|

Honestly, what did everyone think was going to happen? I know, I’ve seen the analyst estimates. They were talking like another six or seven perhaps eight million job losses on top of the twenty-plus already gone. Instead, the payroll report (Establishment Survey) blew everything away, coming in both at two and a half million but also sporting a plus sign. The Household Survey was even better, +3.8mm during May 2020. But, again, why wasn’t this expected? All this payroll report confirms is what we already knew – the economy is being reopened. Quite naturally it will lead to millions of Americans heading back to work. You deprive tens of millions of the opportunity to leave their house and attend to their jobs, once allowed they’re going to flood back in. Now, as usual, the data is being misinterpreted as something it is not. Contributing to the euphoria, as I wrote a couple days ago:

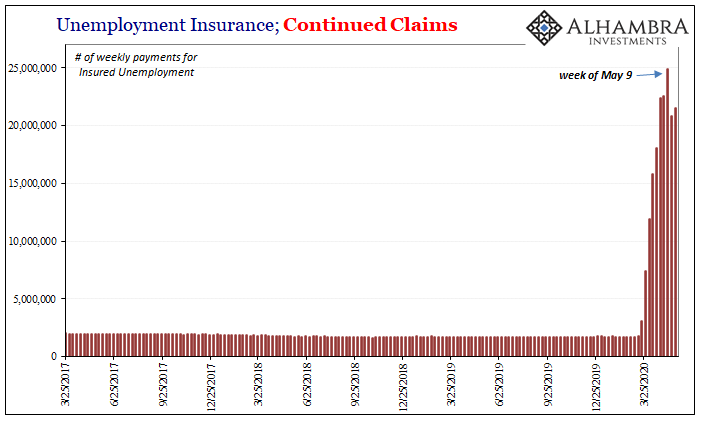

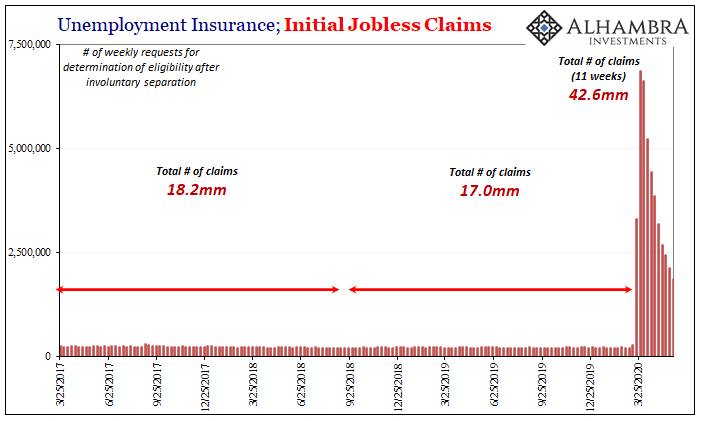

The unemployment claims data (continued) already told us this had happened and even helpfully pinpointed the inflection during the first couple of weeks last month. |

Unemployment Insurance, Continued Claims, 2017-2020 |

| Continued claims as opposed to initial claims relate to separated workers who, as the term indicates, continue to file for state unemployment insurance payments because they haven’t been able to go back to work or find new employment. That number peaked way back during the second week in May, falling by just over 4 million the following week.

And though continued claims increased after that, likely as claimants wrangle with delayed approvals and payments, the overall picture is one where the non-economic part of the dislocation is already beginning to ease. Exactly what has been announced by local and state governments all over the country. Thus, to see payroll gains for all of May should have been unsurprising, even to this degree. In fact, we should expect gigantic positive numbers over the next several months.And we might also need to prepare for some big misses, too, along the way. For one thing, this employment data is particularly unsuited for times like these. I mean this in two ways, the second far more important. First, though, the raw categories survey respondents are placed into based on how they answer specific questions. If you are on furlough, you’re supposed to tell the BLS interviewer you are not working, however evidence suggests that many if not most are claiming they’re still employed since they technically haven’t been fired or laid off. Then there’s the matter of the PPP, the government’s Paycheck Protection Program. Are you employed or unemployed if you’re still getting paid but only because the feds are lending your bosses cash loans? That would mean in reality you don’t really still have a paying job yet you can say that you do because the government is taking responsibility for your salary your company most likely would otherwise have already unloaded. |

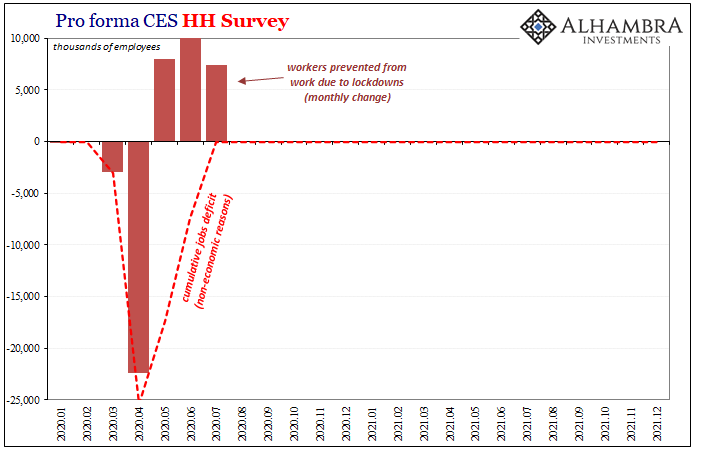

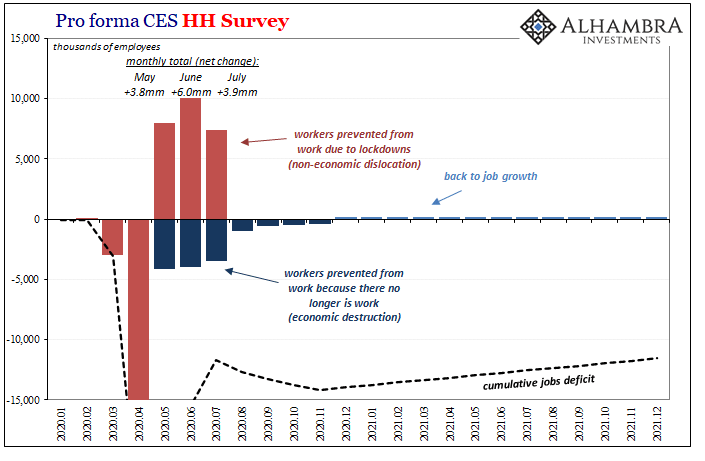

Pro forma CES HH Survey, 2020-2021 |

| That’s not a job, it’s one of many accounting fictions.

And then there’s the noisiness, way beyond the typical volatility. The April 2020 payroll estimate (Establishment Survey) was revised lower by another 669k, while March had almost half a million further subtracted. These by themselves would equate to some of the worst payroll months in the series’ history, except they are mere revisions to those that were. In other words, there’s a huge degree of fluidity and uncertainty going on here. Precision is not in any of these figures. Even so, I have no doubt that the US economy “added” a significant number of jobs during last month as the continued claims figures had already indicated. But it’s not addition, at best only the beginning of a rebound. What most people seem to be doing is extrapolating, in a straight line, from the start of this rebound, it’s “early” start, and how this will lead to a trend which will remain unimpeded all the way back to zero. The V of V’s. And this is where it gets tricky, and the more important second way in which the BLS is doing us no favors. Because we’ve never been in this situation before, we can’t blame the government; no one figured they’d ever have to ask what should be the most important question going forward. If you are unemployed currently, were you laid off because you couldn’t get to work (non-economic shutdown), or because (economic reasons) there’s now no work for you to go back to? What seems to be happening is that given the big positive in May’s payroll data everyone now assumes there’s only the former and none of the latter. Because of this huge “surprise” in employment data, the assumption is being made how once the lockdowns are lifted everyone really will go right back to work and we all go on with our lives as if nothing much happened.But we already know from the initial jobless claims data that companies are still laying off workers at an historic pace. It’s not nearly the 6mm a week earlier in the year, but still around 2mm this leaves enormous job losses which places current circumstances in a category way, way above (meaning worse) both of the last two nastiest recessions (2008-09 and 1981-82). Different and separate from continued claims, together with initial claims the unemployment payment figures tell us there is actually that combination of factors taking place all at the same time. The non-economic layoffs and now its rebound combining with economic layoffs and not yet the more important one. |

Pro forma CES HH Survey, 2020-2021 |

| Let’s assume that the big “V” happens in terms of the non-economic dislocation (above; for illustrative purposes). Since early May was the start of reopening, it only gets big positives from here. I’ve assumed that every job lost because of the shutdowns is zeroed out after only three months. The effects of the COVID-19 factor gone by August.

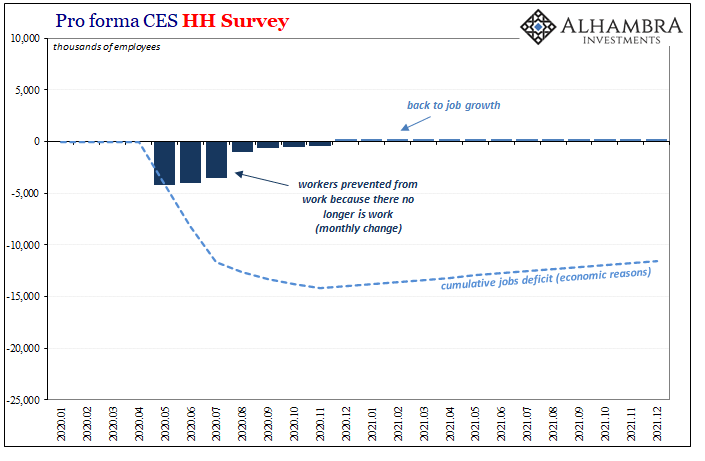

As we know, however, some of those jobs aren’t actually coming back. Companies have already closed (not just small mom and pop restaurants or bars) and shrunken. They are still closing and shrinking (initial claims). Thus, we have to try to account for job losses due to economic reasons which aren’t broken down and separated in the payroll data. Shown below, there were far more than 4mm initial jobless claims during all of May yet I’ve only subtracted that much for our purposes here.Under this assumption, I’ve got job growth returning by December of this year – which may prove to be overly optimistic, as I intend to be for this exercise. The net result is the clash of letters, the non-economic “V” fighting against the economic “L.” In the final illustration, it ends up as something like a checkmark. |

Pro forma CES HH Survey, 2020-2021 |

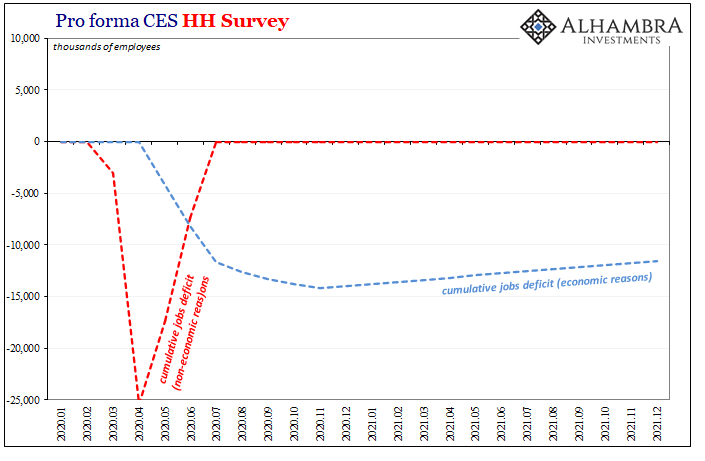

Pro forma CES HH Survey, 2020-2021 |

|

| Here’s the thing: the payroll numbers (HH survey, in this case) are still going to be absolutely enormous over the next three months using these assumptions. I’ve got them as +3.8mm in May (which is the current estimate), +6.0mm in June, and then almost +4mm in July. That’s near +14mm in just three months (can you imagine the mainstream fury?)

And they’re ultimately meaningless, those big numbers. The third quarter of 2020 will see some of the biggest positive changes on record in nearly every account, but none of it will be growth. At most it’s a rebound beginning from an enormous depth, the huge starting deficit or hole. The far more important issue is what I’ve already described, the same thing that has mainstream econometric models keeping policymakers up at night. Below I’ve updated those prior estimates to reflect the current levels contained in the May payroll report. It can still easily end up just like what I’ve shown you above even if the shutdown bottom showed up “early.” |

Labor Difficulties, 2014-2021 |

| That’s because ultimately it won’t matter much – if at all – precisely when the economy bottomed out; if early May, or perhaps June even later in the year. That’s what all the fuss has been about, when. The question, the only question, is how thoroughly (and quickly) it comes back. If it only gets partway as even the optimistic models have assumed, even most of the way to give “stimulus” more benefit of the doubt, that’s a disaster.

And the reason it would only get partway is the economic stuff happening underneath that right now has been buried by the non-economic rebound underway as economies are reopened. We see the big monthly positive this month, the reopening, but we don’t see the destruction which must’ve already taken place. The BLS just isn’t equipped nor ready to differentiate the two. That means, for now, the huge positives will be everywhere even though they could be, very likely are, misleading. In one sense, it’s simple, too; following a two-month period when more than 25mm jobs had disappeared (HH Survey), is gaining 3.8mm back really that impressive even if the start of the rebound is earlier than you might have previously presumed? It only is if you believe that +3.8mm goes forward all the way back to even again. As always, the only thing that matters is if everyone gets to go back to work. These payroll figures simply confirm the non-economic reopening, and the start of some, a small fraction, getting back to work. But we already knew that. |

Unemployment Insurance, Initial Jobless Claims, 2017-2020 |

Full story here Are you the author? Previous post See more for Next post

Tags: bls,COVID-19,employment report,establishment survey,household survey,jobs,Labor Market,Markets,newsletter,payrolls,recovery,unemployment rate