Tag Archive: Eurozone Consumer Confidence

Consumer Confidence measures the level of consumer confidence in economic activity. It is a leading indicator as it can predict consumer spending, which plays a major role in overall economic activity. The reading is compiled from a survey of about 2,300 consumers in the euro zone which asks respondents to evaluate future economic prospects. Higher readings point to higher consumer optimism.

FX Daily, September 28: Greenback Consolidates while Yields Continue to March Higher

The US dollar is consolidating inside yesterday's ranges against the euro and yen while extending its gains against sterling and the dollar-bloc currencies. The sell-off in the US debt market continues to drag global yields higher. The 10-year Treasury yield reached 2.01% on September 8 and now, nearly three weeks later, is near 2.35%. It had finished last week at 2.25%.

Read More »

Read More »

FX Daily, September 21: Market Digests Fed, Greenback Consolidates, Antipodeans Tumble

The market has mostly interpreted the Fed's action in line with our thinking. Despite the lowering of the long-run Fed funds rate, the shifting one of the three hikes from 2019 into 2020, and recognizing that the weaker price impulses are somewhat mysterious, the Fed clearly signaled its bias toward hiking rates one more time this year and three next year.

Read More »

Read More »

FX Daily, July 28: Dollar and Equities Closing Week on Heavy Note

The US dollar is mostly lower, though one of the features of recent days has been the dramatic slide of the Swiss franc, and that is continuing today. The franc is off another 0.5% today, to bring its weekly loss to a sharp 2.5%. The euro finished last week near CHF1.1030 and is now near CHF1.1370; its highest level since the cap was lifted in mid-January 2015.

Read More »

Read More »

FX Daily, July 20: ECB Game Day

The US dollar is enjoying a firmer tone against the major currencies today. It does not appear to be simply position adjustments ahead of the ECB meeting. Consider that Australia reported strong employment data, and after making new highs, reaching almost $0.8000, it has reversed to toy with yesterday's low. A convincing break of that area (~$0.7910), especially on a closing basis, could be the kind of technical reversal that momentum traders take...

Read More »

Read More »

FX Daily, June 29: Run on Dollar and Yen Continues

The main driver of the foreign exchange market is the continued reassessment of the trajectory of monetary policy in the UK, EMU, and Canada. The OIS market does not show that higher rates are discounted for the next policy meeting (August, September, and July respectively), but rather there is greater confidence that, outside of Japan, peak monetary stimulus is behind us.

Read More »

Read More »

FX Daily, June 22: Greenback Goes Nowhere Quickly, While Yen Remains Bid

The summer doldrums begin early. The US dollar is little changed against most of the major currencies. Bond yields are mostly one-two basis points lower, and equity markets are mixed but with a downside bias. Oil prices slump more than 2% on Tuesday and again on Wednesday. This is weighing on bond yields and equities.

Read More »

Read More »

FX Daily, May 30: Mixed Dollar as Market Awaits Preliminary EMU CPI and US Jobs

With the backdrop of US interest rates unable to get much traction, despite the strong probability of another Fed rate hike in a couple of weeks, the third since last November election, the US dollar mixed today. The chief story today, though, is not the greenback but the euro. The euro is trading heavily for the fourth session.

Read More »

Read More »

FX Daily, May 19: Markets Trying to Stabilize Ahead of Weekend

Judging from investors' reactions, the only thing worse that than the low volatility environment is when volatility spikes higher, as it did yesterday. Higher volatility is associated with weakening equity markets, falling interest rates, pressure on emerging markets, a strengthening yen and, sometimes, as was the case yesterday, heavier gold prices.

Read More »

Read More »

FX Daily, April 27: Several Developments ahead of the ECB meeting

The ECB meeting and the press conference that follows it is the main event. However, it has had to compete with the Bank of Japan and Riksbank meetings, as well as the further reflection of the tax reform proposals by the Trump Administration yesterday.

Read More »

Read More »

FX Daily, April 20: Dollar and Yen Push Lower

With the exception of the yen, the US dollar is lower against all the major currencies. US Treasury yields are firm, extending yesterday's rise a little. This may help keep the dollar straddling JPY109, but unwinding long yen cross positions is helping underpin the other major currencies. The Dollar Index is making a new low for the week and appears poised to test support around 98.85-99..00.

Read More »

Read More »

FX Daily, March 23: Some Thoughts about the Recent Price Action

The gains the US dollar scored last month have been largely unwound against the major currencies. The dollar's losses against the yen are a bit greater, and it returned to levels not seen late last November. The down draft in the dollar appears part of a larger development in the capital markets that has also seen the US 10-year yield slide 25 bp in less than two weeks. The two-year yield is off 17 bp.

Read More »

Read More »

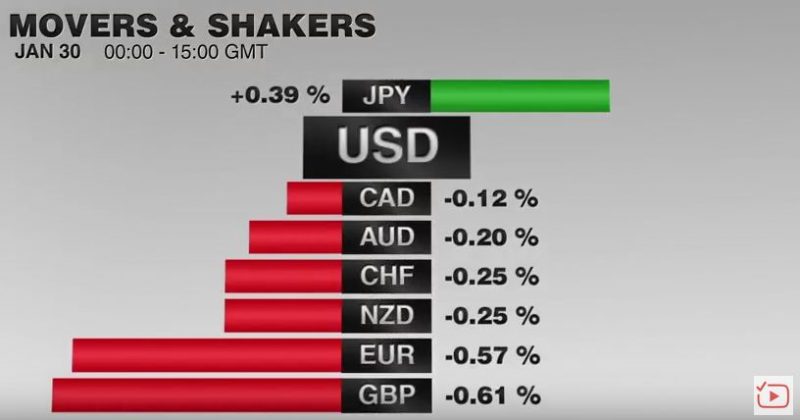

FX Daily, January 30: EUR/CHF falls further to 1.650

The EUR/CHF collapsed once again to 1.0650. This rate broke the 1.0680 - 1.0700 that constituted the previous intervention area.

Reasons can be found in the weak U.S. GDP weak, in Trump's foreign trade policy and in the strong Swiss trade balance.

Read More »

Read More »

FX Daily, January 23: Dollar’s Pre-Weekend Retreat Extended in Asia Before Stabilizing in Europe

The US dollar had a poor close in the North American session before the weekend as investors appear increasing anxious about the new US Administration's economic policies and priorities.With no fresh details emerging over the weekend, some stale dollar longs exited. The dollar stabilized in the European morning, but broader risk appetites were not rekindled, and the Dow Jones Stoxx 600, led by financials, was sold to its lowest level this month.

Read More »

Read More »

FX Daily, November 29: Dollar Comes Back Mostly Firmer, but Focus is Elsewhere

The US dollar correctly lowered yesterday, but most of the selling was over by the end of the Asian session, and the greenback steadied in Europe and North America. The dollar is firm against the euro and yen but within yesterday's broad trading ranges. The Australian and Canadian dollar's gains from yesterday are being pared.

Read More »

Read More »

FX Daily, October 28: Dollar Sidelined, Krona Stabilizes, Rates Firm

The main development here in the last full week of October is the sharp rise in bond yields. US 10-year yields rose nine bp this week coming into today's session, which features the first look at Q3 GDP. The two-year yield is up four bp. European 10-year benchmark yields mostly rose 11-17 bp. UK Gilts were are the upper end of that range. Two-year yields are 3-5 bp higher.

Read More »

Read More »

FX Daily, October 21: Greenback Ending Week on Firm Note

The US dollar is firm especially against the European complex and emerging market currencies. The yen continues to be resilient, and exporters are thought be capping the dollar above JPY104. The dollar is lower against the yen for the fourth consecutive session and set to snap a three-week advancing streak.

Read More »

Read More »