Tag Archive: EUR/CHF

FX Daily, February 10: Quiet Start to the New Week in which Politics may Dominate

Overview: The global capital markets have begun the new week on a cautious tone as investors seek to assess the latest news on the new coronavirus. Nearly all the markets in Asia fell but China. European bourses are lower as well, with the Dow Jones Stoxx 600 off about 0.3%. US shares are soft but little changed.

Read More »

Read More »

FX Daily, February 7: Dollar Rides High as Eurozone Disappoints, and Caution Sets In

Overview: A more cautious tone is evident today in the markets, which seem to have run well ahead of macro developments and evidence that the new coronavirus is not yet contained. After a roughly 3.5% advance in the past three sessions, the MSCI Asia Pacific index pulled back with nearly the markets in the region slipping.

Read More »

Read More »

FX Daily, February 6: Stocks Push Higher but more Cautious Tone may be Emerging

Overview: The bullish enthusiasm that carried the S&P 500 to new closing highs yesterday is helping Asia Pacific and European shares today. The MSCI Asia Pacific Index rose for the third session with Tokyo, Hong Kong, and Korea jumping two percent. Europe's Dow Jones Stoxx 600 gapped to new record highs before stabilizing in mid-morning turnover. US shares are mostly firmer.

Read More »

Read More »

FX Daily, February 5: Markets Extend Recovery, but Look for a Pause

Overview: The S&P 500 gapped higher and surged 1.5% yesterday, the most since in six months, helping set the stage for a continued recovery in global equities, and stoked risk appetites more broadly. An experimental antiviral treatment is to begin clinical testing. All of the markets in the Asia Pacific region advanced, with Japan, China, and Singapore gaining more than 1%.

Read More »

Read More »

FX Daily, February 4: Relief Rally Fueled by Liquidity not Peak in Coronavirus

Overview: The combination of the rally in US shares yesterday and the continued efforts of China to inject liquidity helped lift sentiment today. The MSCI Asia Pacific Index snapped an eight-day slide, and many markets jumped more than 1%. Led by energy and materials, Europe's Dow Jones Stoxx 600 is posting broad gains and is up over 1% in late morning turnover.

Read More »

Read More »

FX Daily, January 31: Stocks Finishing on Poor Note, while the Dollar and Bonds Firm

Overview: It was as if the World Health Organization's recognition of that the new coronavirus is an international health emergency was the catalyst that the markets needed. US equities recovered smartly and managed to close higher on the session. However, the coattails were short, and follow-through buying of US shares fizzled.

Read More »

Read More »

FX Daily, January 30: Contagion Impact not Peaked, Weighs on Risk Appetites

Overview: The ongoing concerns about the geometric progression of the new coronavirus continues to swamp other considerations for investors. Risk continues to be unwound, as the World Health Organization meets to decide if this is indeed a global health emergency. Several large equity markets in Asia were hit particularly hard.

Read More »

Read More »

FX Daily, January 29: Escaped from a Crocodile’s Mouth, Entered a Tiger’s Mouth

Overview: This colorful Malay saying captures the spirit of the animal spirits. Narrowly escaping an escalation of a trade war between the world's two largest economies, the outbreak of a deadly virus has spurred moves, especially the sell-off in stocks and rally in bonds, for which many investors seemed ill-prepared. Even though the virus contagion has not peaked, the recovery in US equities yesterday points to a break the fear and anxiety.

Read More »

Read More »

FX Daily, January 24: Coronavirus Hits Asia Hardest, Europe and the US Resilient

Overview: The new coronavirus in China has moved into the vacuum left by the US-China trade agreement and clear indications that the Bank of Japan, the European Central Bank, and the Federal Reserve are on hold as investors searched for new drivers. The World Health Organization refrained from calling it a public health emergency even though China has dramatically stepped up its efforts to contain the new virus.

Read More »

Read More »

FX Daily, January 23: ECB’s Strategic Review and the Coronavirus Command Investors’ Attention

The spread of the coronavirus and the lockdown in the epicenter in China has again sapped the risk-taking appetite in the capital markets. Asia is bearing the brunt of the adjustment. Tomorrow starts China's week-long Lunar New Year celebration when markets will be closed, which may have also spurred today's drama that aw the Shanghai Composite tumbled 2.75%, bringing the week's loss to 3.2%, the most in five months.

Read More »

Read More »

FX Daily, January 22: Fragile Stability in Capital Markets even as SARS Comparisons Grow

Overview: The S&P 500 lost less than 0.3% yesterday, even as the first case of the Wuhan Virus was found in the US. The relative subdued US reaction may have helped stabilize the capital markets today. Nearly all the major markets in the Asia Pacific regions rose, including more than a 1% gain in Hong Kong and South Korea. European shares are posting small gains near midday.

Read More »

Read More »

FX Daily, January 21: New Respiratory Illness Saps Risk-Taking Appetites

The spread of a new respiratory illness in China has spurred a wave of profit-taking in equities and risk assets more generally. All of the markets in the Asia Pacific region tumbled, with Hong Kong hit the hardest (-2.8%) after posting a key reversal yesterday. The sell-off continued in Europe. The Dow Jones Stoxx 600 is off about 0.8% in late morning turnover, led by consumer discretionary, materials, and energy.

Read More »

Read More »

FX Daily, January 20: Stocks Stall while the Dollar Remains Bid

Overview: The new week is off to a quiet start as the US celebrates Martin Luther King's birthday, and investors look for a fresh focus. Hong Kong and Indian markets were suffered modest declines while most of the other large Asia Pacific markets edged higher. European stocks are trading a little lower, and the Dow Jones Stoxx 600 is threatening to end a four-session advance. Most benchmark bond yields around half a basis point in one direction or...

Read More »

Read More »

Hartnäckige Frankenstärke – Auf der Suche nach den mysteriösen Franken-Käufern

Der cash Insider ist unter @cashInsider auch auf Twitter aktiv. Lesen Sie börsentäglich von weiteren brandaktuellen Beobachtungen am Schweizer Aktienmarkt. Am Morgen des 15. Januars 2015 waren die Devisenmärkten in Aufruhr. Dass die Schweizerische Nationalbank (SNB) das Ende des Euro-Mindestkurses von 1,20 Franken verkünden würde, hatten selbst erfahrenste Marktakteure nicht erwartet.

Read More »

Read More »

FX Daily, January 17: China and the UK Surprise in Opposite Directions

Overview: Helped by new record highs in the US, global stocks are moving higher today. Nearly all the markets in the Asia Pacific region advanced and the seventh consecutive weekly rally is the longest in a couple of years. Europe's Dow Jones Stoxx 600 is at new record highs and appears set to take a four-day streak into next week. US shares are trading firmly.

Read More »

Read More »

FX Daily, January 16: Markets Look for New Cues with US-China Trade Pact Signed

Overview: The global capital markets are calm today as investors await fresh trading incentives. New record highs in the US equity indices gave Asia Pacific stocks a lift, though China and Taiwan were notable exceptions. Europe's Dow Jones Stoxx 600 is firm new record highs set last week. US equities are edging higher in Europe. Benchmark bond yields are little changed.

Read More »

Read More »

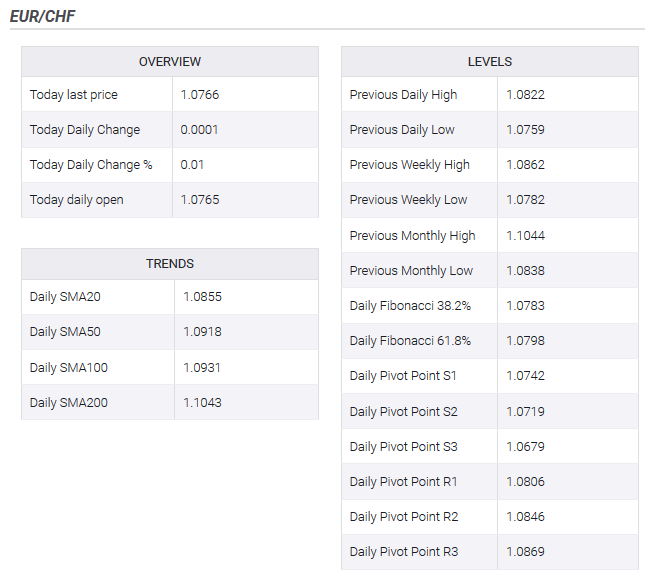

EUR/CHF Price Analysis: Attempting corrective bounce amid oversold conditions

EUR/CHF is looking oversold, as per key daily chart indicator. The hourly chart is reporting a triangle breakout. A corrective bounce to the 5-day average hurdle could be in the offing. EUR/CHF is looking to regain some poise from three-year lows reached on Wednesday.

Read More »

Read More »

FX Daily, January 15: Phase 1 Trade Deal Shifts Terrain of US-China Rivalry

News that US tariffs on China will remain until through at least the November US election and continued US attempts to stymie China (e.g., more curbs on Huawei under consideration and stepped up efforts to force it to cut subsidies to business) have taken some momentum from the push into risk assets. The MSCI Asia Pacific Index snapped a four-day advance today, with only Australian equities among the large regional markets able to sustain upticks.

Read More »

Read More »

EUR/CHF: Franc at 33-month high five years after SNB removed the cap

EUR/CHF is trading at 33-month lows near 1.0759. The US added Switzerland to its current manipulators' list. The SNB removed the cap on the euro on Jan. 15, 2015. Five years after the Swiss National Bank (SNB) shocked the financial markets by abandoning the euro cap, the Swiss Franc is trading at 33-month highs against the single currency.

Read More »

Read More »

FX Daily, January 14: China was a Currency Manipulator for a Few Months

Overview: The leaked US decision to lift the currency manipulator designation on China was the latest fodder fueling the new record highs in the S&P 500. The risk-taking appetite helped extend the rally in the MSCI Asia Pacific Index for the fourth consecutive session. Europe's Dow Jones Stoxx 600 is little changed and trying to snap a two-day decline.

Read More »

Read More »

-637147386339434788-800x347.png)