Tag Archive: $CNY

FX Daily, June 27: Euro Surges on Draghi, While Yuan Rises on Suspected PBOC Action

ECB President Draghi told the audience at the annual ECB Forum transitory factors were holding back inflation. This was quickly understood to be bullish for the euro, and it rallied from near the session lows below $1.12 to around $1.1260, a nine-day high.

Read More »

Read More »

FX Daily, June 21: Heavy Oil Weighs on Yields and Lifts Yen

The US dollar is narrowly mixed against the major currencies. The drop in oil prices (3.3% this week) is seen as one of the factors that may be underpinning the appetite for fixed income, and this, in turn, is lifting the yen. The greenback had approached JPY112 yesterday, but with the drop in oil prices and yields has seen it retreat toward JPY111.00.

Read More »

Read More »

FX Daily, June 14: FOMC and upcoming SNB

The Euro has risen by 0.37% to 1.0901 CHF. This is a typical movement ahead of the SNB meeting tomorrow.

This movement is probably unrelated to the Fed rate hike, given that the USD/JPY has fallen.

It makes sense to go long CHF against JPY, if you bet on an inactive SNB. Inactive SNB would mean that the central bank will not speak about stronger FX Interventions or about lower rates.

Read More »

Read More »

FX Daily, June 07: Markets Mark Time Ahead of Tomorrow

Tomorrow may be the most important day of the quarter for investors. The ECB meets. The UK goes to the polls. Former FBI Comey testifies. Ahead of these significant events, the global capital markets are mostly quiet, with some pockets of activity.

Read More »

Read More »

FX Daily, June 05: US Dollar Starts Important Week Mostly Stable to Higher

The US dollar is beginning what promises to be an important week on a steady to firmer note against most of the major currencies. It is a holiday in parts of Europe (e.g.,m Germany and Switzerland). Although excitement is not until Thursday's ECB meeting, UK election, and the testimony of former US FBI Director Comey, there are several developments today to note.

Read More »

Read More »

FX Daily, June 02: Dollar Marks Time Ahead of US Jobs Report

The foreign exchange market is becalmed, leaving the US dollar narrowly mixed. The euro has been confined to less than a 20-pip range through the Asian session and most of the European morning. The news stream is light. The US withdrawal from the Paris Accord may have garnered the headlines, but as a market force, it is difficult to detect the immediate impact.

Read More »

Read More »

FX Daily, June 01: Greenback Steadies at Lower Levels, Sterling Struggles

The US dollar is mostly firmer against the major currencies. It is consolidating yesterday's losses more than staging much of a recovery. Even sterling, where a YouGov poll has the Tory lead at three percentage points, down from seven previously, is above yesterday's lows. On the other hand, even strong data from Japan did not drive the yen higher.

Read More »

Read More »

FX Daily, May 31: Sterling Takes it On the Chin

Projections showing that the UK Tories could lose their outright majority in Parliament in next week's election spurred sterling sales, which snapped a two-day advance. Polls at the end of last week showed a sharp narrowing of the contest, and this saw sterling shed 1.3% last Thursday and Friday.

Read More »

Read More »

Not Do We Need One, But Do We Need A Different One

On March 24, 2009, then US President Barack Obama gave a prime time televised press conference whose subject was quite obviously the economy and markets. The US and global economy was at that moment trying to work through the worst conditions since the 1930’s and nobody really had any idea what that would mean.

Read More »

Read More »

FX Daily, May 26: Anxiety Levels Rise Ahead of Weekend

The markets are unsettled. It is not so much in the magnitude of moves as the breadth of the move. The nearly 1% rally in gold is a tell, but also the inability of equity market to follow the lead of the US markets, where the S&P 500 and NASDAQ set new records. US yields are softer, and the yen is the strongest of the major currencies, up 0.7% against the greenback.

Read More »

Read More »

FX Weekly Preview: Nothing Like A Good US Drama

US drama distracts from the difficult and ambitious economic program. European and Japanese developments have been constructive. Bank of Canada is the only G7 central bank that meets, and it is not expected to shift from its cautious stance.

Read More »

Read More »

FX Daily, May 15: Softer Dollar and Yen to Start the Week

The US dollar has opened the week softer against the major currencies, except for the Japanese yen. The disappointing US inflation and retail sales data before the weekend have not been shrugged off, even though the US 10-year yield is a little higher and expectations for a Fed hike next month continue to be elevated.

Read More »

Read More »

FX Weekly Preview: Two Known Unknowns

The Trump Administration seems to be trying to cast the US as a revisionist power. Or perhaps it is like Roman emperors long ago trying to draw greater tribute from others. The outlook of US interest rates is critical to the outlook of the dollar.

Read More »

Read More »

FX Daily, May 10: Markets Adjust to North Korean Threat, Fifth Fall in US Oil Inventories and Trump Drama

Investors absorbed a few developments that might have been disruptive for the markets with little fanfare. North Korea's ambassador to the UK warned that his country would go ahead with its sixth nuclear test, as South Korea elected a new president who wants to reduce tensions on the peninsula.

Read More »

Read More »

FX Daily, May 08: Euro Bought on Rumor, Sold on Fact

The euro initially opened higher in Asia following confirmation that Macron was elected the next president of France, but quickly fell below $1.0960 before bouncing back toward $1.10 only to be sold again in early Europe below the pre-weekend low near $1.0950. A break now of $1.0930 could signal a return to the lower end of the range seen since the first round of the French election near $1.0850-$1.0870.

Read More »

Read More »

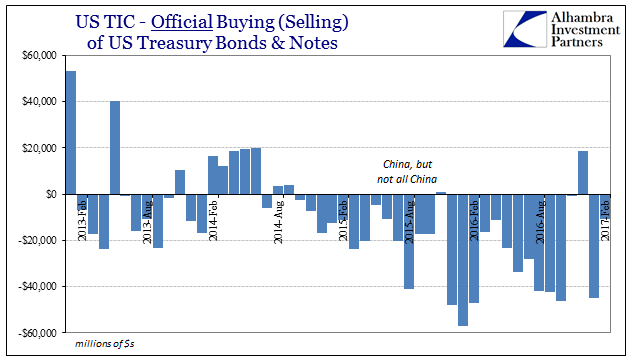

‘Dollar’ ‘Improvement’

According to the headline TIC statistics, foreign central banks have in the past six months sold the fewest UST’s since the 6-month period ended November 2015. That may indicate an easing of “dollar” pressure in the private markets due to “reflation” sentiment.

Read More »

Read More »

More Thinking about Trade as Pence and Ross Head to Tokyo

Pence and Ross may "feel out" Abe for interest in a bilateral trade agreement. The US enjoys a small trade surplus with countries it has free-trade agreements. Ownership-based framework of the current account and value-added trade suggest the US trade imbalance is not a significant problem.

Read More »

Read More »

FX Daily, April 17: Markets Trying to Stabilize in Holiday-Thin Activity

Financial centers in Europe are closed for the extended Easter holiday. Australian and New Zealand markets were also closed. The drop in US 10-year Treasury yields in early Asia, with a brief push below 2.20%, appears to have kept the dollar under pressure. As the North American market prepares to open, the dollar is softer against the all major currencies and many emerging market currencies.

Read More »

Read More »

FX Weekly Preview: What to Watch in the Week Ahead

Many observers misunderstood US President Trump's "American First" rhetoric. Trump's earlier writings show that this is not a reference to the 1940s effort to keep the US out of WWII, with its isolationist tint. Rather, Trump's use goes back to the original use by President Harding in the 1920s. It was a rejection of the Wilsonian multilateralism (e.g. League of Nations) and a robust defense of unilateralism.

Read More »

Read More »

FX Daily, April 05: Dialing it Up on Hump Day

he dollar is practically unchanged against the euro and yen in the first two sessions of the week. The pace can be expected to pick up starting Wednesday. Although the euro slipped through $1.0650, it was not sustained, and on Monday and Tuesday, the euro finished near its highs.

Read More »

Read More »