Tag Archive: EUR/CHF

FX Weekly Review, March 20 – March 25: Dollar Bottom Near?

In the last week, the Swiss Franc index recovered and gained about 2%. The dollar index lost 1.5%. Position adjustments: The dollar tended to trade heaviest against those currencies that speculators were short, like the euro, yen, and sterling.

Read More »

Read More »

FX Daily, March 24: Dollar Trying to Stabilize Ahead of the Weekend

The US dollar has been stabilizing over the past couple of sessions. This broad stability of the dollar is impressive because of the questions of the prospects of US President Trump's economic agenda. Expectations for tax reform and infrastructure spending have bolstered investor confidence and helped boost equity prices despite what appears to be stretched valuation.

Read More »

Read More »

FX Daily, March 23: Some Thoughts about the Recent Price Action

The gains the US dollar scored last month have been largely unwound against the major currencies. The dollar's losses against the yen are a bit greater, and it returned to levels not seen late last November. The down draft in the dollar appears part of a larger development in the capital markets that has also seen the US 10-year yield slide 25 bp in less than two weeks. The two-year yield is off 17 bp.

Read More »

Read More »

FX Weekly Review, March 13 – March 18: Fed Disappoints, Dollar Losses

The failure of the Fed to signal an increased pace of normalization and the prospects of other central banks raising rates spurred dollar losses, which deteriorated its technical outlook.

Read More »

Read More »

FX Daily, March 17: Dollar Remains Heavy

The dollar is softer against most of the major currencies to cap a poor weekly performance. The Dollar Index is posting what may be its biggest weekly loss since last November. The combination of the Federal Reserve not signaling an acceleration of normalization, while the market remains profoundly skeptical of even its current indications, and perceptions that the ECB and BOE can raise earlier than anticipated weighed on the dollar. The PBOC...

Read More »

Read More »

FX Daily, March 16: Greenback Consolidates Losses as Yields Stabilize

The US dollar remained under pressure in Asia following the disappointment that the FOMC did not signal a more aggressive stance, even though its delivered the nearly universally expected 25 bp rate hike. News that the populist-nationalist Freedom Party did worse than expected in the Dutch elections also helped underpin the euro, which rose to nearly $1.0750 from a low close to $1.06 yesterday.

Read More »

Read More »

FX Daily, March 14: Brexit Takes Fresh Toll on Sterling, While Dollar Firms more Broadly

UK Prime Minister May got the parliamentary approval the courts ruled was necessary to formally trigger Article 50. It is not clear what UK she will lead out the EU. Scotland is beginning the legal proceedings to hold another referendum on independence. There is some talk that Northern Ireland, which voted to remain, might be allowed to rejoin the Republic of Ireland.

Read More »

Read More »

FX Daily, March 13: Bonds and Equities Rally, Dollar Heavy

Hit by profit-taking ahead of the weekend, despite US jobs data that remove the last hurdle to another Fed hike this week, the greenback remains on the defensive. It has softened against all the major currencies and many of the emerging market currencies. The chief exception is those in eastern and central Europe.

Read More »

Read More »

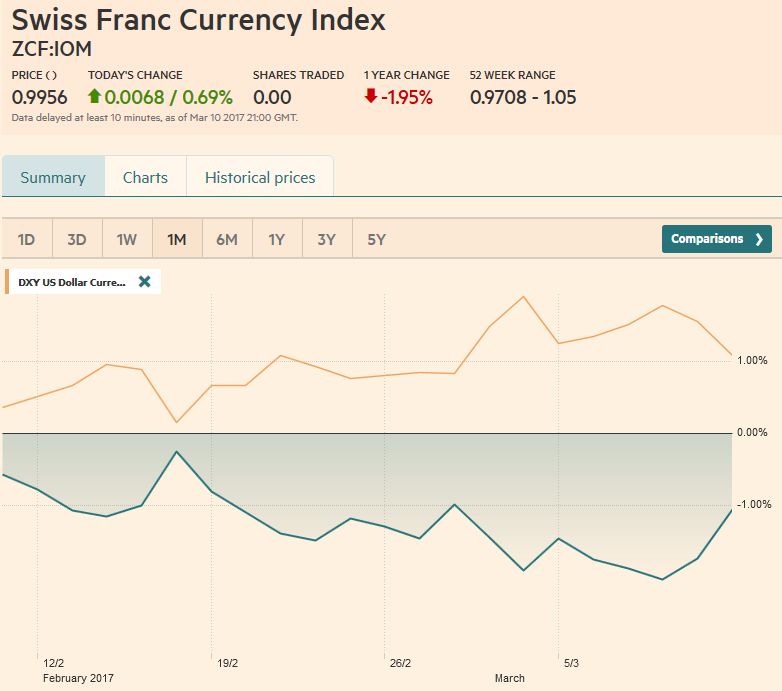

FX Weekly Review, March 06 – March 11: CHF loses against the euro

The Swiss Franc lost this week in particular against the euro, given that Mario Draghi was less dovish than expected. If the stronger euro is driven only by speculators, or also by "real money" (investments in cash, bonds, stocks) will be visible in Monday's sight deposits release.

Read More »

Read More »

FX Daily, March 10: US Jobs Data: Deja Vu All Over Again?

A week ago, after nine Fed officials had spoken, the market widely expected Yellen and Fischer to confirm that the table was set for a rate hike later this month. They did, and the dollar and US interest rates fell. Now, after a strong ADP jobs report (298k), everyone recognizes upside risk to today’s national report, and the dollar has lost its upside momentum against most major currencies, but the Japanese yen.

Read More »

Read More »

FX Daily, March 09: Pre-ECB Squaring Lifts Euro in a Strong USD Context

The euro tested the lower of its range near $1.05 in Asia before short covering in Europe lifted back toward yesterday's highs near $1.0575. However, buoyed by the upside surprise in the ADP estimate of private sector jobs growth, the dollar is firmer against most other currencies today. The US 10-year yield is up 20 bp this week.

Read More »

Read More »

FX Daily, March 07: Greenback Continues to Recover from the Late Pre-Weekend Slide

The US dollar has continued to recover from the slide on what still largely appears to have been a buy the rumor sell the fact response to Yellen's speech just before last weekend. Yellen was the last of around 11 Fed officials that spoke last week, and nearly all but Bullard signaled readiness to hike rates at next month's meeting.

Read More »

Read More »

FX Daily, March 06: The Dollar Gives Back More Before Consolidating

The US dollar's pre-weekend pullback was extended in early European turnover but appeared to quickly run out of steam. The prospect of a constructive US employment report at the end of the week, especially given the steady decline in weekly initial jobless claims to new cyclical lows, underscores the likelihood that the Fed hikes rates next week. Bloomberg puts the odds above 90%, while the CME estimates a nearly 80% chance.

Read More »

Read More »

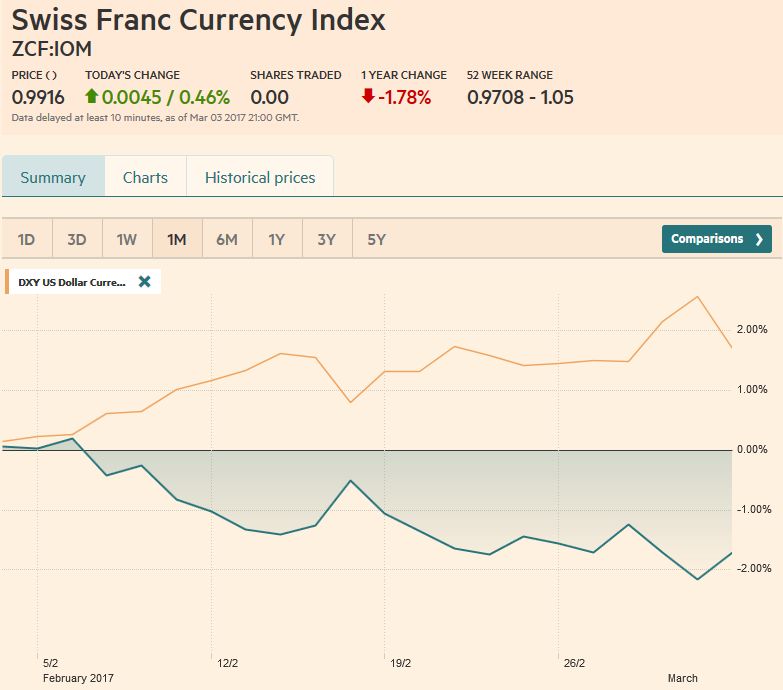

FX Weekly Review, February 27 – March 04: Dramatic Shift in Fed Expectations Spurs Dollar Gains, but Now What?

The pendulum of market sentiment swung hard and fast toward a Fed rate hike in the middle of March. The signals from Fed officials, including Governor Brainard and Powell, spurred the move. According to Bloomberg, the market had discounted a 90% chance of a hike before Yellen and Fischer spoke. A week ago, Bloomberg calculations showed a 40% chance of a move.

Read More »

Read More »

FX Daily, March 03: Yellen and Jobs Report Last Two Hurdles to US Hike

The US dollar is narrowly mixed as Yellen's speech in Chicago is awaited. The greenback's three-day advance against the euro and four-day advance against the yen is at risk. The dollar-bloc currencies, where speculators in the futures market had gone net long, continue to underperform.

Read More »

Read More »

FX Daily, March 02: Dollar Remains Bid

The US dollar is bid against the major currencies as the combination the increased expectation of a Fed rate hike and the President's commitment to fiscal stimulus buoys sentiment. The dollar-bloc, where speculators in the futures market, have grown a net long position, are leading the move.

Read More »

Read More »

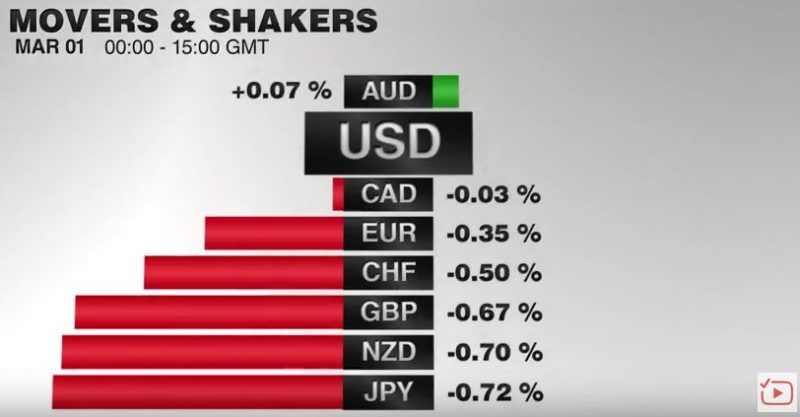

FX Daily, March 01: Greenback Bounces, More Fed than Trump

The much-anticipated speech by US President Trump was light on the details that investors interested in, like the tax reform, infrastructure initiative, and deregulation. There appears to be an agreement to repeal the national healthcare, but there is no consensus on its replacement.

Read More »

Read More »

FX Daily, February 28: Markets Little Changed as Breakout is Awaited

The capital markets are becalmed, and the US dollar is in narrow trading ranges. Month-end considerations are at work, but the key event is much-awaited speech US President Trump to a joint session of Congress this evening (early Wednesday in Asia). The hope is that he provides the policy signals that allow the dollar to break out of its recent ranges.

Read More »

Read More »

FX Daily, February 27: Asia Stumbles, Europe Recovers, Waiting for Trump

The late recovery in US equities before the weekend did little good for Asian markets. Nearly all the Asian equity markets moved lower, led by the 1.0% decline in Japan's Topix. It was the third successive loss for the Topix, which is the long losing streak of the year so far. The MSCI Asia Pacific Index lost 0.6%, further pushing it off the 17-month high seen last week.

Read More »

Read More »

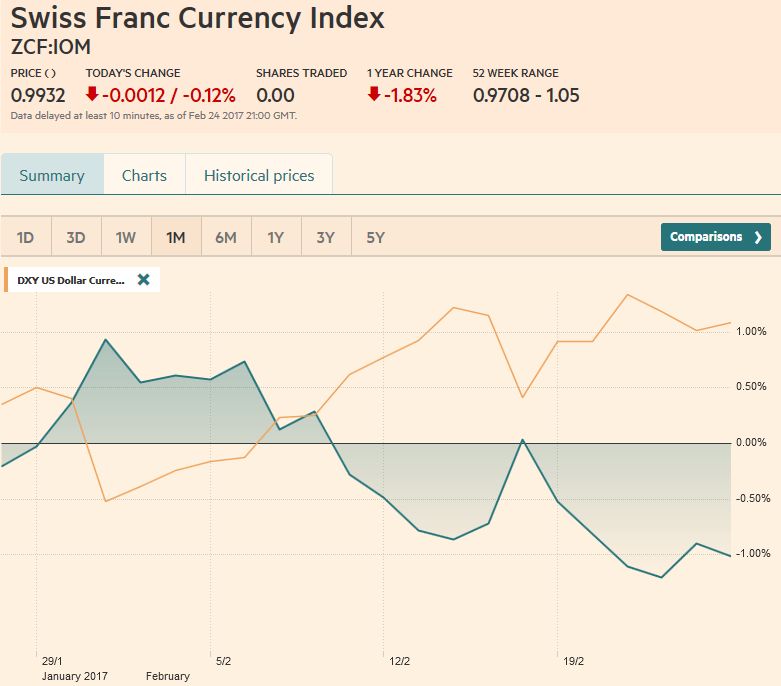

FX Weekly Review, February 20 – 25: Ranges in FX: Respect the Price Action

It is difficult right now to talk about the foreign exchange market using the dollar as the numeraire. The dollar was stronger against most of the major currencies last week, but not the yen or sterling. The Dollar Index itself was little changed, rising less than 0.15%.

Read More »

Read More »