Tag Archive: EUR/CHF

FX Daily, July 16: Dollar Softens a Little as Market Awaits Developments

The US dollar is slightly softer against most of the major currencies but is in narrow ranges ahead of today's key events, which include US retail sales and the debate in the UK parliament over Brexit. The yen is the main exception. The local markets are closed for a public holiday, and the yen did initially strengthen (the dollar eased to ~JPY112.10) but surrendered those gains and consolidating its biggest loss last week in 10 months.

Read More »

Read More »

FX Daily, July 13: Trump Trips Sterling, but Greenback Enjoys Broad Gains

President Trump weighed in on Brexit and spurred the largest drop in sterling in more than two weeks. Trump encouraged Brexit, but he indicated he "would have done it much differently" and that he "actually told Theresa May how to do it, but she did not listen." Trump cautioned that May's plan would mean it would still be too close to the EU and this would "kill" a free-trade deal with the US. In effect, Trump backed the harder Brexit camp...

Read More »

Read More »

FX Daily, July 12: Dollar Remains Firm as Risk Returns

The US dollar rallied yesterday as the escalating trade tensions between the world's top two economies choked off the animal spirits and a marked down in equities and risk assets. It remains firm today even as risk has come back. Equities are mostly higher today and bonds lower. Emerging market currencies, from Turkey to South Africa are firmer, as is the Chinese yuan.

Read More »

Read More »

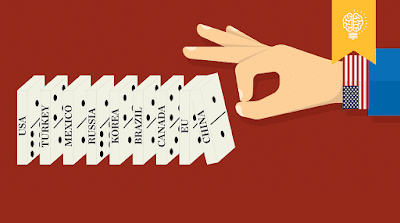

FX Daily, July 11: Escalating Trade Tensions Set Tone for Capital Markets

The US took the first step in making good its threat to put a 10% tariff on $200 bln of Chinese goods in response to the PRC retaliating for the 25% tariff on $34 bln of its exports. The US provided a list of products that will get the new tariffs after the public comment period is completed at the end of next month. This time the list included numerous consumer goods, like digital cameras, baseball gloves, but have left off popular products, like...

Read More »

Read More »

FX Daily, July 10: May Survives to Fight Another Day, but Sterling’s Recovery Falters

The political obituary of UK's May, who many see as an "accidental" Prime Minister, has been written many times in the past year and a half only to be withdrawn. Again, it looked like the resignation of two ministers, and a couple of junior ministers was going to spur a leadership challenge. While this still may come to pass, the hard Brexit camp, which has huffed and puffed, simply does not appear to represent a majority of the Tory Party, and...

Read More »

Read More »

FX Daily, July 09: Possibility of a Soft Brexit Excites Sterling (too Early?)

After a little wobble, sterling has responded favorably to the resignation of the UK Brexit team led by David Davis. The idea is that a path to a softer Brexit is good for sterling. In fairness, it is a bit early to reach this conclusion, and the softer dollar tone puts wind in sterling's sale. There is a GBP244 mln sterling option at $1.3375 that expires today. The June highs were set in the $1.3450-$1.3470 area.

Read More »

Read More »

FX Daily, July 05: Dollar is Mixed on Eve of US Jobs and Tariffs

The US dollar is softer against most of the major currencies and mixed against the emerging market currencies. European currencies firmer, with the continued recovery of the Swedish krona on the back of a more hawkish central bank, and the euro poking through $1.17 for the first time in over a week with the help of strong factory orders report from Germany. Central and East European currencies are leading among emerging markets. Asian equities...

Read More »

Read More »

FX Daily, June 27: Renminbi Slide Continues and Oil Extends Surge

The US dollar is mostly firmer today, though has slipped back below the JPY110 level, as lower yields and equities support the Japanese yen. The main story in the foreign exchange market today is the continued slide in the Chinese renminbi. The decline is the sharpest since the 2015 devaluation.

Read More »

Read More »

FX Daily, June 22: BOE Spurs Dollar Pullback

The Bank of England's hawkish hold yesterday, spurred by three dissents in favor of an immediate hike, changed the near-term dynamics in the foreign exchange market. Both the euro and sterling fell to new lows for the year before reversing higher. Yesterday's gains are being extended today.

Read More »

Read More »

FX Daily, June 21: Dollar Driven Higher

The half-hearted and shallow attempts by the currencies to recover appear to be emboldening the dollar bulls today, The greenback is higher against all major and emerging market currencies today. Demand for dollars is strong enough to offset the broader risk-off environment that is pulling stocks and core yields lower that is usually supportive of the yen.

Read More »

Read More »

FX Daily, June 19: America First Clashes With Made in China 2025

The escalation of trade tensions between the world's two largest economies is scaring investors, who are liquidating equities and buying core bonds. The dollar and yen are the strongest of the major currencies. The Swiss franc is mostly steady as it too is benefiting from the unwinding of risk trades.

Read More »

Read More »

FX Daily, June 15: Dollar Slips While Escalating Trade Tensions may Roil Markets

The Dollar Index edged higher to its best level this year before turning down as market attention shifts from central banks to trade tensions. Reports confirm that the US will go ahead with the 25% tariff on $50 bln of Chinese goods and provide some specificity today. The final list is expected to be similar to the goods that had been identified in the preliminary list, with an emphasis on electronic goods, apparently on ideas that they may have...

Read More »

Read More »

FX Daily, June 12: US-Korea Summit Fails to Impress Investors

The US dollar initially rallied in early Asia ahead of the US-North Korea summit but has subsequently shed the gains and more. As North American dealers return to their desks, the dollar is lower against nearly all the major currencies, but the yen and Canadian dollar.

Read More »

Read More »

FX Daily, June 5: Sterling Jumps Ahead, While US Equities Have Small Coattails

The British pound is benefiting from the stronger than expected service and composite PMI readings, which among other things are serving as a distraction from the government's seemingly tortured approach to Brexit and the sales of part of its stake in RBS for a GBP2 bln loss. Financials are a drag on the FTSE 100 today (~-0.5% while other major bourses are higher).

Read More »

Read More »

FX Daily, June 01: Ironic Twists to End the Tumultuous Week

The week is ending quite a bit different than it began. The main banking concern is not in Italy but in German, where shares in Deutsche Bank shares fell to a record low yesterday, and S&P Global cut its credit rating one step to BBB+ (third-lowest investment grade).

Read More »

Read More »

FX Daily, May 31: Don’t Confuse Calmer Markets with Resolution

The global capital markets that were in panic mode on Tuesday stabilized yesterday, and corrective forces have carried into today's activity. However, the underlying issues in Italy and Spain are hardly clarified in the past 48 hours. Moreover, the US push on trade is intensifying again.

Read More »

Read More »

FX Daily, May 30: Italian Reprieve, Euro Bounces, Trade Tensions Rise

After what could be described as a 15-sigma event yesterday in the Italian bond market, a reprieve today has seen the euro recover a cent from yesterday's lows. While the political situation in Italy is worrisome, many observers suspect that the new banking rules exacerbated the illiquidity that explains outsized moves.

Read More »

Read More »

FX Daily, May 25: US Dollar Loses Momentum Ahead of the Weekend

The euro and sterling were sold through yesterday's lows in Asia, but rebounded in Europe, with the help of mildly constructive data in the form of the German IFO and details of UK Q1 GDP. The IFO climate measure matched the April reading and thereby snapped a five-month slide. The expectations component slipped, but the current assessment improved.

Read More »

Read More »

FX Daily, May 24: Greenback Pushes Lower

The US dollar is pulling back after recording new highs for the year against the euro and sterling. The greenback is lower against nearly all the major currencies, but the Canadian dollar. It is also softer against most of the emerging market currencies. The chief exception is the Turkish lira. Yesterday's 300 bp rate hike could only stem the rot momentarily and the lira's 2.3% decline today, wipes out 2/3 of the annual rate increase.

Read More »

Read More »

FX Daily, May 23: Dollar and Yen Surge, European Data Disappoints

The US dollar has extended its gains against most of the major currencies. Momentum, positioning, and divergence continue to drive it. The euro briefly traded a little below $1.17, an important technical area and has enjoyed a bounce in late morning turnover in Europe.

Read More »

Read More »