Tag Archive: $CNY

Understanding the Latest International Reserve Figures

At the end of every quarter, the IMF publishes the most authoritative reserve data with a three-month lag. On Good Friday, the IMF published Q4 17 reserve holdings. A recent article on Bloomberg played up an economist's forecast that euro reserves would increase by $500 bln over the next couple of years. A review of the reserve data may help us evaluate such a claim, which if true, could have important implications for international investors.

Read More »

Read More »

FX Daily, April 10: XI’s Day, but Not So Good for Putin

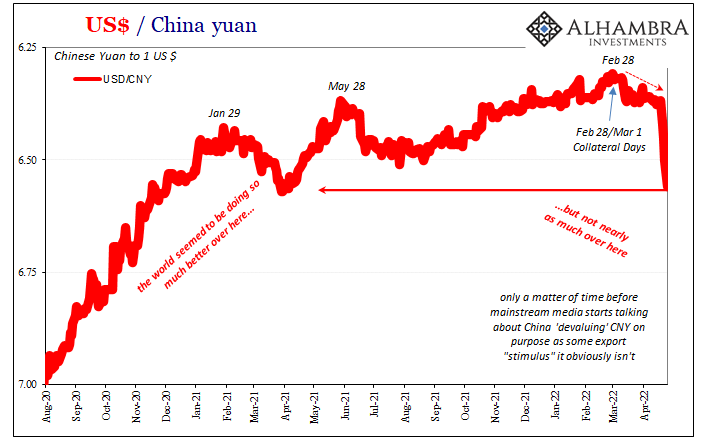

It did not look so good. The S&P 500 fell about 1.65% in the last couple hours of trading yesterday paring its gains. Press reports indicated that President Trump's lawyer's office, house and hotel were the subject of search warrants. A Bloomberg report citing people who knew said that China would consider devaluing the yuan.

Read More »

Read More »

FX Daily, April 09: Asian and European Equities Shrug Off US Decline

US shares slumped before the weekend amid concern that Trump Administration was prepared to escalate the trade tensions with China. However, cooler heads are prevailing, and there is a recognition that the conflict is still in the posturing phase. No sanctions have gone to into effect. As the Economist points out, nearly 100 of the Chinese products the US proposed slap a tariff on are not currently being exported to the US. The US has a 60-day...

Read More »

Read More »

FX Daily, April 05: Investors Find Comfort in Brinkmanship Blinks

Global equity markets are higher, following the stunning recovery in the US yesterday, where the S&P 500 rallied 76 points or 3% from its lows to it highs, near where it finished. The outside up day is seeing following through today. Without China and Hong Kong, which are on holiday, the MSCI Asia Pacific Index snapped a three-day down draft and closed 0.55% higher.

Read More »

Read More »

Central banks adding euros to their FX reserves

Central banks are looking beyond the dollar to grow their foreign exchange reserves for the first time in a decade. Rising trade tensions, and a recovering European economy bode well for the euro making a stronger case for central banks to diversify into the monetary union's currency.

Read More »

Read More »

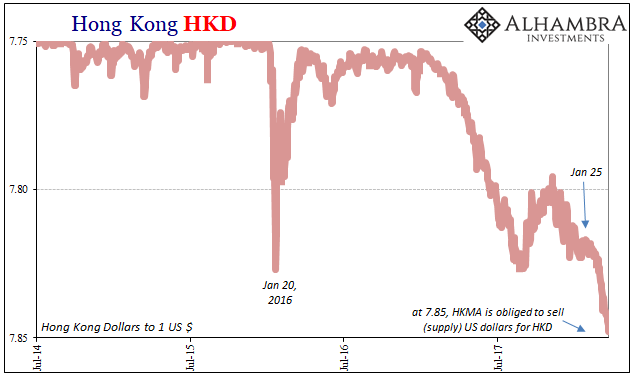

Just A Few More Pips

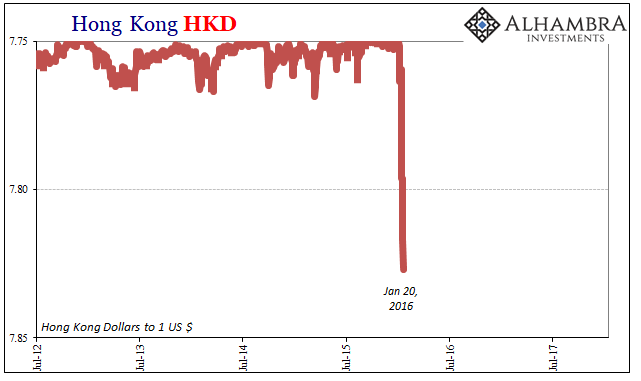

On Page 1, Chapter 1 of the Central Banker Crisis Handbook it states very clearly, “do not make it worse.” It’s something like the Hippocratic oath where monetary authorities must first assess what their actions might do to an already fragile system. It’s why they take great pains to try and maintain composure, appearing calm and orderly while conflagration rages all around. The last thing you want to do is confirm the run.

Read More »

Read More »

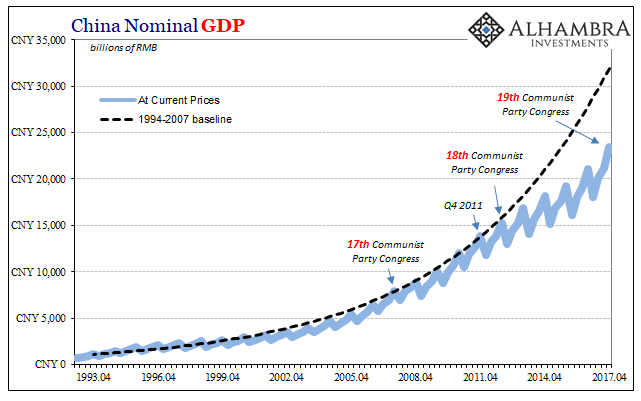

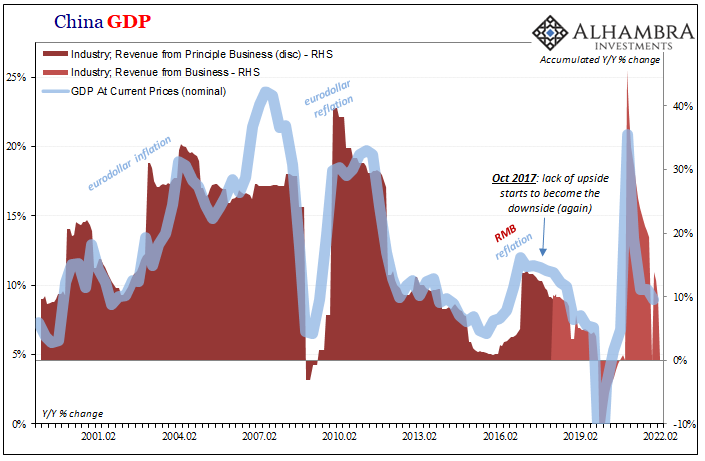

The Boom Reality of Uncle He’s Globally Synchronized L

Top Chinese leadership is taking further shape. With Xi Jinping’s continuing consolidation of power going on right this minute, most of the changes aren’t really changes, at least not internally. To the West, and to the mainstream, what the Chinese are doing seems odd, if not more than a little off. Unlike in the West, however, there is determined purpose that is in many ways right out in the open. Many here had been expecting that outgoing PBOC...

Read More »

Read More »

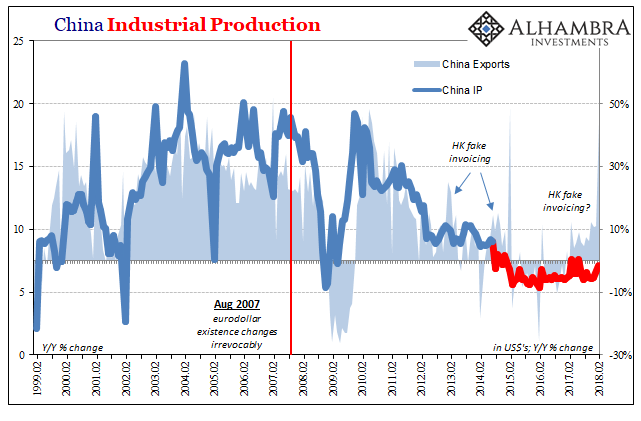

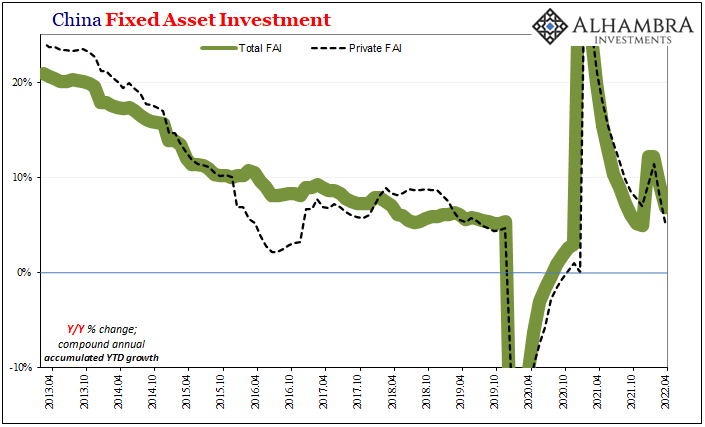

China’s Questionable Start to 2018

The Chinese government reported estimates for Industrial Production, Retail Sales, and Fixed Asset Investment (FAI) for both January and February 2018. The National Bureau of Statistics prepares and calculates China’s major economic statistics in this manner at the beginning of each year due to the difficulties created by calendar effects (New Year Golden Week).

Read More »

Read More »

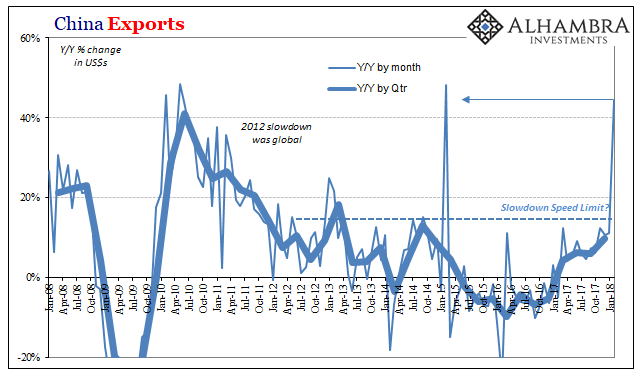

China Exports: Trump Tariffs, Booming Growth, or Tainted Trade?

China’s General Administration of Customs reported that Chinese exports to all other countries were in February 2018 an incredible 44.5% more than they were in February 2017. Such a massive growth rate coming now has served to intensify the economic boom narrative.

Read More »

Read More »

FX Daily, March 07: Renewed Threat of Trade War Makes Investors Angry

In response to the resignation of one of the few "globalist" advisers in the US Administration, the resignation Cohn has sent ripples through the capital markets. Stocks have been marked down across the world. The prospects of a trade war are also not good for growth and it may be adding to the pressure on yields.

Read More »

Read More »

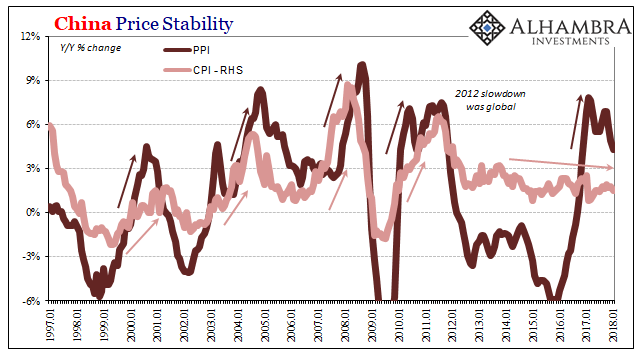

China: Inflation? Not Even Reflation

The conventional interpretation of “reflation” in the second half of 2016 was that it was simply the opening act, the first step in the long-awaiting global recovery. That is what reflation technically means as distinct from recovery; something falls off, and to get back on track first there has to be acceleration to make up that lost difference.

Read More »

Read More »

FX Daily, February 12: Equity Markets Find Firmer Footing, Dollar Softens

The most important development today has been the stability in the equity markets after last week's meltdown. The recovery from new lows in the US before the weekend set the tone for today's moves. Tokyo markets were on holiday, and the MSCI Asia Pacific Index excluding Japan snapped a seven-day slide with a nearly 0.6% gain.

Read More »

Read More »

FX Weekly Preview: Recovering from Too Much of a Good Thing?

Too much of a good thing is bad. That, in a nutshell, is an important insight that Hyman Minsky offered about the financial sector, but has broader application. The low volatility that has been a characteristic of the capital markets for the past few years spurred financial innovation to profit from it.

Read More »

Read More »

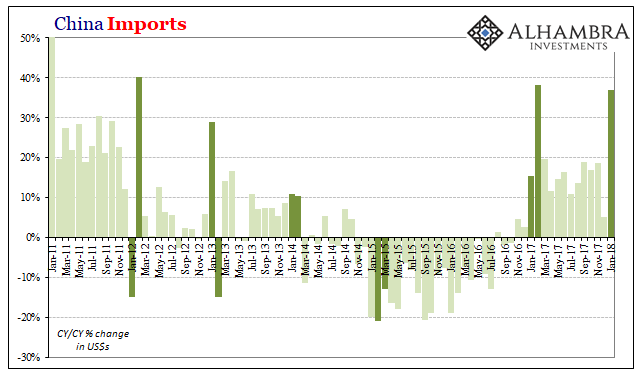

China: CNY, Not Imports

In February 2013, the Chinese Golden Week fell late in the calendar. The year before, 2012, New Year was January 23rd, meaning that the entire Spring festival holiday was taken with the month of January. The following year, China’s New Year was placed on February 10, with the Golden Week taking up the entire middle month of February.

Read More »

Read More »

FX Daily, February 09: Equity Sell-Off Extends to Asia, but More Muted in Europe

The 100-point slide in the S&P 500 and the 1000-point drop in the Dow Jones Industrials yesterday spurred more bloodletting in Asia. The 1.8% drop in the MSCI Asia Pacific Index (for a 6.7% loss for the week) may conceal the magnitude of the regional losses. At one point the CSI 300 of the large Chinese mainland shares was off more than 6% before closing off 4.3% (and 10% for the week). The H-shares index was down 3.9% and 12% for the week.

Read More »

Read More »

FX Daily, February 08: Dollar Firms, While Equities Search for Stability

The swings in the equity markets are subsiding, bond yields are firm and the US dollar is extending its recovery. Although US equities closed lower, the MSCI Asia Pacific Index snapped a four-day drop by posting a 0.25% gain. However, the MSCI Emerging Markets Index is off nearly as much, though the range was modest. European markets are also lower, and the range for the Dow Jones Stoxx 600 is the smallest in more than a week.

Read More »

Read More »

US Imports: A Little Inflation For Yellen, A Little More Bastiat

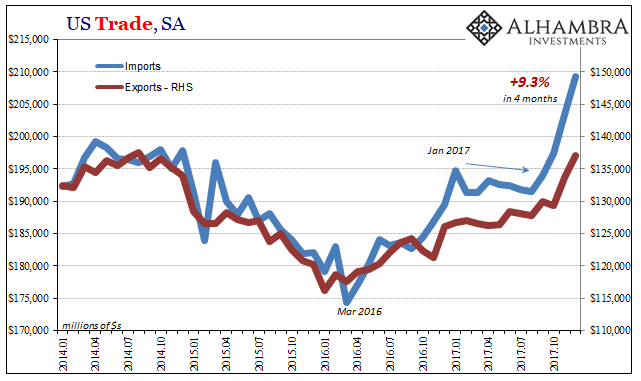

US imports rocketed higher once again in December, according to just-released estimates from the Census Bureau. Since August 2017, the US economy has been adding foreign goods at an impressive pace. Year-over-year (SA), imports are up just 10.4% (only 9% unadjusted) but 9.3% was in just those last four months. For most of 2017, imports were flat and even lower.

Read More »

Read More »

Central Bank Transparency, Or Doing Deliberate Dollar Deals With The Devil

The advent of open and transparent central banks is a relatively new one. For most of their history, these quasi-government institutions operated in secret and they liked it that way. As late as October 1993, for example, Alan Greenspan was testifying before Congress intentionally trying to cloud the issue as to whether verbatim transcripts of FOMC meetings actually existed.

Read More »

Read More »

FX Daily, January 18: Currencies Consolidate After Chop Fest

The US dollar rallied in the North American afternoon yesterday and the timing coincided with the release of the Fed's Beige Book that saw several districts report wage and price pressures. The US 10-year yield moved toward toward 2.60%, and helped by speculation that as US companies repatriate earnings kept abroad that they may have to liquidate the investments, some of which are thought to be in Treasuries.

Read More »

Read More »

China and US Treasuries

The US Treasury market was consolidating yesterday's 7.5 basis point jump in 10-year yields when Bloomberg's headline hit. The claim was that Chinese officials are "wary of Treasuries". Yields rose quickly to test 2.60% and the dollar moved lower. It is difficult to determine the significance of the claim as the Bloomberg story does not quote anyone.

Read More »

Read More »