Tag Archive: dollar price

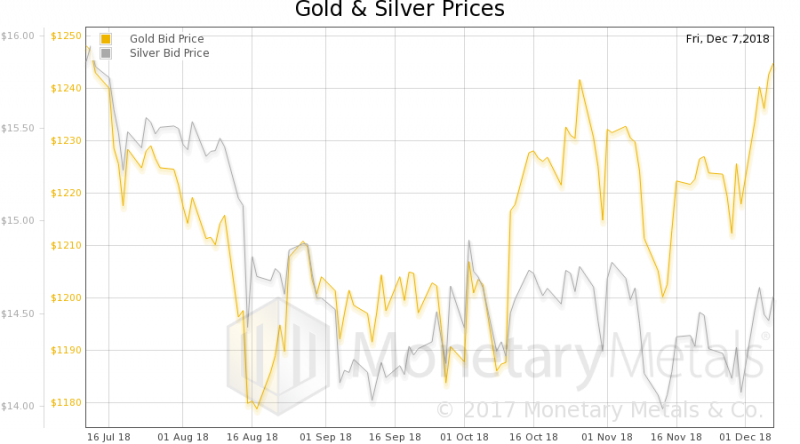

The Prodigal Parent, Report 9 Dec 2018

The Baby Boom generation may be the first generation to leave less to their children than they inherited. Or to leave nothing at all. We hear lots—often from Baby Boomers—about the propensities of their children’s generation. The millennials don’t have good jobs, don’t save, don’t buy houses in the same proportions as their parents, etc.

Read More »

Read More »

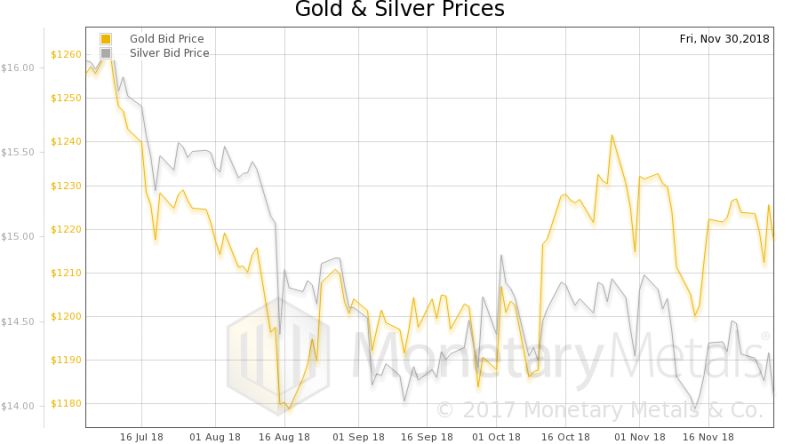

Inflation, Report 2 Dec 2018

What is inflation? Any layman can tell you—and nearly everyone uses it this way in informal speech—that inflation is rising prices. Some will say “due to devaluation of the money.” Economists will say, no it’s not rising prices per se. That is everywhere and always the effect. The cause, the inflation as such, is an increase in the quantity of money. Which is the same thing as saying devaluation.

Read More »

Read More »

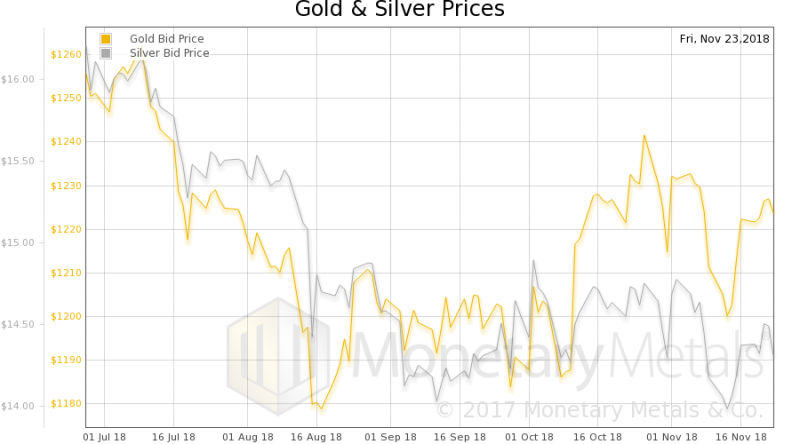

A Golden Renaissance, Report 25 Nov 2018

There is the freedom of speech battle, with the forces of darkness advancing all over. For example, in Pakistan, there are killings of journalists. Saudi Arabia apparently had journalist Khashoggi killed. New Zealand now can force travellers to provide the password to their phones so the government can go through all your data, presumably including your gmail, Onedrive, Evernote, and WhatsApp.

Read More »

Read More »

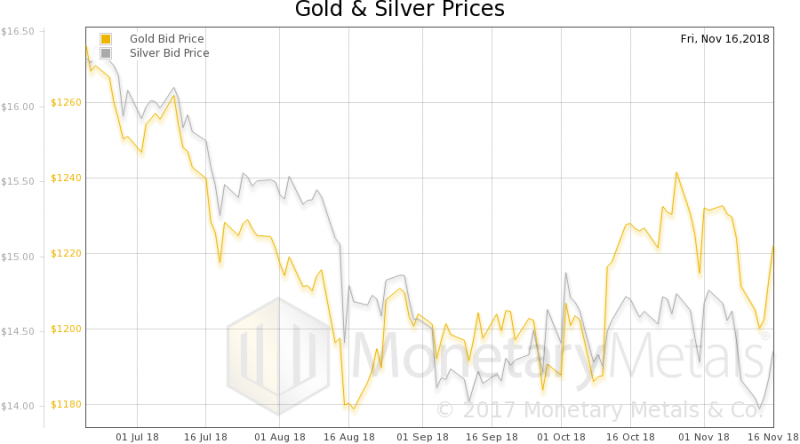

The Ultimate Stablecoin, Report 18 Nov 2018

A long time ago in a galaxy far, far away we wrote a series of articles arguing that bitcoin is not money and is not sound. Bitcoin was skyrocketing at the time, as we wrote most of them between July 30 and Oct 1 last year. Back in those halcyon days, volatility was deemed to be a feature.

Read More »

Read More »

The Failure of a Gold Refinery, Report 12 Nov 2018

So this happened: Republic Metals, a gold refiner, filed bankruptcy on November 2. The company had found a discrepancy in its inventory of around $90 million, while preparing its financial statements.

We are not going to point the Finger of Blame at Republic or its management, as we do not know if this was honest error or theft.

Read More »

Read More »

Wizard’s First Rule, Report 4 Nov 2018

Terry Goodkind wrote an epic fantasy series. The first book in the series is entitled Wizard’s First Rule. We recommend the book highly, if you’re into that sort of thing. However, for purposes of this essay, the important part is the rule itself: “Wizard’s First Rule: people are stupid.” “People are stupid; given proper motivation, almost anyone will believe almost anything.

Read More »

Read More »

What Can Kill a Useless Currency, Report 28 Oct 2018

There is a popular notion, at least among American libertarians and gold bugs. The idea is that people will one day “get woke”, and suddenly realize that the dollar is bad / unbacked / fiat / unsound / Ponzi / other countries don’t like it / . When they do, they will repudiate it. That is, sell all their dollars to buy consumer goods (i.e. hyperinflation), gold, and/or whatever other currency.

Redemptions Balanced With Deposits

No national...

Read More »

Read More »

Useless But Not Worthless, Report 21 Oct 2018

Let’s continue to look at the fiasco in the franc. We say “fiasco”, because anyone in Switzerland who is trying to save for retirement has been put on a treadmill, which is now running backwards at –¾ mph (yes, miles per hour in keeping with our treadmill analogy). Instead of being propelled forward towards their retirement goals by earning interest that compounds, they are losing principal.

Read More »

Read More »

You Can’t Eat Gold, Report 14 Oct 2018

“You can’t eat gold.” The enemies of gold often unleash this little zinger, as if it dismisses the idea of owning gold and indeed the whole gold standard. It is a fact, you cannot eat gold. However, it dismisses nothing.

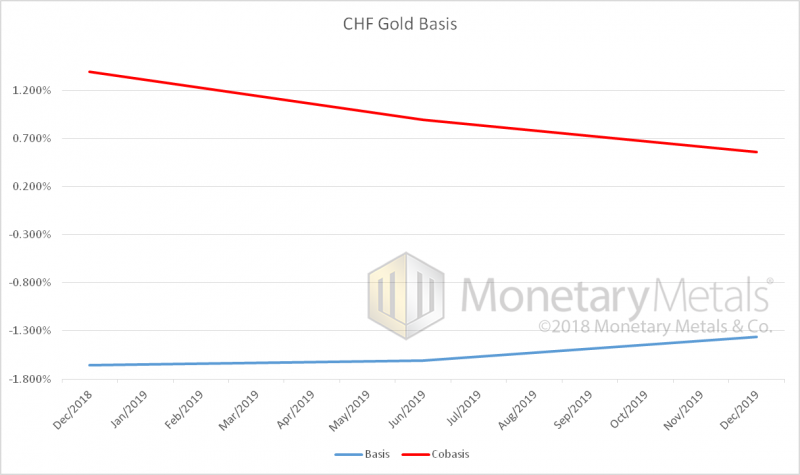

This gives us an idea. Let’s tie three facts together. One, you can’t eat gold. Two, gold is in backwardation in Switzerland. And three, speculation is a bet on the price action.

Read More »

Read More »

The Toxic Stew, Report 7 Oct 2018

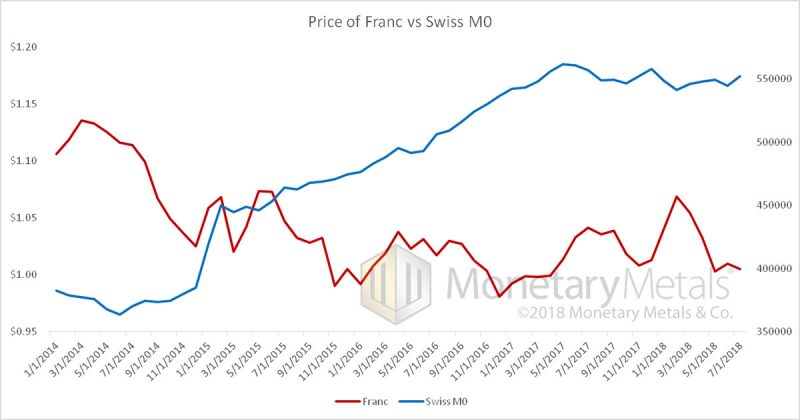

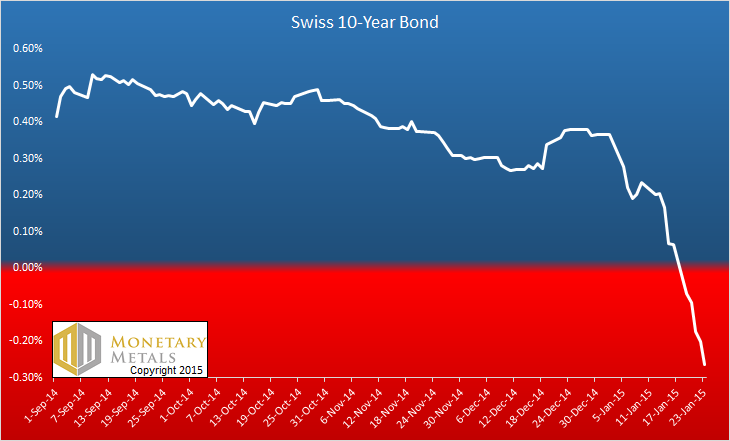

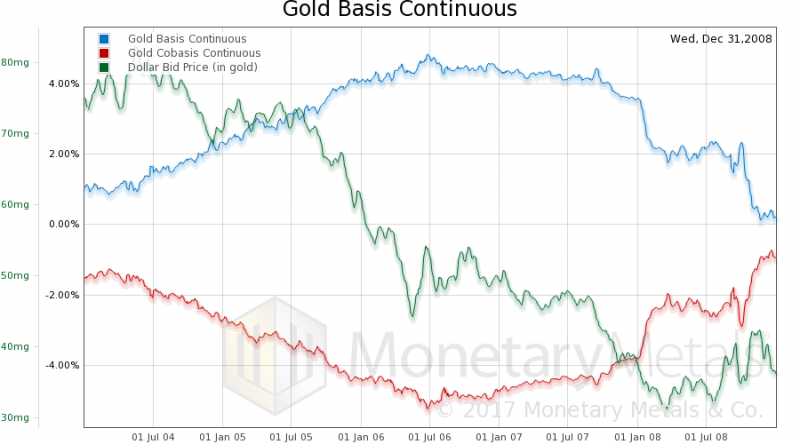

Last week, we shined a spotlight on a crack in the monetary system that few people outside of Switzerland (and not many inside either) were aware of. There is permanent gold backwardation measured in Swiss francs. Everyone knows that the Swiss franc has a negative interest rate, but so far as we know, Keith is the only one who predicted this would lead to its collapse (and he was quite early, having written that in January 2015).

Read More »

Read More »

Yield Curve Compression – Precious Metals Supply and Demand

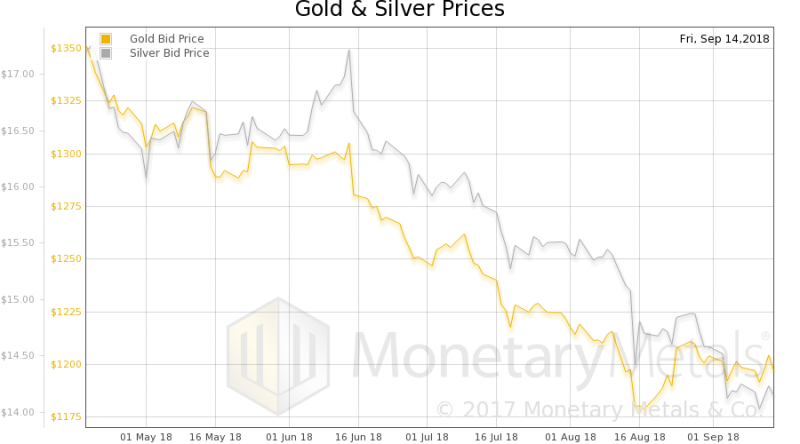

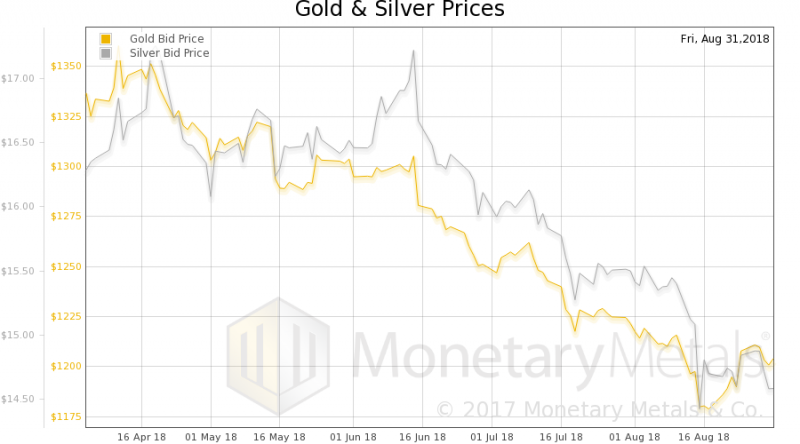

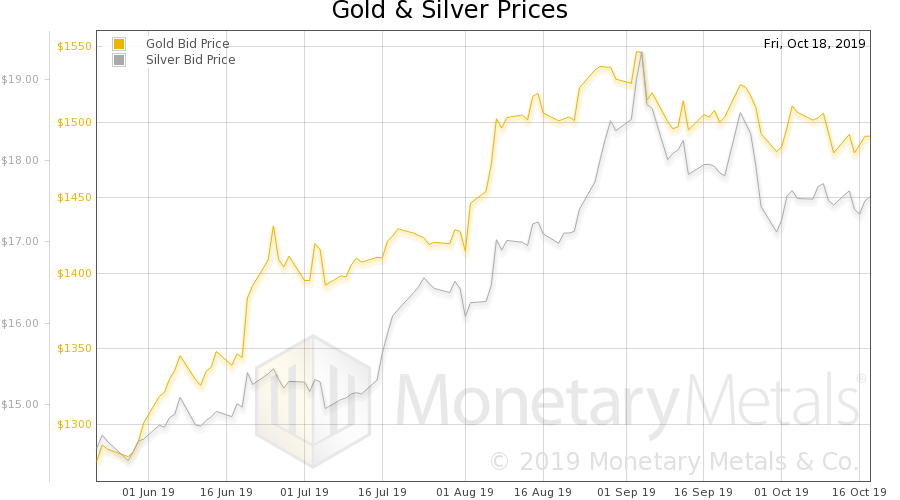

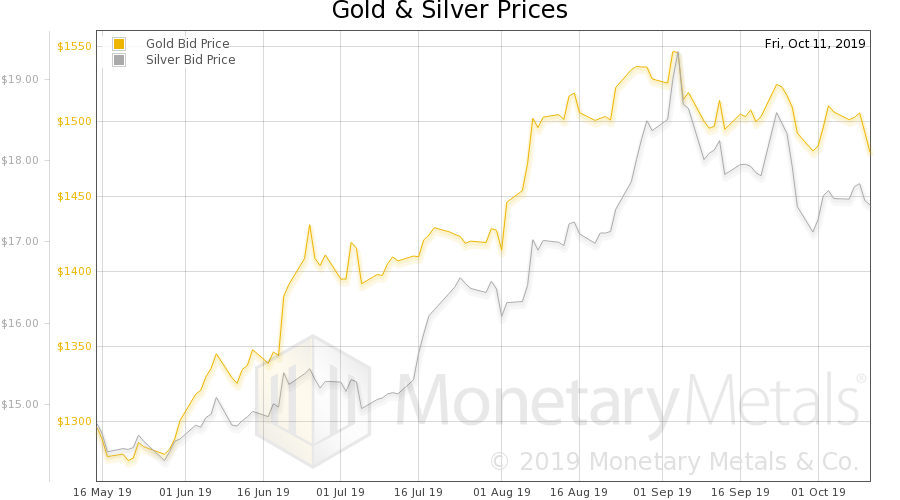

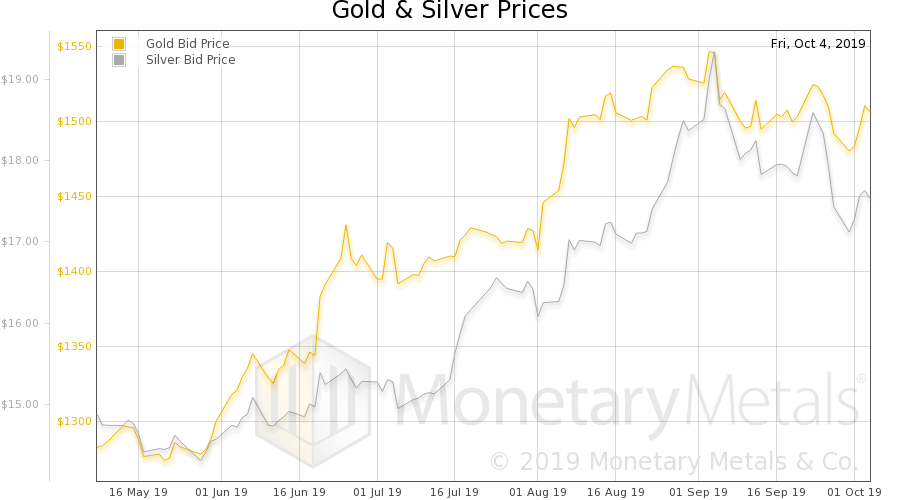

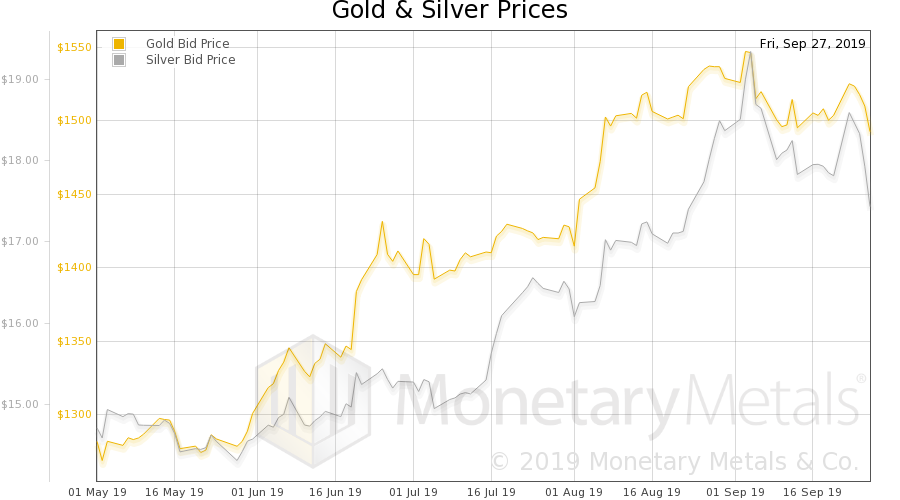

The price of gold fell nine bucks last week. However, the price of silver shot up 33 cents. Our central planners of credit (i.e., the Fed) raised short-term interest rates, and threatened to do it again in December. Meanwhile, the stock market continues to act as if investors do not understand the concepts of marginal debtor, zombie corporation, and net present value.

Read More »

Read More »

Permanent Gold Backwardation, Report 30 Sep 2018

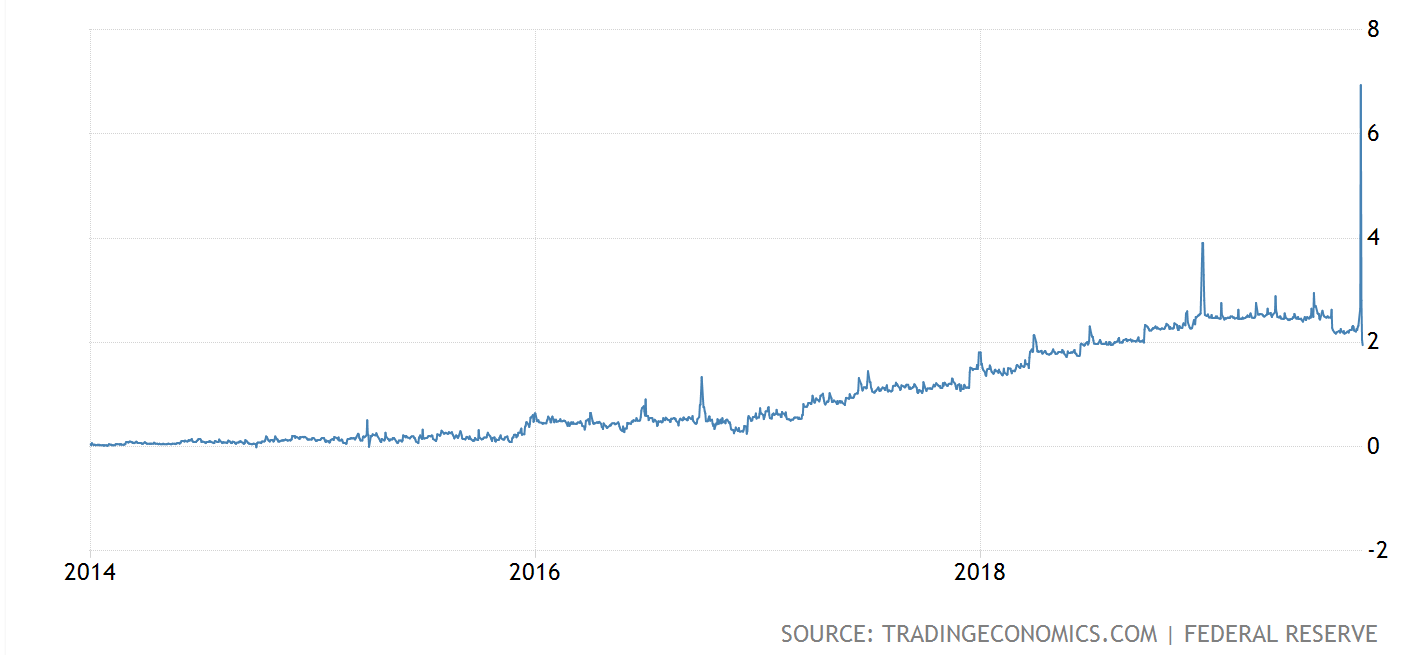

Sometimes, one just needs to look in the right place. And often in those cases, it just takes a conversation to alert one where to look. We had a call with a Swiss company this week, to discuss gold financing for their business. They reminded us that there is a negative interest rate on Swiss francs. And then they said that a swap of francs for gold has a cost. That is, the CHF GOFO rate is negative (the dollar based 12-month MM GOFO™ is +2.4%).

Read More »

Read More »

Why Are Wages So Low, Report 23 Sep 2018

Last week, we talked about the capital consumed by Netflix—$8 billion to produce 700 shows. They’re spending more than two thirds of their gross revenue generating content. And this content has so little value, that a quarter of their audience would stop watching if Netflix adds ads (sorry, we couldn’t resist a little fun with the English language).

Read More »

Read More »

Never Mind the Bollocks, Here’s the Avocado Toast, Report 16 Sep 2018

For about ten bucks a month, Netflix will give you all the movies you can watch, plus tons of TV show series and other programs, such as one-off science documentaries. They don’t offer all movies, merely more than you can watch. Oh, and there are no commercials. They don’t just give you old BBC reruns, which you know they can get for a pittance.

Read More »

Read More »

Why the Fed Denied the Narrow Bank, Report 9 Sep 2018

It’s not every day that a clear example showing the horrors of central planning comes along—the doublethink, the distortions, and the perverse incentives. It’s not every year that such an example occurs for monetary central planning. One came to the national attention this week. A company called TNB applied for a Master Account with the Federal Reserve Bank of New York.

Read More »

Read More »

Illicit Arbitrage Cut by Tax Cuts and Jobs Act, Report 3 Sep 2018

This week, we are back to our ongoing series on capital destruction. Let’s consider the simple transaction of issuing a bond. Party X sells a bond to Party Y. We will first offer something entirely uncontroversial. If the interest rate rises after Y buys the bond, then Y takes a loss. Or if the interest rate falls, then Y makes a capital gain. This is simply saying that the bond price moves inverse to the interest rate.

Read More »

Read More »

Another Gold Bearish Factor, Report 26 August 2018

Last week, we said that the consensus is that gold must go down (as measured in terms of the unstable dollar) and then will rocket higher. We suggested that if everyone expects an outcome in the market, the outcome is likely not to turn out that way. We also said that this time, there is likely less leverage employed to buy gold and that gold is less leveraged as well.

Read More »

Read More »

Submerged Lighthouse Syndrome – Precious Metals Supply and Demand

Last week, the lighthouse went down 24 meters (gold went down $24), or 50 inches (if you prefer, silver went down 50 cents). However, let’s take a look at the only true picture of supply and demand. Are the fundamentals dropping with the market price?

Read More »

Read More »

In Next Crisis, Gold Won’t Drop Like 2008, Report 19 August 2018

Last week, we discussed the tension between forces pushing the dollar up and down (measured in gold—you cannot measure the dollar in terms of its derivatives such as euro, pound, yen, and yuan). And we gave short shrift to the forces pushing the dollar down. We said only that to own a dollar is to be a creditor. And if the debtors seem in imminent danger of default, then creditors should want to escape this risk.

Read More »

Read More »

Fundamental Price of Gold Decouples Slightly – Precious Metals Supply and Demand

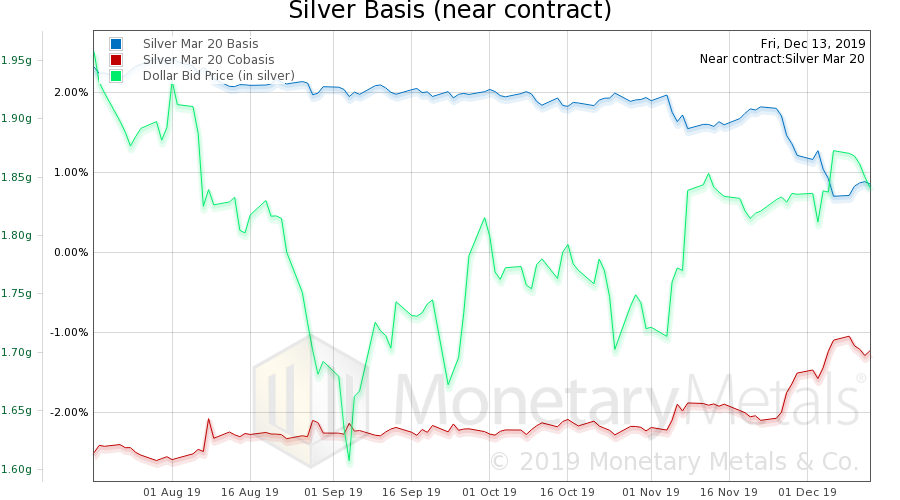

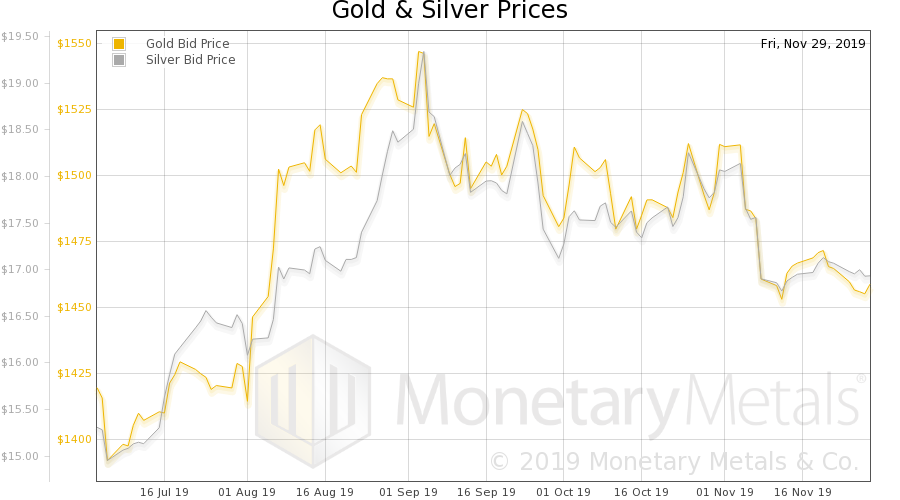

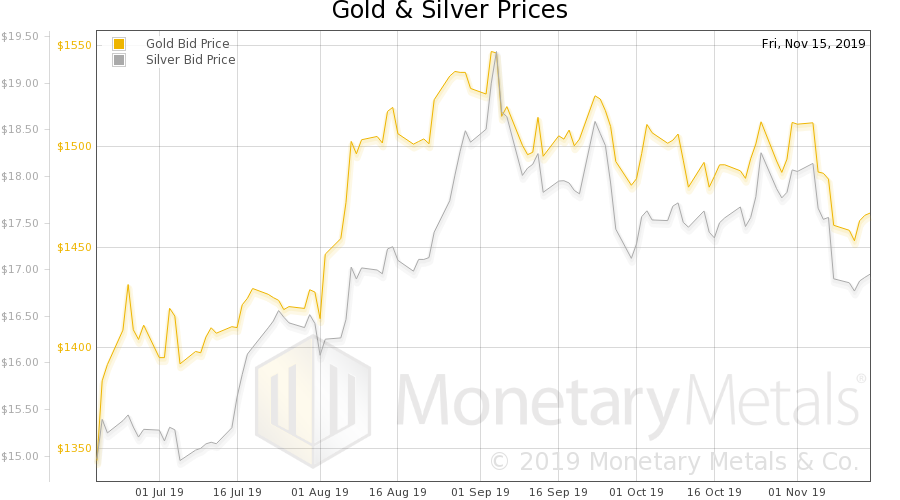

Keith Weiner’s weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

Receive a Daily Mail from this Blog

Live Currency Cross Rates

On Swiss National Bank

On Swiss National Bank

-

SNB’s Chairman Schlegel: A few months of negative inflation wouldn’t be a problem

14 days ago -

SNB Sight Deposits: decreased by 3.6 billion francs compared to the previous week

2025-12-17 -

2025-07-31 – Interim results of the Swiss National Bank as at 30 June 2025

2025-07-31 -

SNB Brings Back Zero Percent Interest Rates

2025-06-26 -

Hold-up sur l’eau potable (2/2) : la supercherie de « l’hydrogène vert ». Par Vincent Held

2025-06-24

Main SNB Background Info

Main SNB Background Info

-

SNB Sight Deposits: decreased by 3.6 billion francs compared to the previous week

2025-12-17 -

The Secret History Of The Banking Crisis

2017-08-14 -

SNB Balance Sheet Now Over 100 percent GDP

2016-08-29 -

The relationship between CHF and gold

2016-07-23 -

CHF Price Movements: Correlations between CHF and the German Economy

2016-07-22

Featured and recent

-

Ruhestand ist dein Ende

Ruhestand ist dein Ende -

Kilo Koala Silver Coin: Unbelievable Size (Watch This Coin!)

Kilo Koala Silver Coin: Unbelievable Size (Watch This Coin!) -

Der wahre Grund? #politik #krieg #deutschland #europa #wirtschaft #russland #ukraine #putin #usa

Der wahre Grund? #politik #krieg #deutschland #europa #wirtschaft #russland #ukraine #putin #usa -

Warum Lebensverlängerung nicht das eigentliche Problem löst.

Warum Lebensverlängerung nicht das eigentliche Problem löst. -

Strategie-Fehler korrigieren: So überlebt dein Portfolio jede Krise

Strategie-Fehler korrigieren: So überlebt dein Portfolio jede Krise -

Silber & Gold: Kommen jetzt neue Rekorde?

Silber & Gold: Kommen jetzt neue Rekorde? -

Private Credit Funds Falling Out Of Favor

Private Credit Funds Falling Out Of Favor -

Wichtige Morning News mit Oliver Klemm #537

Wichtige Morning News mit Oliver Klemm #537 -

Quartalszahlen Crash – United Health Aktie 22% im Minus!

Quartalszahlen Crash – United Health Aktie 22% im Minus! -

Covid ist nicht vorbei – die Folgen bleiben

Covid ist nicht vorbei – die Folgen bleiben

More from this category

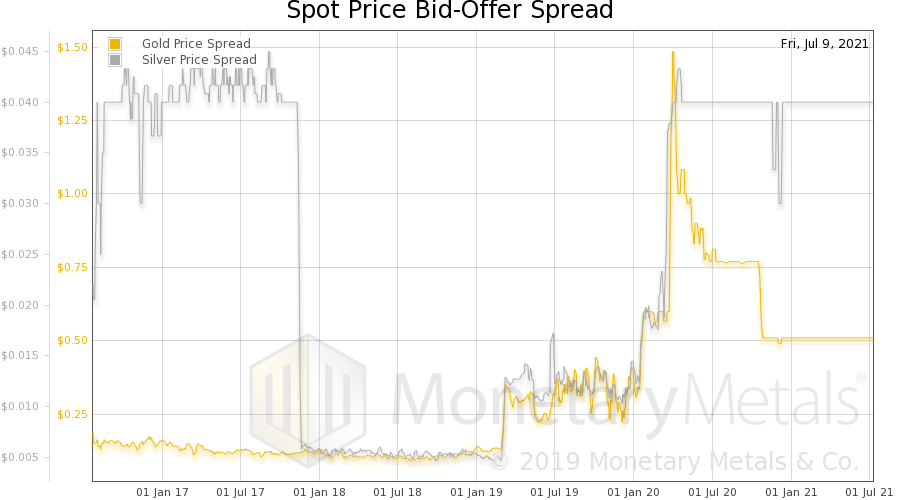

Basel III’s Effect on Gold and Silver

Basel III’s Effect on Gold and Silver13 Jul 2021

Defaults Are Coming, Market Report, 22 June

Defaults Are Coming, Market Report, 22 June23 Jun 2020

When Is a Capital Gain Capital Consumption? Market Report, 25 May

When Is a Capital Gain Capital Consumption? Market Report, 25 May26 May 2020

Gold and Silver Markets Start to Normalize, Report 4 May

Gold and Silver Markets Start to Normalize, Report 4 May5 May 2020

Crouching Silver, Hidden Oil Market Report 20 Apr

Crouching Silver, Hidden Oil Market Report 20 Apr21 Apr 2020

The Out Has Not Yet Begun to Fall, Market Report 31 March

The Out Has Not Yet Begun to Fall, Market Report 31 March2 Apr 2020

Wealth Consumption vs. Growth – Precious Metals Supply and Demand

Wealth Consumption vs. Growth – Precious Metals Supply and Demand3 Jan 2020

Open Letter to John Taft, Report 17 Dec

Open Letter to John Taft, Report 17 Dec18 Dec 2019

The End of an Epoch, Report 8 Dec

The End of an Epoch, Report 8 Dec10 Dec 2019

Money and Prices Are a Dynamic System, Report 1 Dec

Money and Prices Are a Dynamic System, Report 1 Dec3 Dec 2019

Raising Rates to Fight Inflation, Report 24 Nov

Raising Rates to Fight Inflation, Report 24 Nov26 Nov 2019

The Perversity of Negative Interest, Report 17 Nov

The Perversity of Negative Interest, Report 17 Nov18 Nov 2019

What’s the Price of Gold in the Gold Standard, Report 10 Nov

What’s the Price of Gold in the Gold Standard, Report 10 Nov12 Nov 2019

Targeting nGDP Targeting, Report 3 Nov

Targeting nGDP Targeting, Report 3 Nov5 Nov 2019

Bitcoin Myths, Report 27 Oct

Bitcoin Myths, Report 27 Oct28 Oct 2019

Wealth Accumulation Is Becoming Impossible, Report 20 Oct

Wealth Accumulation Is Becoming Impossible, Report 20 Oct22 Oct 2019

Motte and Bailey Fallacy, Report 13 Oct

Motte and Bailey Fallacy, Report 13 Oct15 Oct 2019

A Wealth Tax Consumes Capital, Report 6 Oct

A Wealth Tax Consumes Capital, Report 6 Oct7 Oct 2019

The Purchasing Power of Capital, Report 29 Sep

The Purchasing Power of Capital, Report 29 Sep1 Oct 2019

Treasury Bond Backwardation, Report 22 Sep

Treasury Bond Backwardation, Report 22 Sep24 Sep 2019