Tag Archive: COVID-19

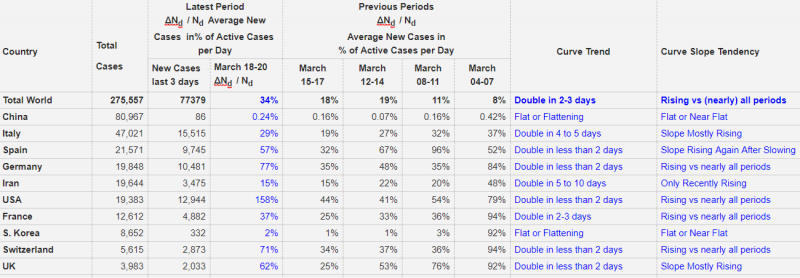

Corona’s Exponential Curve Slope Tracking, March 20

Key for understanding the expansion of the Coronavirus, is the slope (or steepness / derivation) of the curve.

This post compares the slope values of different countries.

Read More »

Read More »

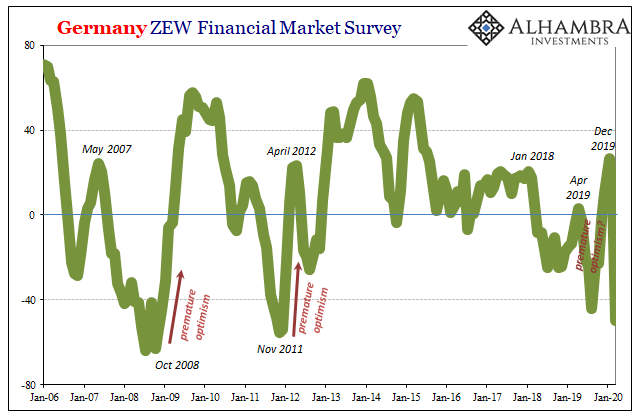

Stagnation Never Looked So Good: A Peak Ahead

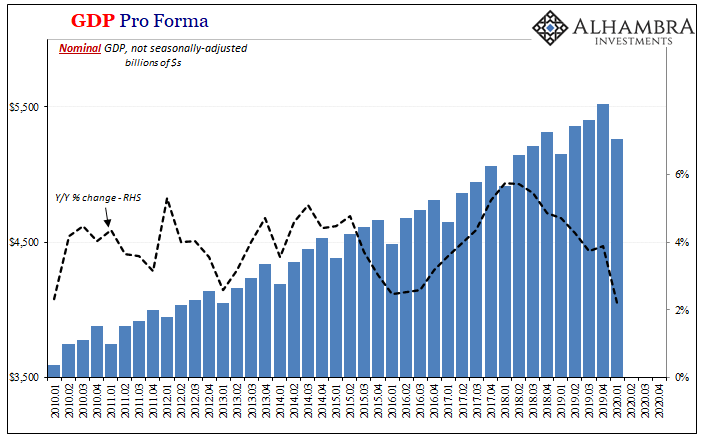

Forward-looking data is starting to trickle in. Germany has been a main area of interest for us right from the beginning, and by beginning I mean Euro$ #4 rather than just COVID-19. What has happened to the German economy has ended up happening everywhere else, a true bellwether especially manufacturing and industry.

Read More »

Read More »

FX Daily, March 16: Monday Blues: Fed Moves Bigly and Stocks Slump

Overview: The Federal Reserve and central banks in the Asia Pacific region acted forcefully, but were unable to ease the consternation of investors. The Reserve Bank of New Zealand cut key rates by 75 bp. The Bank of Japan appears to have doubled its ETF purchase target to JPY12 trillion, and the Reserve Bank of Australia is preparing for new measures that will be announced Thursday.

Read More »

Read More »

FX Daily, March 12: Trump Dump as Market Turns to ECB

Overview: After the Bank of England and the UK Treasury announced both monetary and fiscal support, the focus turns to the ECB, but the proximity of the US Congressional recess (next week) without strong fiscal measures being in place sucked the oxygen away from other issues. President Trump's national address in the Asian session failed to reassure investors.

Read More »

Read More »

FX Daily, March 11: US Over-Promises and Under-Delivers, while BOE Steps Up with 50 bp Rate Cut

Overview: The S&P 500 and Dow Jones Industrials sold off after the higher open and briefly traded below yesterday's lows. Investors seemed disappointed that the Trump Administration was not ready with specific policies after Monday's tease that had initially helped lift Asia Pacific and European markets earlier on Tuesday. This sparked a sharp decline in Europe into the close.

Read More »

Read More »

FX Daily, March 2: Central Banks’ Words of Assurance have Short Life

Overview: Comments beginning with Powell before the weekend, and BOJ and BOE earlier today promising support have saw equity markets briefly stabilize after last week's dramatic moves. The G7 will hold a teleconference this week, but speculation of a coordinated rate move does not seem particularly likely. Most of the large stock markets in the Asia Pacific region rallied, led by a 3%+ advance in China.

Read More »

Read More »

FX Daily, February 28: Fallout Accelerates

Overview: The dramatic response by investors to Covid-19 continues unabated and worse. The slide is accelerating. The S&P 500 posted a 4.4% loss yesterday, its worst session since 2011, and the sell-off is continuing. Many markets in Asia Pacific, including Japan, China, Korea, Australia, India, Singapore, and Thailand, fell by more than 3%.

Read More »

Read More »

FX Daily, February 27: The Rot Continues but Somewhat Less Dollar Friendly

A new phase of the Covid-19 is at hand. Yesterday was the first time that the number of new cases in the world surpassed the number of new cases China acknowledged. This confirms what we have known, namely that the battle for containing it in China has been lost.

Read More »

Read More »

FX Daily, February 24: Stocks Slammed and Yields Drop as Virus Containment Fails

Overview: The ring of containment of Covid-19 has grown from China. The new frontline is Japan, South Korea, Italy, and Iran. A lockdown of around 50k people near Milan and Austria blocking trains from Italy is scaring investors. Asian markets fell, but South Korea bore the brunt with a nearly 4% decline. The national holiday in Japan spared local equities.

Read More »

Read More »