Tag Archive: Eurozone Industrial Production

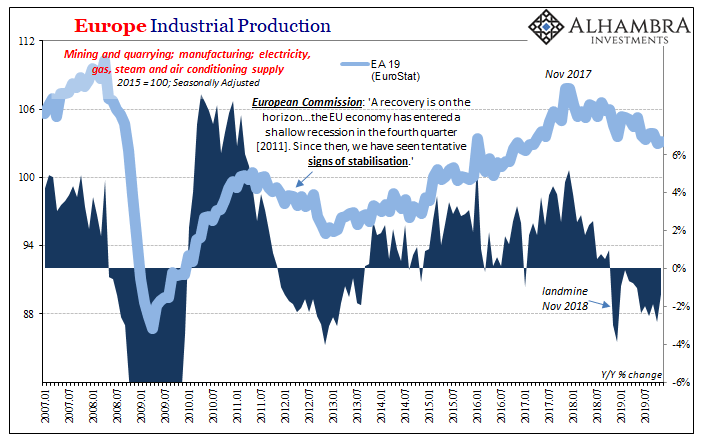

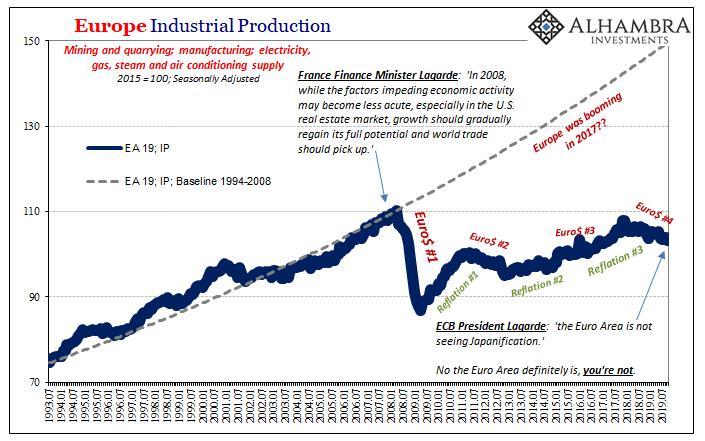

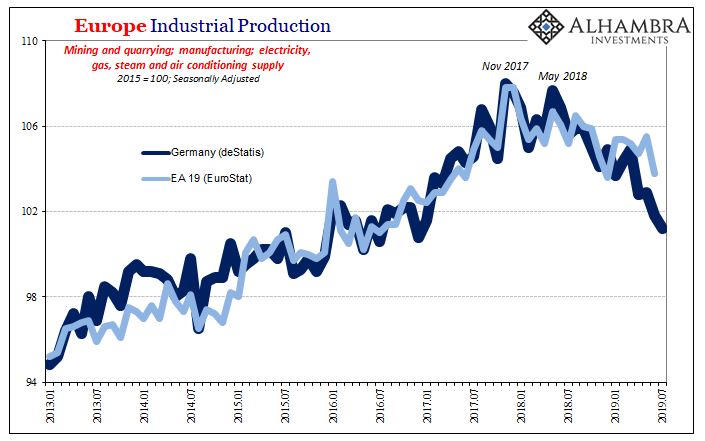

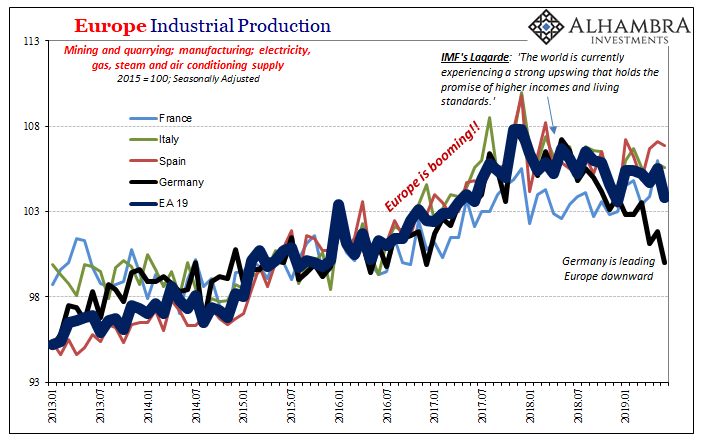

Industrial Production measures the change in the total inflation-adjusted value of output produced by manufacturers, mines, and utilities.

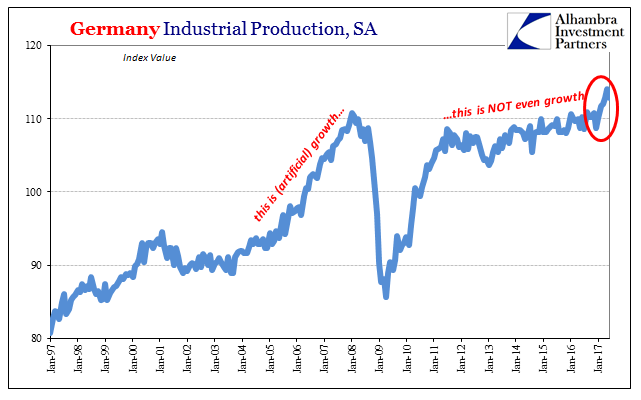

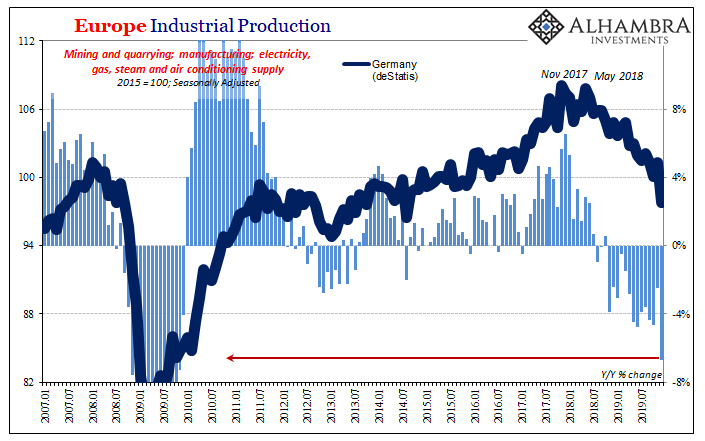

Industrial Production: Irreführende Statistiken

Germany’s Federal Statistical Office (DeStatis) reported today disappointing figures for Industrial Production. The seasonally-adjusted series fell in June 2017 month-over-month for the first time this year, last declining in December 2016. The index had been on a tear, rising nearly 5% in the first five months of this year.

Read More »

Read More »

FX Daily, July 12: Currencies Stabilize, but Yen Strengthens

The US dollar and sterling have stabilized after being sold off yesterday. The yen, which had begun recovering from a four-month low, is the strongest of the major currencies today, gaining around 0.5% against the dollar (@~JPY113.40).

Read More »

Read More »

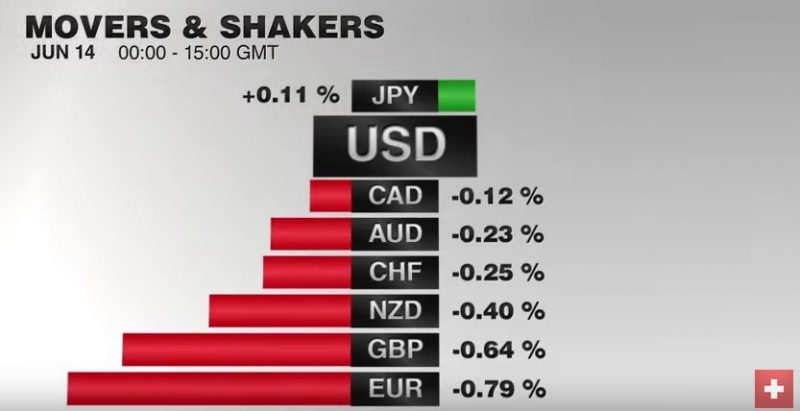

FX Daily, June 14: FOMC and upcoming SNB

The Euro has risen by 0.37% to 1.0901 CHF. This is a typical movement ahead of the SNB meeting tomorrow.

This movement is probably unrelated to the Fed rate hike, given that the USD/JPY has fallen.

It makes sense to go long CHF against JPY, if you bet on an inactive SNB. Inactive SNB would mean that the central bank will not speak about stronger FX Interventions or about lower rates.

Read More »

Read More »

FX Daily, May 12: Markets Becalmed Ahead of US data and Weekend

The foreign exchange market is becalmed, and the major currencies are little changed. The US dollar is mixed, but mostly a little lower. Sterling is the weakest of the majors, off 0.3%, near $1.2850, having been rebuffed by offers in front of $1.30 several times. It has not recovered from the quarterly inflation report and Carney's press conference.

Read More »

Read More »

FX Daily, April 11: Dollar Pushed Lower in Subdued Activity

The US dollar has a slight downside bias today through the European morning. The market does not seem particularly focused on high frequency data, though sterling traded higher after an unchanged year-over-year reading of 2.3%, and the euro traded higher after a stronger Germany ZEW survey.

Read More »

Read More »

FX Daily, March 14: Brexit Takes Fresh Toll on Sterling, While Dollar Firms more Broadly

UK Prime Minister May got the parliamentary approval the courts ruled was necessary to formally trigger Article 50. It is not clear what UK she will lead out the EU. Scotland is beginning the legal proceedings to hold another referendum on independence. There is some talk that Northern Ireland, which voted to remain, might be allowed to rejoin the Republic of Ireland.

Read More »

Read More »

FX Daily, February 14: Markets Showing Little Love on Valentines

Corrective pressures are gripping the major capital markets today.The Dollar Index's nine-day advancing streak is being threatened by the position adjustment ahead of Yellen's testimony later today. Despite record high closes in the main US equity markets yesterday, Asia could not follow suit. It tried to initially, and recorded new highs since July 2015, but sellers emerged and the MSCI Asia Pacific Index closed marginally lower on the lows of the...

Read More »

Read More »

FX Daily, January 12: Dollar and Yields Ease Further, but Look for Recovery

After a choppy North American session yesterday, the dollar and US yields remain under pressure. The dollar is lower against all the major currencies and most emerging market currencies, including the recently shellacked Turkish lira and Mexican peso.

Read More »

Read More »

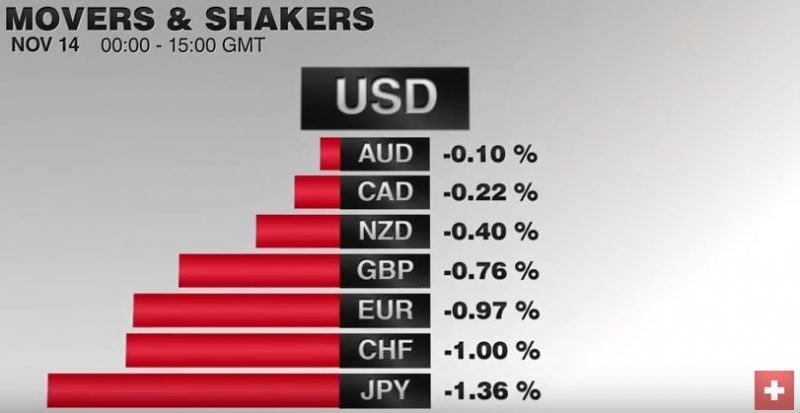

FX Daily, November 14: Dollar Steps Up to Start Week

The US dollar rally that moved into a higher gear in the second half of last week has begun the new week with a bang. It is up against nearly all the major and emerging market currencies. Even sterling, which last week, managed to eke out modest gains against the greenback is under pressure today.

Read More »

Read More »

FX Daily, September 14: Precarious Stabilization

Swiss ZEW expectations came in better than expected. The value was +2.7 instead of expected negative value. The US dollar advanced yesterday and is in narrow ranges with a mostly softer bias today. The exception is the Japanese yen. Japanese press have reported that more negative rates are under consideration may have contributed to the weakness of the yen.

Read More »

Read More »

FX Daily, June 14: Capital Markets Remain at UK Referendum’s Mercy

"The Swiss Franc was the strongest performer, EUR/CHF has fallen to 1.08 by 0.8%". A spate of opinion polls showing a tilt toward Brexit, and the leading UK newspaper urging the Leave vote on the front page, keep the global capital markets on edge. Equities are lower, though of note ahead of the MSCI decision first thing Wednesday in Asia, Chinese shares eked out a small gain.

Read More »

Read More »