Tag Archive: Emerging Markets

Emerging Markets: What Changed

The Reserve Bank of India hiked rates for the first time since 2014. Malaysia’s central bank governor resigned. Czech central bank tilted more hawkish. Russia central bank tilted more dovish. Argentina got a $50 bln standby program from the IMF.

Read More »

Read More »

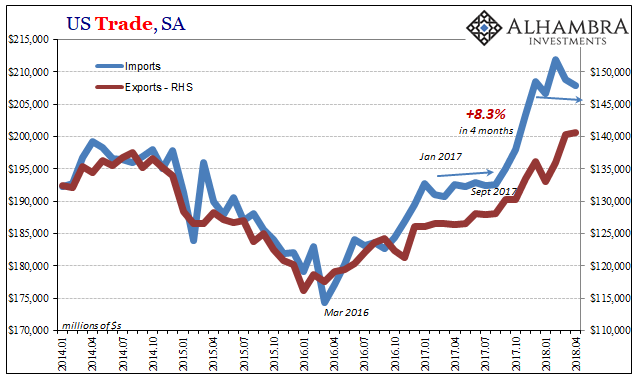

US Trade Settles Down Again

US trade is further leveling off after several months of artificial intrusions. On the import side, in particular, first was a very large and obvious boost following last year’s big hurricanes along the Gulf Coast. Starting in September 2017, for four months the value of imported goods jumped by an enormous 8.3% (revised, seasonally-adjusted). Most of the bump related to consumer and capital goods.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX put in a mixed performance Friday, and capped off an overall mixed week. Over that week, the best performers were IDR, TRY, and INR while the worst were BRL, MXN, and ARS. US yields are recovering and likely to put renewed pressure on EM FX.

Read More »

Read More »

Emerging Market Preview: Week Ahead

EM FX has started the week mixed. Some relief was seen as US rates stalled out last week, but this Friday’s jobs number could be key for the next leg of this dollar rally. On Wednesday, the Fed releases its Beige book for the upcoming June 13 FOMC meeting, where a 25 bp hike is widely expected. We believe EM FX remains vulnerable to further losses.

Read More »

Read More »

Emerging Markets: What Changed

President Trump canceled the planned summit with North Korea’s Kim Jong Un. Malaysia’s new Finance Minister Lim was sworn in along with 13 other cabinet ministers. Philippine central bank cut reserve ratios for commercial banks by one percentage point to 18% effective June 1. The United Arab Emirates opened up its economy to more foreign investment.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX ended Friday on a weak note and extended the slide. For the week as a whole, the best EM performers were PHP, TWD, and SGD while the worst were ARS, ZAR, and TRY. With US rates continuing to move higher, we believe selling pressures on EM FX will remain in play this week. Our recently updated EM Vulnerability Table supports our view that divergences within EM will remain.

Read More »

Read More »

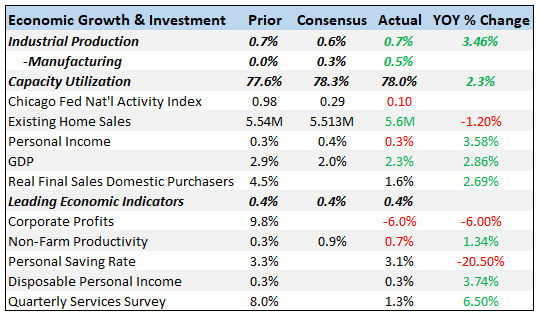

Bi-Weekly Economic Review: Growth Expectations Break Out?

There are a lot of reasons why interest rates may have risen recently. The federal government is expected to post a larger deficit this year – and in future years – due to the tax cuts. Further exacerbating those concerns is the ongoing shrinkage of the Fed’s balance sheet. Increased supply and potentially decreased demand is not a recipe for higher prices. In addition, there is some fear that the ongoing trade disputes may impact foreign demand...

Read More »

Read More »

Emerging Markets: What Changed

Bank Indonesia started a tightening cycle with a 25 bp hike to 4.5%. Jailed Malaysia opposition leader Anwar Ibrahim was released by new Prime Minister Mahathir. Malaysia scrapped the controversial 6% goods and services tax (GST). Violent protests shook Israel as the relocated US embassy opened in Jerusalem.

Read More »

Read More »

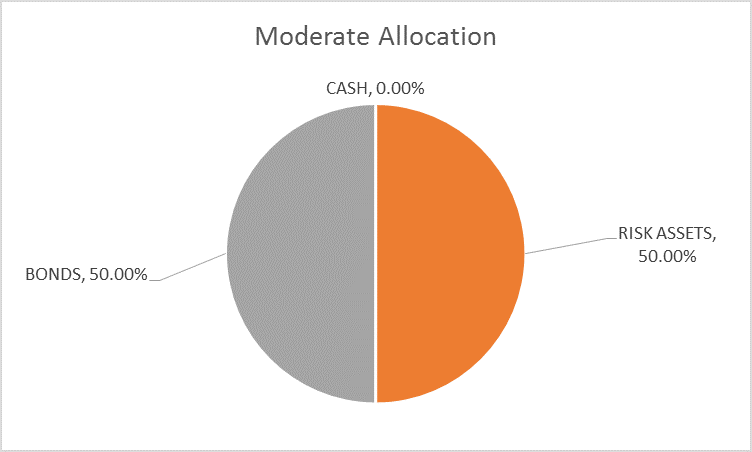

Global Asset Allocation Update

The risk budget changes this month as I add back the 5% cash raised in late October. For the moderate risk investor, the allocation to bonds is still 50% while the risk side now rises to 50% as well. I raised the cash back in late October due to the extreme overbought nature of the stock market and frankly it was a mistake. Stocks went from overbought to more overbought and I missed the rally to all time highs in January.

Read More »

Read More »

FX Daily, May 16: US Yields Soften After Yesterday’s Surge

The US dollar is mixed today after the Dollar Index rose to new 2018 highs yesterday. It is being driven by rising US rates, which also punishes short dollar positions. The US 10-year yield rose seven basis points yesterday to nearly 3.10%. It is consolidating near 3.06% now. Many see the yield rising toward 3.20%, which would match the mid-2011 high.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX ended Friday on a week note and capped of another generally negative week. Worst performers last week were ARS, BRL, and TRY while the best were ZAR, RUB, and KRW. We remain negative on EM FX and look for losses to continue. US retail sales data Tuesday pose further downside risks to EM FX.

Read More »

Read More »

Bi-Weekly Economic Review: Oil, Interest Rates & Economic Growth

The yield on the 10 year Treasury note briefly surpassed the supposedly important 3% barrier and then….nothing. So, maybe, contrary to all the commentary that placed such importance on that level, it was just another line on a chart and the bond bear market fear mongering told us a lot about the commentators and not a lot about the market or the economy.

Read More »

Read More »

Emerging Markets Preview: The Week Ahead

EM FX came under intense selling pressures last week. The worst performers were ARS, TRY, and MXN while the best were PHP, KRW, and TWD. US rates are likely to remain the key driver for EM FX, and so PPI and CPI data will be closely watched this week. We believe EM FX will remain under pressure.

Read More »

Read More »

Emerging Markets: What Changed

Bank Indonesia is taking measures to stabilize the local bond market. The Philippine central bank is tilting more hawkish. Czech National Bank cut its inflation forecasts. The Turkish government is loosening fiscal policy to drum up popular support. S&P downgraded Turkey to BB- with stable outlook. Argentina officials are taking significant measures to support the peso. Brazil central bank made a subtle shift in its FX intervention strategy.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX ended Friday on a firm note, capping off a generally softer week overall. TRY and PHP were the best performers last week, while CLP and ZAR were the worst. US core PCE, ISM manufacturing, FOMC meeting, and jobs data all pose risks to EM this week. We remain a bit defensive on risk assets in general now.

Read More »

Read More »

Emerging Market Preview: Week Ahead

EM FX came under renewed pressure last week as US yields rose to new highs for the cycle. RUB and TRY were the top performers last week, while MXN and COP were the worst. There are no Fed speakers this week due to the embargo ahead of the May 2 FOMC meeting. While we see little chance of a hike then, markets are likely to remain nervous.

Read More »

Read More »

Emerging Markets: What Changed

The Reserve Bank of India is tilting more hawkish. Tensions on the Korean peninsula are easing. The Trump administration reversed course on Russia sanctions. Turkey is heading for early elections.

Raul Castro stepped down as president of Cuba. Mexico polls show continued gains for Andres Manuel Lopez Obrador.

Read More »

Read More »

Emerging Markets: What Changed

Hong Kong Monetary Authority intervened to defend the HKD peg. Moody’s upgraded Indonesia by a notch to Baa2 with a stable outlook. MAS tightened policy by adjusting the slope of its S$NEER trading band up “slightly.” Hungary Prime Minister Orban won a fourth term for his Fidesz party. Poland central bank Governor said it’s possible that the next move will be a rate cut. Russia outlined a range of potential retaliatory measures in response to US...

Read More »

Read More »

Emerging Markets: What Changed

Reserve Bank of India cut its inflation forecast for the first half of FY2018/19 to 4.7-5.1%. Former South Korean President Park was sentenced to 24 years in prison. Malaysia Prime Minister Razak has called for early elections. Bahrain discovered its biggest oil field since it started producing crude in 1932. Local press reports Turkey’s Deputy Prime Minister Simsek tendered his resignation.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX was mostly stronger last week, despite the dollar’s firm tone against the majors. Best EM performers on the week were MXN, KRW, and COP while the worst were ZAR, INR, and PEN. US jobs data poses the biggest risk to EM this week, as US yields have been falling ahead of the data. Indeed, the current US 10-year yield of 2.74% is the lowest since February 6.

Read More »

Read More »