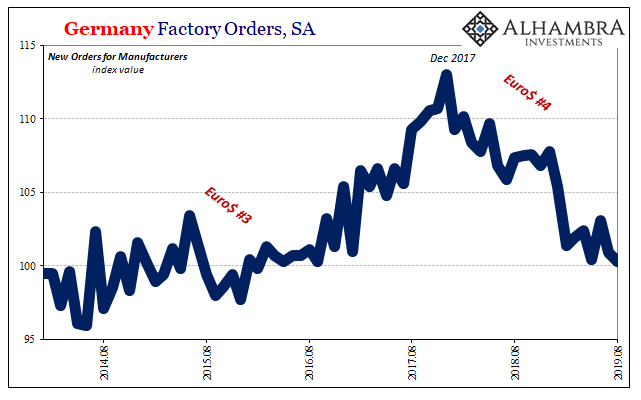

Downturn Rising, German Industry

You know things have really changed when Economists start revising their statements more than the data. What’s going on in the global economy has quickly reached a critical stage. This represents a big shift in expectations, a really big one, especially in the mainstream where the words “strong” and “boom” couldn’t have been used any more than they were.

Read More »

Read More »

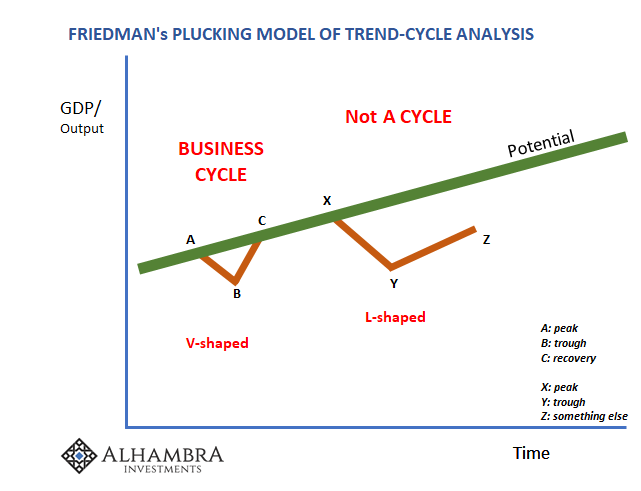

It’s Not That There Might Be One, It’s That There Might Be Another One

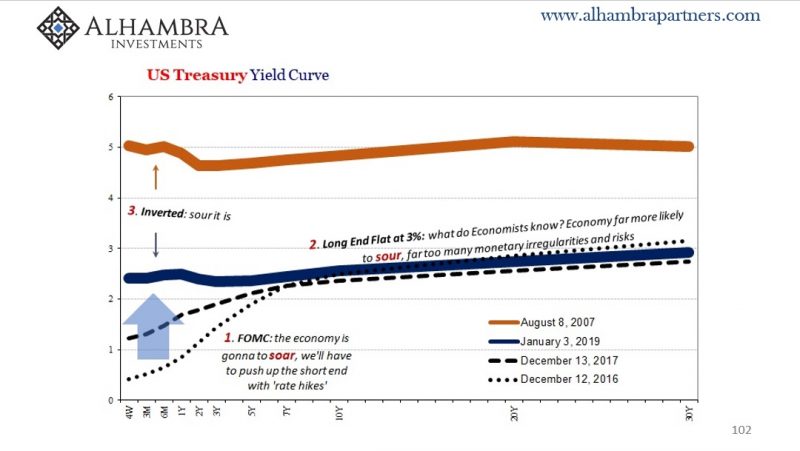

It was a tense exchange. When even politicians can sense that there’s trouble brewing, there really is trouble brewing. Typically the last to figure these things out, if parliamentarians are up in arms it already isn’t good, to put it mildly. Well, not quite the last to know, there are always central bankers faithfully pulling up the rear of recognizing disappointing reality.

Read More »

Read More »

That’s A Big Minus

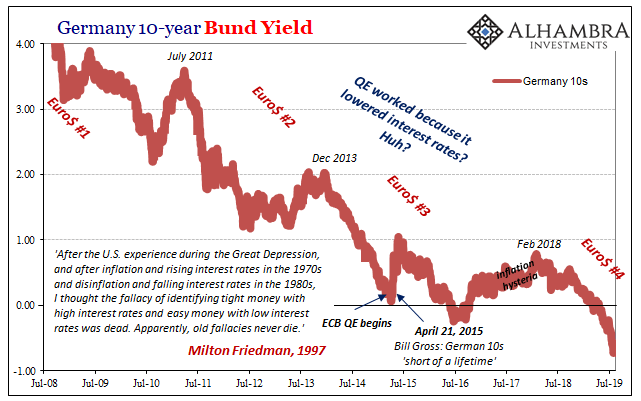

Goods require money to finance both their production as well as their movements. They need oil and energy for the same reasons. If oil and money markets were drastically awful for a few months before December, and then purely chaotic during December, Mario Draghi of all people should’ve been paying attention.

Read More »

Read More »

You Know It’s Coming

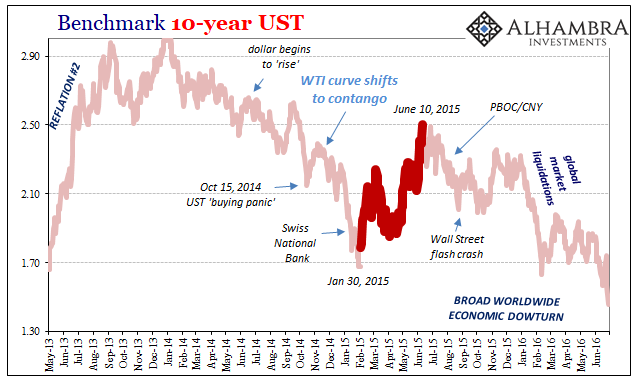

After a horrible December and a rough start to the year, as if manna from Heaven the clouds parted and everything seemed good again. Not 2019 this was early February 2015. If there was a birth date for Janet Yellen’s “transitory” canard it surely came within this window. It didn’t matter that currencies had crashed and oil, too, or that central banks had been drawn into the fray in very unexpected ways.

Read More »

Read More »

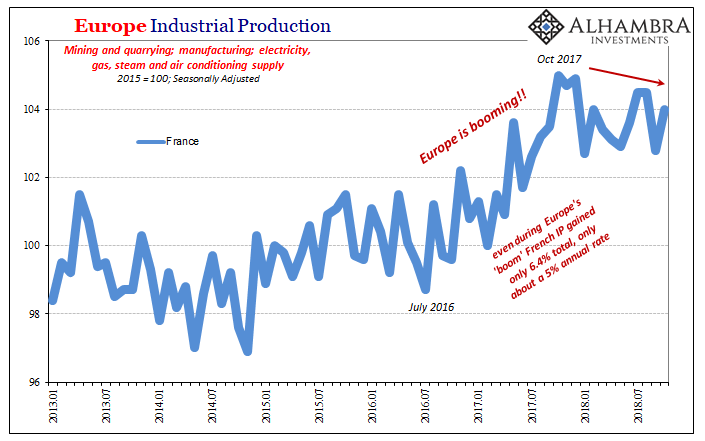

‘Paris’ Technocrats Face Another Drop

How quickly things change. Only a few days ago, a fuel tax in France was blamed for widespread rioting. Today, Emmanuel Macron’s government under siege threatens to break its fiscal budget. Having given up on gasoline and diesel, the French government now promises wage increases and tax cuts.

Read More »

Read More »

ECB (Data) Independence

Mario Draghi doesn’t have a whole lot going for him, but he is at least consistent – at times (yes, inconsistent consistency). Bloomberg helpfully reported yesterday how the ECB’s staff committee that produces the econometric projections has recommended the central bank’s Governing Council change the official outlook. Since last year, risks have been “balanced” in their collective opinion.

Read More »

Read More »

FX Daily, September 12: Dollar Chops in Narrow Ranges

Eurostat confirmed that EMU industrial output fell for a second consecutive month in July. The 0.8% decline was larger than expected and is the third decline of such a magnitude in four months and weighed on the euro. German and Spanish industrial output had surprised on the downside last week, and Italy matched suit today with a report showing a 1.8% contraction, much larger than expected, and bringing the year-over-year rate to -1.3% (workday...

Read More »

Read More »

FX Daily, April 12: Geopolitics Overshadow the Fed, Greenback Steadies

The US dollar steadied at lower levels, while equities eased as investors remain focused on the preparations to strike Syria and still tense rhetoric on trade. Reports indicate that the US and France have moved warships into the area and the UK has moved submarines within striking distance as well.

Read More »

Read More »

FX Daily, February 14: Investors Remain Uneasy even as Equities Stabilize

There is an unease that continues to hang over the market. It is as if a shoe fell last week, and most investors seem to be waiting for the other shoe to drop. It is hard to imagine the kind of body blow that the equities took last week without some kind of follow through and knock-on effects. Moreover, the focus today on US CPI may prove for nought.

Read More »

Read More »

FX Daily, January 11: Capital Markets Calmer, Greenback Consolidates

As market participants were just getting their sea legs back after the start of the year, it was hit by a one-two punch of ideas that BOJ policy was turning less accommodative and that Chinese officials were wary of adding to their Treasury holdings. Then late yesterday, a news wire reported that Canada suspected the US was going to withdraw from NAFTA.

Read More »

Read More »

FX Daily, December 13: Greenback Quiet Ahead of Five Central Bank Meetings

The Federal Reserve gets the balling rolling today with the FOMC meeting, which is most likely to deliver the third hike of the year. Tomorrow, four European central banks meet: Norway, Switzerland, the UK, and the ECB. The MSCI Asia Pacific Index rose nearly 0.3%, though Japanese and Indian shares were lower. In Europe, the Down Jones Stoxx 600 is paring yesterday's gains (-0.2%) led by utilities and telecom. Consumer discretion and financials are...

Read More »

Read More »

FX Daily, November 14: Euro Rides High After German GDP

Sterling is trading in the lower end of yesterday's range and has been confined to about a quarter a cent on either side of $1.31. On the other hand, the euro has pushed a bit through GBP0.8950 to reach its best level since October 26. Sweden also reported softer than expected October inflation.

Read More »

Read More »

FX Daily, October 12: Discipline Argues Against Consensus Narrative

Following the release of the FOMC minutes from last month's meeting, the consensus narrative that has emerged says that it was dovish because there is a growing worry the reason inflation fell is not simply due to transitory factors. This explains, according to the narrative the dollar's losses and the stock market rally.

Read More »

Read More »

FX Daily, September 13: Sterling Shines While Euro Stalls in Front of $1.20

The next leg of the business trip takes me to Frankfurt. Sporadic updates will continue. We have been identifying the $1.3430 area is a reasonable technical target for sterling. It represents the 50% retracement of sterling's losses since the day of the referendum June 2016 when it briefly traded $1.50. Also helping sterling is the unwinding of short cross positions against the euro.

Read More »

Read More »

FX Daily, August 14: Sigh of Relief Weighs on Yen and Gold, while Lifting Equities and the Dollar

The lack of new antagonisms over the weekend between the US and North Korea has prompted the markets to react accordingly. Already before the weekend, we detected some signs that at least some market participants had begun looking past the dramatic rhetoric.

Read More »

Read More »